This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule H

for the current year.

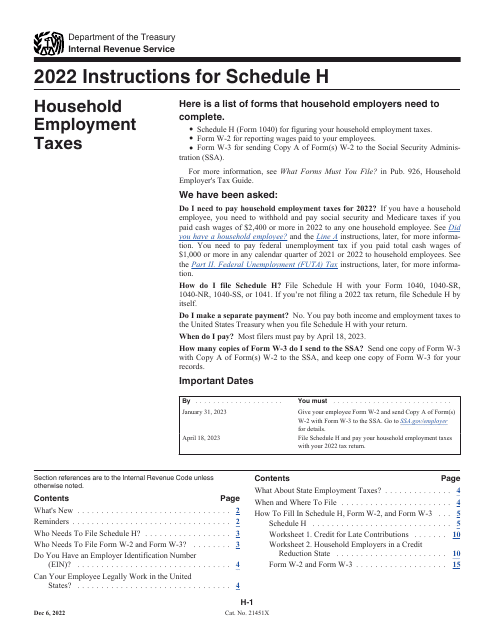

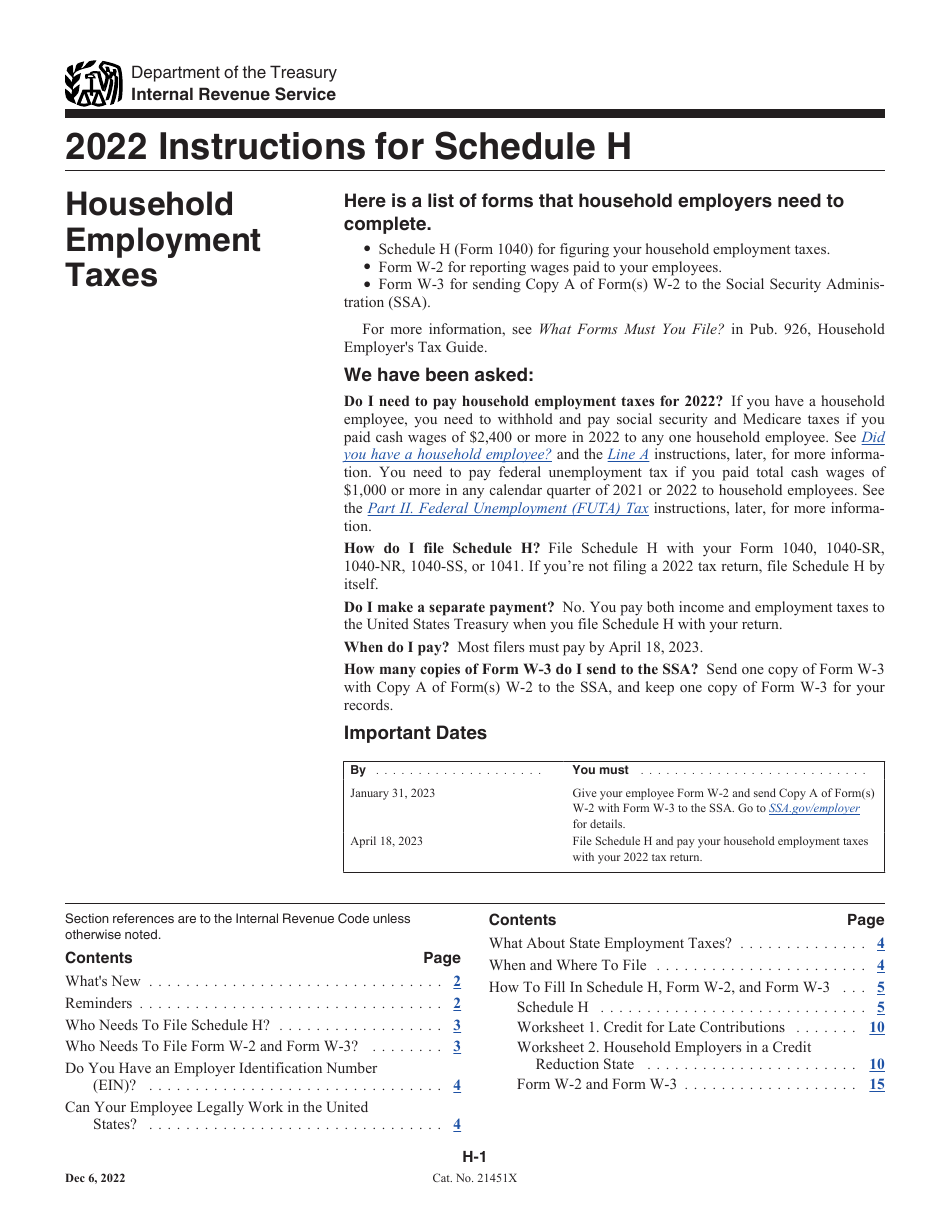

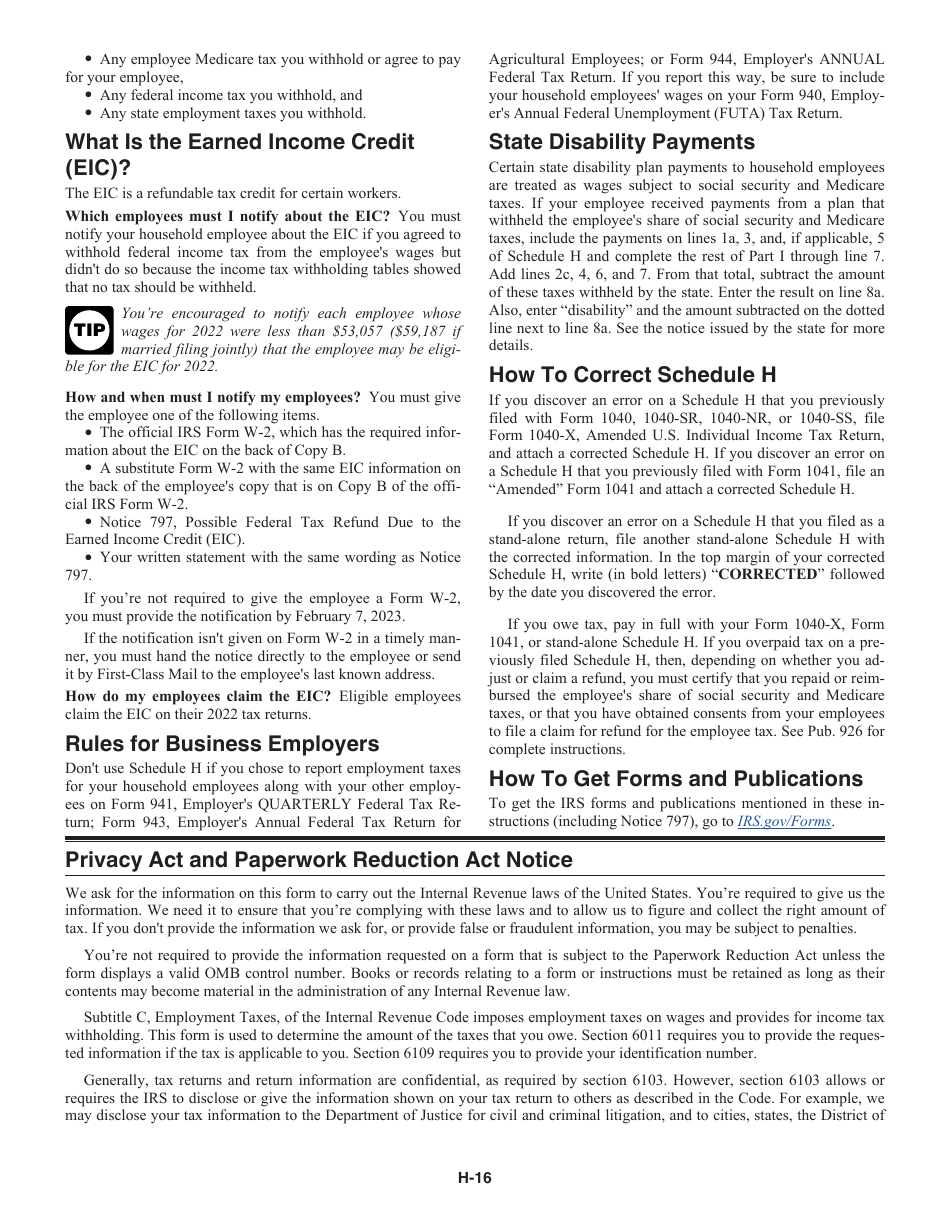

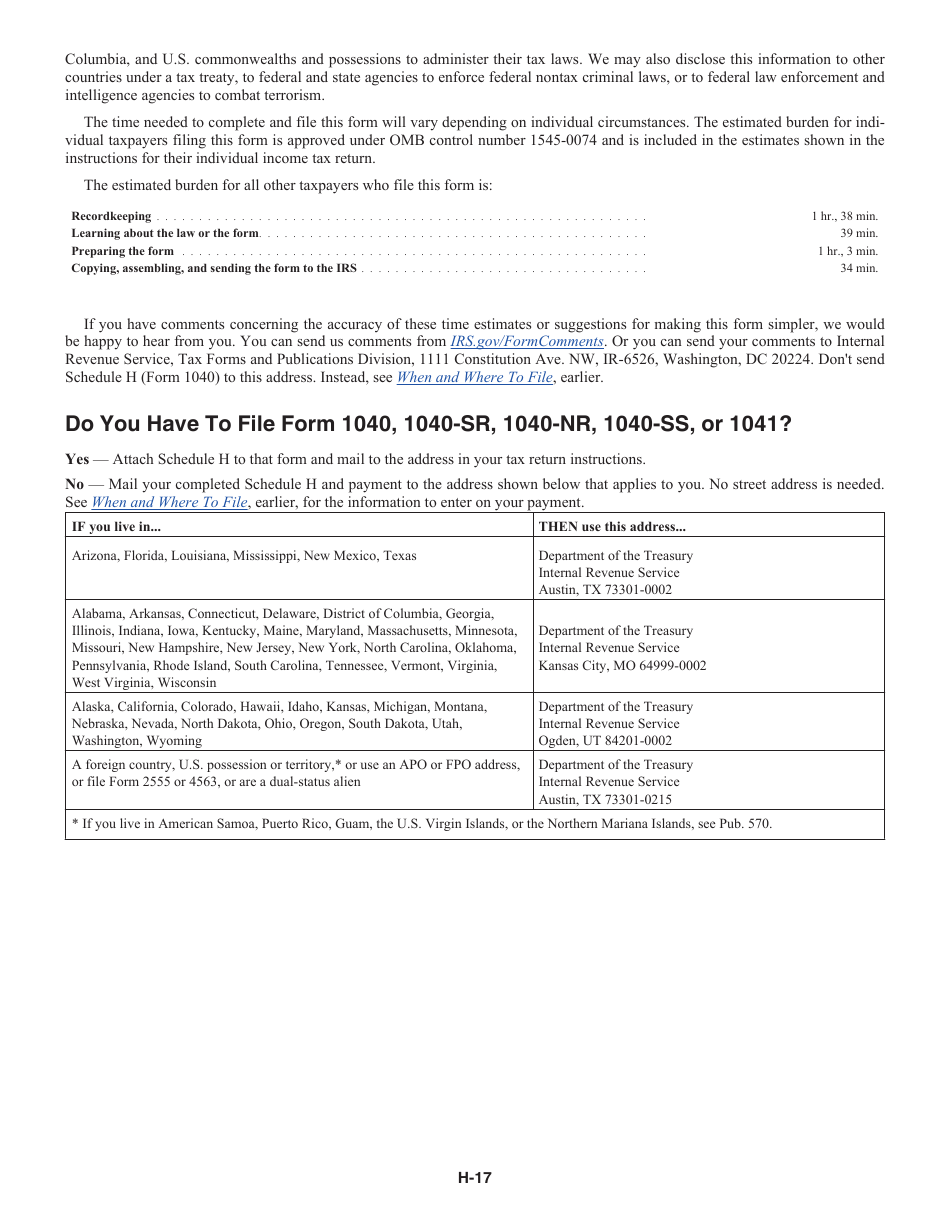

Instructions for IRS Form 1040 Schedule H Household Employment Taxes

This document contains official instructions for IRS Form 1040 Schedule H, Household Employment Taxes - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule H is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule H?

A: IRS Form 1040 Schedule H is used to report household employment taxes.

Q: Who needs to file IRS Form 1040 Schedule H?

A: You need to file IRS Form 1040 Schedule H if you paid household employees a total of $2,300 or more in wages during the tax year.

Q: What are household employment taxes?

A: Household employment taxes are taxes that are paid by individuals who employ household employees, such as nannies, babysitters, or housekeepers.

Q: What information is required to fill out IRS Form 1040 Schedule H?

A: You will need to provide information about the household employees, including their names, Social Security numbers, and wages paid to them during the tax year.

Q: How do I calculate household employment taxes?

A: You can use the Household Employment Tax Calculator provided by the IRS to calculate the amount of taxes you owe.

Q: When is the deadline to file IRS Form 1040 Schedule H?

A: IRS Form 1040 Schedule H must be filed along with your annual tax return, usually by April 15th.

Q: Are there any exemptions or deductions available for household employment taxes?

A: Yes, there are certain exemptions and deductions available, such as the Child and Dependent Care Credit. Consult the IRS guidelines or a tax professional for more information.

Q: What happens if I don't file IRS Form 1040 Schedule H?

A: Failure to file IRS Form 1040 Schedule H or pay the required household employment taxes can result in penalties and interest charges.

Q: Can I file IRS Form 1040 Schedule H electronically?

A: Yes, you can file IRS Form 1040 Schedule H electronically.

Q: Is IRS Form 1040 Schedule H applicable in both the USA and Canada?

A: No, IRS Form 1040 Schedule H is specific to the United States and not applicable in Canada. There may be similar forms for household employment taxes in Canada.

Instruction Details:

- This 17-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.