This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990, 990-EZ Schedule A

for the current year.

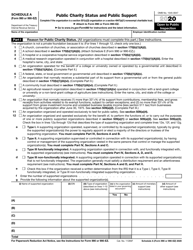

Instructions for IRS Form 990, 990-EZ Schedule A Public Charity Status and Public Support

This document contains official instructions for IRS Form 990 Schedule A and IRS Form 990-EZ Schedule A . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule A is available for download through this link.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is a reporting form used by tax-exempt organizations to provide information about their activities, finances, and governance.

Q: What is the purpose of Form 990?

A: The purpose of Form 990 is to ensure transparency and accountability of tax-exempt organizations by providing the IRS and the public with information about the organization's operations and finances.

Q: Who needs to file Form 990?

A: Most tax-exempt organizations, including public charities, private foundations, and certain other types of tax-exempt organizations, are required to file Form 990.

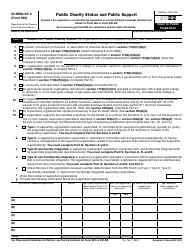

Q: What is Schedule A of Form 990-EZ?

A: Schedule A is a part of Form 990-EZ that is used to determine an organization's public charity status and public support.

Q: What is public charity status?

A: Public charity status is a designation given to organizations that are primarily supported by donations and government grants, rather than private foundations or individuals.

Q: What is public support?

A: Public support refers to the financial support that an organization receives from contributions, grants, and other forms of public support.

Q: How do I determine if an organization qualifies as a public charity?

A: To qualify as a public charity, an organization must meet certain support tests, which are calculated using information provided in Schedule A of Form 990-EZ.

Q: What happens if an organization fails the public support tests?

A: If an organization fails the public support tests, it may lose its public charity status and be reclassified as a private foundation. This could have implications for the organization's tax status and reporting requirements.

Instruction Details:

- This 20-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.