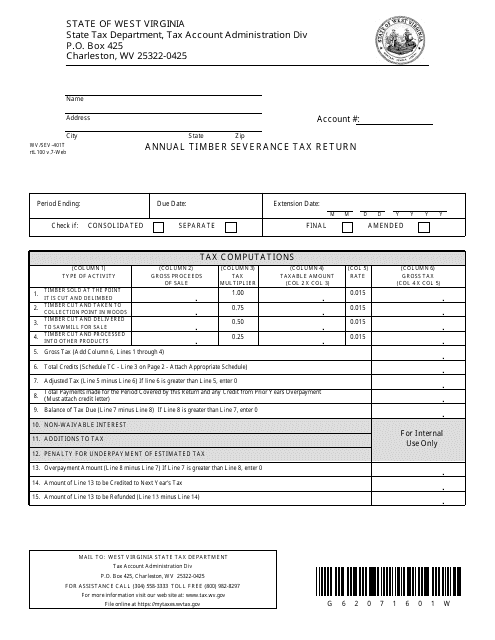

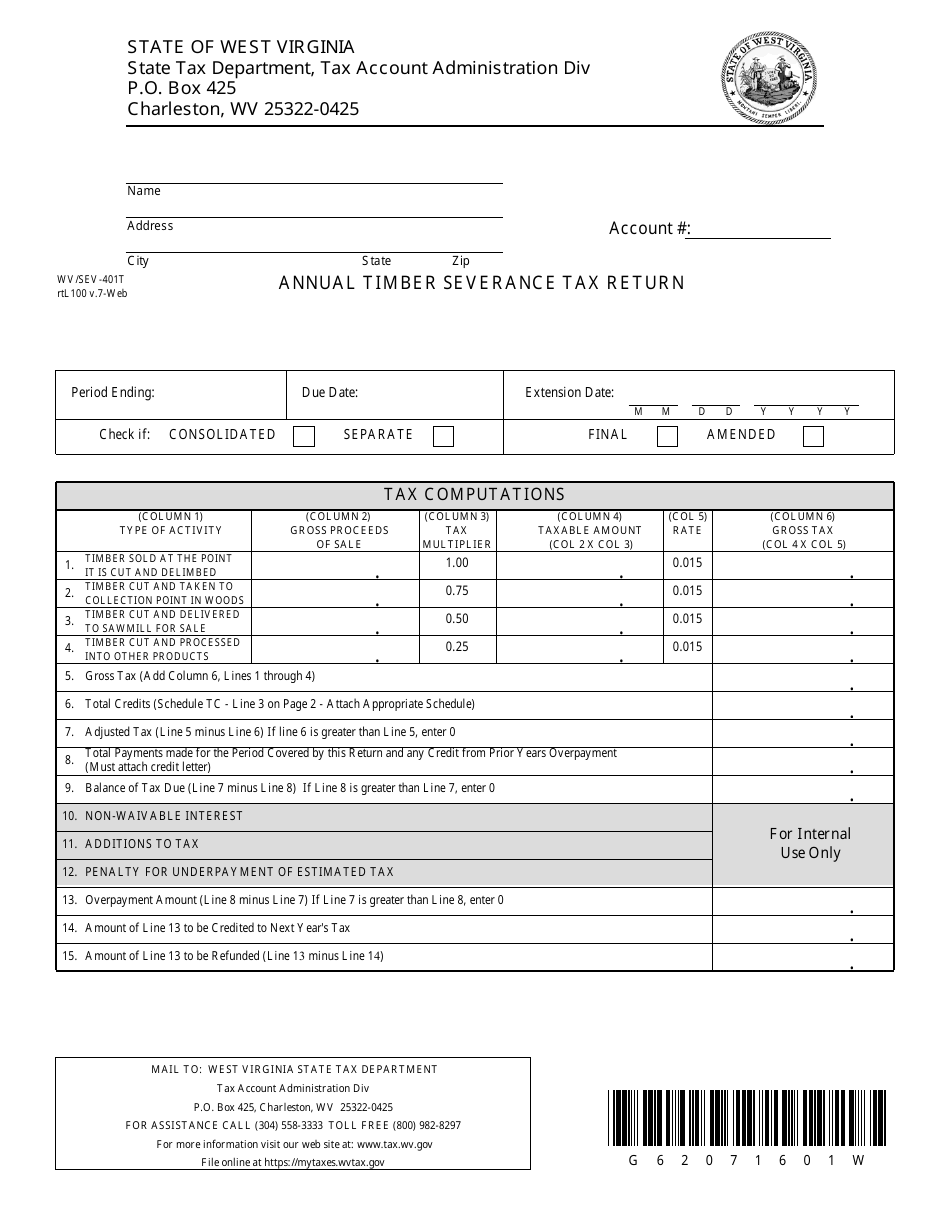

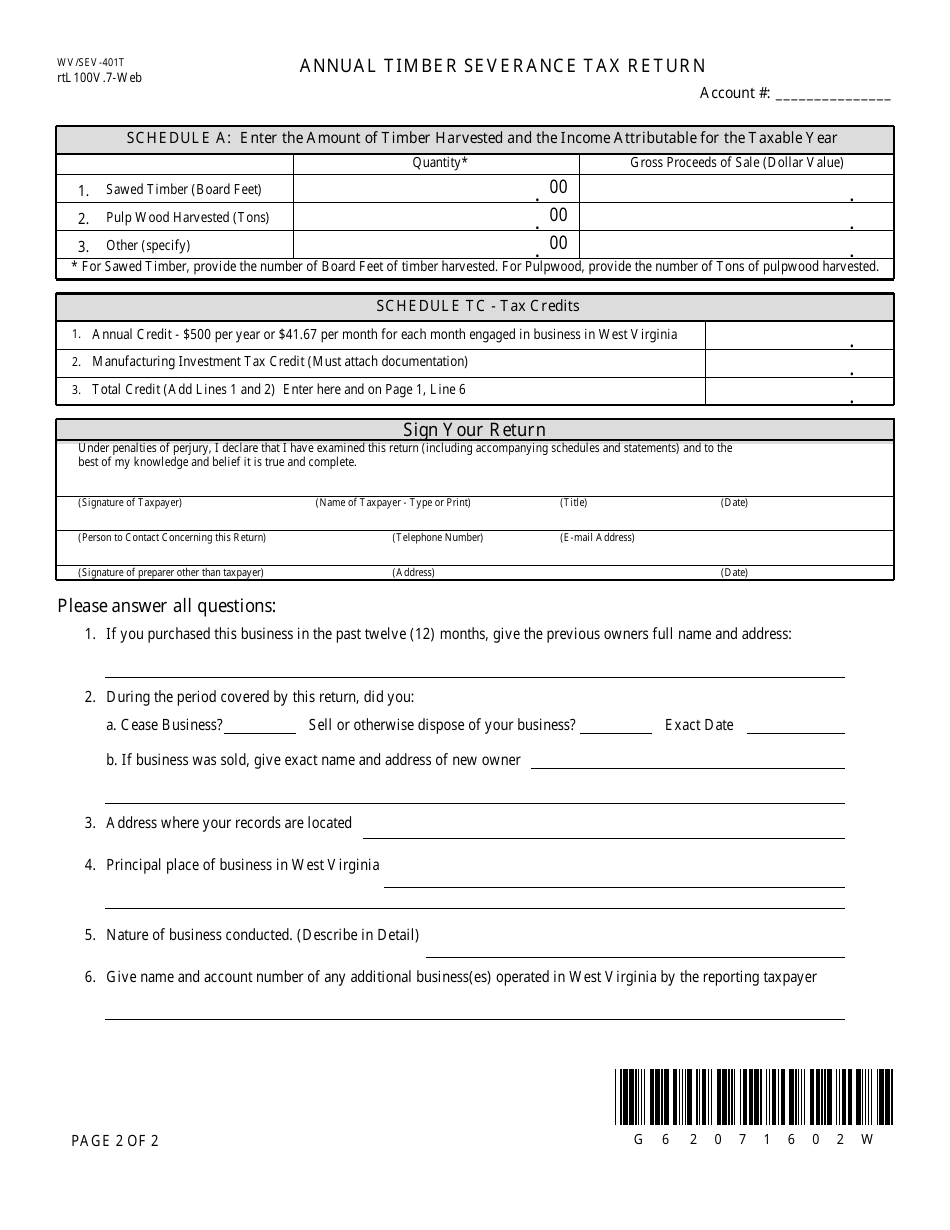

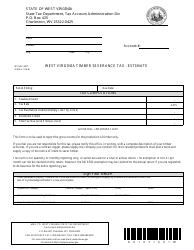

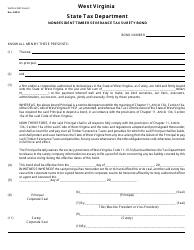

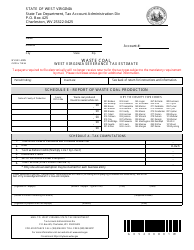

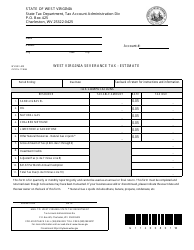

Form WV / SEV-401t Annual Timber Severance Tax Return - West Virginia

What Is Form WV/SEV-401t?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the WV/SEV-401t form?

A: The WV/SEV-401t form is the Annual Timber Severance Tax Return used in West Virginia.

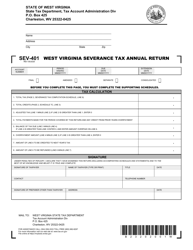

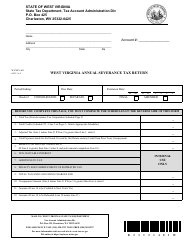

Q: Who needs to file the WV/SEV-401t form?

A: Individuals or businesses engaged in timber severance in West Virginia need to file the WV/SEV-401t form.

Q: What is the purpose of the WV/SEV-401t form?

A: The WV/SEV-401t form is used to report and pay the annual timber severance tax in West Virginia.

Q: When is the deadline to file the WV/SEV-401t form?

A: The deadline to file the WV/SEV-401t form is February 28th of each year.

Q: Are there any penalties for late filing of the WV/SEV-401t form?

A: Yes, there are penalties for late filing of the WV/SEV-401t form. It is important to file the form by the deadline to avoid penalties.

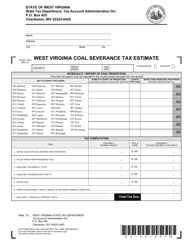

Q: What information is required to complete the WV/SEV-401t form?

A: The WV/SEV-401t form requires information such as the taxpayer's name, address, timber severance details, and calculation of tax liability.

Q: How can I pay the timber severance tax mentioned in the WV/SEV-401t form?

A: The timber severance tax mentioned in the WV/SEV-401t form can be paid by check or money order, or through electronic payment methods like ACH debit.

Q: Is the WV/SEV-401t form required to be filed every year?

A: Yes, the WV/SEV-401t form needs to be filed annually for each taxable year in which timber severance occurs.

Q: Who can I contact for further assistance with the WV/SEV-401t form?

A: You can contact the West Virginia State Tax Department for further assistance with the WV/SEV-401t form.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/SEV-401t by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.