This version of the form is not currently in use and is provided for reference only. Download this version of

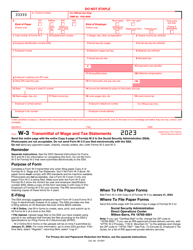

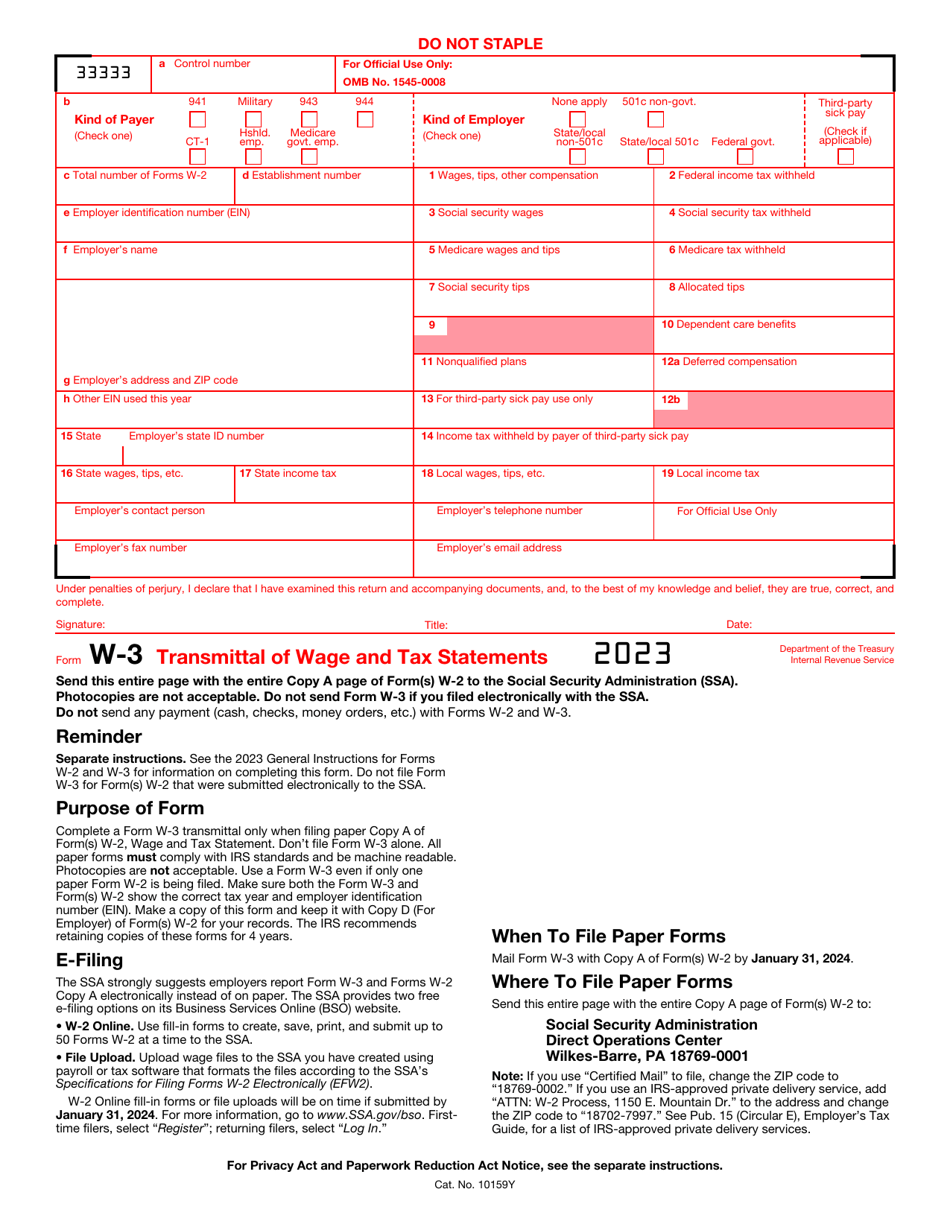

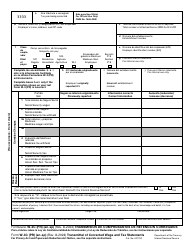

IRS Form W-3

for the current year.

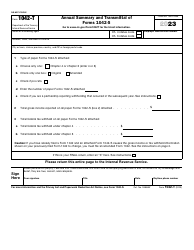

IRS Form W-3 Transmittal of Wage and Tax Statements

What Is IRS Form W-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form W-3?

A: IRS Form W-3 is a transmittal form used to report wage and tax information for employees.

Q: Who needs to file IRS Form W-3?

A: Employers who are required to file Form W-2, Wage and Tax Statement, must also file Form W-3 to transmit the forms to the IRS.

Q: When is IRS Form W-3 due?

A: Form W-3 is generally due by the end of January each year, along with the corresponding Form W-2s.

Q: What information do I need to complete IRS Form W-3?

A: You will need to provide information such as your employer identification number (EIN), total wages, total income tax withheld, and other relevant employee tax information.

Form Details:

- A 2-page form available for download in PDF;

- This form will be used to file next year's taxes. Choose a previous version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of IRS Form W-3 through the link below or browse more documents in our library of IRS Forms.