This version of the form is not currently in use and is provided for reference only. Download this version of

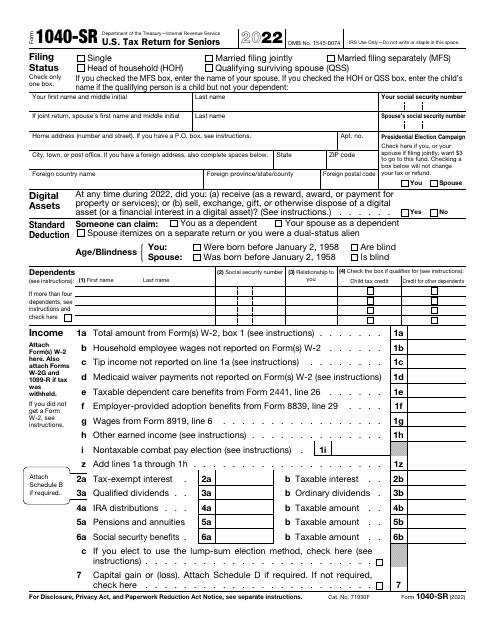

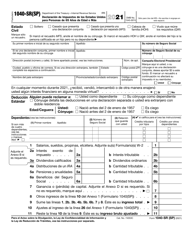

IRS Form 1040-SR

for the current year.

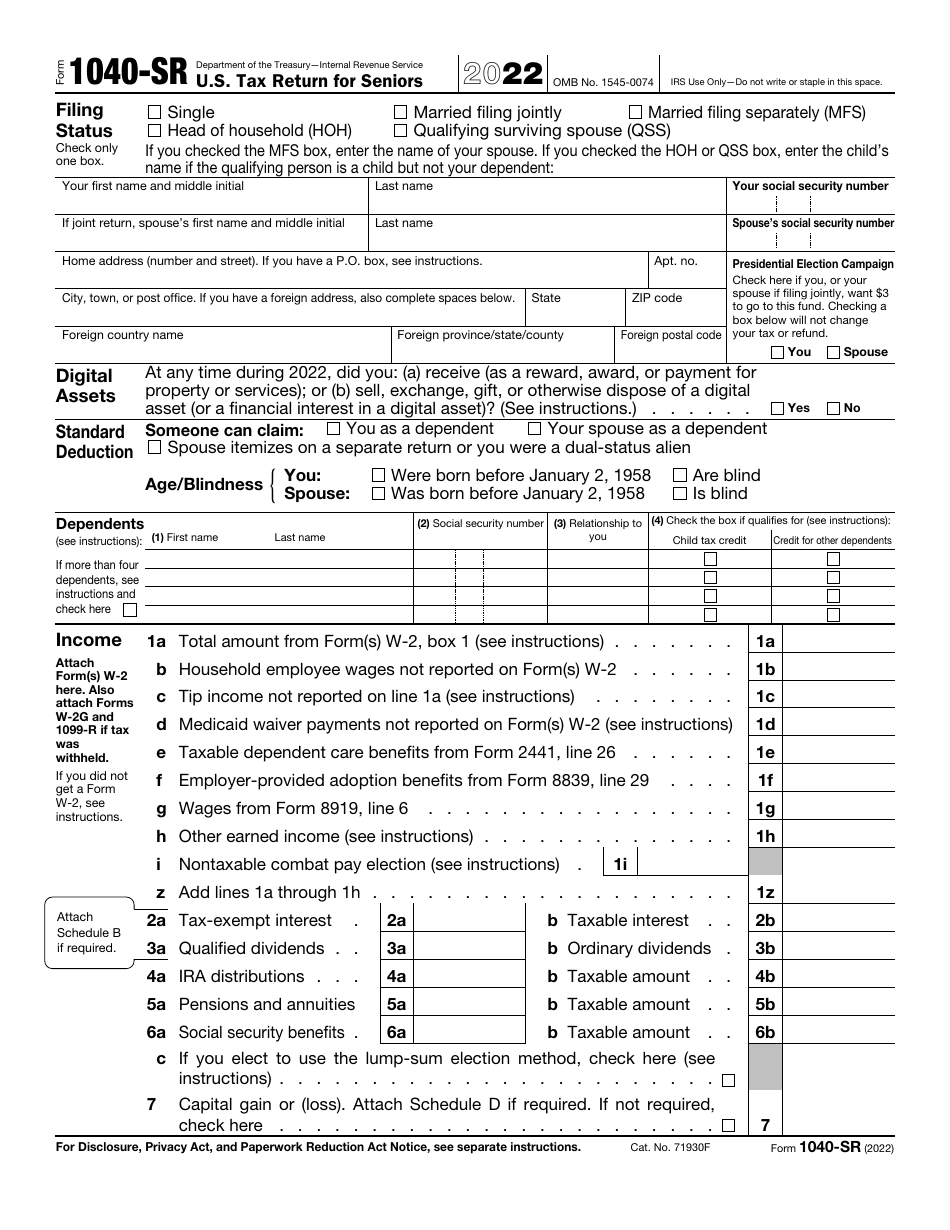

IRS Form 1040-SR U.S. Tax Return for Seniors

What Is IRS Form 1040-SR?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040-SR?

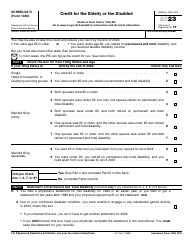

A: IRS Form 1040-SR is a U.S. tax return specifically designed for seniors, aged 65 and older.

Q: Who can use IRS Form 1040-SR?

A: Only individuals who are aged 65 or older can use IRS Form 1040-SR.

Q: What is the difference between Form 1040-SR and regular Form 1040?

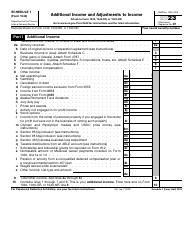

A: Form 1040-SR is a simplified version of Form 1040, tailored for seniors. It has larger font size and allows for reporting retirement income more prominently.

Q: What is the purpose of Form 1040-SR?

A: The purpose of Form 1040-SR is to simplify the tax filing process for seniors and cater to their specific tax needs and preferences.

Q: What types of income can be reported on Form 1040-SR?

A: Form 1040-SR can be used to report various types of income, such as wages, pensions, Social Security benefits, retirement distributions, and investment income.

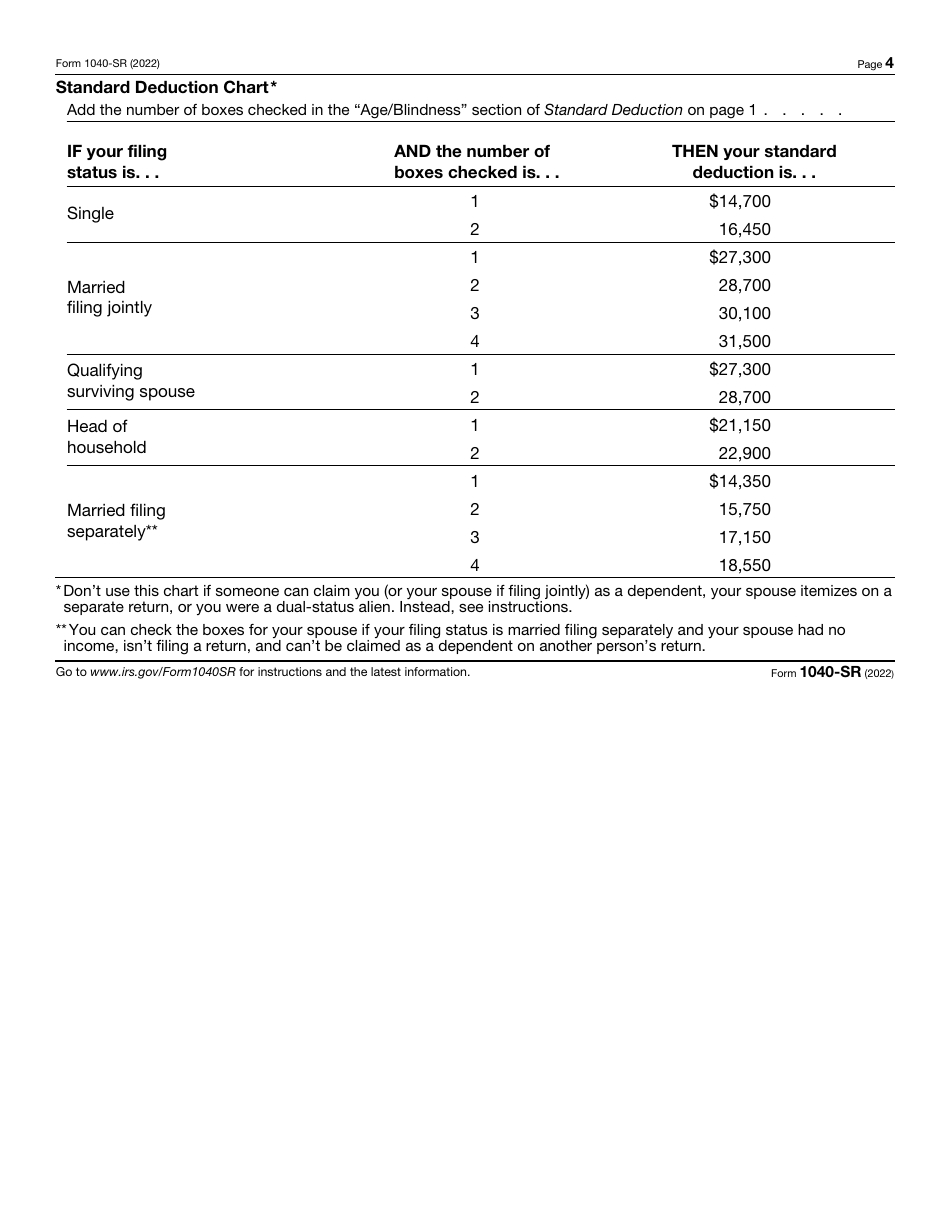

Q: Can I claim deductions and credits on Form 1040-SR?

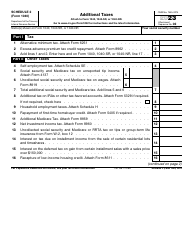

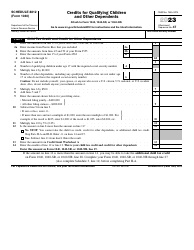

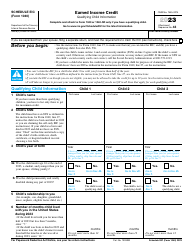

A: Yes, you can claim deductions and credits on Form 1040-SR, just like on the regular Form 1040.

Q: What is the deadline for filing Form 1040-SR?

A: The deadline for filing Form 1040-SR is the same as the regular Form 1040 – generally, April 15th of each year.

Q: Is Form 1040-SR available for electronic filing?

A: Yes, Form 1040-SR is available for electronic filing, just like the regular Form 1040.

Q: Are there any income limits to use Form 1040-SR?

A: No, there are no income limits to use Form 1040-SR. Any senior can use it, regardless of their income level.

Form Details:

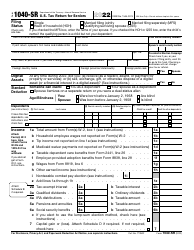

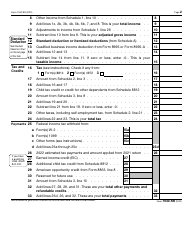

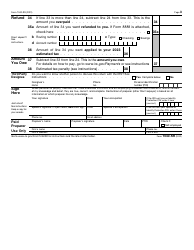

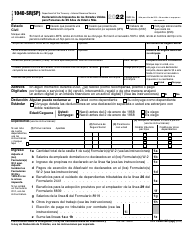

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-SR through the link below or browse more documents in our library of IRS Forms.