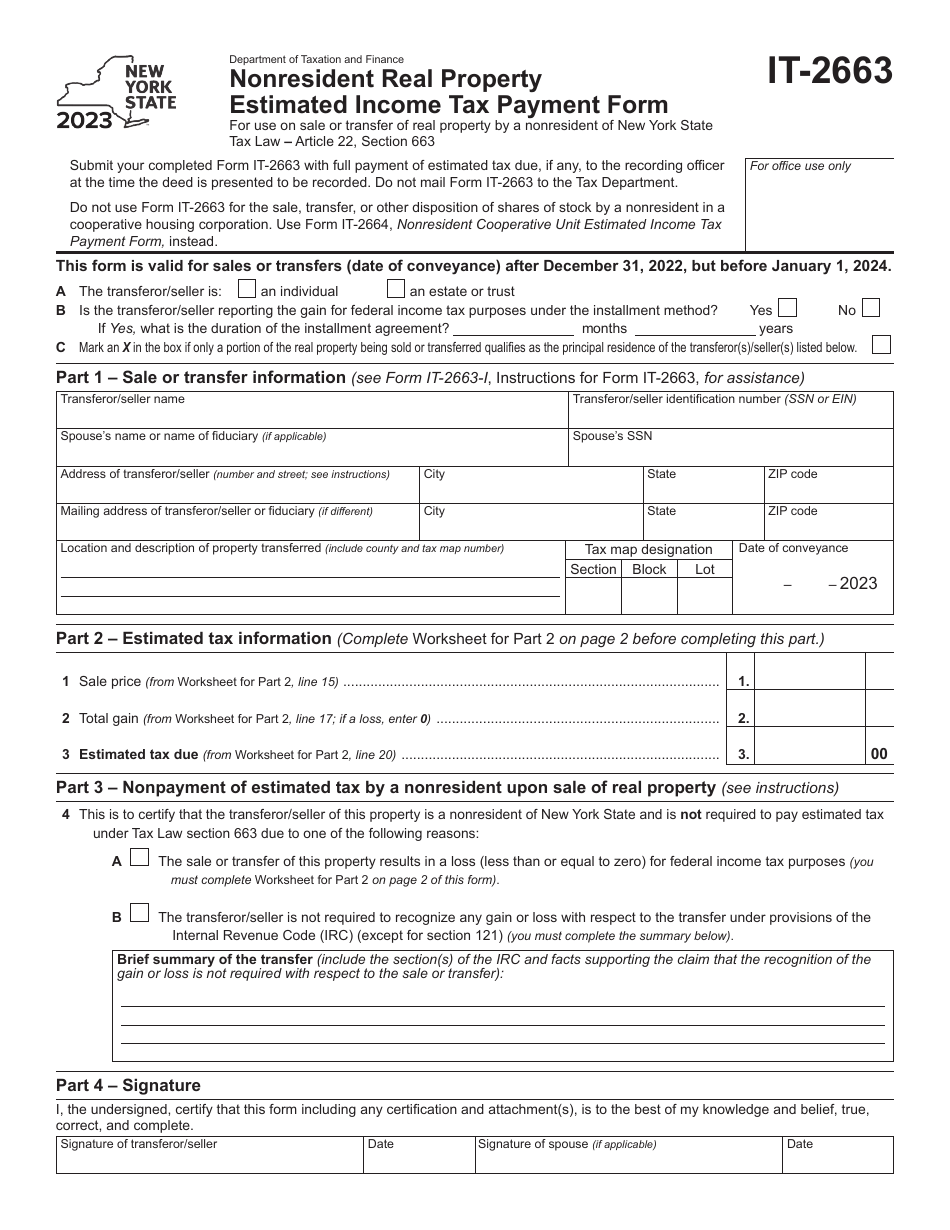

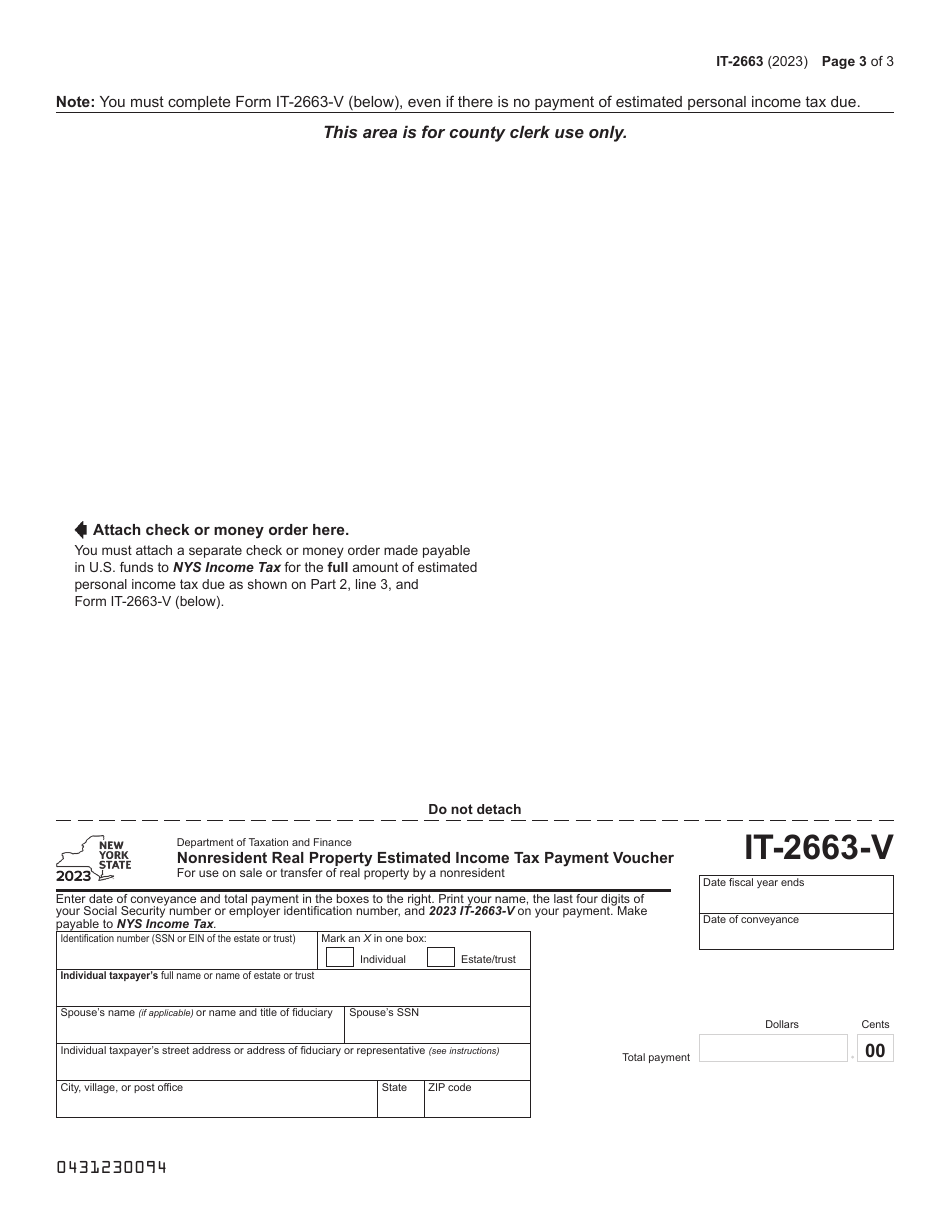

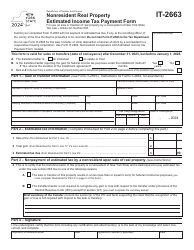

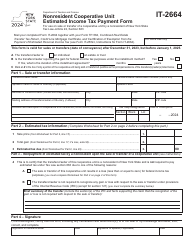

Form IT-2663 Nonresident Real Property Estimated Income Tax Payment Form for Use on Sale or Transfer of Real Property by a Nonresident of New York State - New York

What Is Form IT-2663?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2663?

A: Form IT-2663 is the Nonresident Real Property Estimated Income Tax Payment Form for use on the sale or transfer of real property by a nonresident of New York State.

Q: Who needs to file Form IT-2663?

A: Nonresidents of New York State who are selling or transferring real property need to file Form IT-2663.

Q: What is the purpose of Form IT-2663?

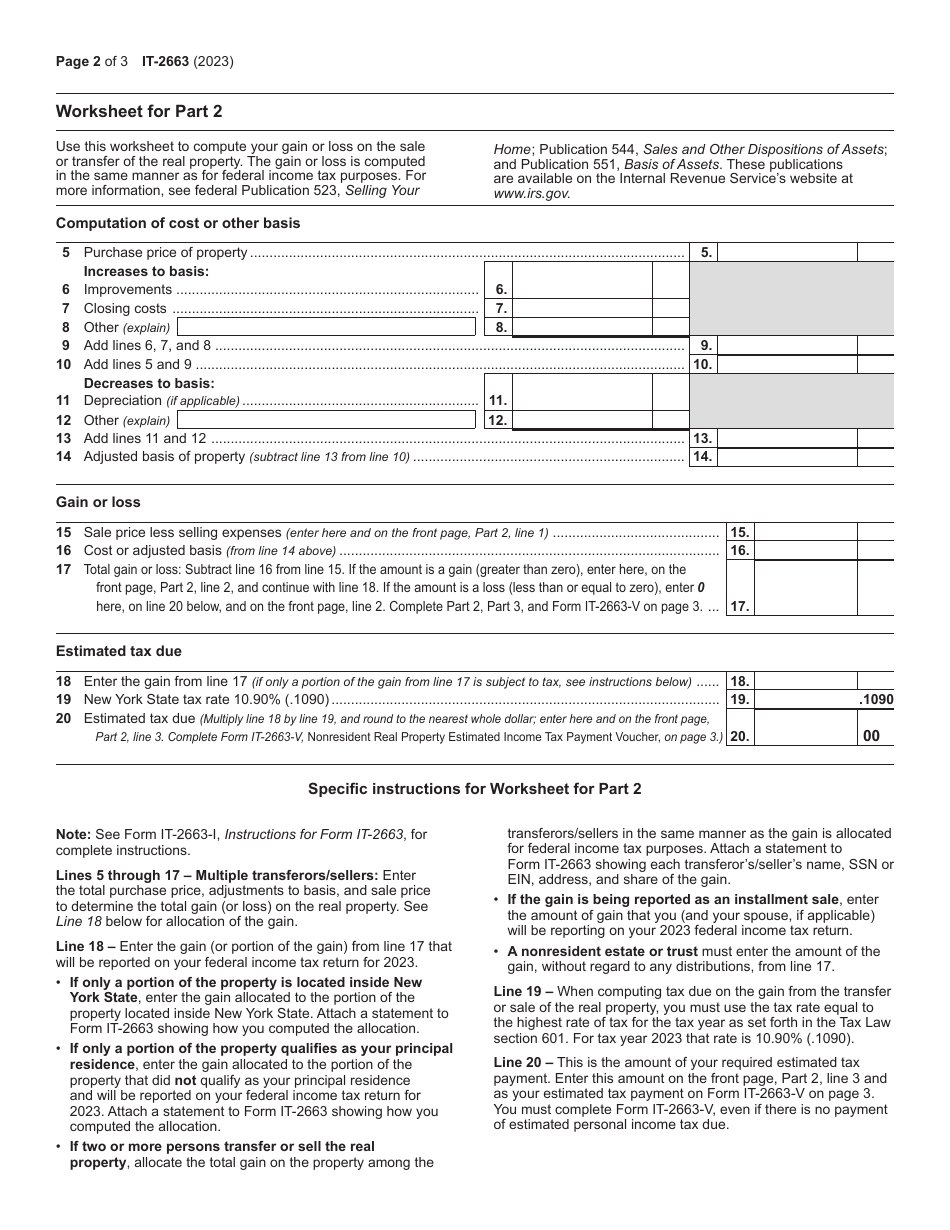

A: The purpose of Form IT-2663 is to calculate and pay the estimated income tax owed by a nonresident on the sale or transfer of real property in New York State.

Q: What information is required on Form IT-2663?

A: Form IT-2663 requires information such as the seller's name and address, property information, sale price, estimated gain, and estimated tax due.

Q: When should Form IT-2663 be filed?

A: Form IT-2663 should be filed at least 20 days before the closing date of the real property sale or transfer.

Q: Is there a fee for filing Form IT-2663?

A: No, there is no fee for filing Form IT-2663.

Q: What happens if Form IT-2663 is not filed?

A: If Form IT-2663 is not filed, the buyer may be required to withhold 8.82% of the sale price or transferor's consideration as a tax withholding.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2663 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.