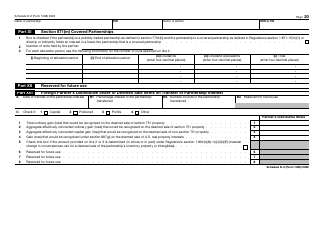

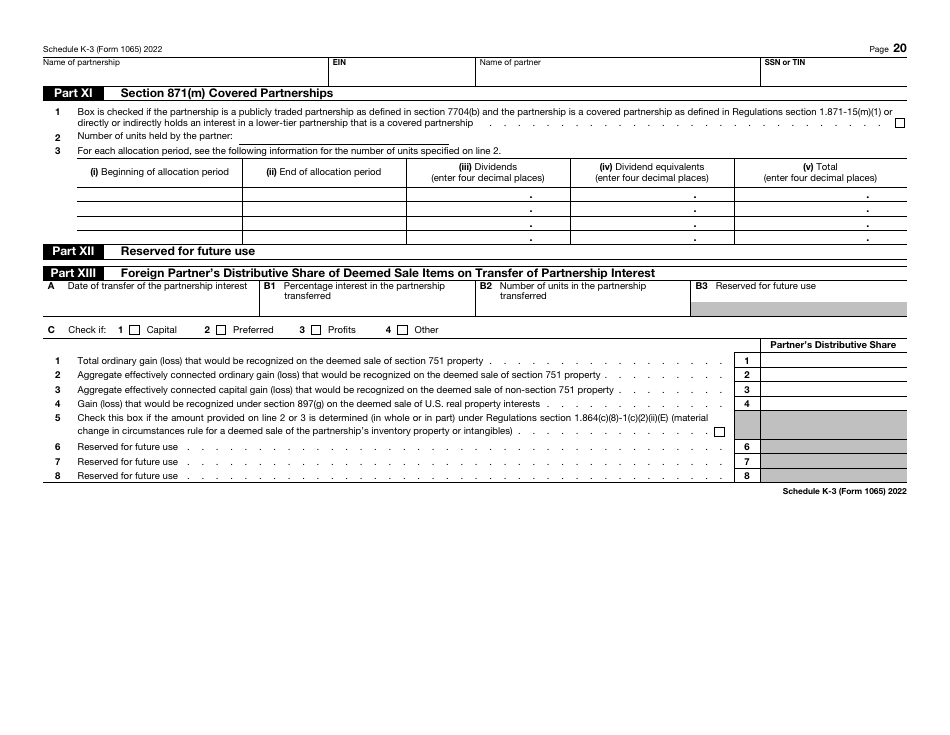

This version of the form is not currently in use and is provided for reference only. Download this version of

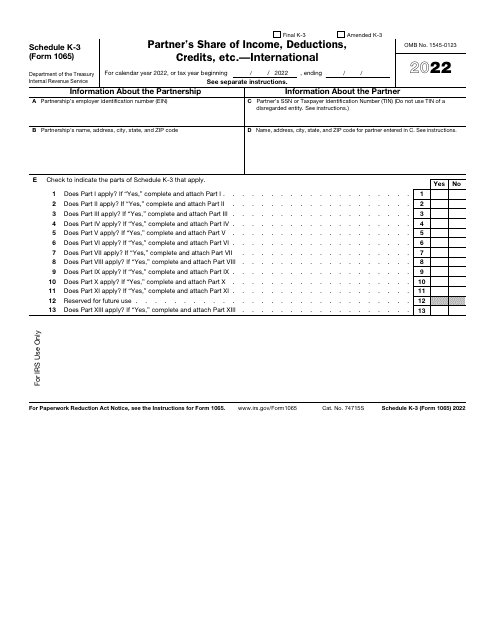

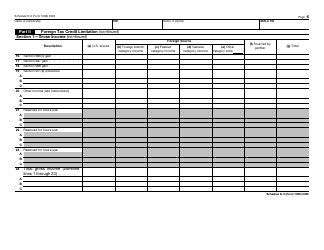

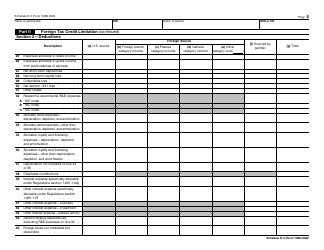

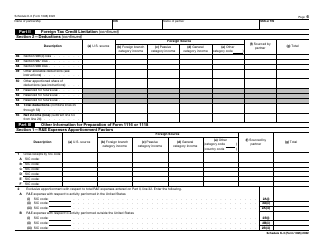

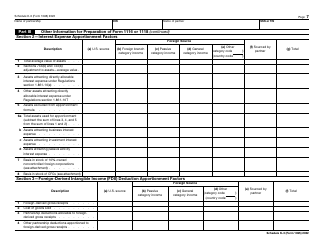

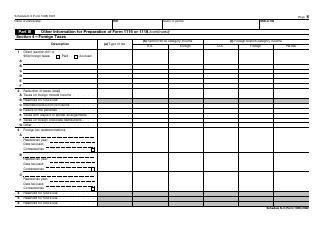

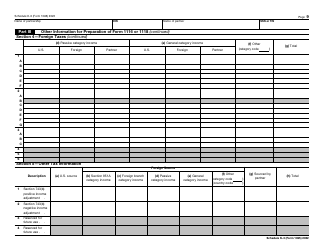

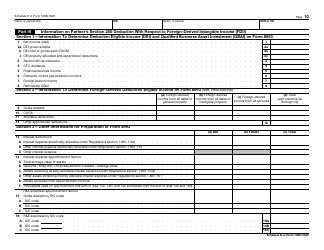

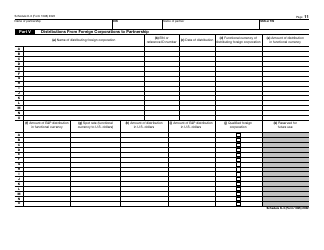

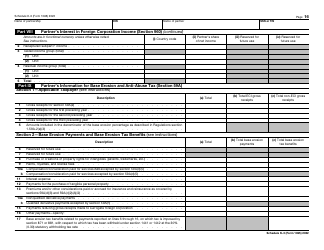

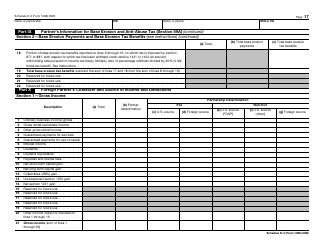

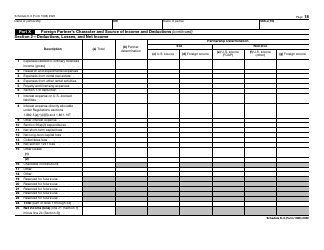

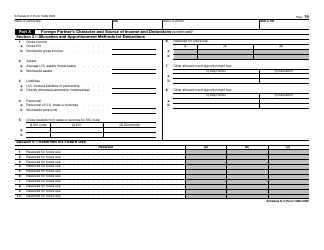

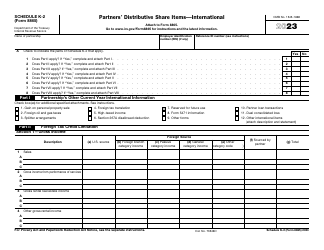

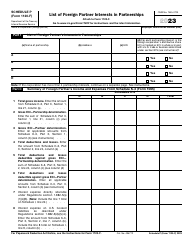

IRS Form 1065 Schedule K-3

for the current year.

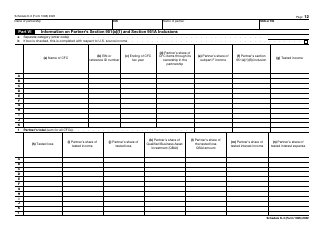

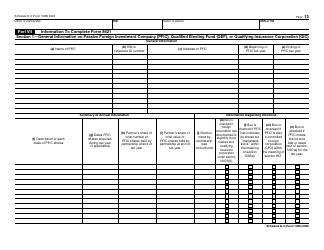

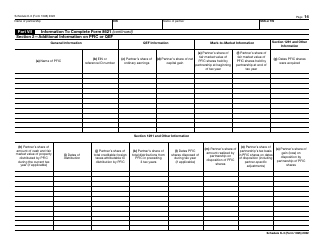

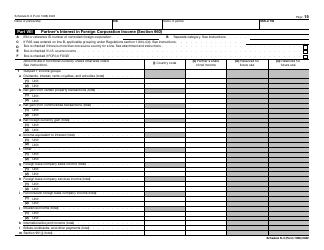

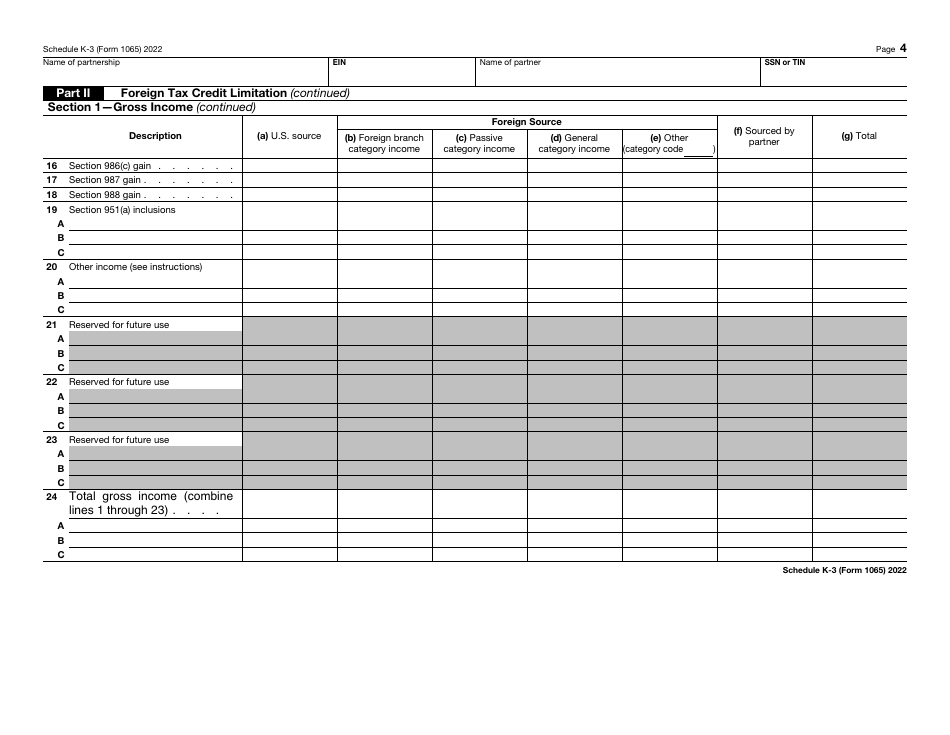

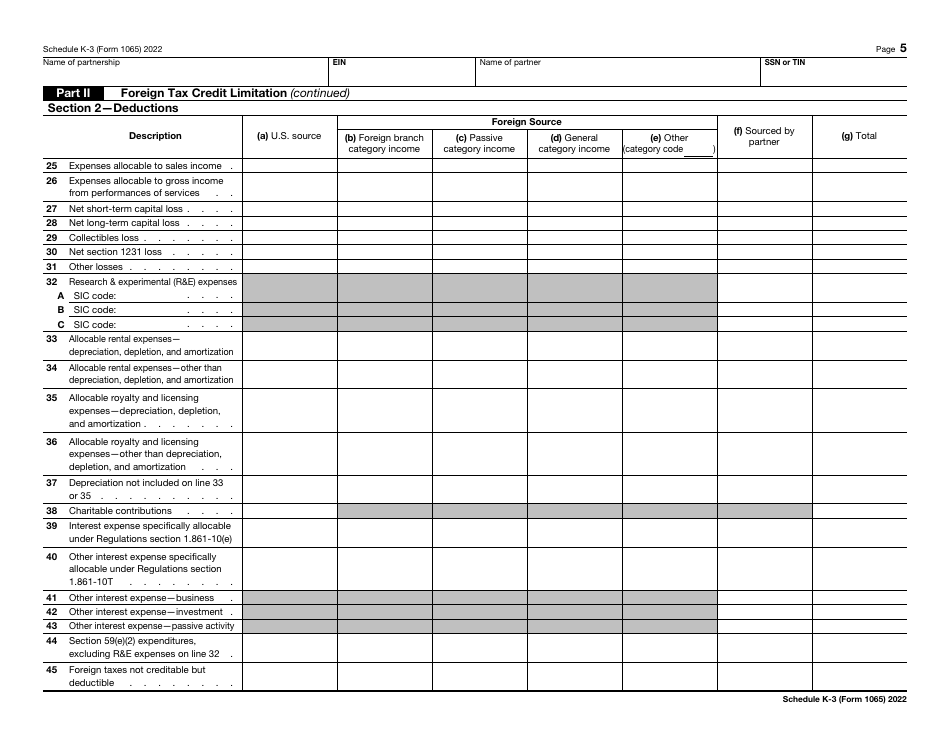

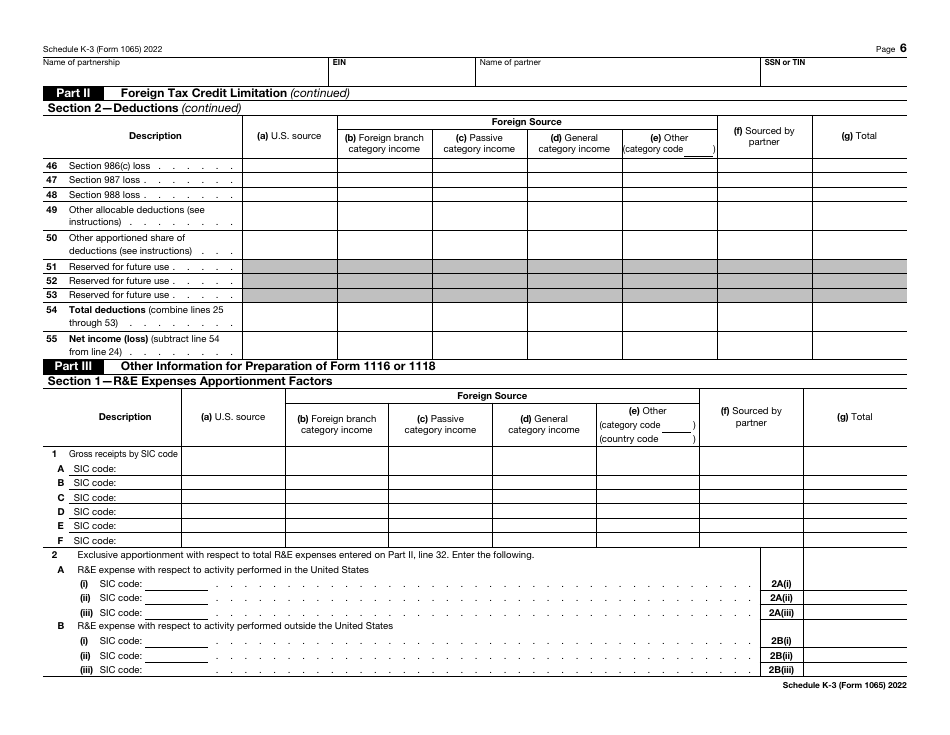

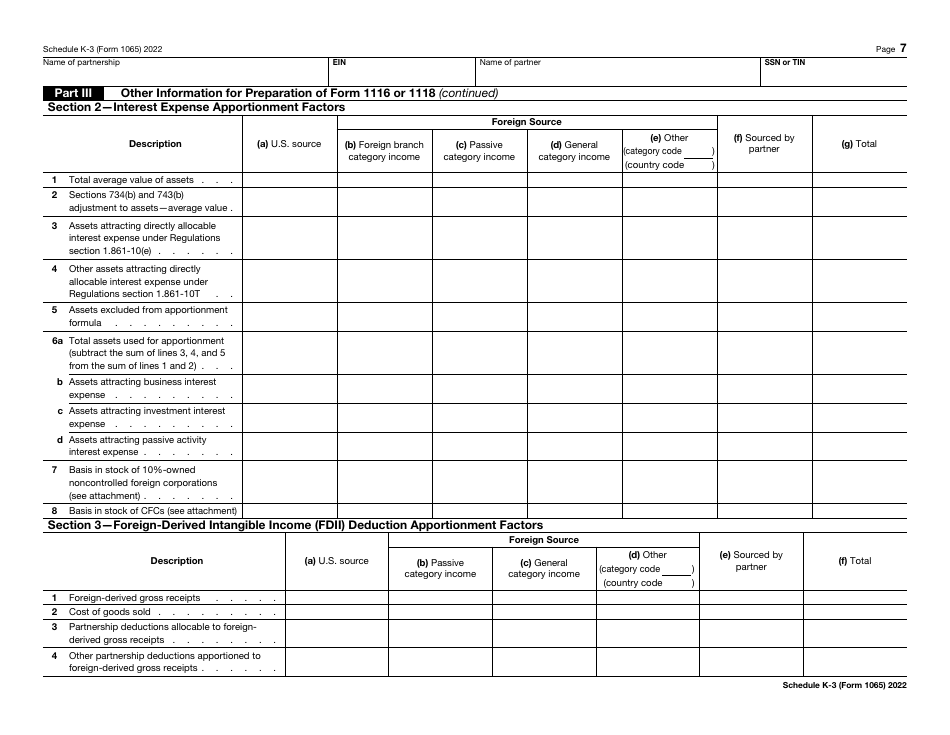

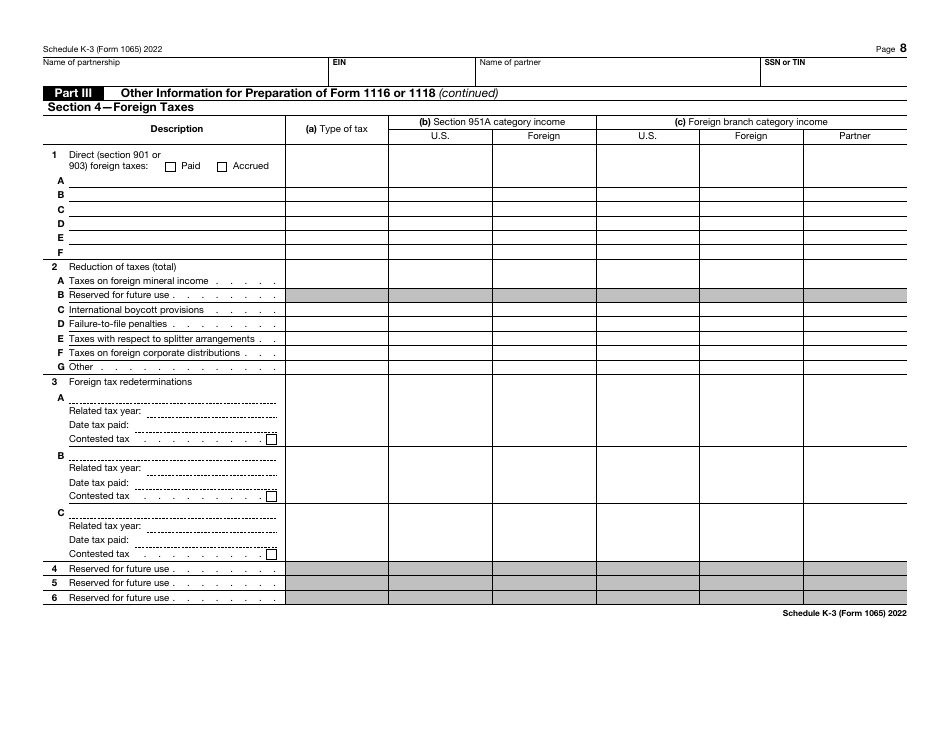

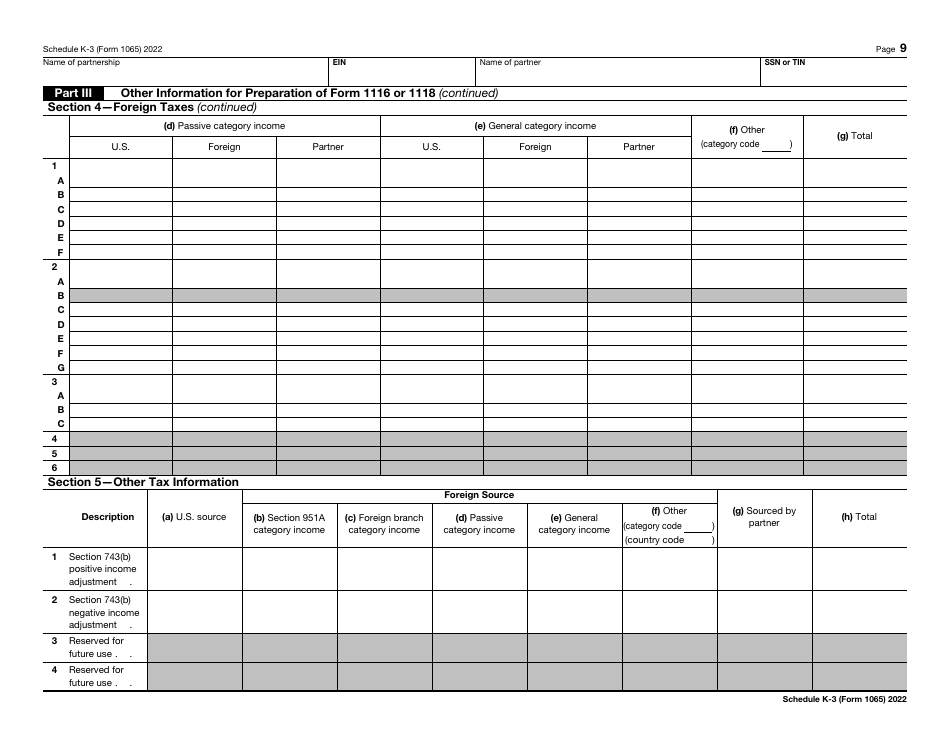

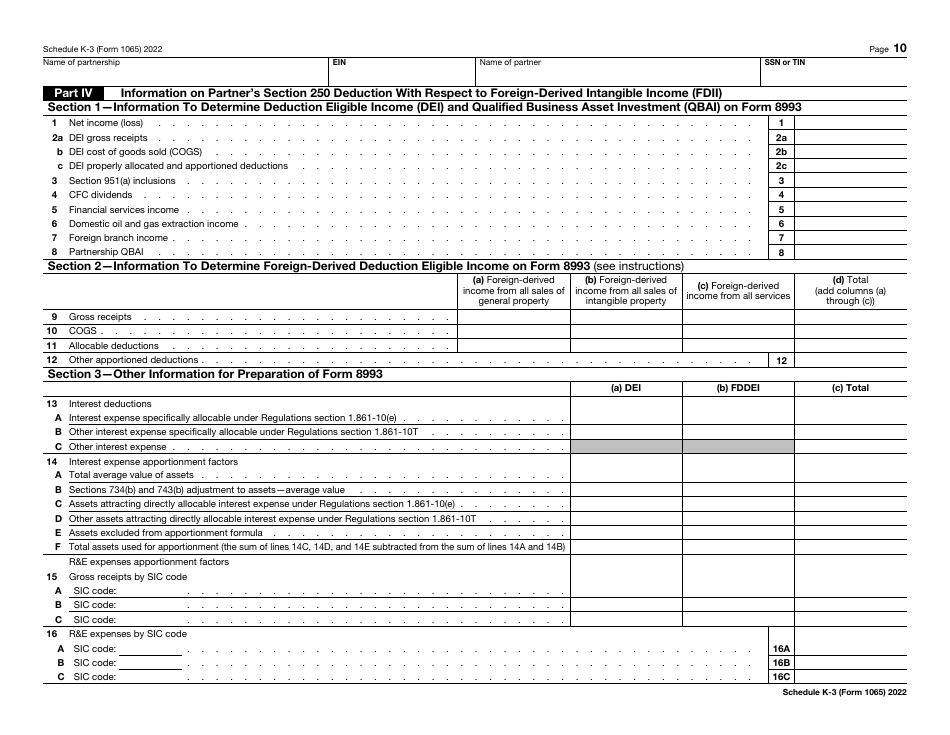

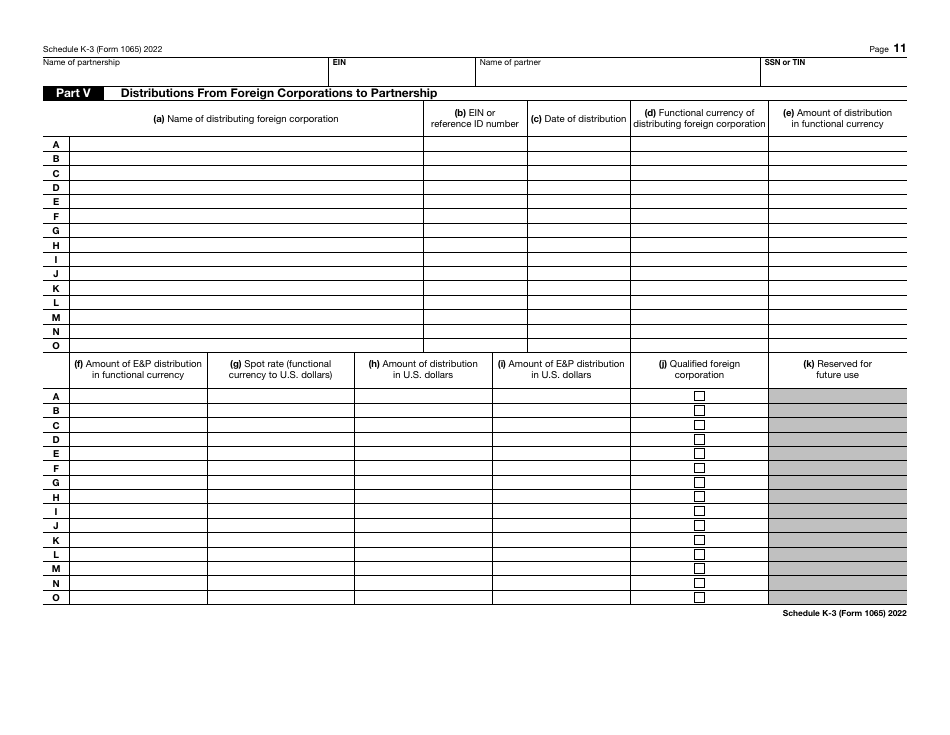

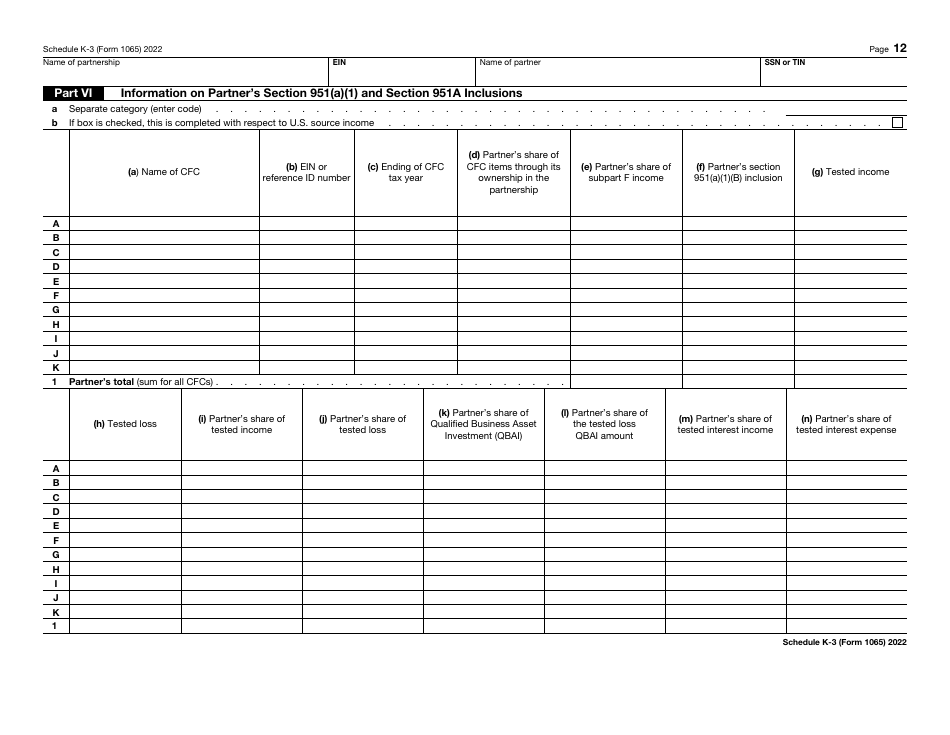

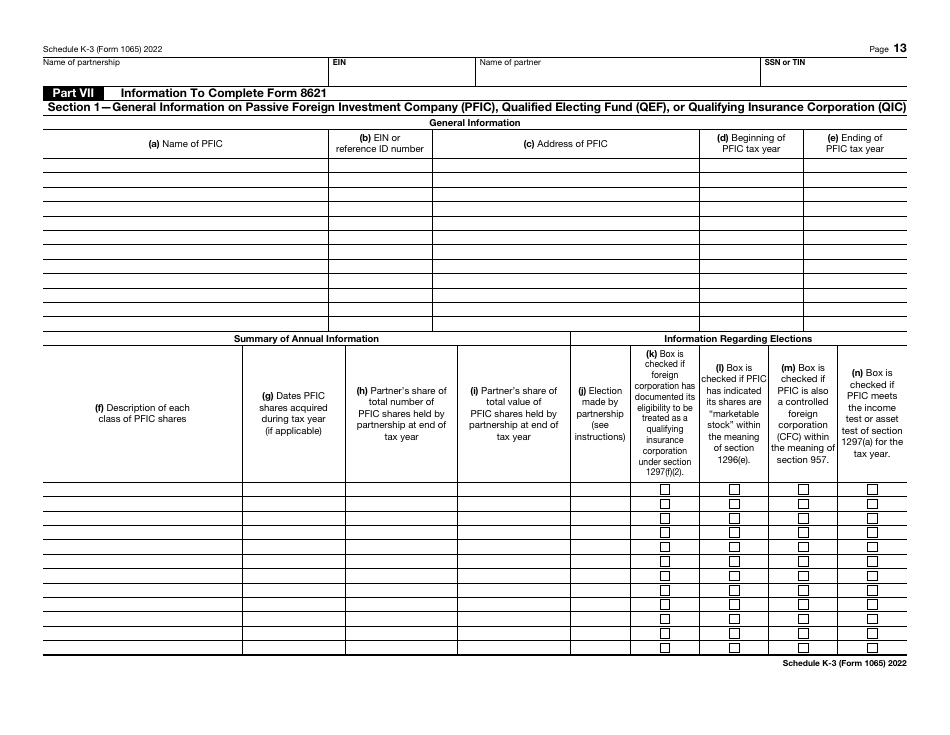

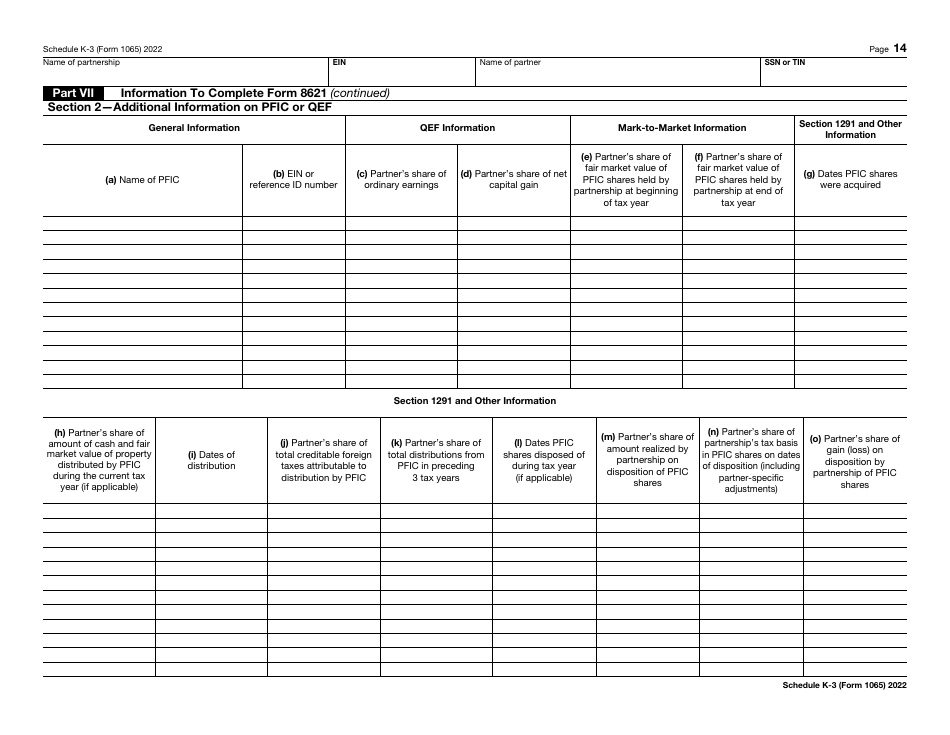

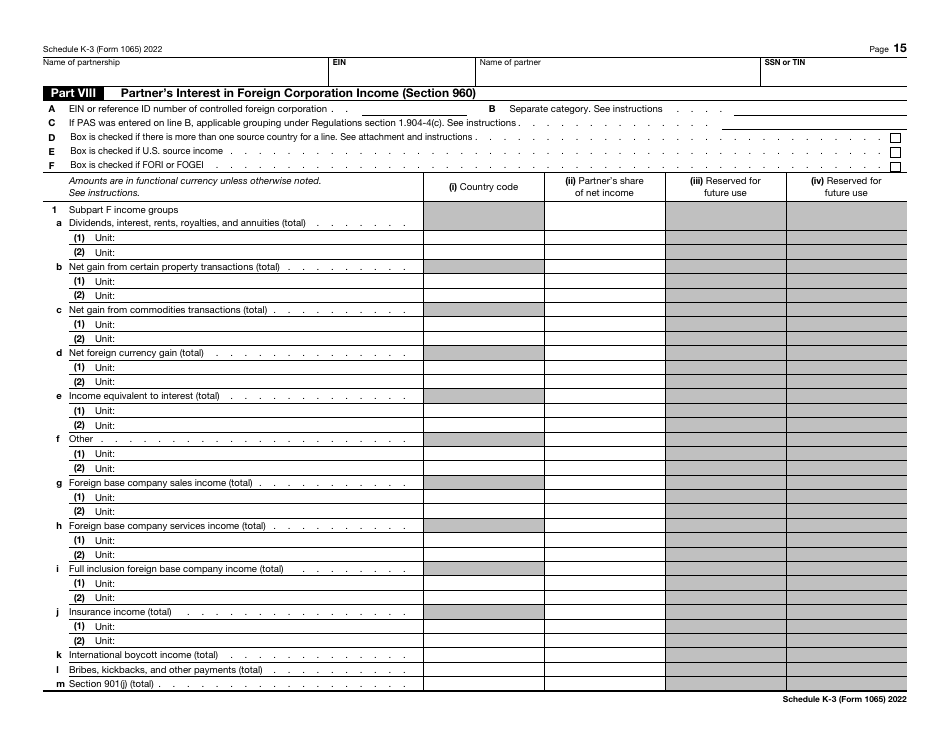

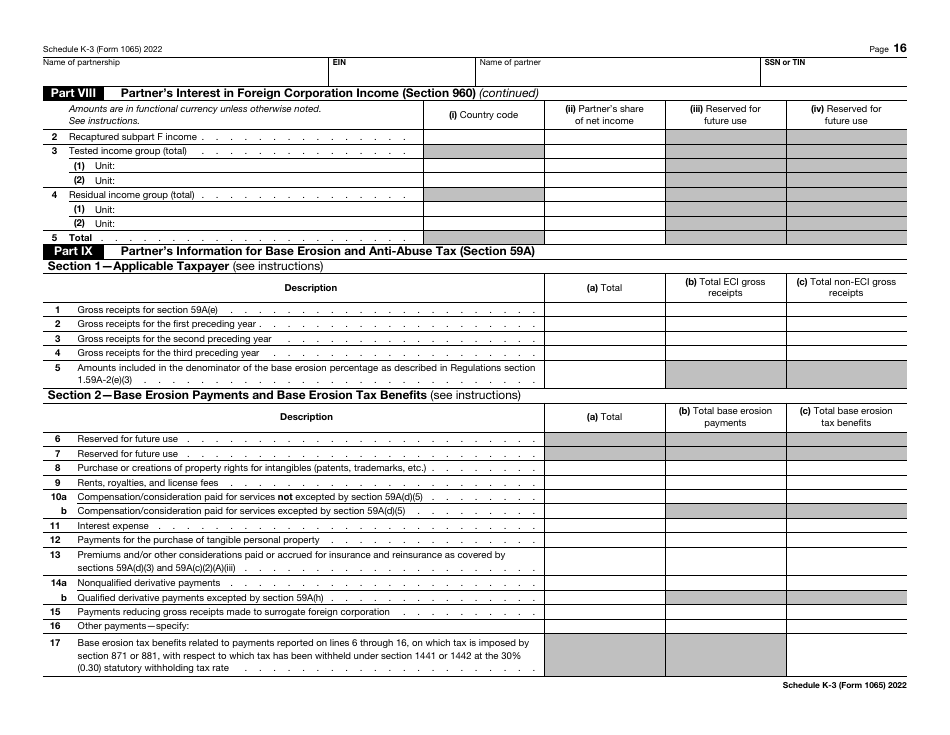

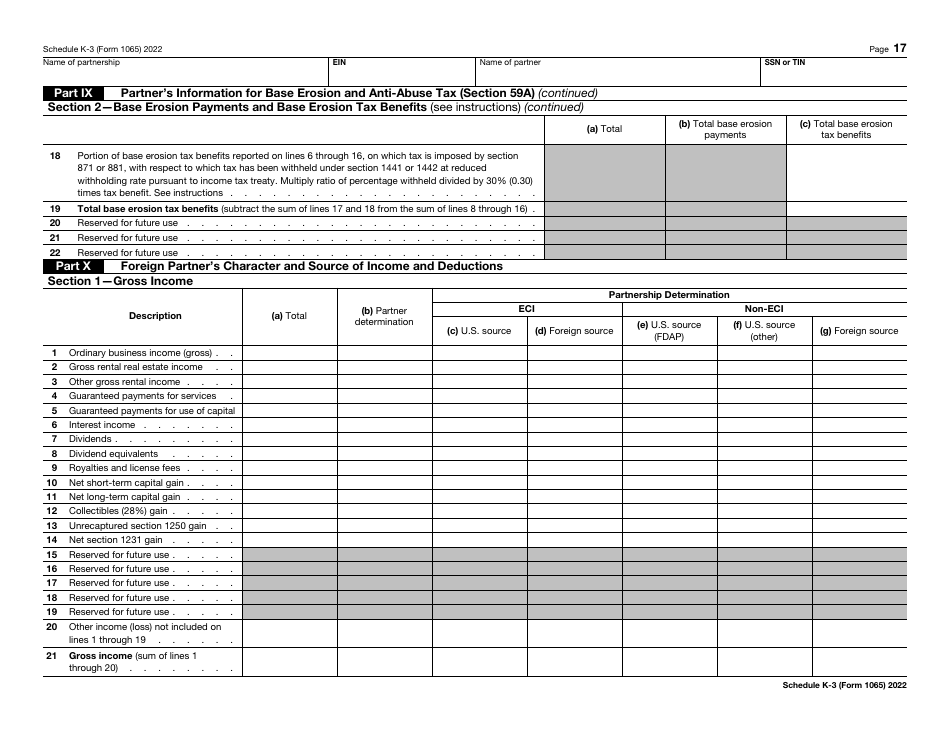

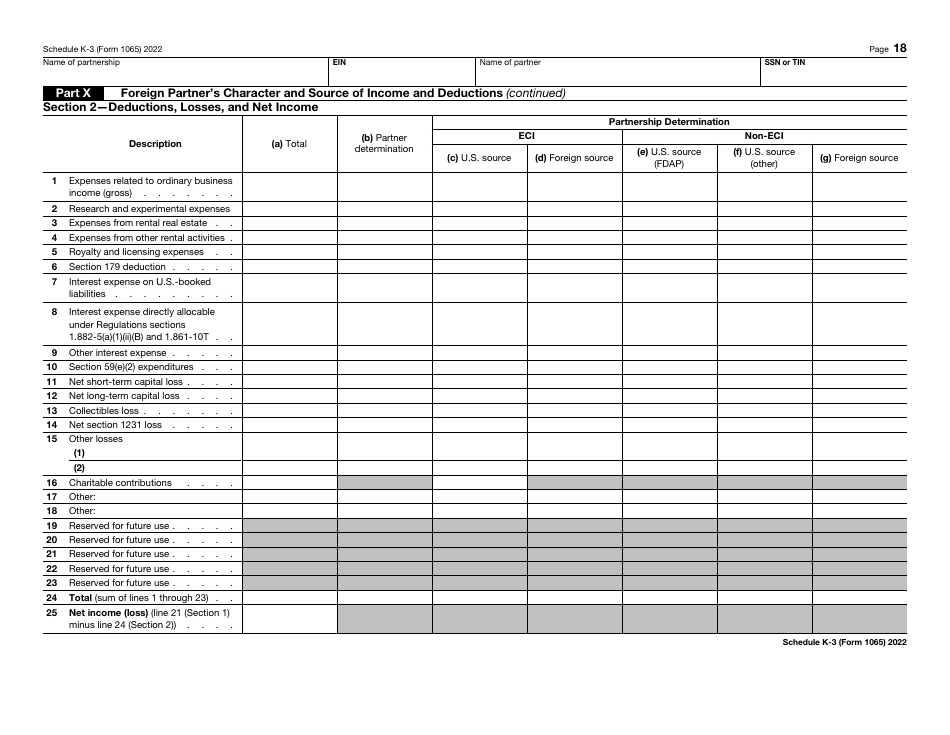

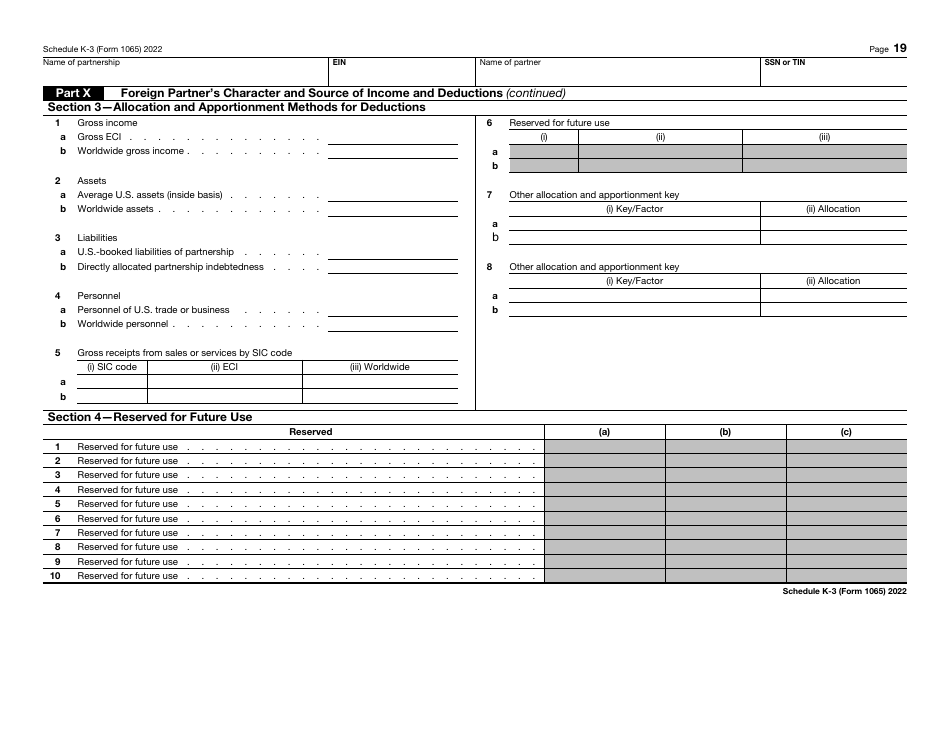

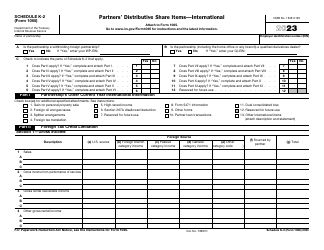

IRS Form 1065 Schedule K-3 Partner's Share of Income, Deductions, Credits, Etc. - International

What Is IRS Form 1065 Schedule K-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1065, U.S. Return of Partnership Income. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1065 Schedule K-3?

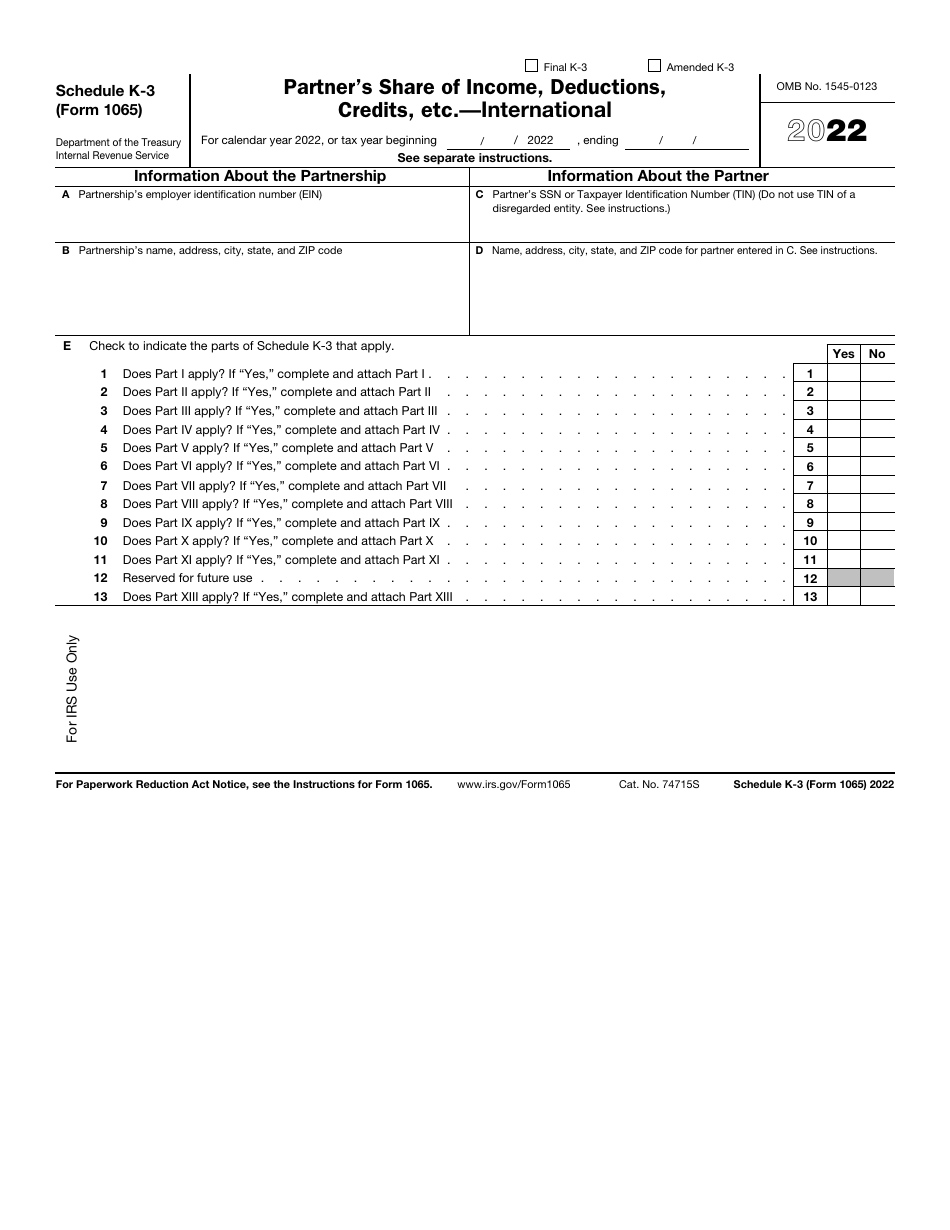

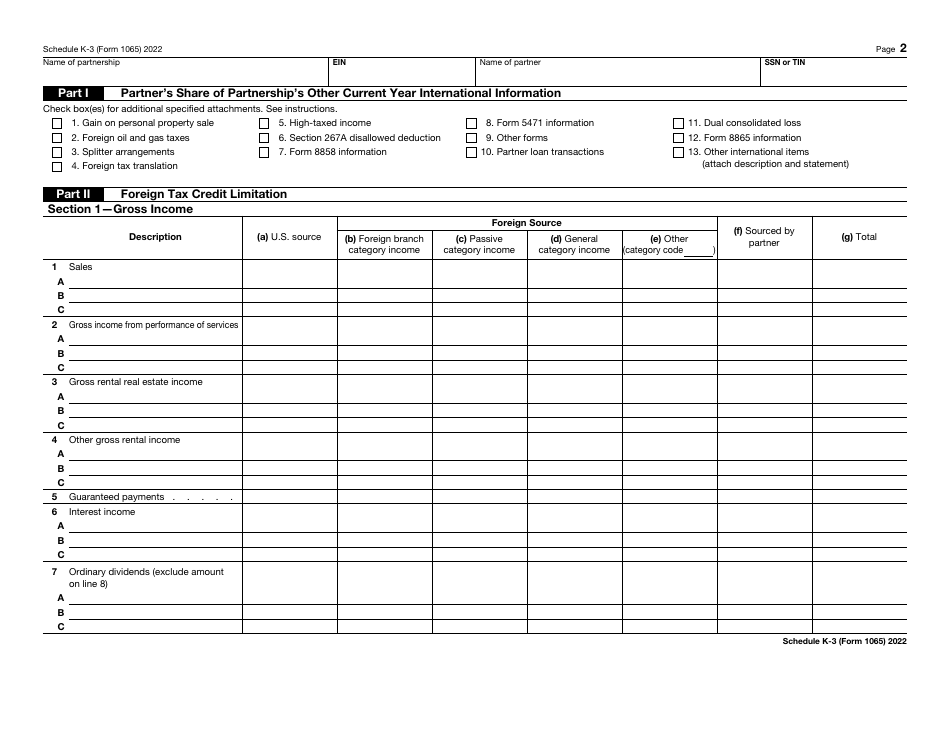

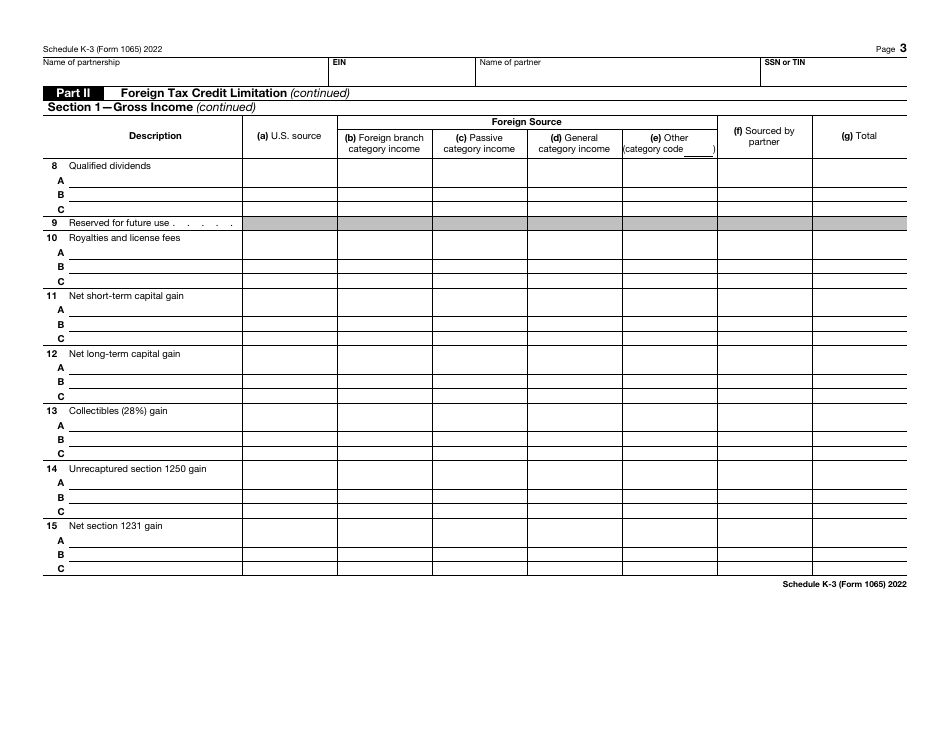

A: IRS Form 1065 Schedule K-3 is a form used by partnerships to report a partner's share of income, deductions, credits, and other relevant information.

Q: Who needs to file IRS Form 1065 Schedule K-3?

A: Partnerships that have international partners or report international activities need to file IRS Form 1065 Schedule K-3.

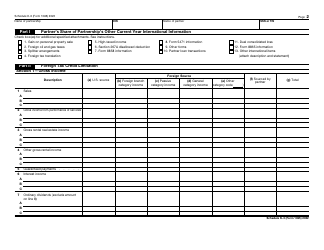

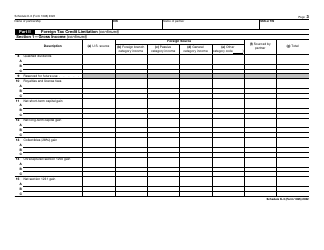

Q: What information does IRS Form 1065 Schedule K-3 include?

A: IRS Form 1065 Schedule K-3 includes a partner's share of income, deductions, credits, and other information related to international activities.

Q: Is IRS Form 1065 Schedule K-3 separate from Form 1065?

A: Yes, IRS Form 1065 Schedule K-3 is a separate form that accompanies Form 1065 for partnerships with international activities.

Q: Are there any deadlines for filing IRS Form 1065 Schedule K-3?

A: Yes, partnerships are required to file IRS Form 1065 Schedule K-3 by the same deadline as Form 1065, which is typically March 15th.

Q: Can I e-file IRS Form 1065 Schedule K-3?

A: Currently, IRS Form 1065 Schedule K-3 cannot be e-filed and must be filed by mail.

Q: Do I need to provide a copy of IRS Form 1065 Schedule K-3 to the partners?

A: Yes, partnerships are required to provide each partner with a copy of IRS Form 1065 Schedule K-3 to report their share of income, deductions, credits, etc.

Form Details:

- A 20-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065 Schedule K-3 through the link below or browse more documents in our library of IRS Forms.