This version of the form is not currently in use and is provided for reference only. Download this version of

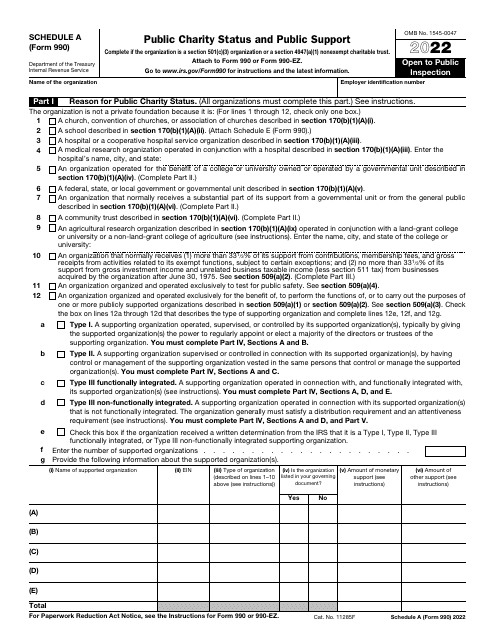

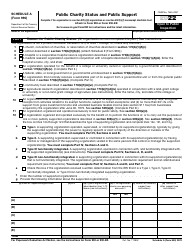

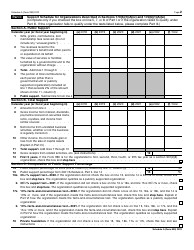

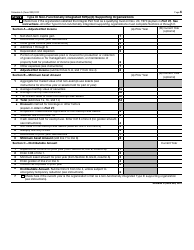

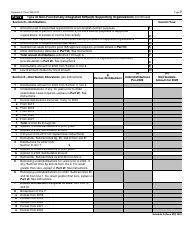

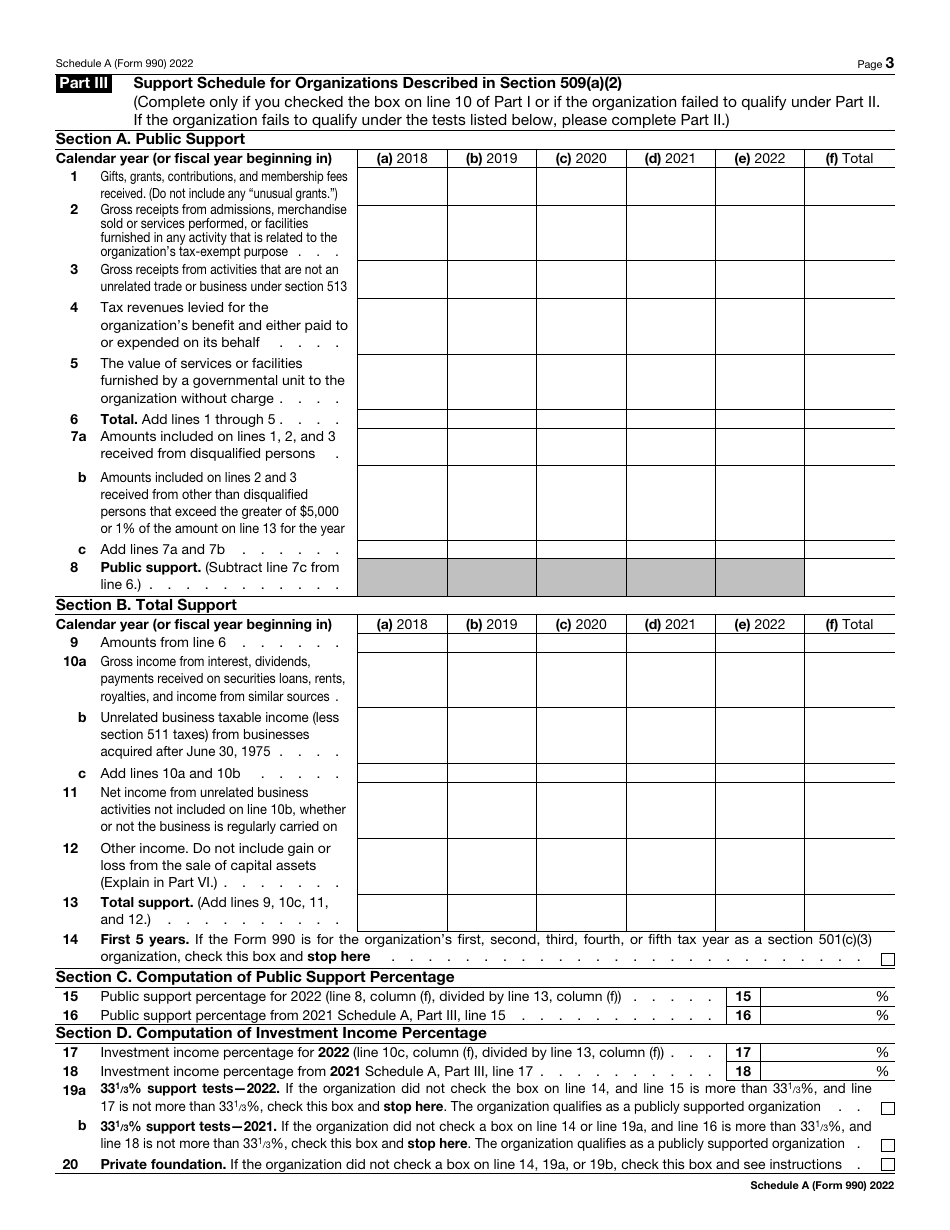

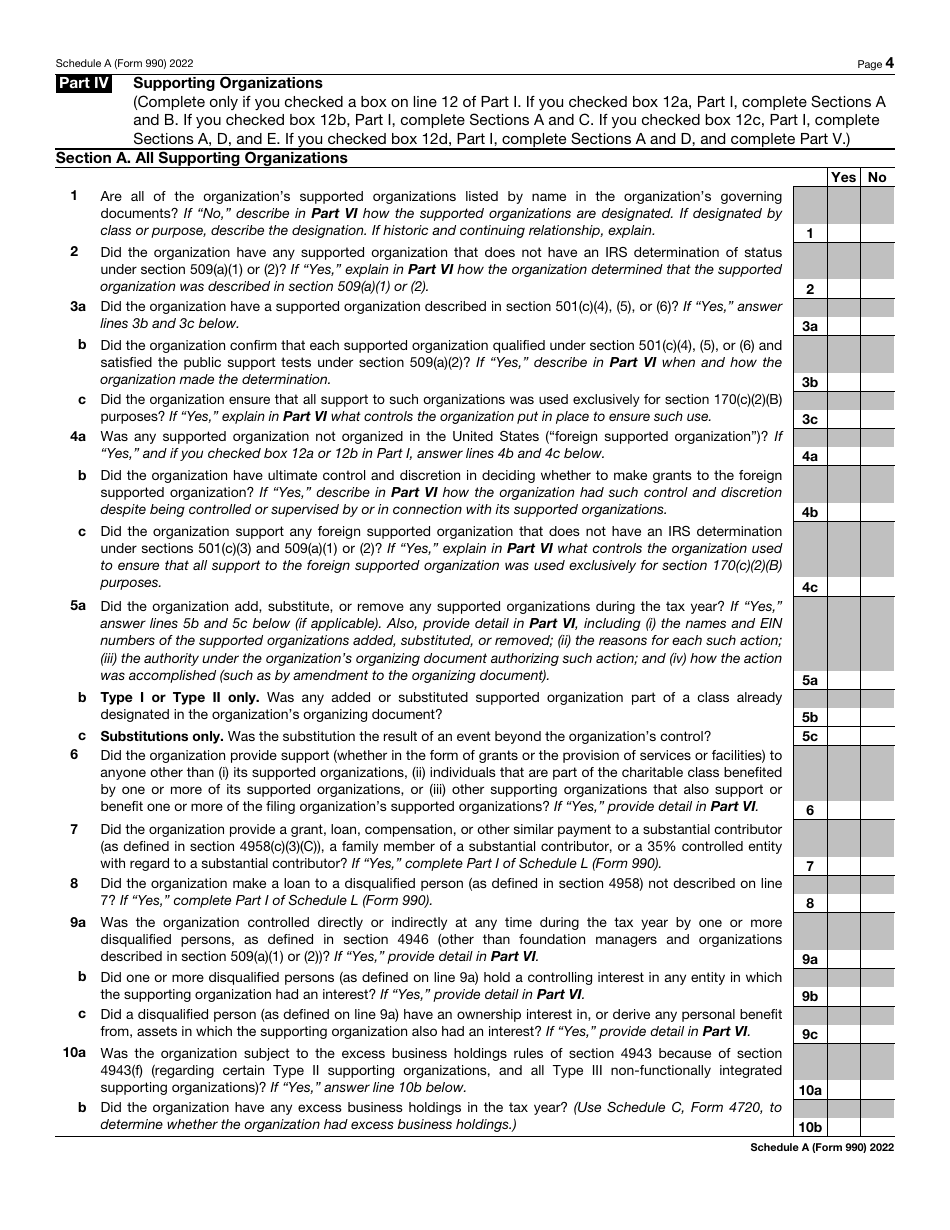

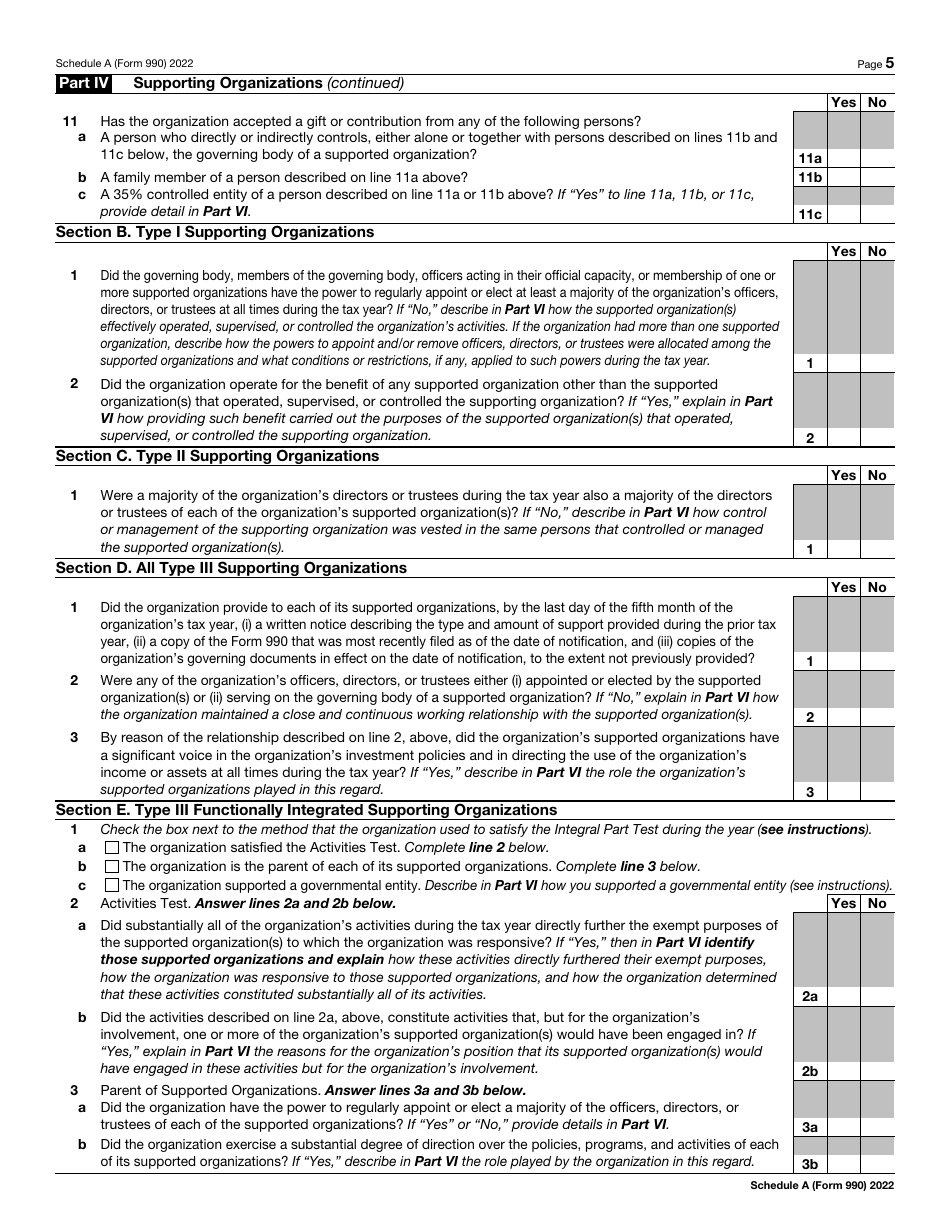

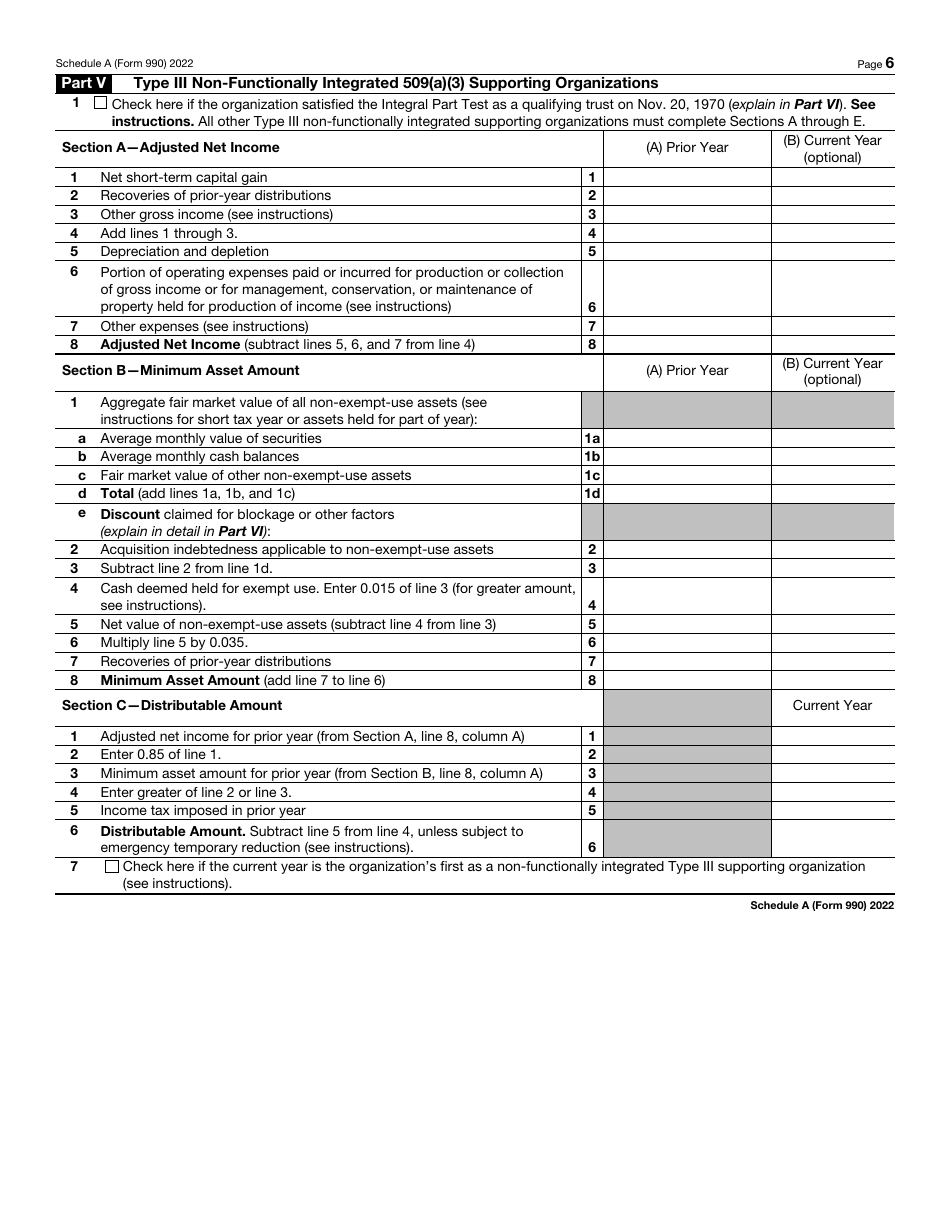

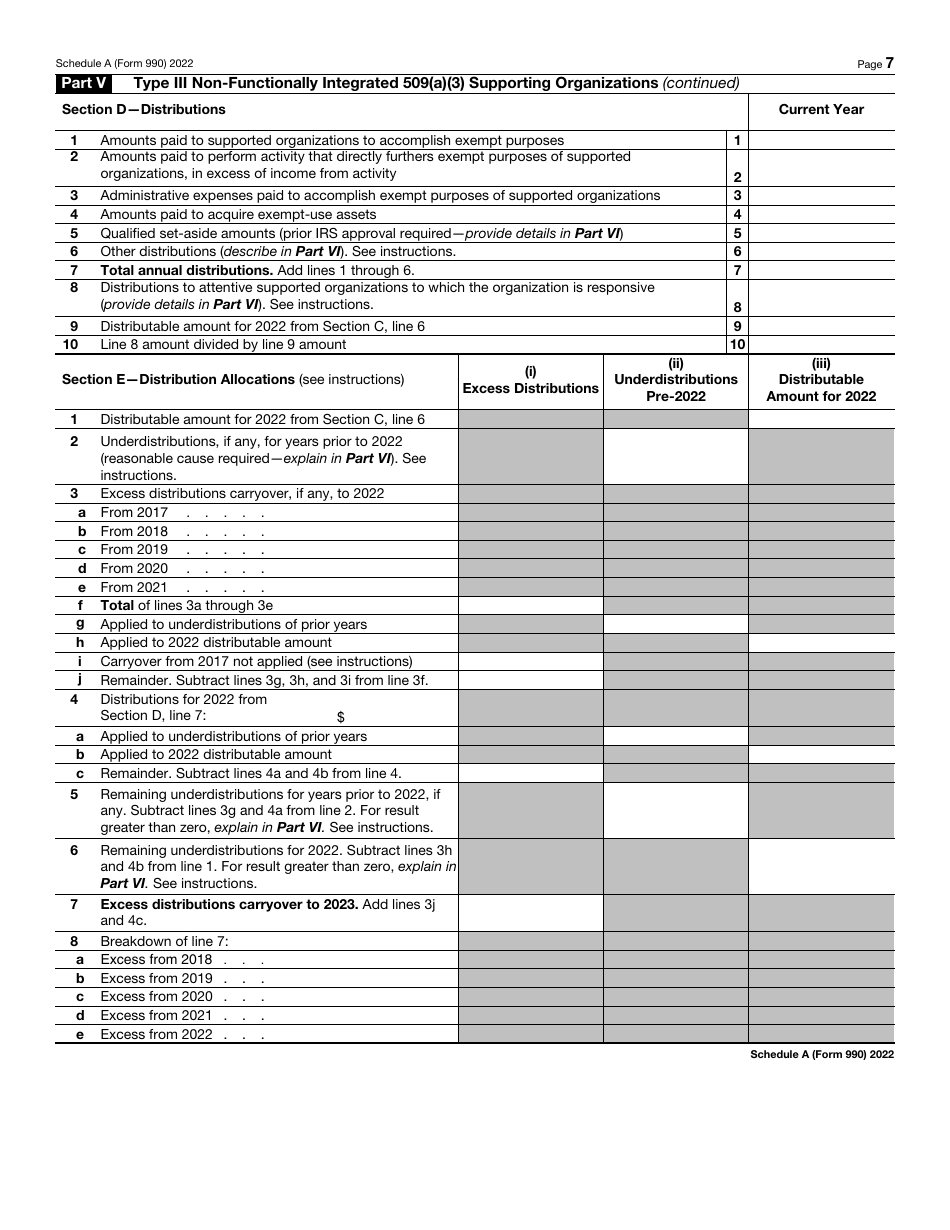

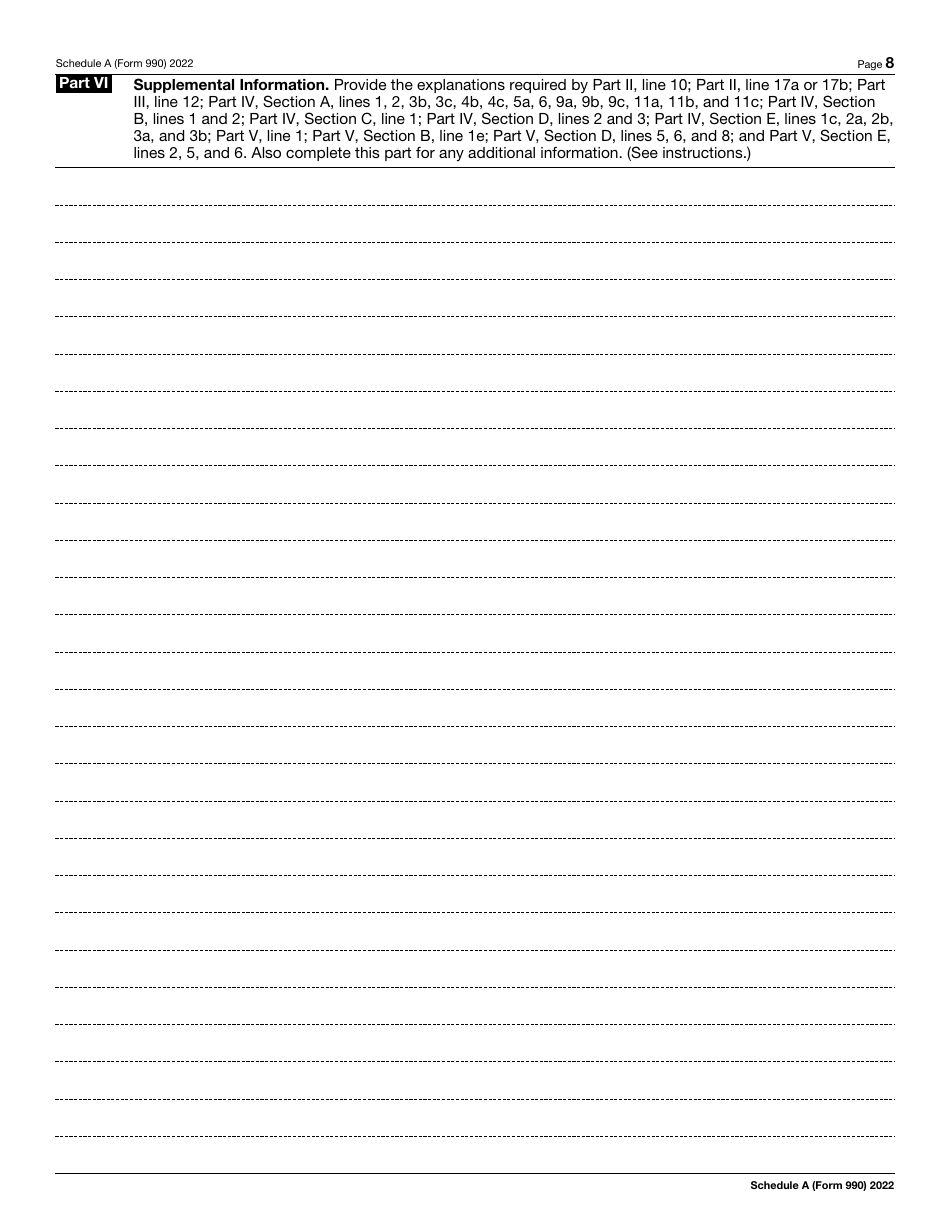

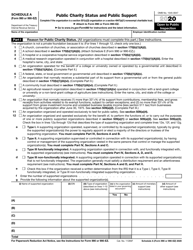

IRS Form 990 Schedule A

for the current year.

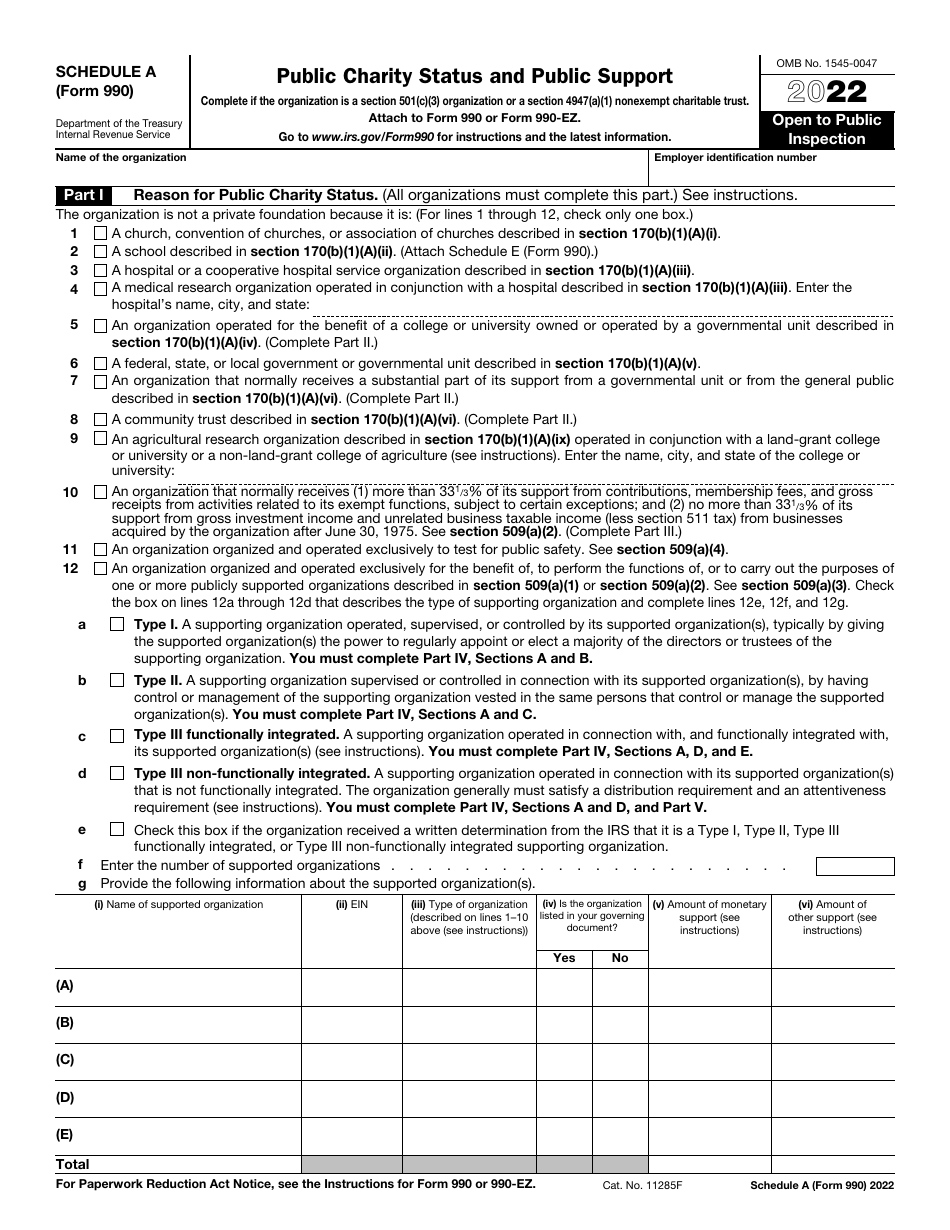

IRS Form 990 Schedule A Public Charity Status and Public Support

What Is IRS Form 990 Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule A?

A: IRS Form 990 Schedule A is a form used by nonprofit organizations to report their public charity status and public support.

Q: What is public charity status?

A: Public charity status refers to the classification of a nonprofit organization that receives a substantial amount of its funding from the general public or government sources.

Q: What is public support?

A: Public support refers to the financial contributions and support a nonprofit organization receives from the general public, government sources, and other public charities.

Q: Why is it important for nonprofits to report their public charity status and public support?

A: Reporting public charity status and public support is important for nonprofits to maintain their tax-exempt status and to provide transparency to donors, government agencies, and the general public.

Q: Who needs to file IRS Form 990 Schedule A?

A: Nonprofit organizations that are classified as public charities and meet certain criteria for public support are required to file IRS Form 990 Schedule A.

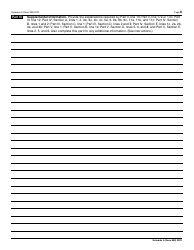

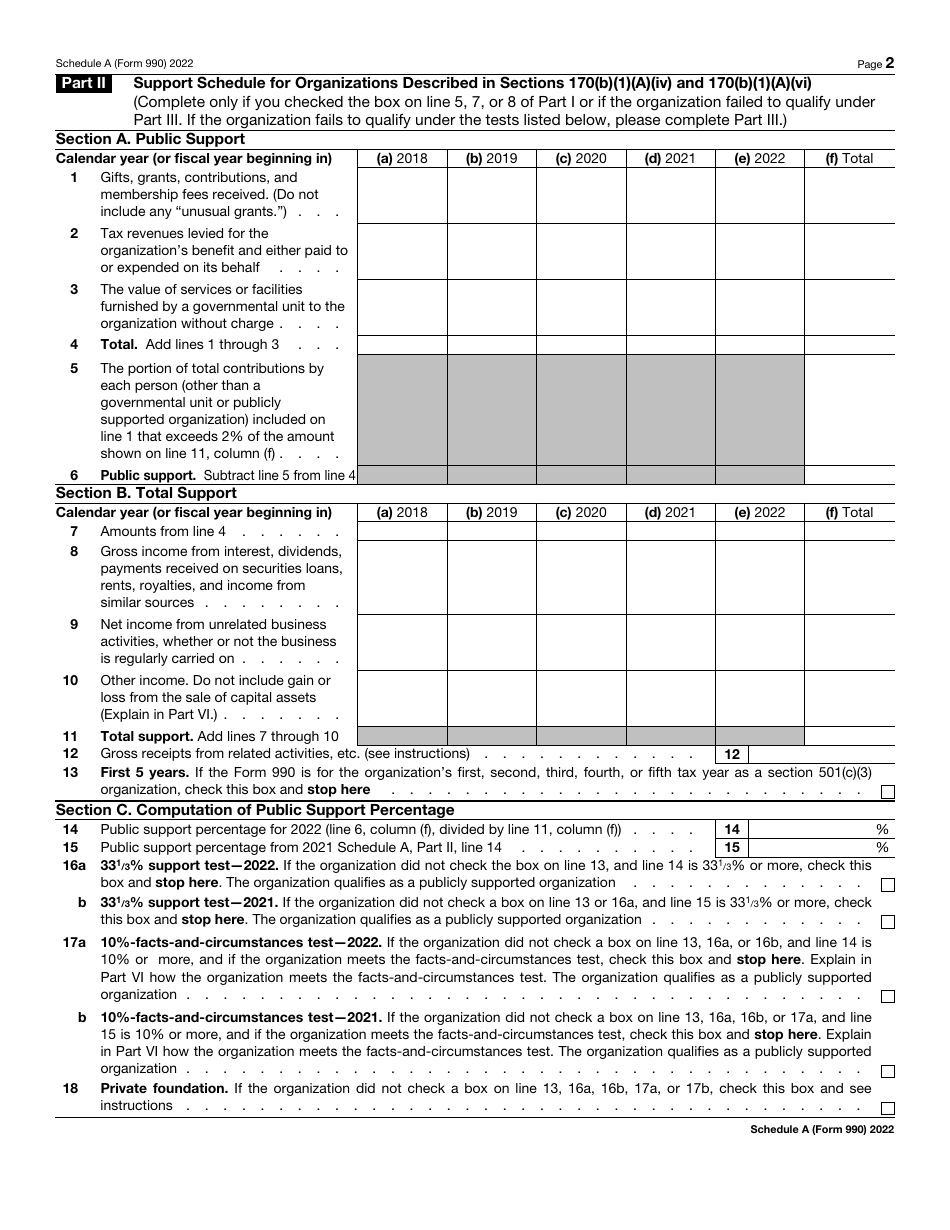

Q: What information is required to be reported on IRS Form 990 Schedule A?

A: IRS Form 990 Schedule A requires information on the nonprofit organization's sources of public support, public charity status, and other related details.

Q: When is the deadline to file IRS Form 990 Schedule A?

A: The deadline to file IRS Form 990 Schedule A is based on the nonprofit organization's fiscal year, but it is generally due on the 15th day of the 5th month after the end of the fiscal year.

Q: Are there any penalties for not filing IRS Form 990 Schedule A?

A: Yes, nonprofit organizations that fail to file IRS Form 990 Schedule A or file it improperly may face penalties, including the loss of tax-exempt status.

Q: Can a nonprofit organization lose its public charity status?

A: Yes, if a nonprofit organization fails to meet the requirements for public support or engages in activities that jeopardize its public charity status, it can lose its public charity classification.

Form Details:

- A 8-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule A through the link below or browse more documents in our library of IRS Forms.