This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1065-X

for the current year.

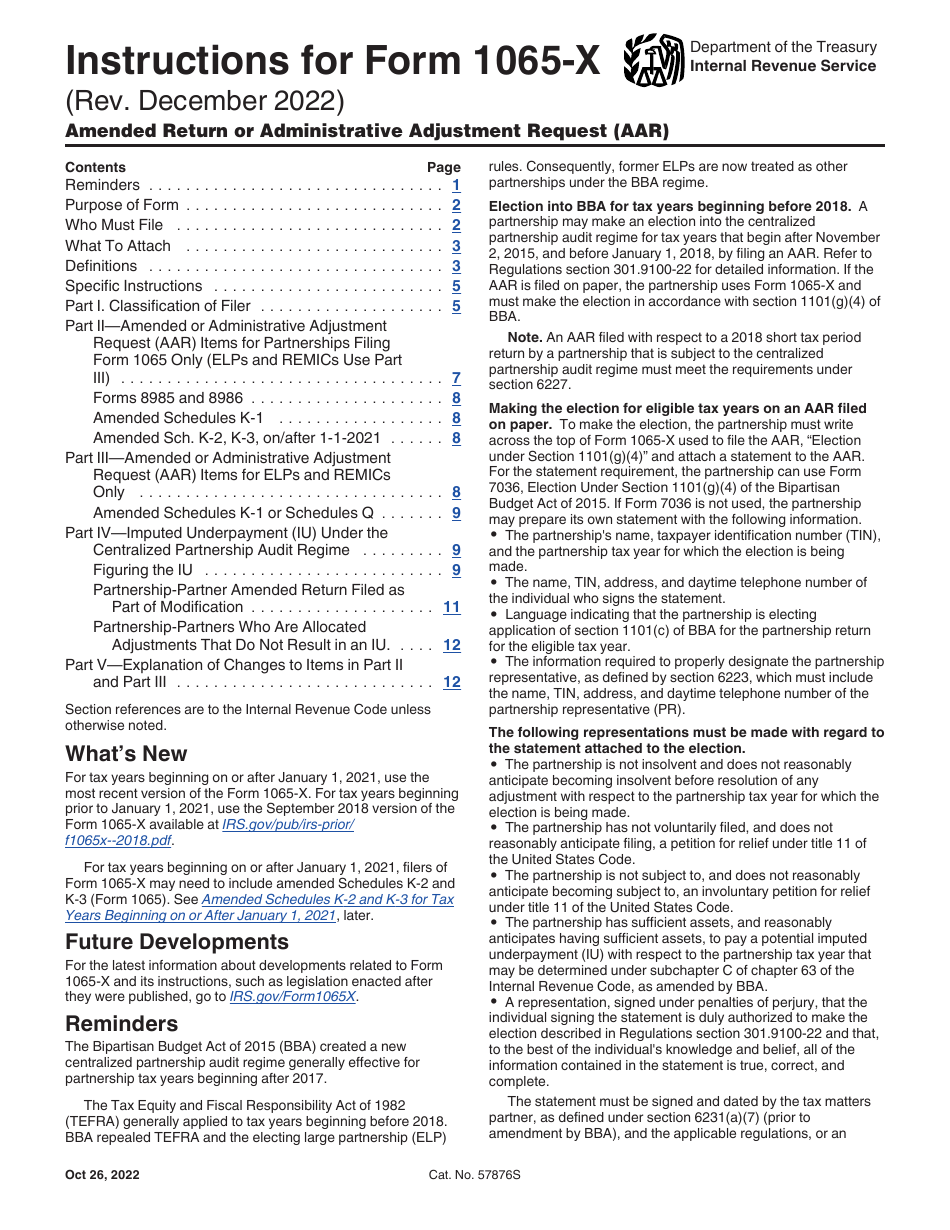

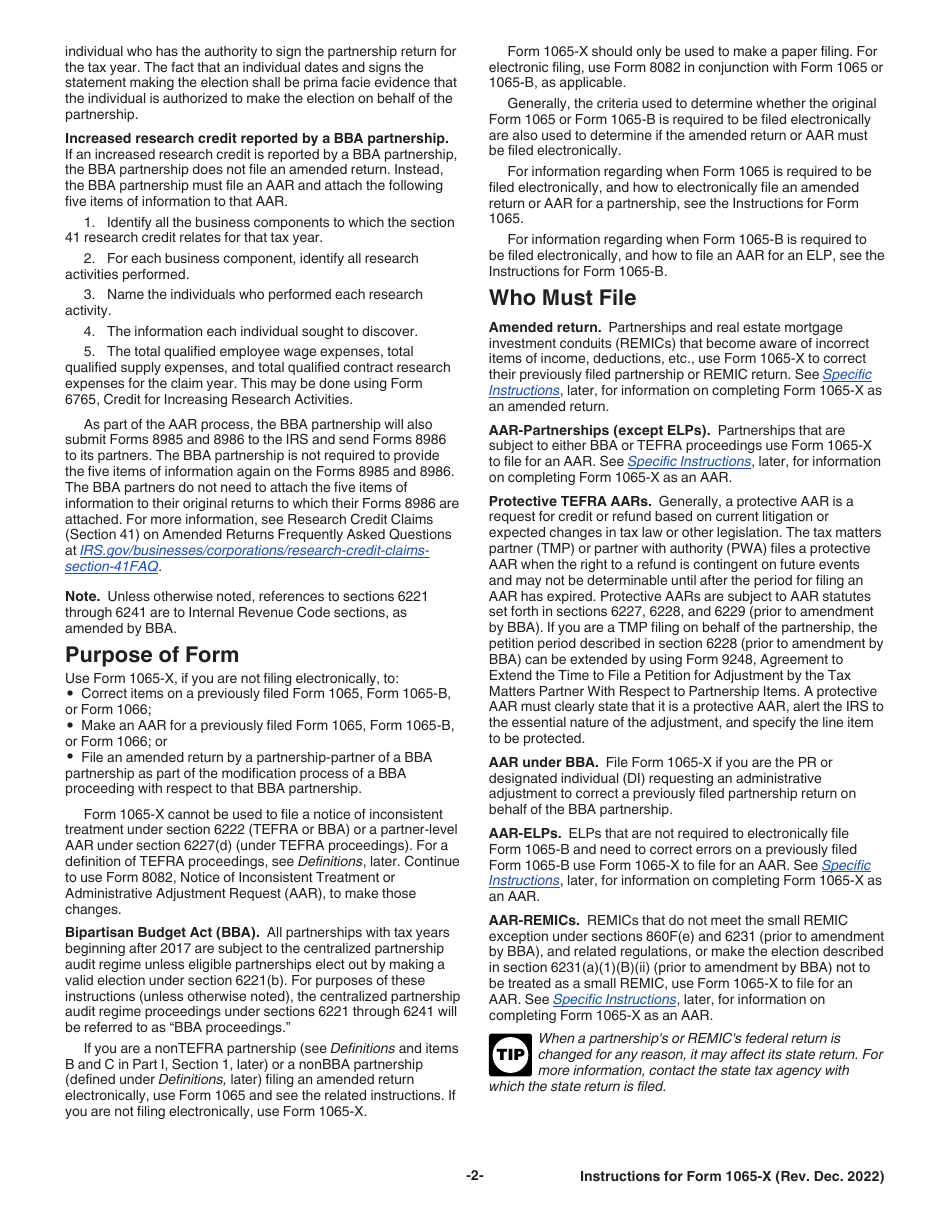

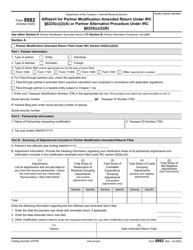

Instructions for IRS Form 1065-X Amended Return or Administrative Adjustment Request (AAR)

This document contains official instructions for IRS Form 1065-X , Amended Return or Administrative Adjustment Request (Aar) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1065-X is available for download through this link.

FAQ

Q: What is IRS Form 1065-X?

A: IRS Form 1065-X is used for filing an amended return or administrative adjustment request (AAR) for partnership tax returns.

Q: When should I use IRS Form 1065-X?

A: You should use IRS Form 1065-X when you need to make changes or corrections to a previously filed partnership tax return.

Q: What is the purpose of filing an amended return?

A: The purpose of filing an amended return is to correct any errors or update information on a previously filed partnership tax return.

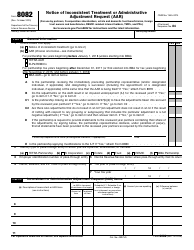

Q: What is an administrative adjustment request (AAR)?

A: An administrative adjustment request (AAR) is a request to make adjustments to a partnership tax return outside of the normal amendment process.

Q: Who can file IRS Form 1065-X?

A: Partnerships can file IRS Form 1065-X to amend their partnership tax return.

Q: What should I include when filing IRS Form 1065-X?

A: When filing IRS Form 1065-X, you should include a complete copy of the amended partnership tax return along with any necessary explanations or supporting documents.

Q: Is there a deadline for filing IRS Form 1065-X?

A: Yes, there is a deadline for filing IRS Form 1065-X. Generally, it must be filed within three years from the date the original return was filed or within two years from the date the tax was paid, whichever is later.

Q: Can I e-file IRS Form 1065-X?

A: No, you cannot e-file IRS Form 1065-X. It must be filed by mail.

Q: Are there any penalties for not filing IRS Form 1065-X?

A: There may be penalties for not filing IRS Form 1065-X or for filing it late. It is important to consult the instructions or seek professional advice to understand the specific penalties that may apply.

Instruction Details:

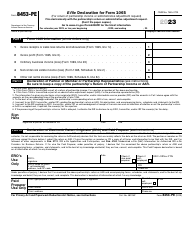

- This 12-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.