This version of the form is not currently in use and is provided for reference only. Download this version of

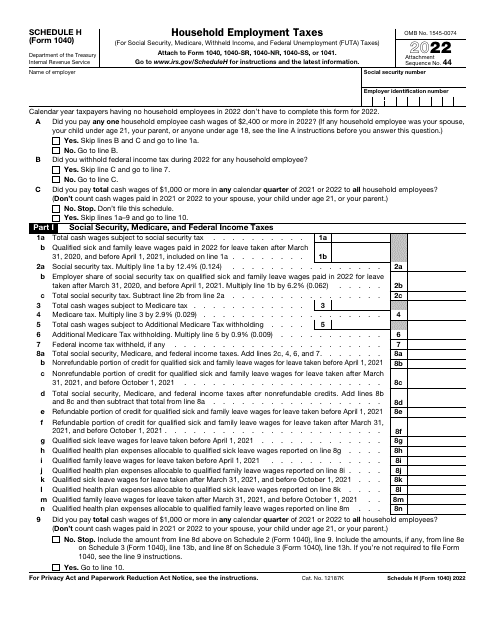

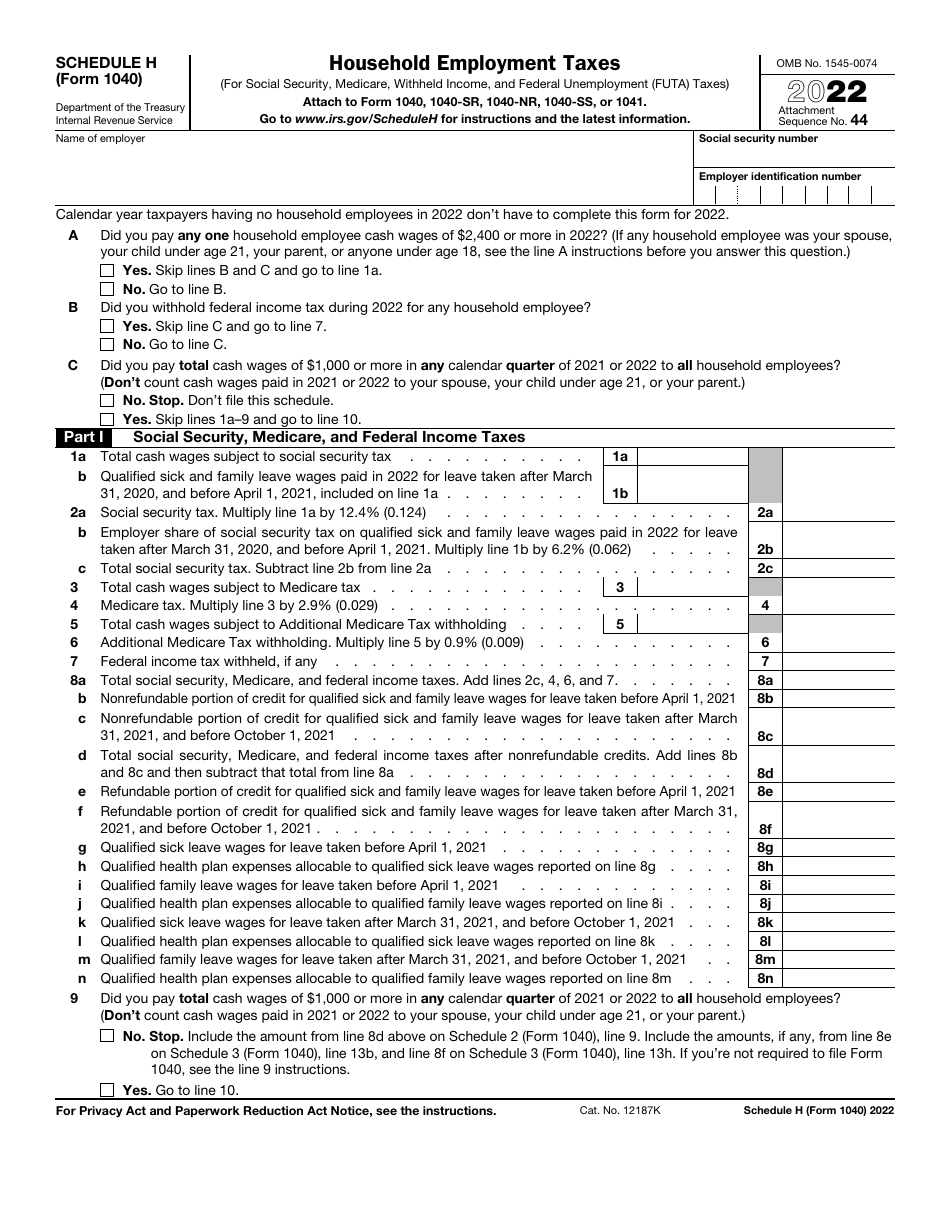

IRS Form 1040 Schedule H

for the current year.

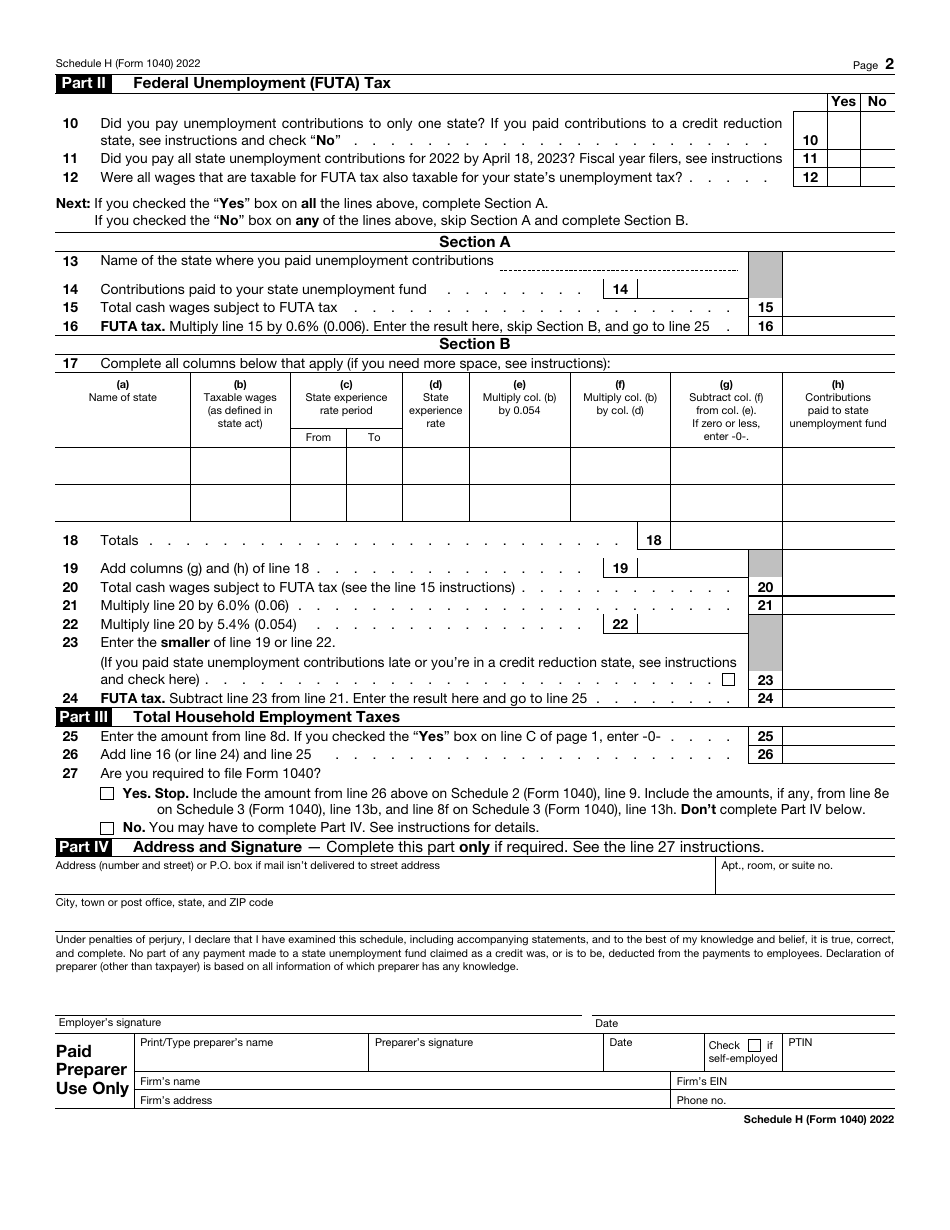

IRS Form 1040 Schedule H Household Employment Taxes

What Is IRS Form 1040 Schedule H?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule H?

A: IRS Form 1040 Schedule H is a form used to report household employment taxes.

Q: What are household employment taxes?

A: Household employment taxes are the taxes an employer must pay when they hire someone to work in their home.

Q: Who needs to file IRS Form 1040 Schedule H?

A: Anyone who pays someone to work in their home and meets certain criteria needs to file Schedule H along with their annual tax return.

Q: What information is required to fill out IRS Form 1040 Schedule H?

A: To fill out Schedule H, you will need to provide information about the employee, such as their name, Social Security number, and wages paid.

Q: What happens if I don't file IRS Form 1040 Schedule H?

A: If you are required to file Schedule H and fail to do so, you may be subject to penalties and interest on unpaid taxes.

Q: Is there a deadline to file IRS Form 1040 Schedule H?

A: Schedule H must be filed along with your annual tax return, which is typically due on April 15th of the following year.

Q: Can I e-file IRS Form 1040 Schedule H?

A: Yes, you can e-file Schedule H along with your annual tax return if you are submitting your taxes electronically.

Q: Are there any exemptions or deductions available for household employment taxes?

A: Yes, there are certain exemptions and deductions available for household employment taxes. Consult the instructions for Schedule H or a tax professional for more information.

Form Details:

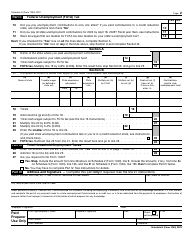

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule H through the link below or browse more documents in our library of IRS Forms.