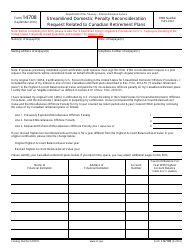

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule R

for the current year.

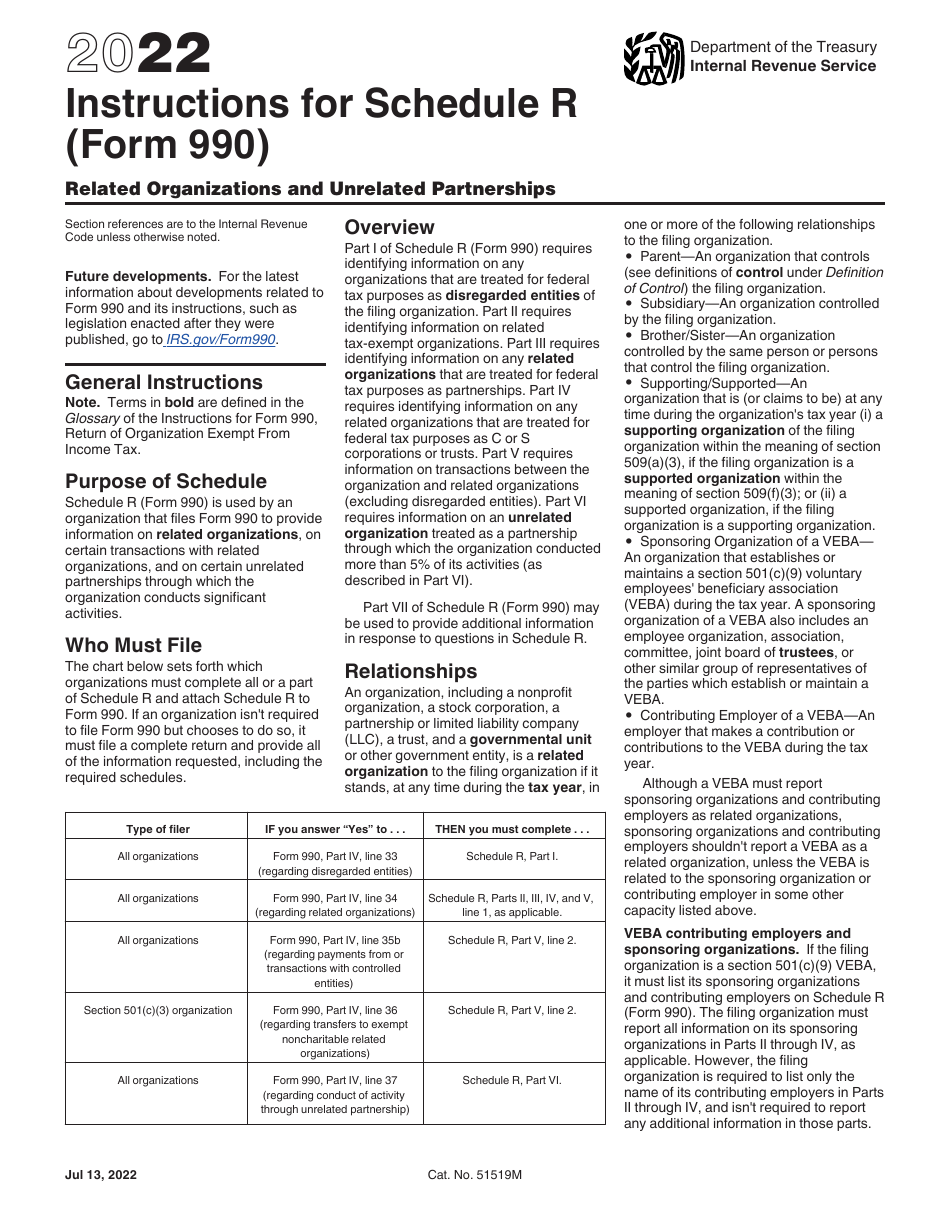

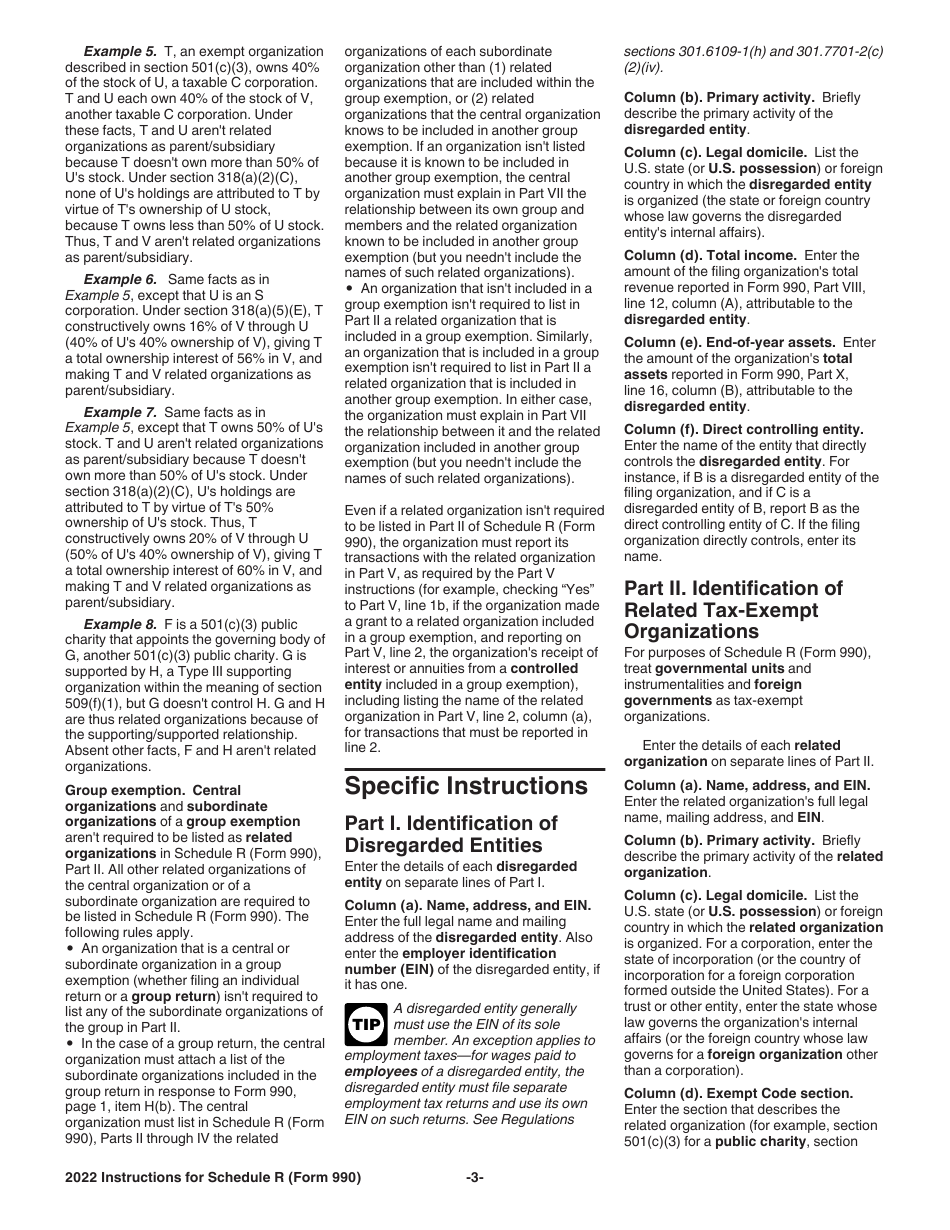

Instructions for IRS Form 990 Schedule R Related Organizations and Unrelated Partnerships

This document contains official instructions for IRS Form 990 Schedule R, Related Organizations and Unrelated Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule R is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule R?

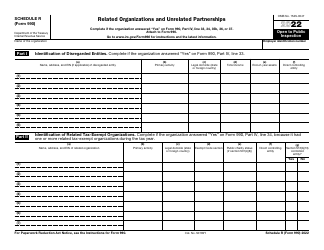

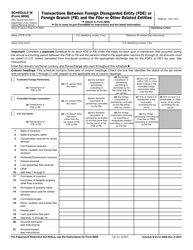

A: IRS Form 990 Schedule R is a supplementary form used to report related organizations and unrelated partnerships.

Q: Who is required to file IRS Form 990 Schedule R?

A: Non-profit organizations that have certain relationships with other organizations or partnerships are required to file Form 990 Schedule R.

Q: What information is reported on IRS Form 990 Schedule R?

A: Form 990 Schedule R requires information about any relationships with other organizations or partnerships, such as financial transactions, contributions, and activities.

Q: When is the deadline for filing IRS Form 990 Schedule R?

A: The deadline for filing Form 990 Schedule R is the same as the deadline for filing the annual Form 990, which is usually the 15th day of the 5th month after the end of the organization's fiscal year.

Q: What should I do if I have questions or need assistance with IRS Form 990 Schedule R?

A: If you have questions or need assistance with Form 990 Schedule R, you can contact the IRS or seek guidance from a tax professional or accountant.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.