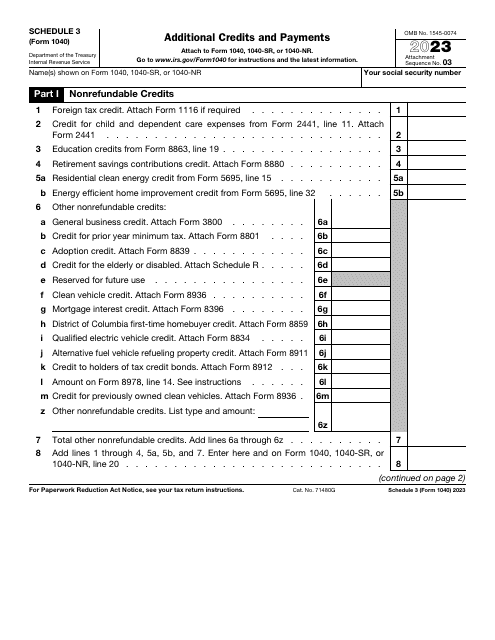

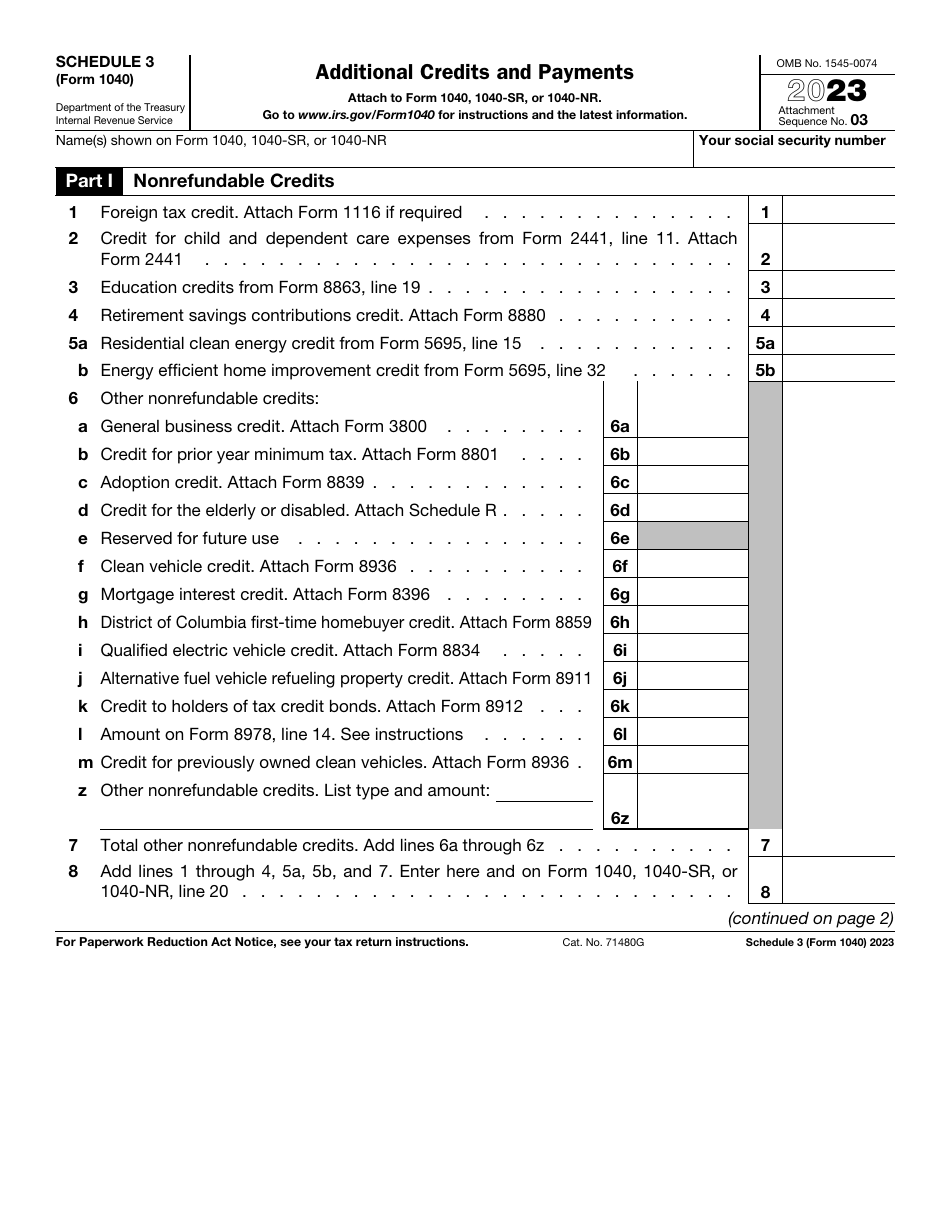

IRS Form 1040 Schedule 3 Additional Credits and Payments

What Is IRS Form 1040 Schedule 3?

IRS Form 1040 Schedule 3, Additional Credits and Payments , is a fiscal instrument that elaborates on payments and credits that may let an individual lower the taxes they would otherwise have to pay in full or add to the amount of tax refund they are claiming. Taxpayers are required to attach this form to their annual income statement - IRS Form 1040, U.S. Individual Income Tax Return, whether you are reporting tax credits you are entitled to receive or you were able to qualify for a child tax credit that reduces your tax liability.

This document was issued by the Internal Revenue Service (IRS) in 2023 - previous editions of the schedule are now outdated. An IRS Form 1040 Schedule 3 fillable version can be found via the link below.

Form 1040 Schedule 3 Instructions

Follow these Schedule 3 1040 instructions to describe the credits and deductions that apply to your income tax:

-

Start with your personal details - indicate your full name the way it is written on your income statement and your social security number . There is no need to add more information on top of the form since your contact details will be listed in the other documentation.

-

Read the list of nonrefundable credits that may or may not apply in your case - naturally, you are permitted to skip the credits you cannot claim . You will be required to specify the accurate amount of credit and combine the amounts to demonstrate the total amount of nonrefundable credits you qualify for whether you are hoping to reduce your tax liability after purchasing an eco-friendly car, contributing sufficient funds to your retirement savings account, or buying your first residential property in the District of Columbia.

-

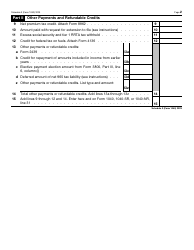

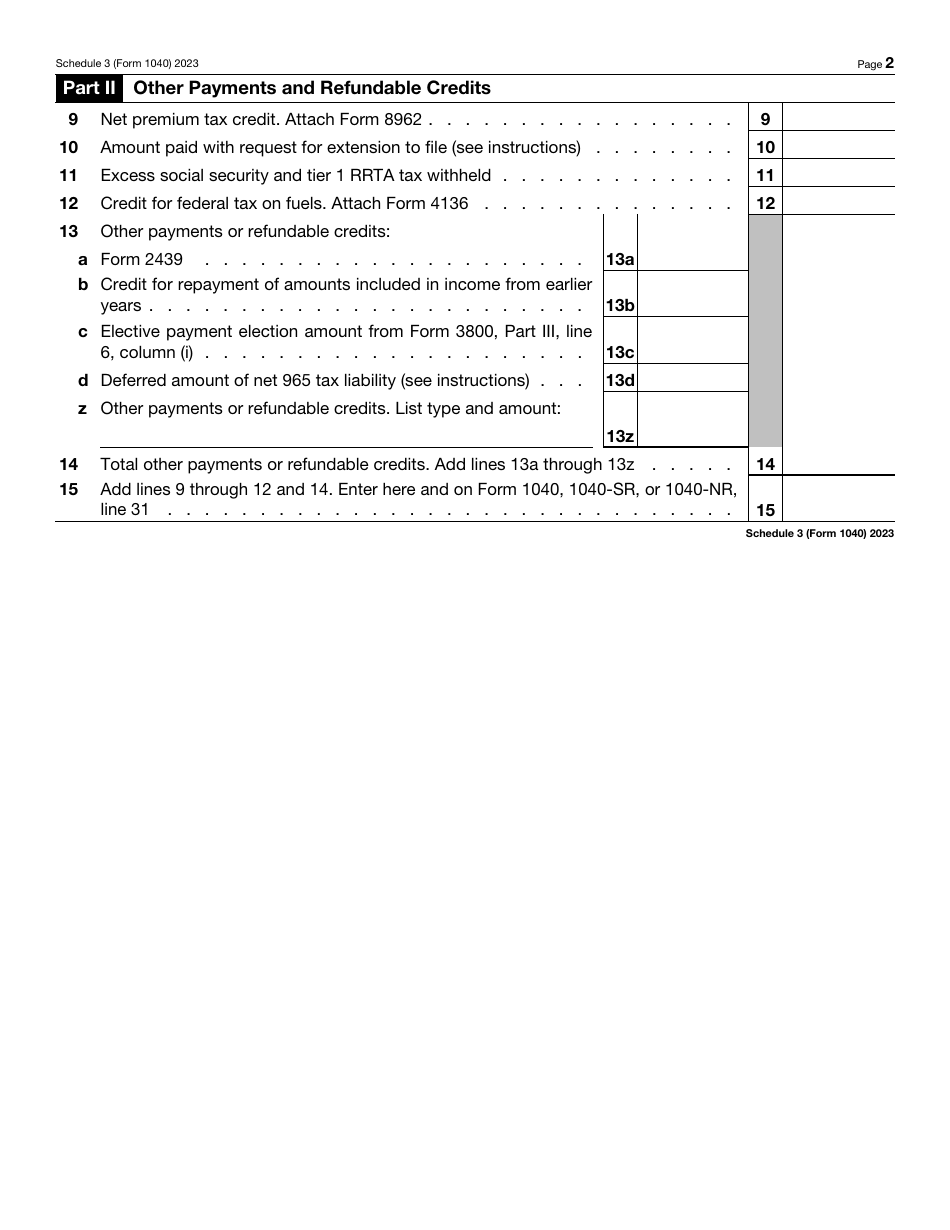

Go to the second page of the form if there are other payments you have to enter . Additionally, this part of the document must be completed if there are any refundable credits you can claim which means you will be getting a refund from tax organs in the future. You also have an opportunity to identify other credits and payments apart from those listed in the form - simply mention the type of the credit or payment and its amount. After you combine all the results, write down the total amount on a designated line in your income statement.

-

Apart from adding the results of your computations to your income statement, make sure you comply with other filing requirements related to IRS Form 1040 Schedule 3 . For instance, a taxpayer that qualifies for a credit as a consequence of adopting a child during the tax period covered by the form is obliged to prepare and submit IRS Form 8839, Qualified Adoption Expenses, in order to provide more information about the procedure and the tax they end up owing. Do not forget to make a copy of the document for your personal records before you file the papers.