This version of the form is not currently in use and is provided for reference only. Download this version of

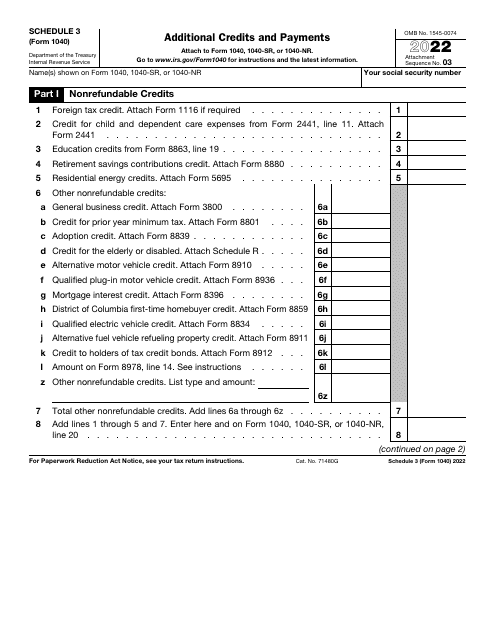

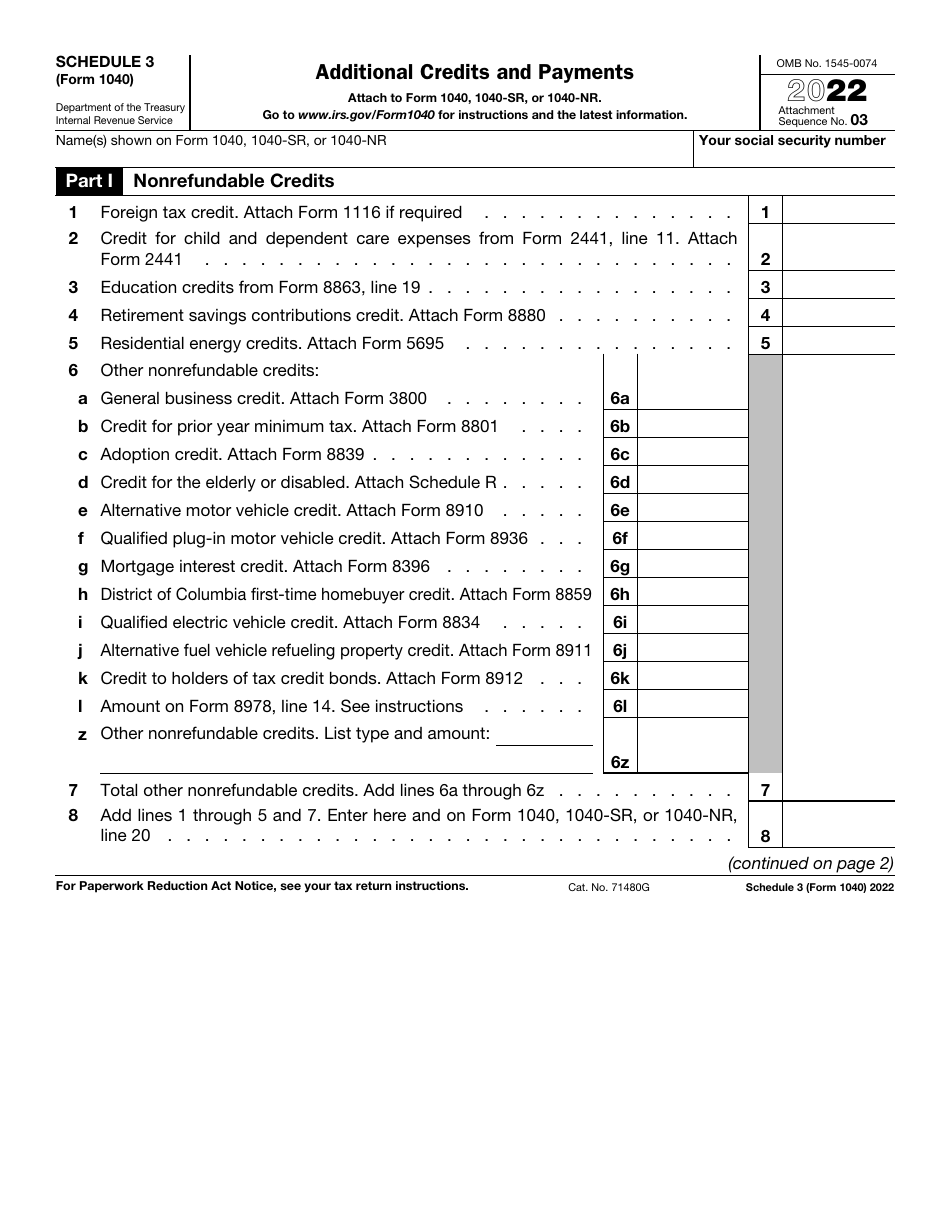

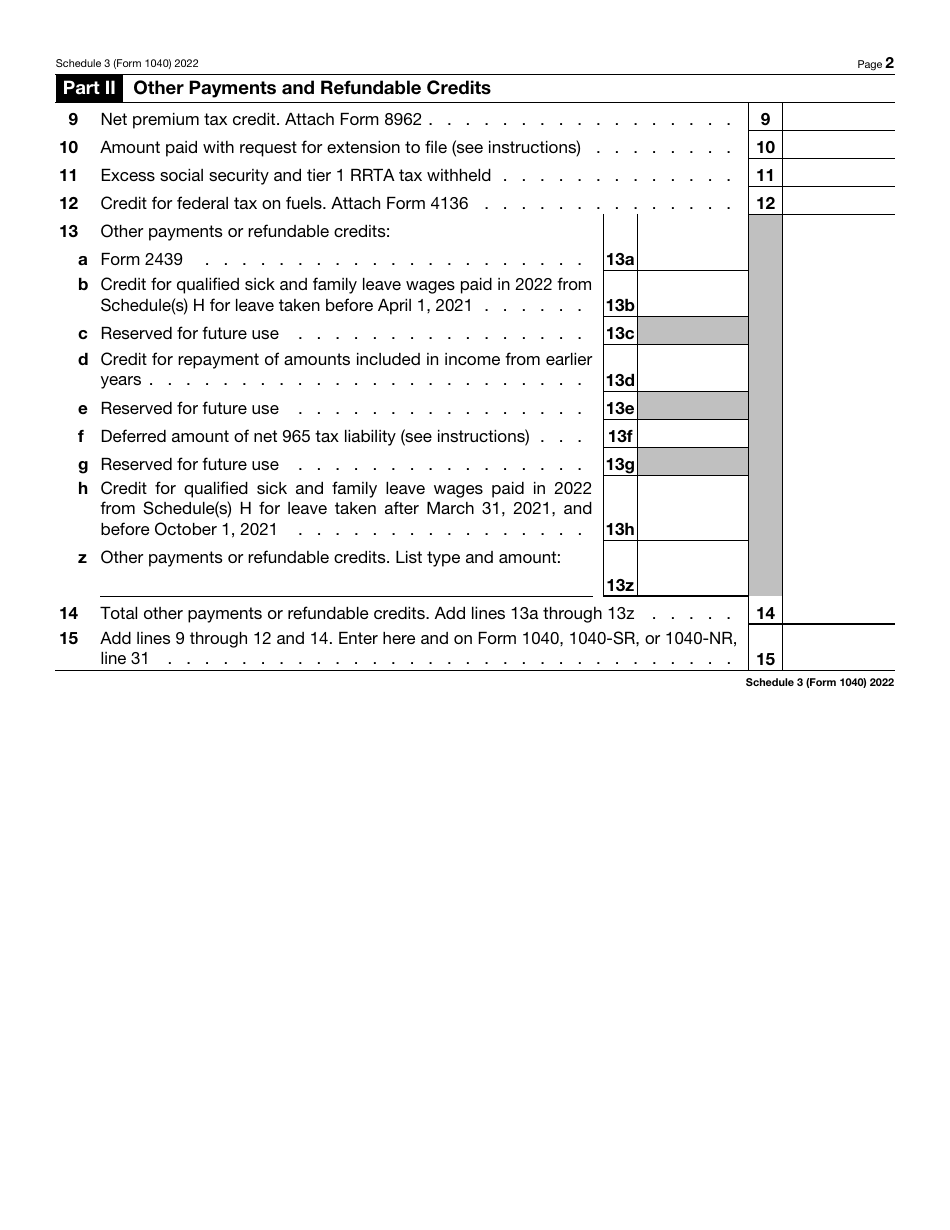

IRS Form 1040 Schedule 3

for the current year.

IRS Form 1040 Schedule 3 Additional Credits and Payments

What Is IRS Form 1040 Schedule 3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 1040 Schedule 3?

A: Form 1040 Schedule 3 is a supplemental form used to report additional credits and payments on your federal income tax return.

Q: What kind of credits and payments are reported on Form 1040 Schedule 3?

A: Form 1040 Schedule 3 is used to report credits such as the foreign tax credit, education credits, and the residential energy credit, as well as certain other payments.

Q: Do I need to file Form 1040 Schedule 3?

A: You may need to file Form 1040 Schedule 3 if you have specific credits or payments to report that are not already included on your main Form 1040.

Q: Can I e-file Form 1040 Schedule 3?

A: Yes, you can e-file Form 1040 Schedule 3 along with your main Form 1040 using electronic tax filing options.

Q: Are there any specific instructions for completing Form 1040 Schedule 3?

A: Yes, the IRS provides detailed instructions on how to complete Form 1040 Schedule 3. Make sure to review these instructions carefully before filling out the form.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule 3 through the link below or browse more documents in our library of IRS Forms.