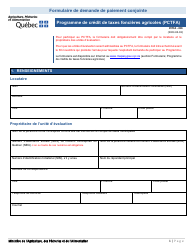

This version of the form is not currently in use and is provided for reference only. Download this version of

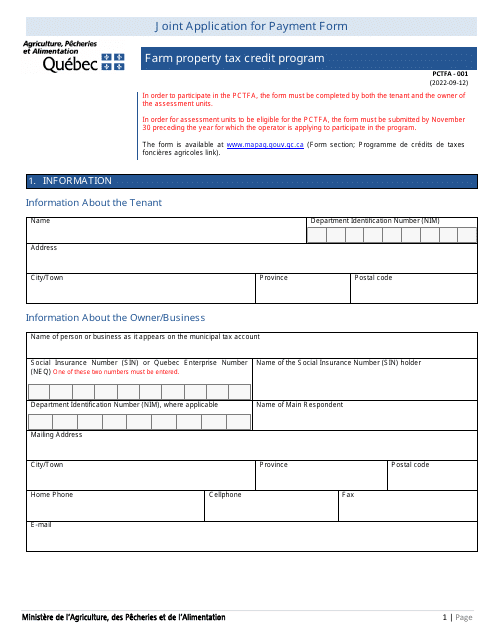

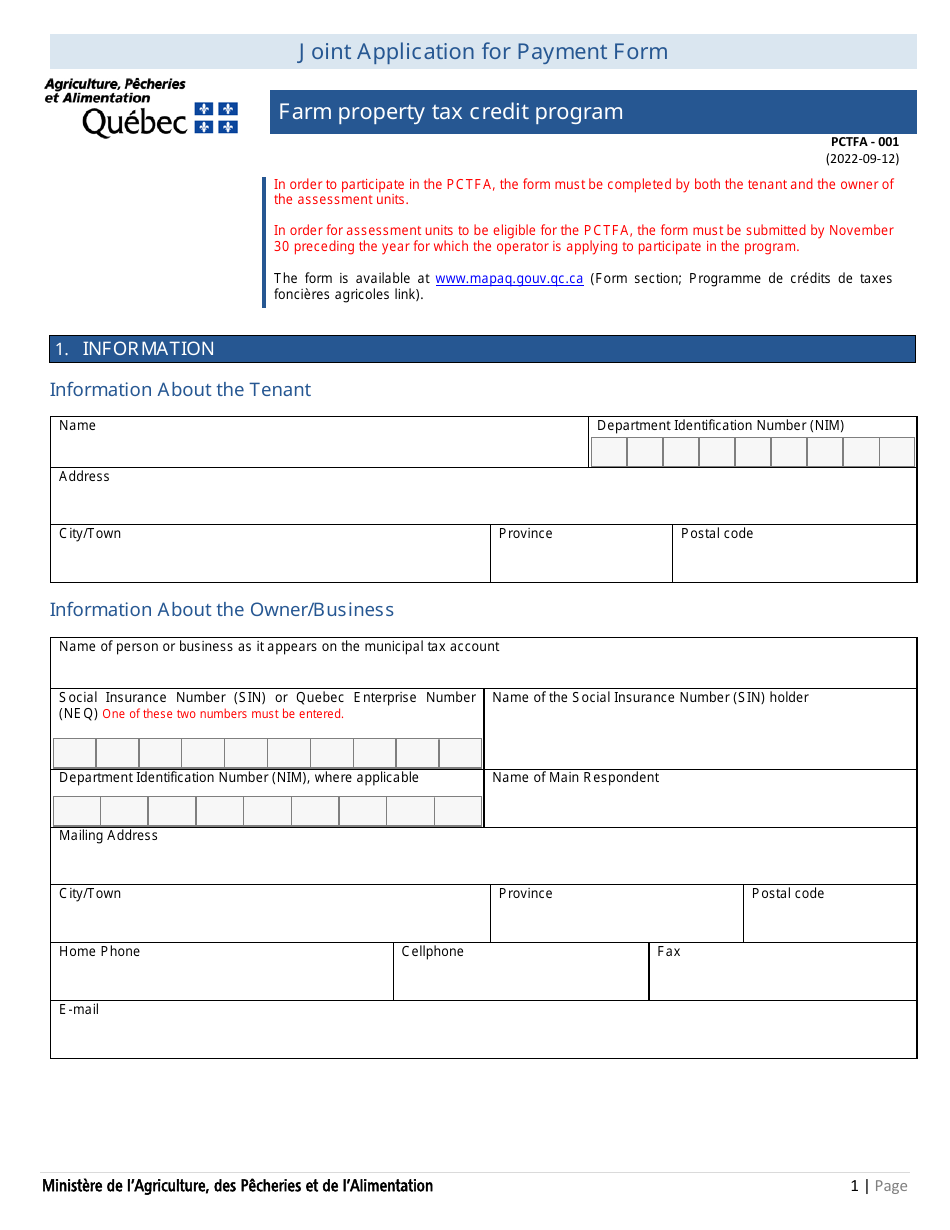

Form PCTFA-001

for the current year.

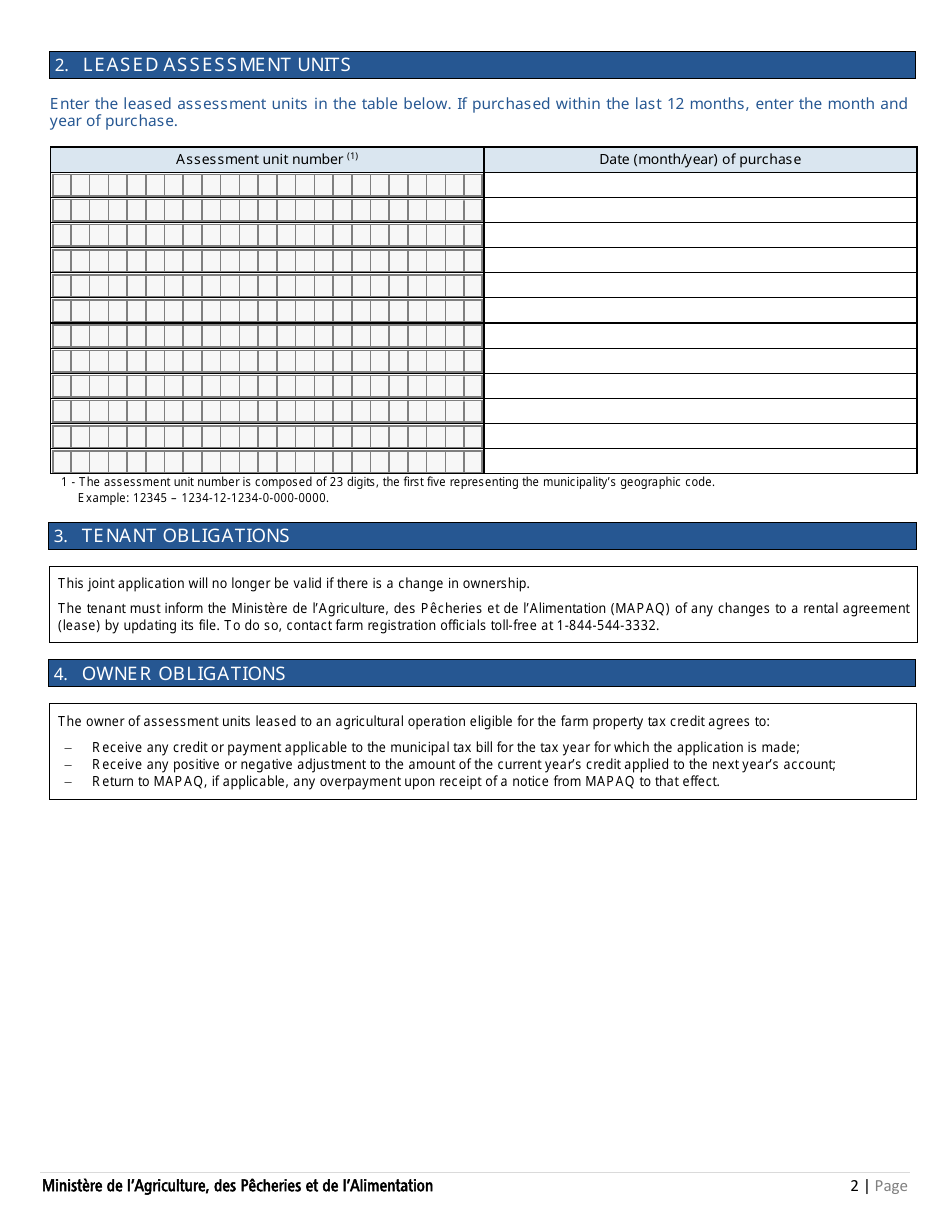

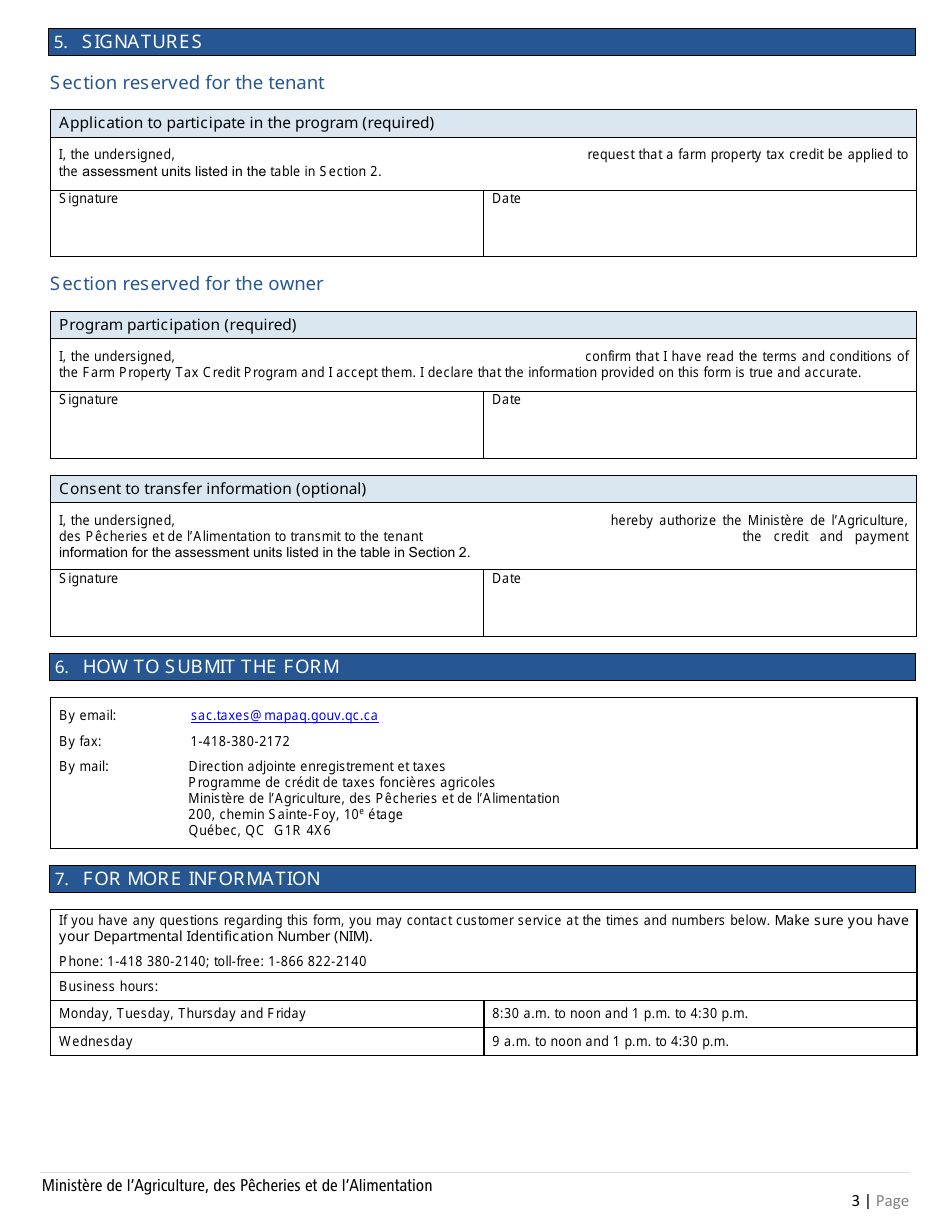

Form PCTFA-001 Joint Application for Payment Form - Farm Property Tax Credit Program - Quebec, Canada

The Form PCTFA-001 is used for the Joint Application for Payment under the Farm Property Tax Credit Program in Quebec, Canada. It is specifically designed for farmers to apply for tax credits related to their agricultural properties.

The farmer or agricultural property owner in Quebec, Canada files the Form PCTFA-001 Joint Application for Payment Form for the Farm Property Tax Credit Program.

FAQ

Q: What is Form PCTFA-001?

A: Form PCTFA-001 is the Joint Application for Payment Form for the Farm Property Tax Credit Program in Quebec, Canada.

Q: What is the Farm Property Tax Credit Program?

A: The Farm Property Tax Credit Program is a program in Quebec, Canada that provides tax credits to eligible farmers.

Q: Who can apply for the Farm Property Tax Credit Program?

A: Farmers in Quebec, Canada who meet the eligibility criteria can apply for the Farm Property Tax Credit Program.

Q: What is the purpose of Form PCTFA-001?

A: Form PCTFA-001 is used to apply for payment under the Farm Property Tax Credit Program in Quebec, Canada.

Q: What information is required on Form PCTFA-001?

A: Form PCTFA-001 requires information such as the farmer's personal details, property details, and income details.

Q: When should Form PCTFA-001 be submitted?

A: Form PCTFA-001 should be submitted according to the deadlines specified by the provincial government of Quebec, Canada.

Q: Is there a fee to submit Form PCTFA-001?

A: No, there is no fee to submit Form PCTFA-001 for the Farm Property Tax Credit Program.

Q: How long does it take to process Form PCTFA-001?

A: The processing time for Form PCTFA-001 can vary, but it usually takes several weeks to receive a response.