This version of the form is not currently in use and is provided for reference only. Download this version of

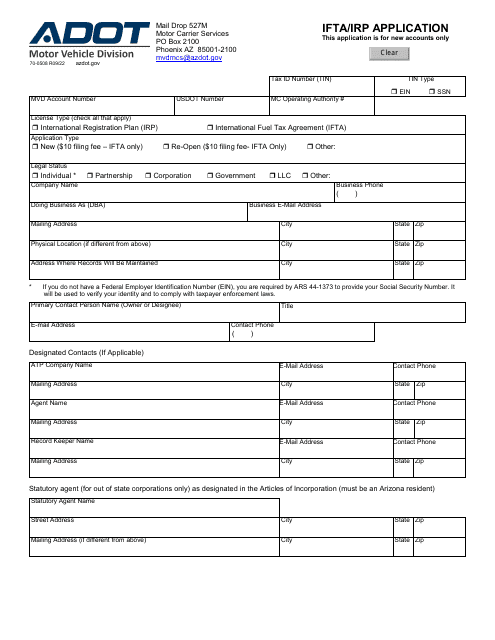

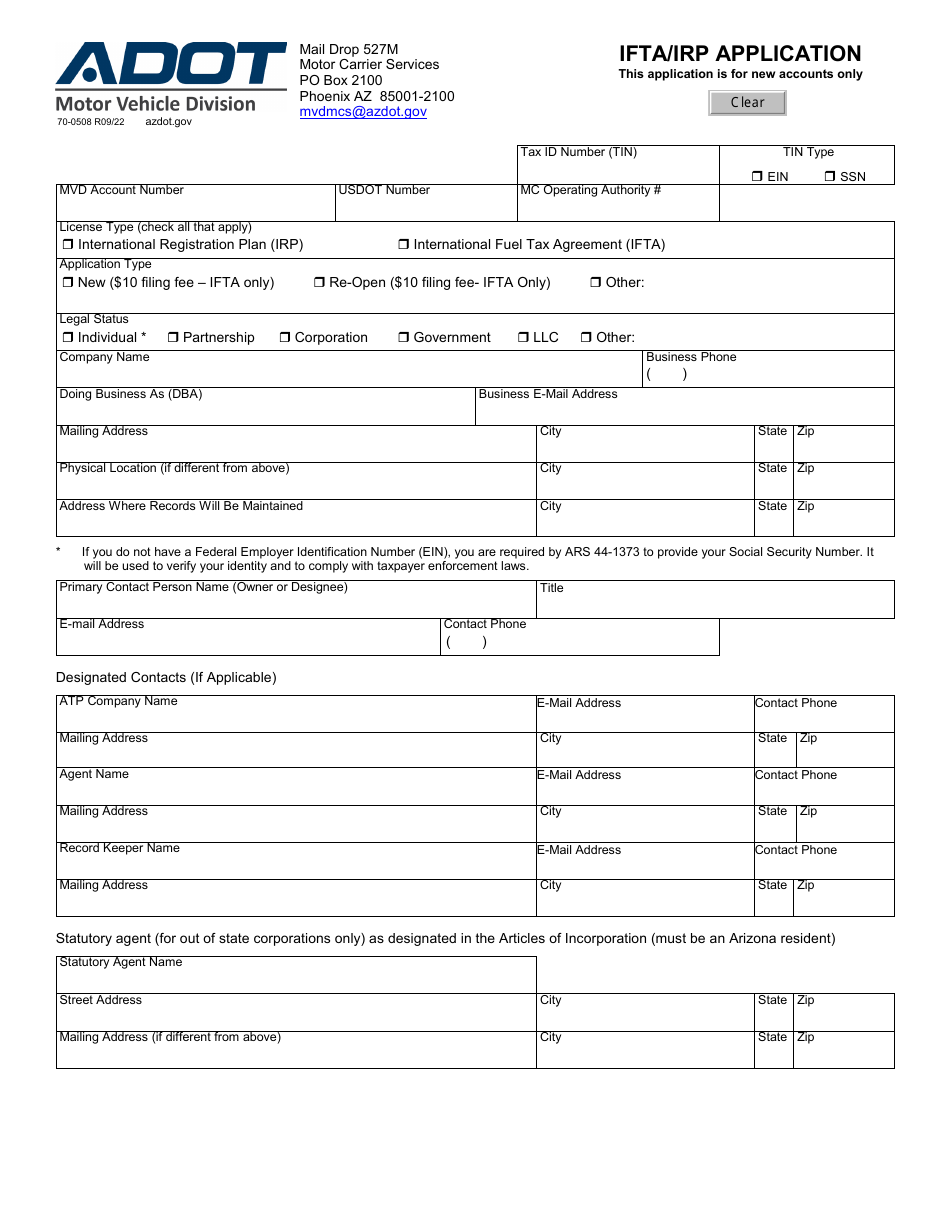

Form 70-0508

for the current year.

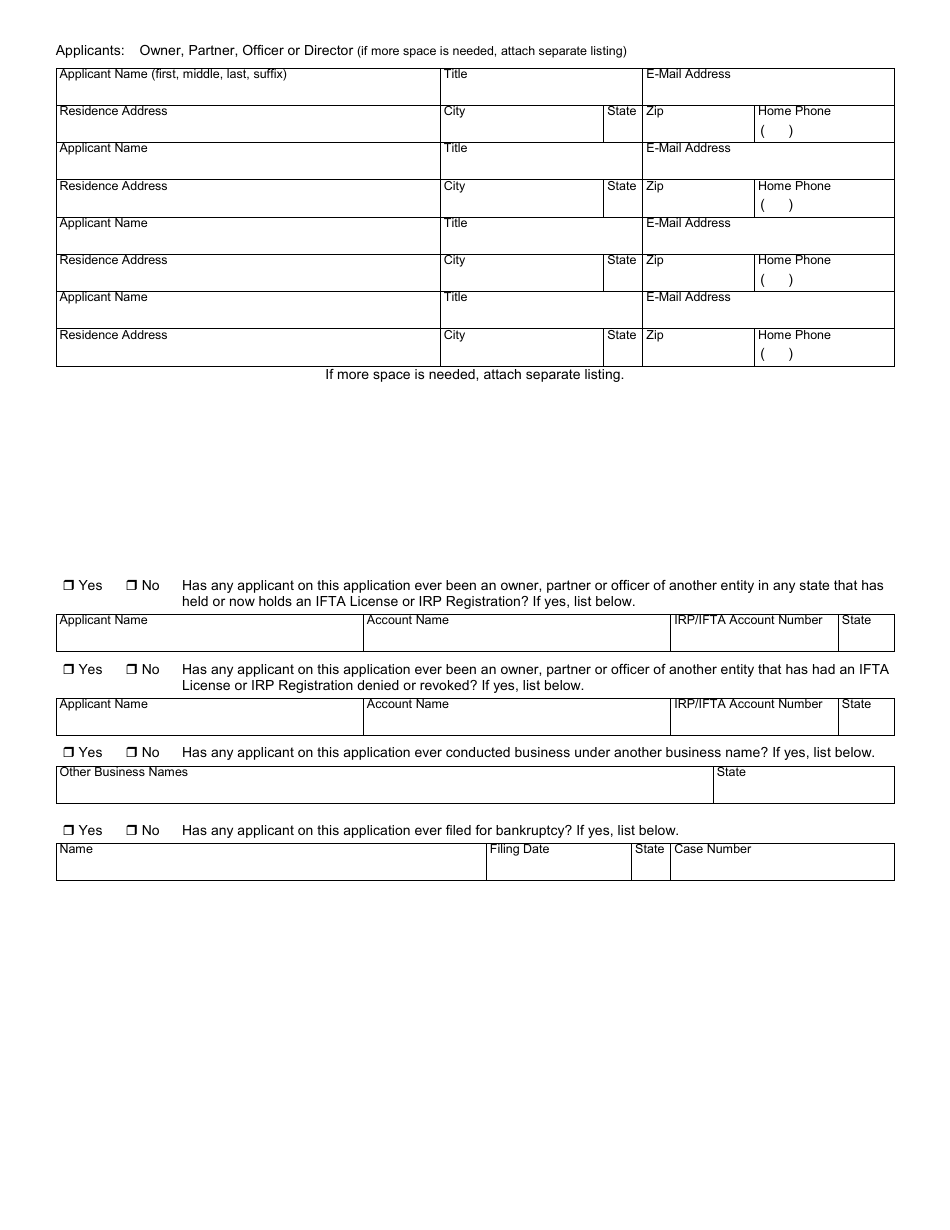

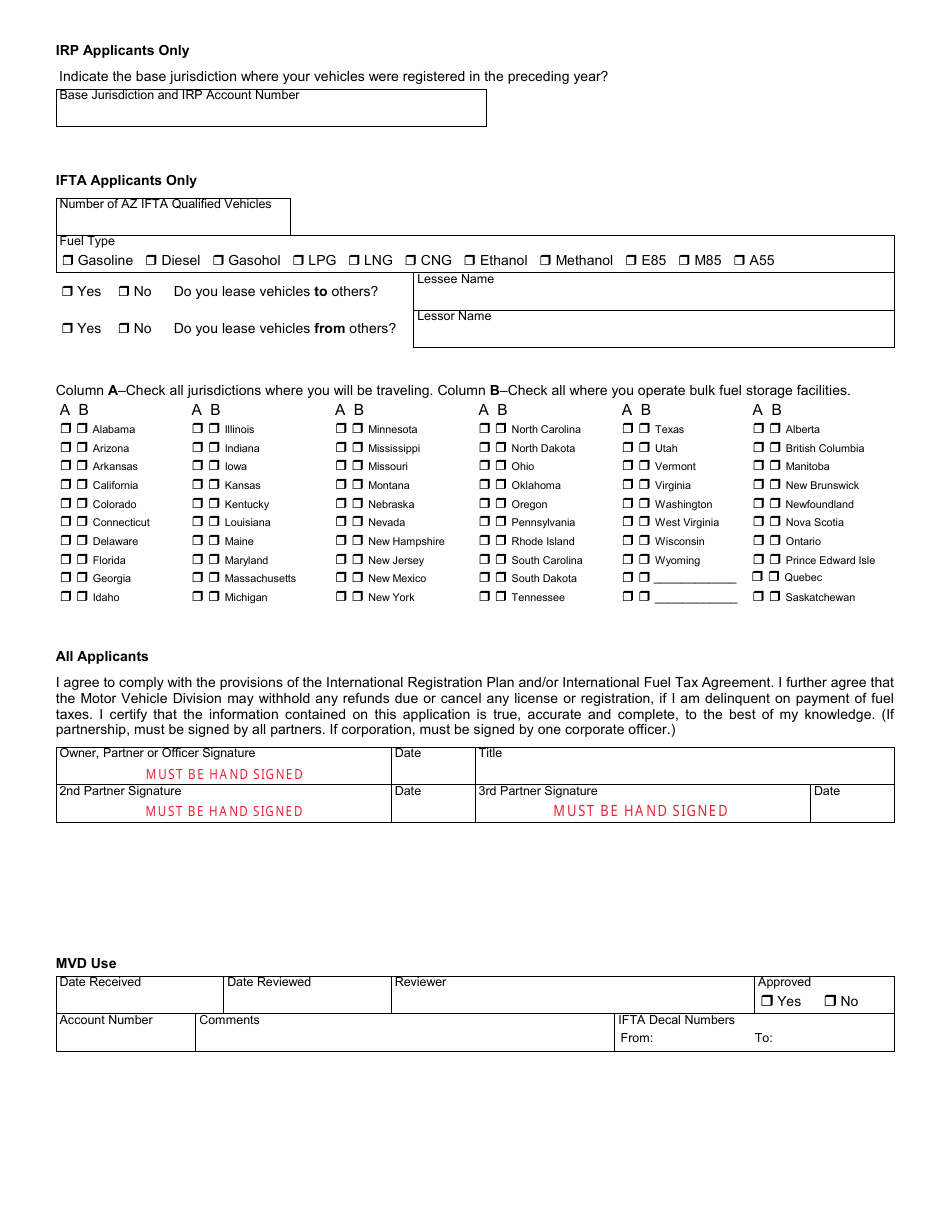

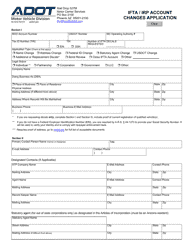

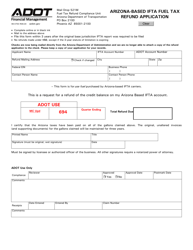

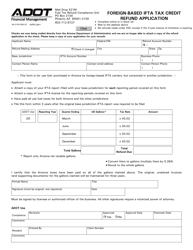

Form 70-0508 Ifta / Irp Application - Arizona

What Is Form 70-0508?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 70-0508 Ifta/Irp Application used for?

A: Form 70-0508 Ifta/Irp Application is used for applying for the International Fuel Tax Agreement (IFTA) and the International Registration Plan (IRP) in Arizona.

Q: What is the International Fuel Tax Agreement (IFTA)?

A: The International Fuel Tax Agreement (IFTA) is an agreement between the 48 contiguous United States and Canadian provinces that simplifies the reporting and payment of fuel taxes by interstate motor carriers.

Q: What is the International Registration Plan (IRP)?

A: The International Registration Plan (IRP) is an agreement between the United States and Canadian provinces that allows interstate operation of commercial vehicles with apportioned license plates.

Q: Who needs to file form 70-0508 Ifta/Irp Application?

A: Motor carriers who operate qualified motor vehicles in interstate commerce and engage in the transportation of persons or property are required to file form 70-0508 Ifta/Irp Application.

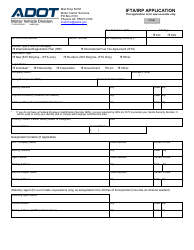

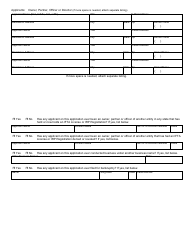

Q: What information is required on form 70-0508 Ifta/Irp Application?

A: Form 70-0508 Ifta/Irp Application requires information regarding the motor carrier, qualified motor vehicles, distance records, and fuel consumption records.

Q: When should form 70-0508 Ifta/Irp Application be filed?

A: Form 70-0508 Ifta/Irp Application should be filed before the first day of the month in which the motor carrier intends to operate under the IFTA and IRP licenses.

Q: What are the consequences of not filing form 70-0508 Ifta/Irp Application?

A: Failure to file form 70-0508 Ifta/Irp Application may result in penalties, fines, and the suspension of IFTA and IRP privileges.

Q: Is there a fee for filing form 70-0508 Ifta/Irp Application?

A: Yes, there is a fee for filing form 70-0508 Ifta/Irp Application. The fee amount varies depending on the number of qualified motor vehicles being registered.

Q: Are there any exemptions to filing form 70-0508 Ifta/Irp Application?

A: Yes, certain motor carriers may be exempt from filing form 70-0508 Ifta/Irp Application. Contact the Motor Carrier Services Division for more information on exemptions.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 70-0508 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.