This version of the form is not currently in use and is provided for reference only. Download this version of

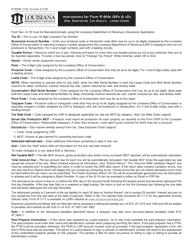

Instructions for Form R-9036, SEV G-1D

for the current year.

Instructions for Form R-9036, SEV G-1D Gas Severance Tax Return - Lease Detail - Louisiana

This document contains official instructions for Form R-9036 , and Form SEV G-1D . Both forms are released and collected by the Louisiana Department of Revenue.

FAQ

Q: What is Form R-9036?

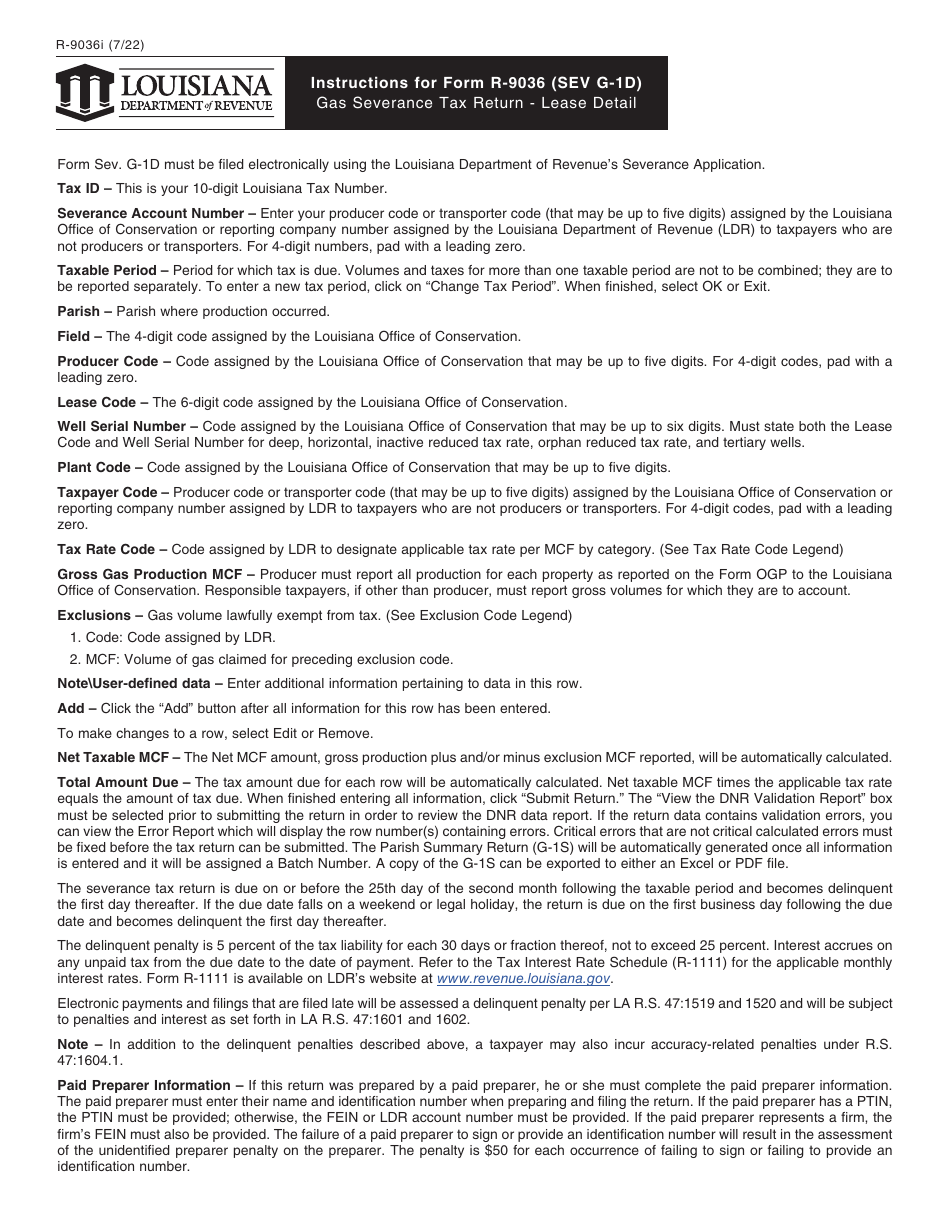

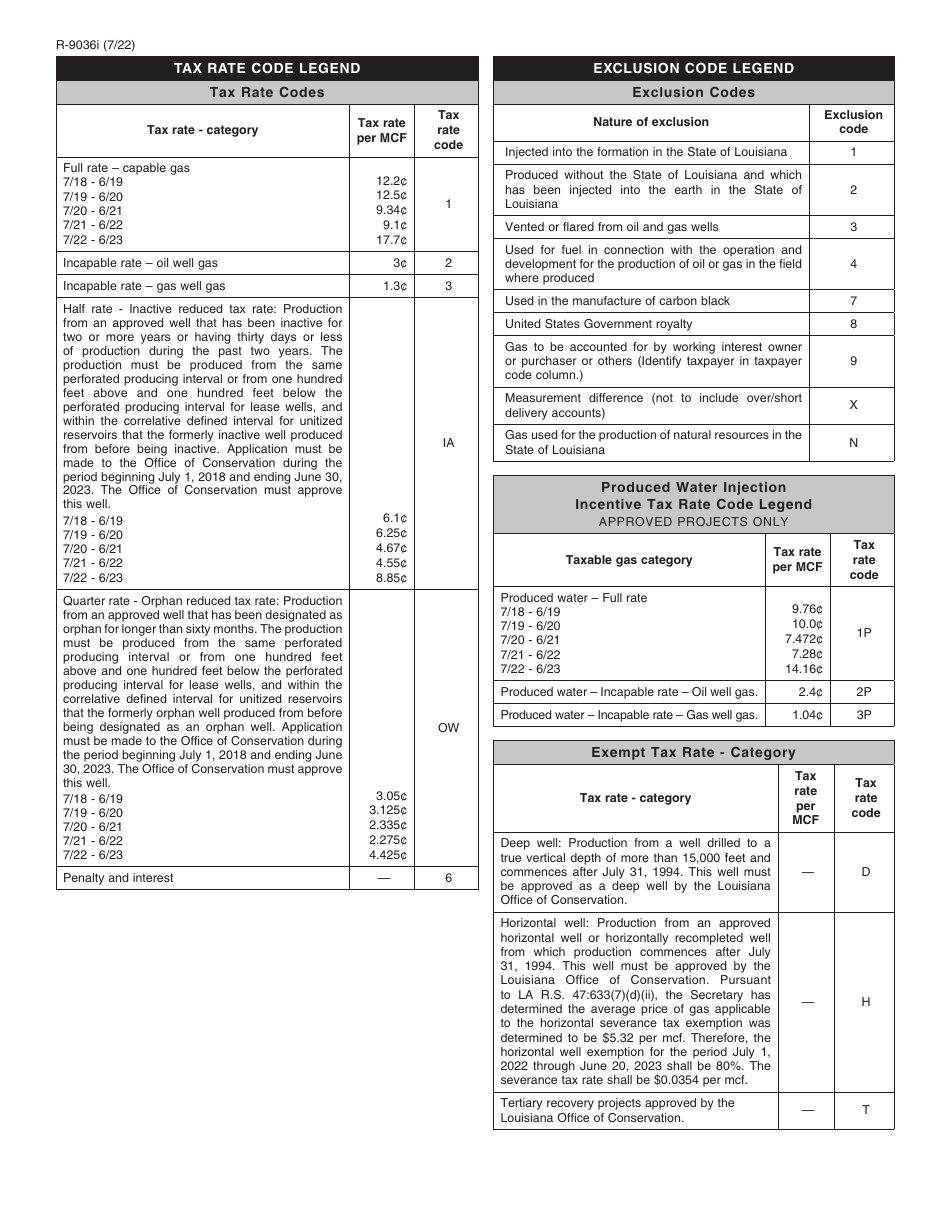

A: Form R-9036 is the SEV G-1D Gas Severance Tax Return - Lease Detail form for reporting gas severance taxes in Louisiana.

Q: What is the purpose of Form R-9036?

A: The purpose of Form R-9036 is to report and pay gas severance taxes on gas produced in Louisiana.

Q: Who needs to file Form R-9036?

A: Any person or company engaged in the production of gas in Louisiana needs to file Form R-9036.

Q: When is Form R-9036 due?

A: Form R-9036 is due on or before the 20th day of the month following the end of the reporting period.

Q: What information is required on Form R-9036?

A: Form R-9036 requires information such as lease number, well number, production volume, wellhead pressure, and tax calculations.

Q: Are there any penalties for late filing of Form R-9036?

A: Yes, there are penalties for late filing of Form R-9036, including interest charges on any unpaid tax.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.