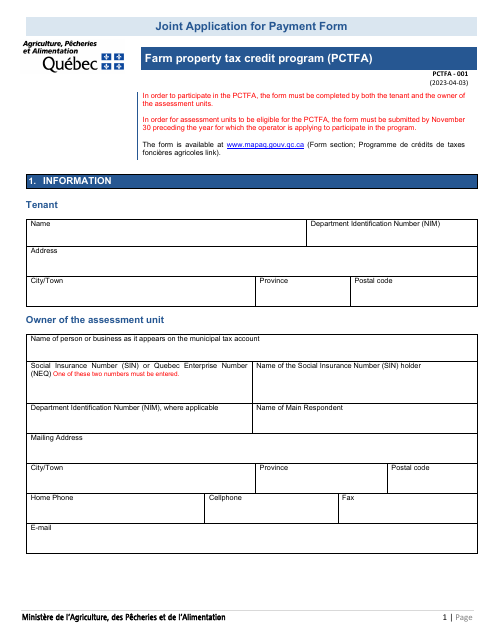

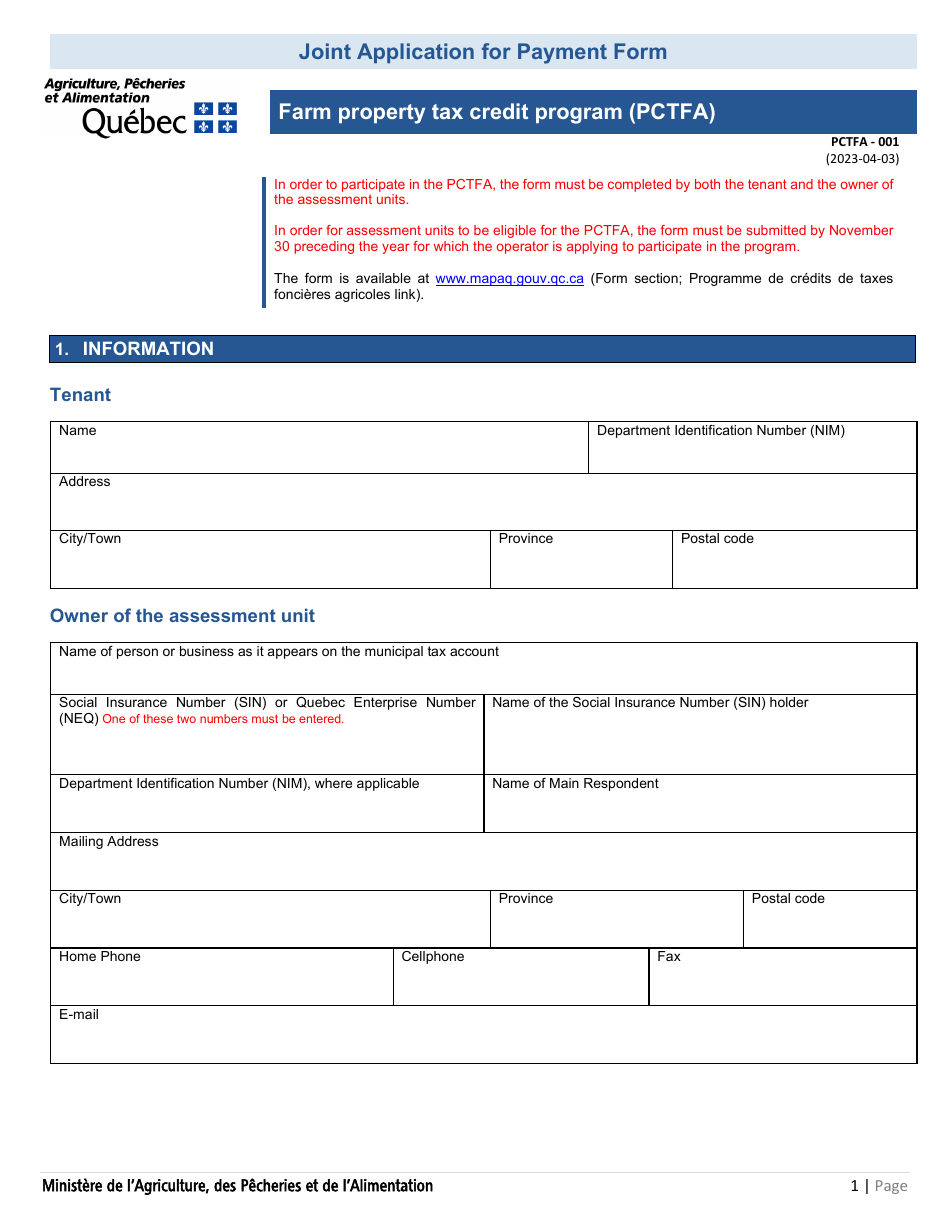

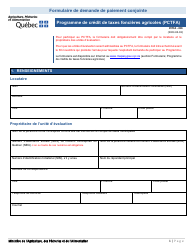

Form PCTFA-001 Joint Application for Payment Form - Farm Property Tax Credit Program (Pctfa) - Quebec, Canada

Form PCTFA-001 is used in Quebec, Canada for applying for the Farm Property Tax Credit Program (PCTFA), which is a program designed to provide tax relief to eligible farmers on their property taxes.

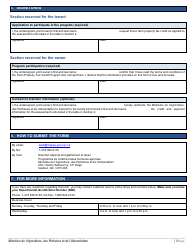

The Form PCTFA-001 Joint Application for Payment form under the Farm Property Tax Credit Program in Quebec, Canada is typically filed jointly by the property owner and the municipality.

Form PCTFA-001 Joint Application for Payment Form - Farm Property Tax Credit Program (Pctfa) - Quebec, Canada - Frequently Asked Questions (FAQ)

Q: What is Form PCTFA-001? A: Form PCTFA-001 is the Joint Application for Payment form for the Farm Property Tax Credit Program (PCTFA) in Quebec, Canada.

Q: What is the Farm Property Tax Credit Program (PCTFA)? A: The Farm Property Tax Credit Program (PCTFA) is a program in Quebec, Canada that provides tax credits to farmers to alleviate the burden of property taxes.

Q: Who can use Form PCTFA-001? A: Form PCTFA-001 can be used by farmers in Quebec, Canada who wish to apply for the Farm Property Tax Credit.

Q: What is the purpose of Form PCTFA-001? A: Form PCTFA-001 is used to apply for the Farm Property Tax Credit in Quebec, Canada, which provides tax relief for farmers.

Q: Is Form PCTFA-001 specific to Quebec, Canada? A: Yes, Form PCTFA-001 is specific to the Farm Property Tax Credit Program in Quebec, Canada.

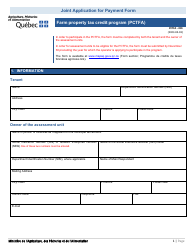

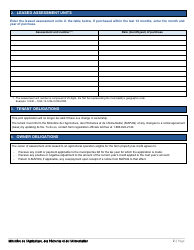

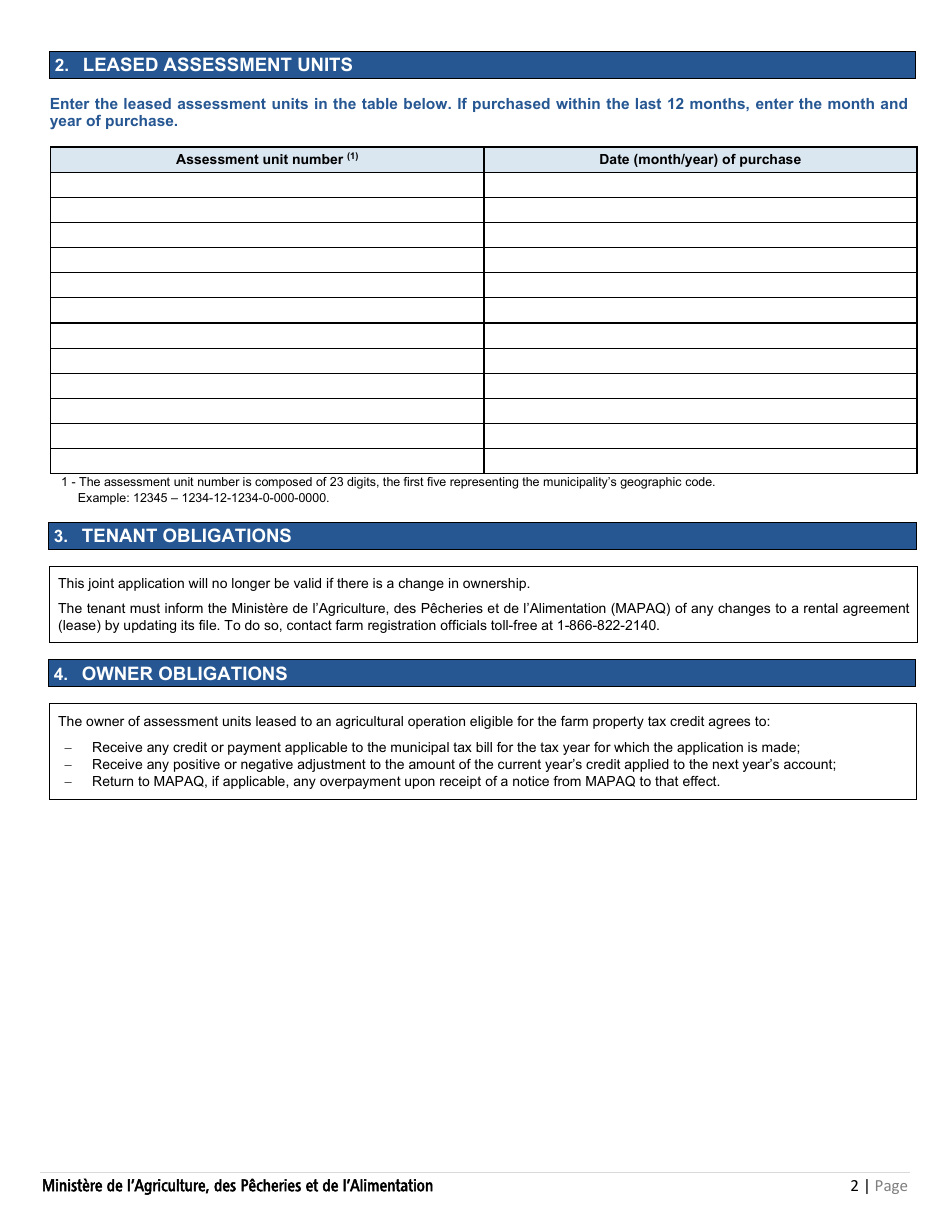

Q: What information do I need to fill out Form PCTFA-001? A: To fill out Form PCTFA-001, you will need information about your farm property and your tax information.

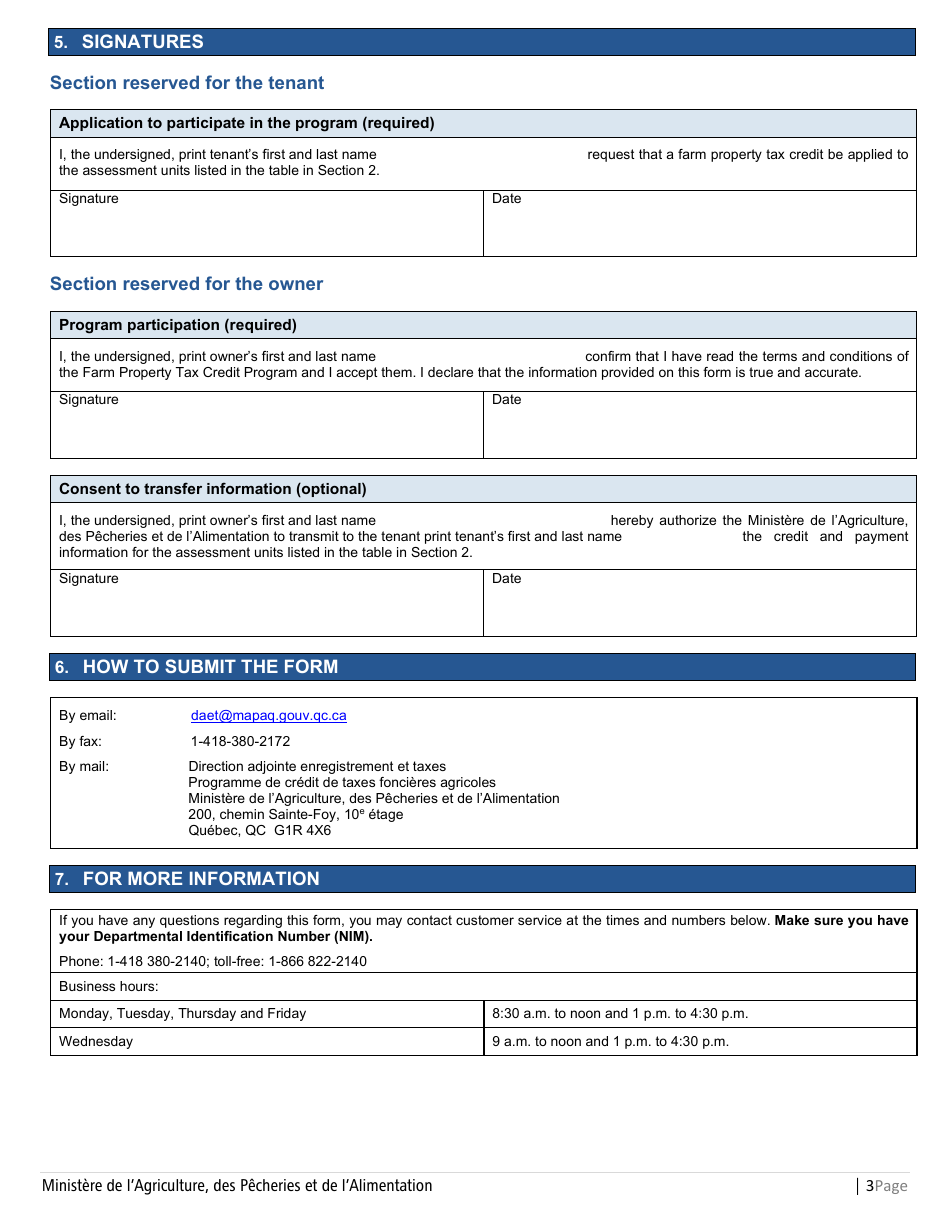

Q: Is there a deadline for submitting Form PCTFA-001? A: Yes, there is typically a deadline for submitting Form PCTFA-001. It is important to check with the relevant government agency in Quebec, Canada for the specific deadline.

Q: What happens after I submit Form PCTFA-001? A: After you submit Form PCTFA-001, it will be reviewed by the government agency in Quebec, Canada. If approved, you may be eligible for the Farm Property Tax Credit.