This version of the form is not currently in use and is provided for reference only. Download this version of

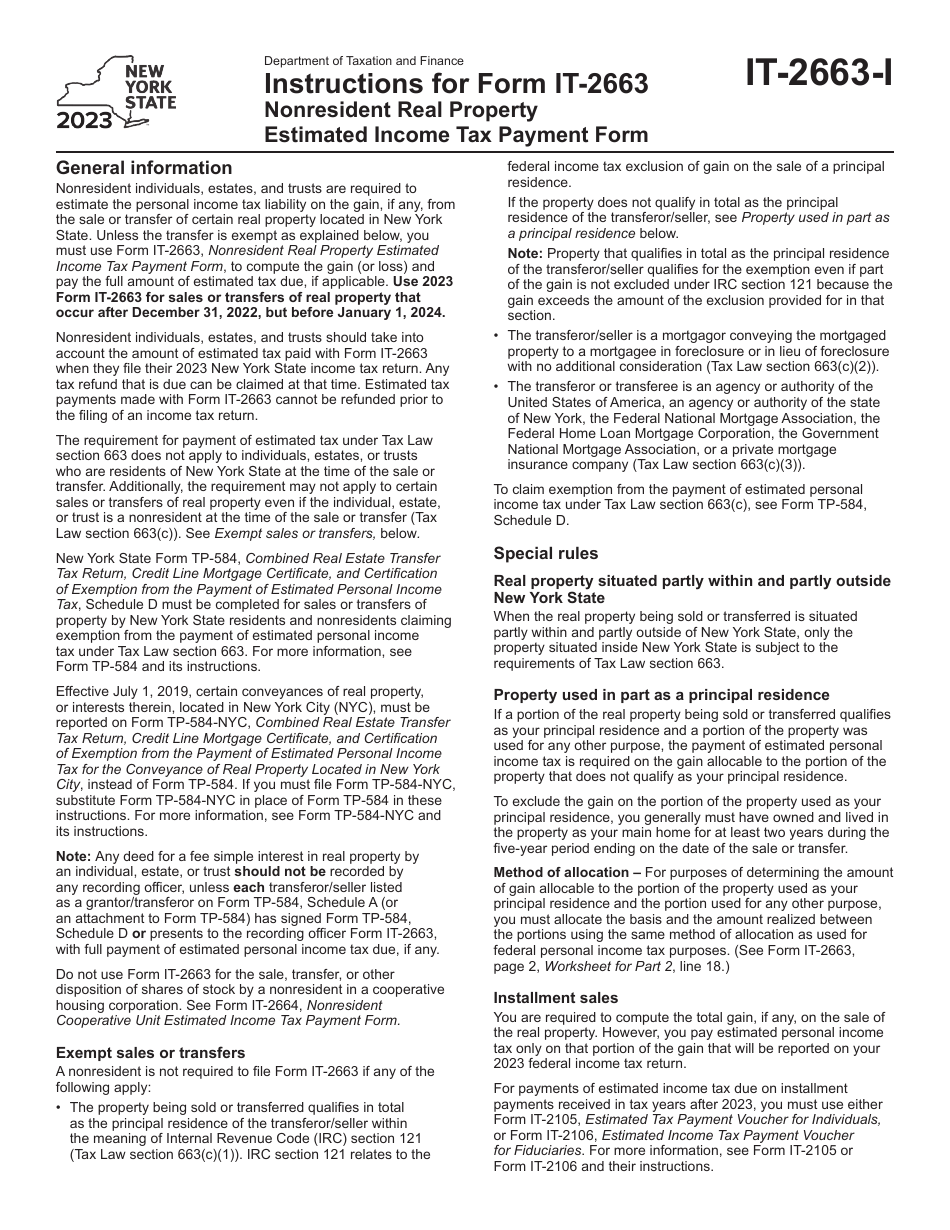

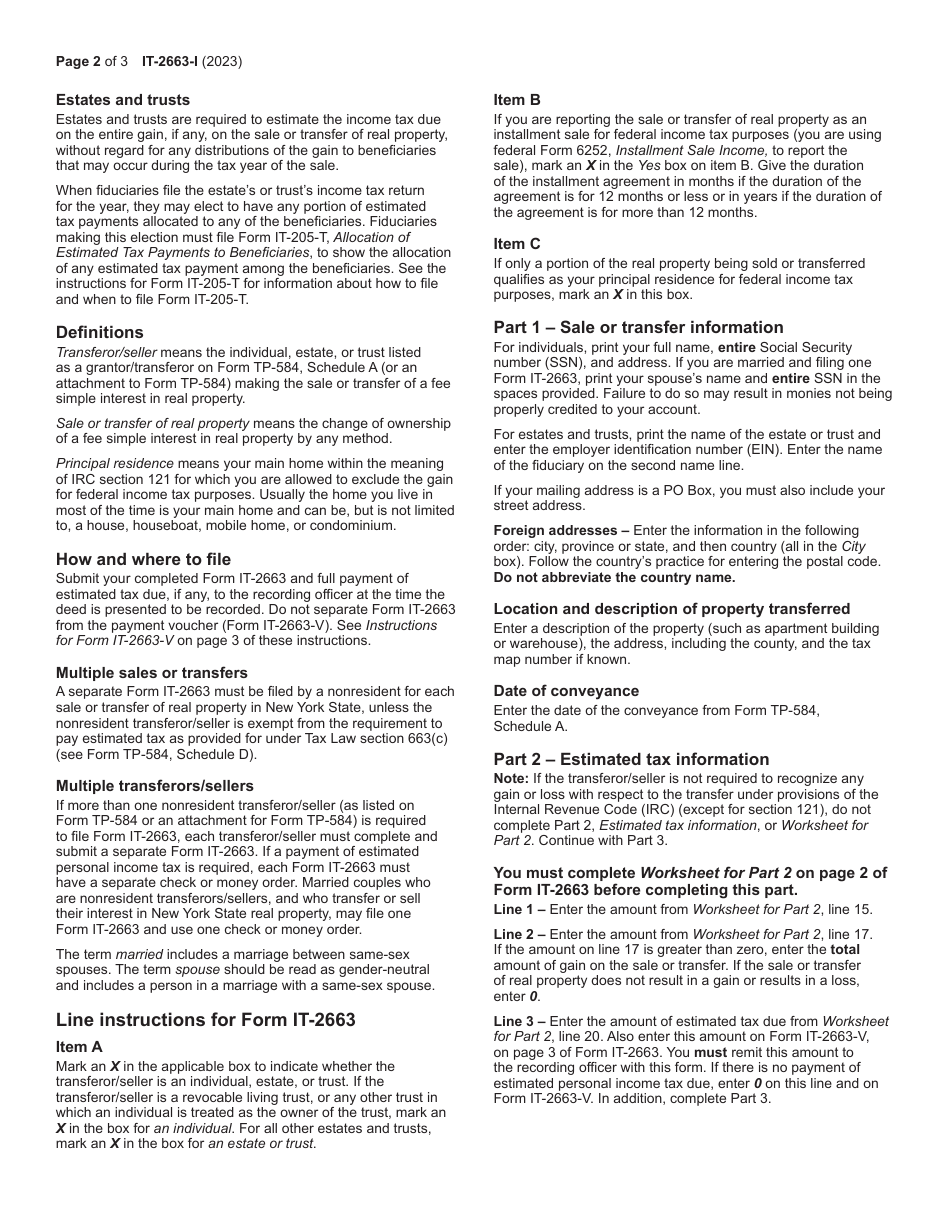

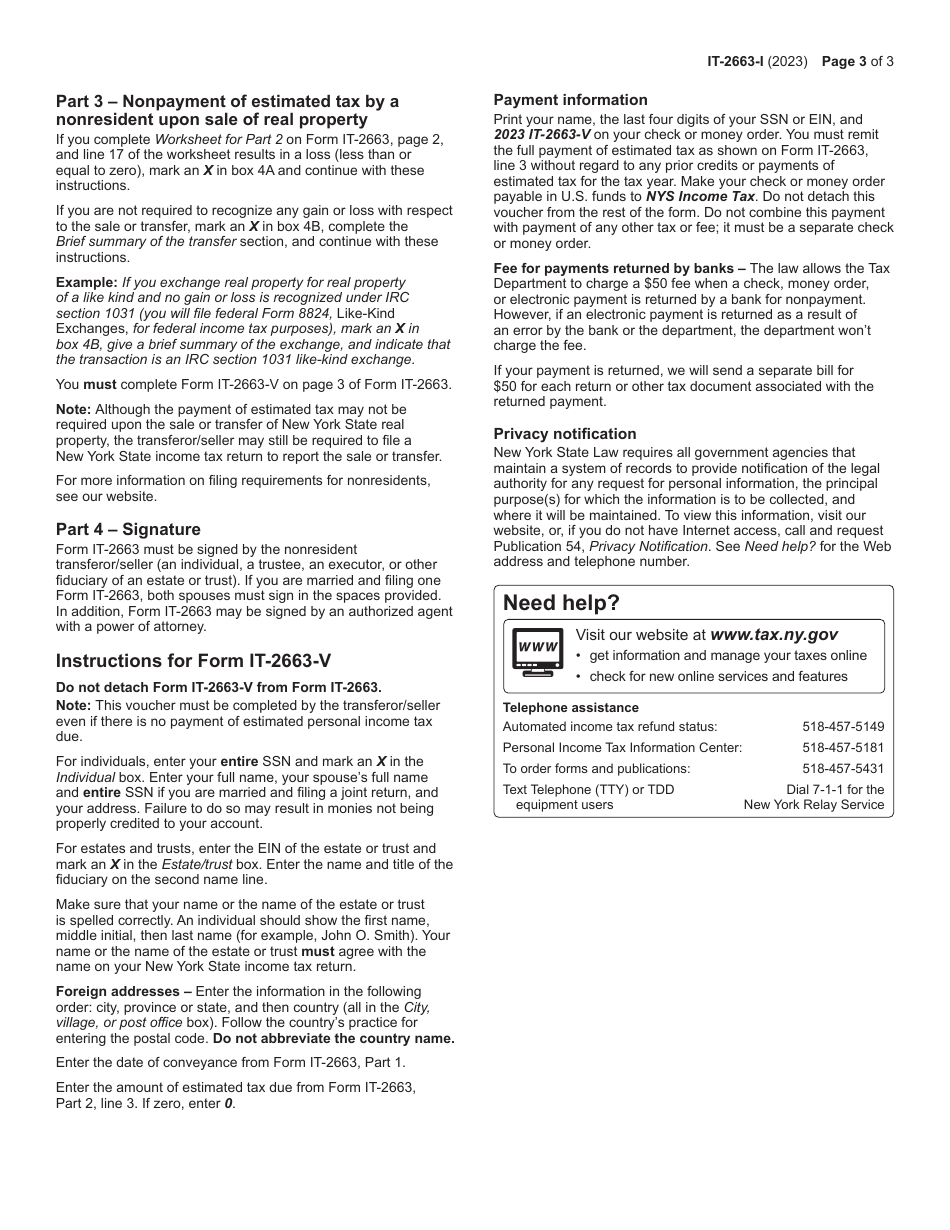

Instructions for Form IT-2663

for the current year.

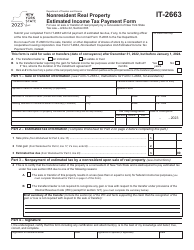

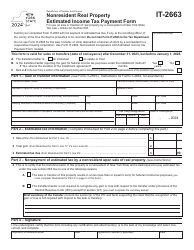

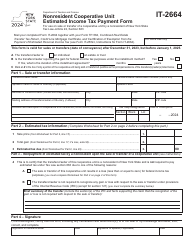

Instructions for Form IT-2663 Nonresident Real Property Estimated Income Tax Payment Form - New York

This document contains official instructions for Form IT-2663 , Nonresident Income Tax Payment Form - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-2663 is available for download through this link.

FAQ

Q: What is Form IT-2663?

A: Form IT-2663 is the Nonresident Real Property Estimated Income Tax Payment Form for New York.

Q: Who needs to file Form IT-2663?

A: Nonresidents of New York who own real property in the state and are receiving rental income from that property need to file Form IT-2663.

Q: What is the purpose of Form IT-2663?

A: The purpose of Form IT-2663 is to report and pay estimated income tax on rental income from real property in New York.

Q: When should Form IT-2663 be filed?

A: Form IT-2663 should be filed and the estimated tax payment should be made on a quarterly basis, with due dates of April 15, June 15, September 15, and January 15.

Q: What information is needed to complete Form IT-2663?

A: To complete Form IT-2663, you will need information about the property, the rental income received, and any expenses related to the property.

Q: Are there any penalties for not filing Form IT-2663?

A: Yes, there are penalties for failure to file Form IT-2663 or failure to make the required estimated tax payments.

Q: Is Form IT-2663 only for nonresidents?

A: Yes, Form IT-2663 is specifically for nonresidents of New York who own real property in the state.

Q: Can I get a refund if I overpay on my estimated tax payments?

A: Yes, if you overpay on your estimated tax payments, you may be eligible for a refund when you file your annual income tax return.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose an older version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.