This version of the form is not currently in use and is provided for reference only. Download this version of

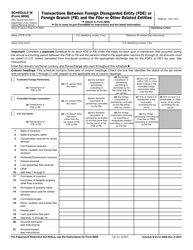

IRS Form 990 Schedule R

for the current year.

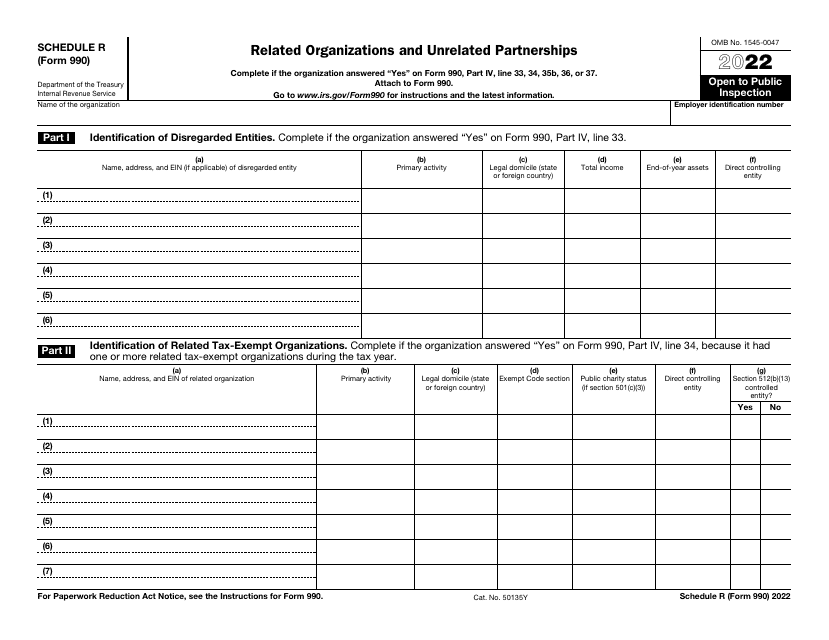

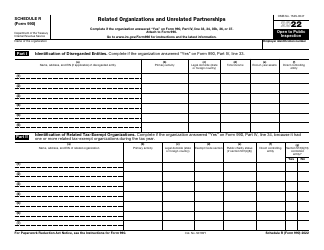

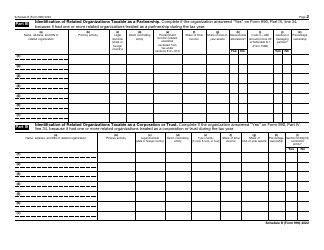

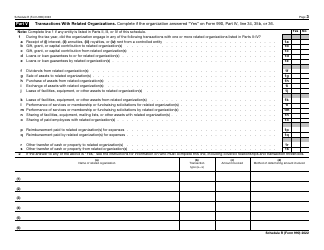

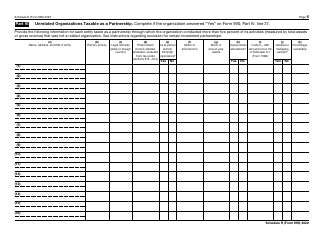

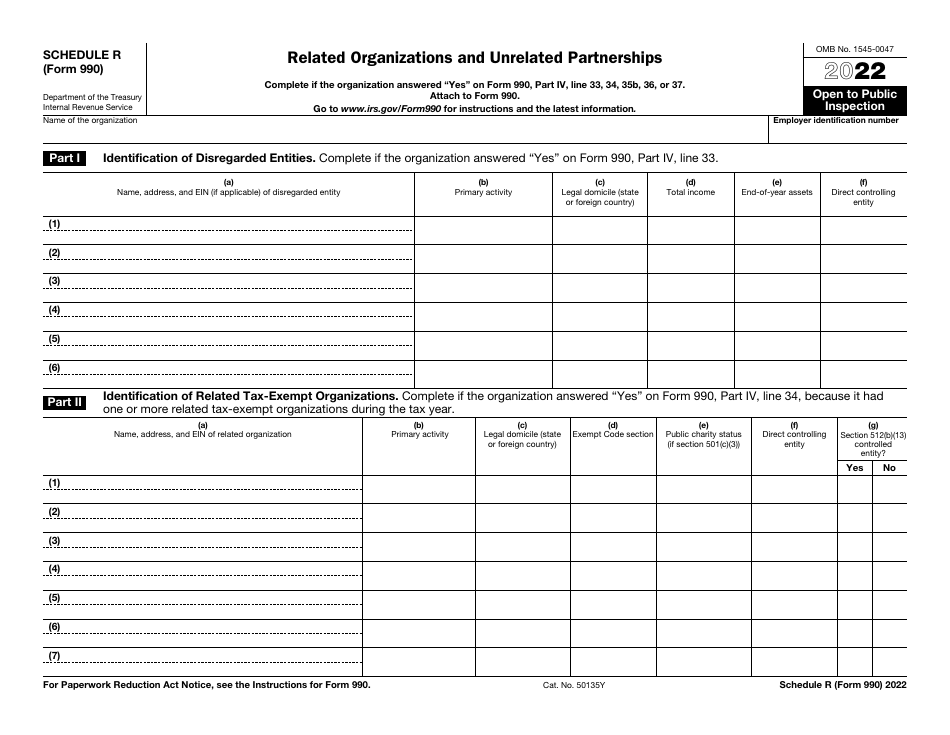

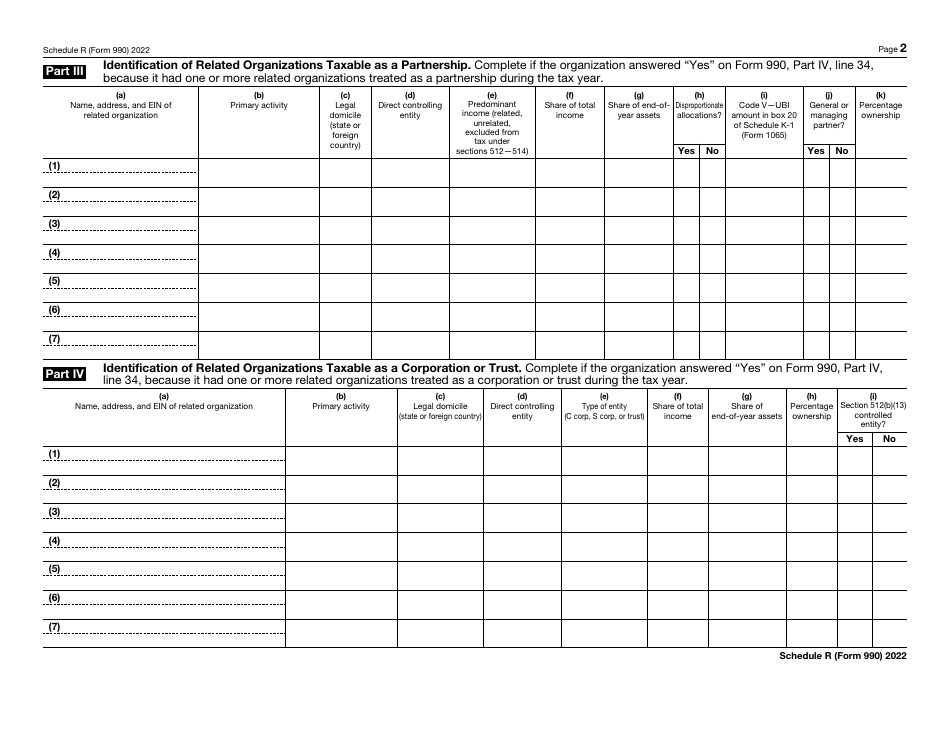

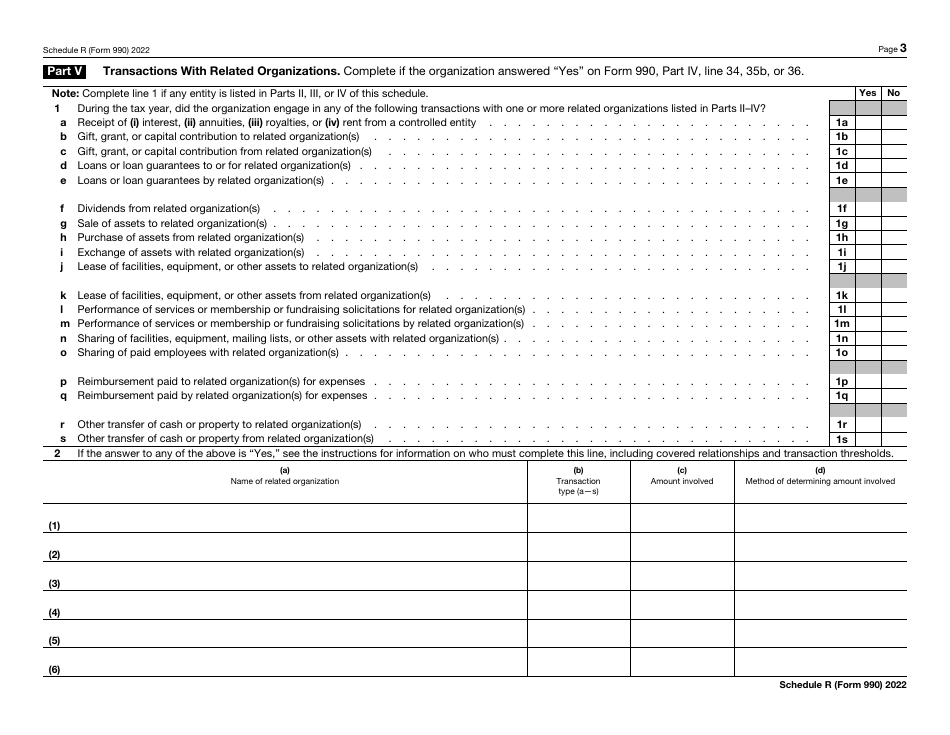

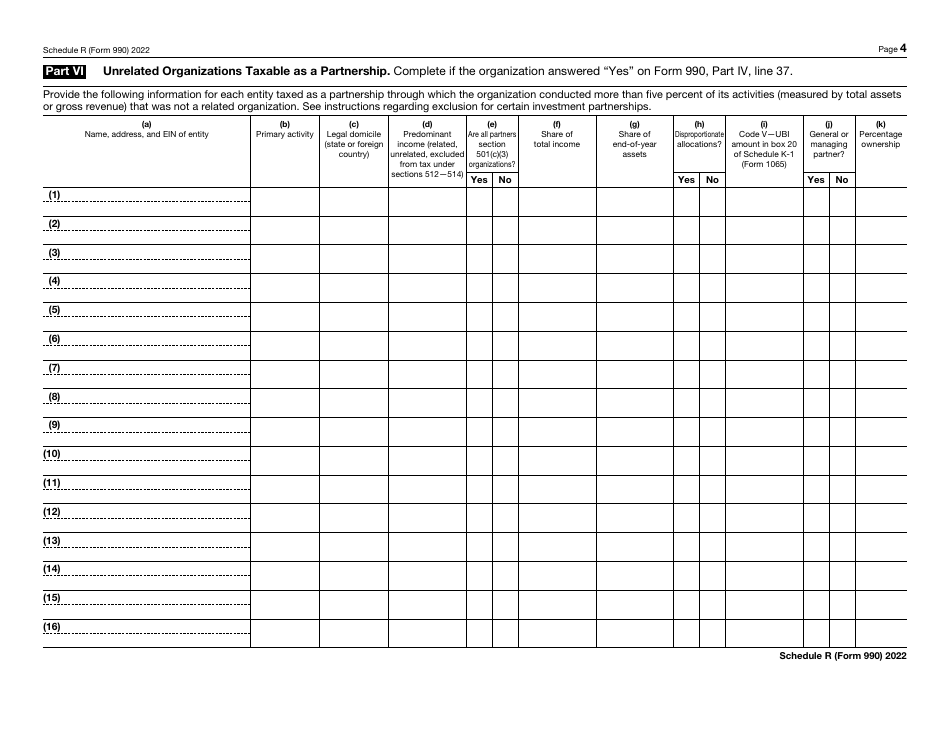

IRS Form 990 Schedule R Related Organizations and Unrelated Partnerships

What Is IRS Form 990 Schedule R?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule R?

A: IRS Form 990 Schedule R is a supplementary form that nonprofits use to report their related organizations and unrelated partnerships.

Q: Who needs to file IRS Form 990 Schedule R?

A: Nonprofit organizations that have related organizations or are engaged in partnerships that are not related to their primary exempt purpose.

Q: What is a related organization?

A: A related organization is another nonprofit entity that is controlled by, controls, or is under common control with the filing organization.

Q: What is an unrelated partnership?

A: An unrelated partnership is a partnership in which the nonprofit organization participates but is not related to its exempt purpose.

Q: What information needs to be provided on IRS Form 990 Schedule R?

A: The form requires information about the nature of the relationship or partnership, financial data, and transactions between the organizations.

Q: Is IRS Form 990 Schedule R required for all nonprofits?

A: No, only nonprofits that have related organizations or engage in unrelated partnerships need to file IRS Form 990 Schedule R.

Q: When is the deadline to file IRS Form 990 Schedule R?

A: The deadline to file IRS Form 990 Schedule R is the same as the deadline for the annual Form 990 filing, which is the 15th day of the 5th month after the end of the organization's fiscal year.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule R through the link below or browse more documents in our library of IRS Forms.