This version of the form is not currently in use and is provided for reference only. Download this version of

SBA Form 1244

for the current year.

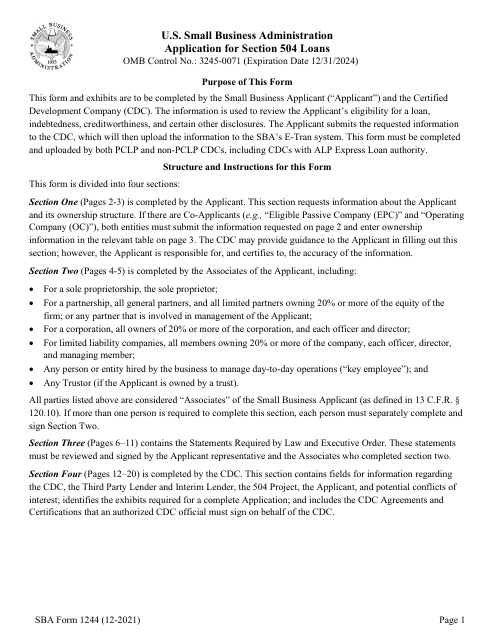

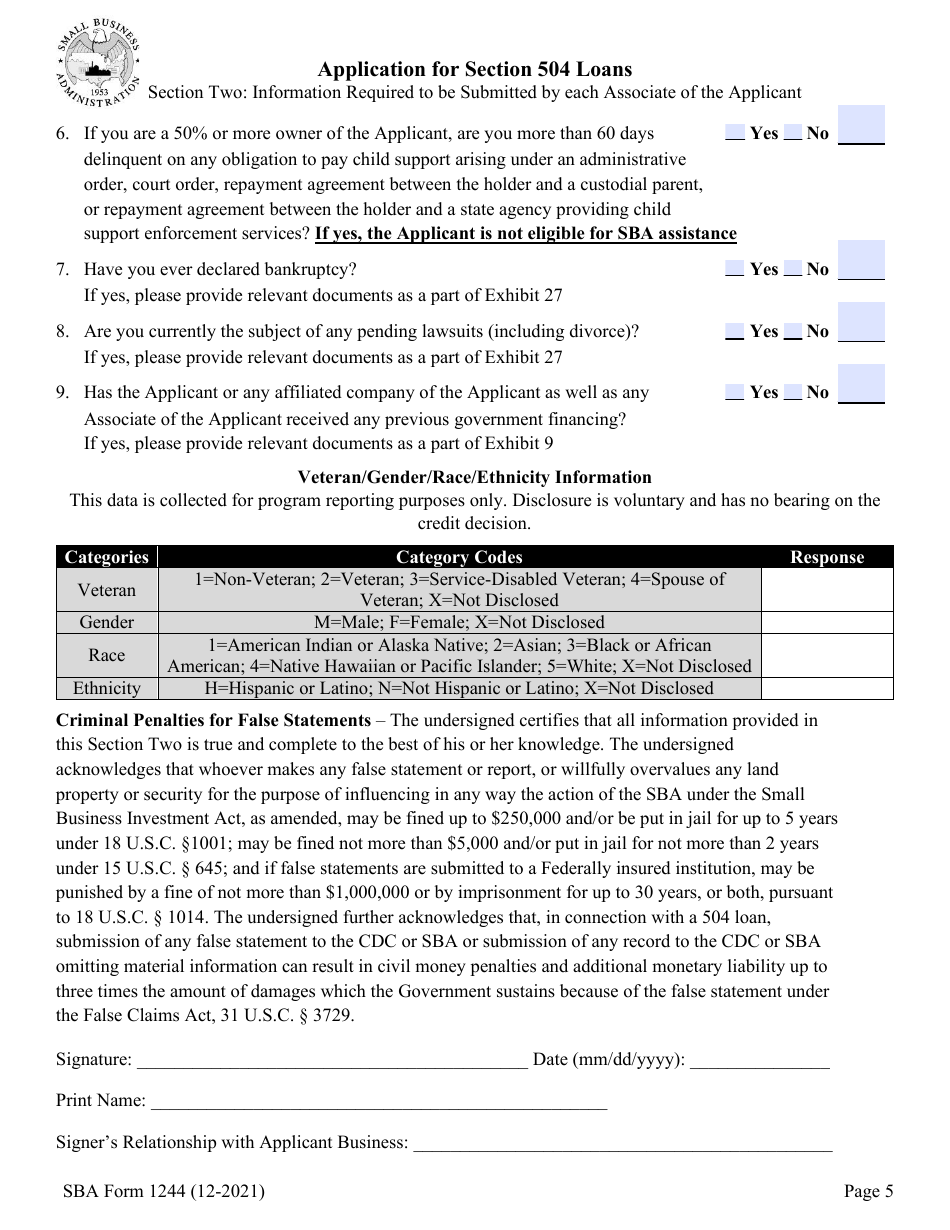

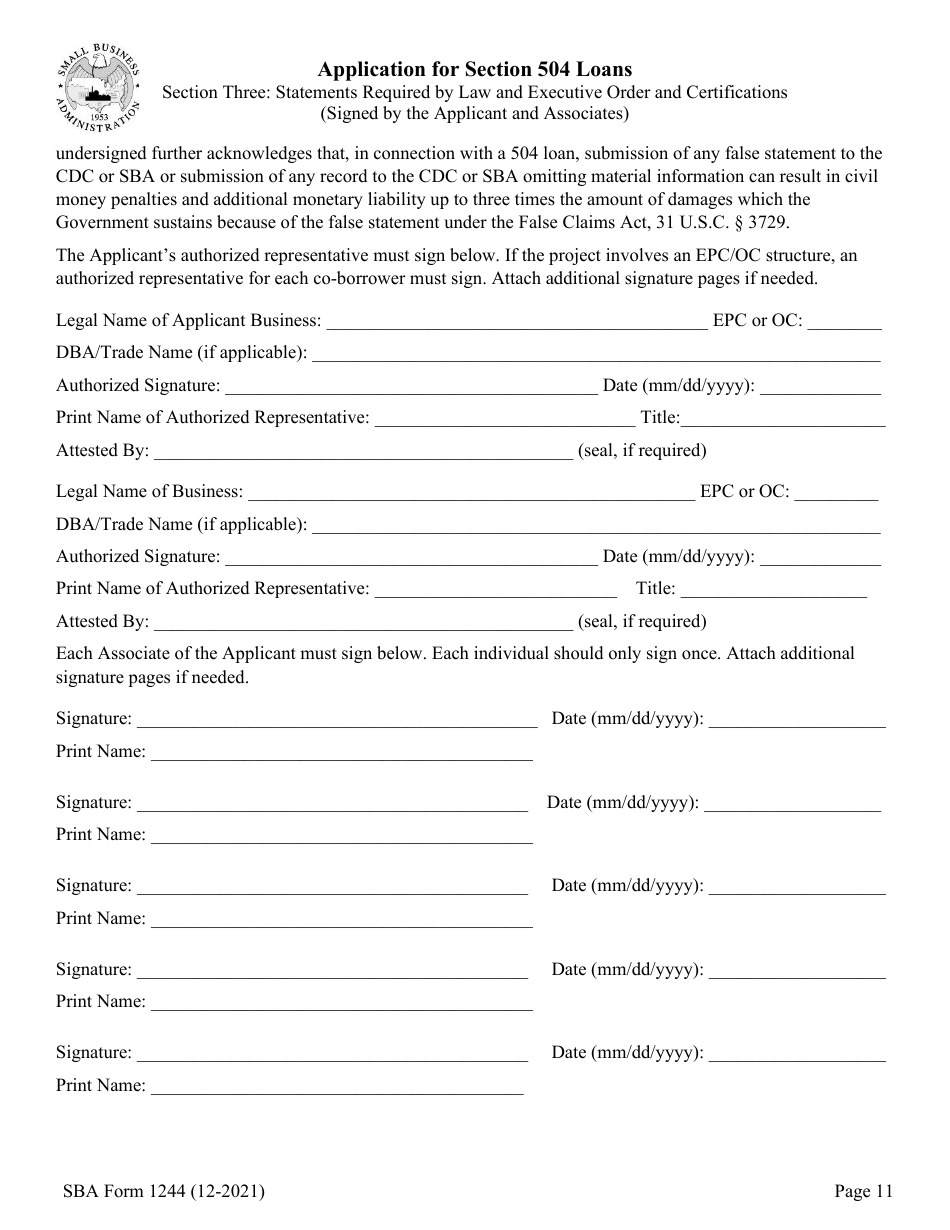

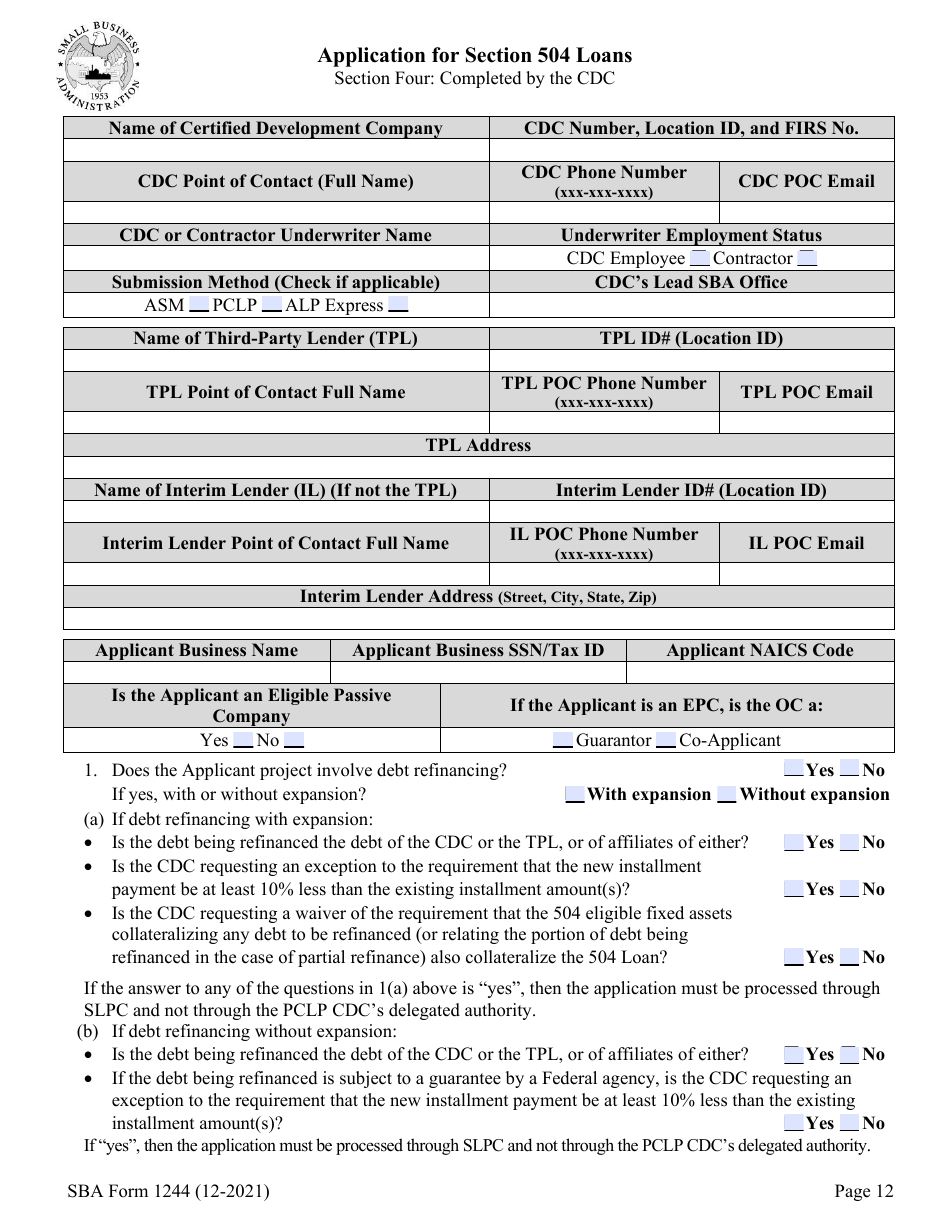

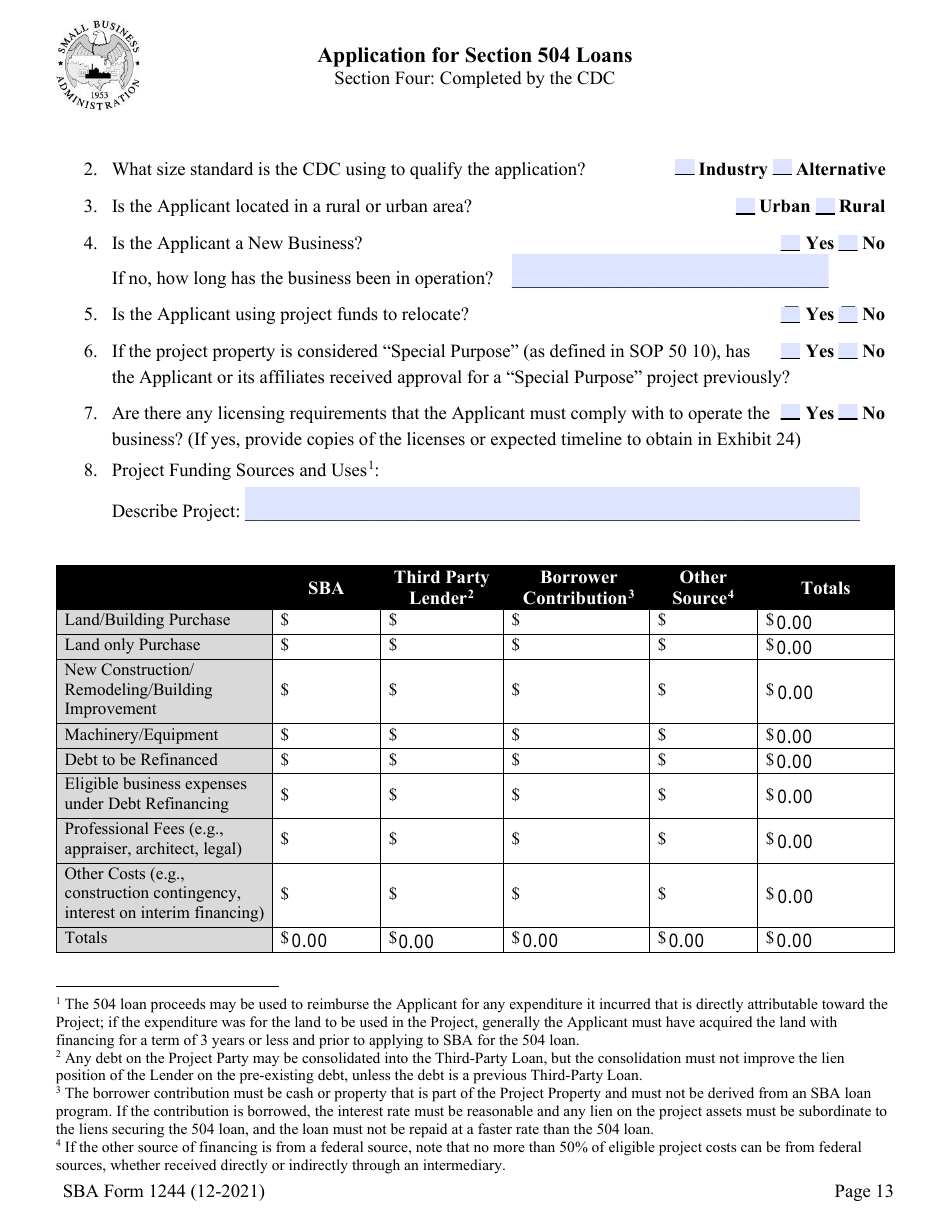

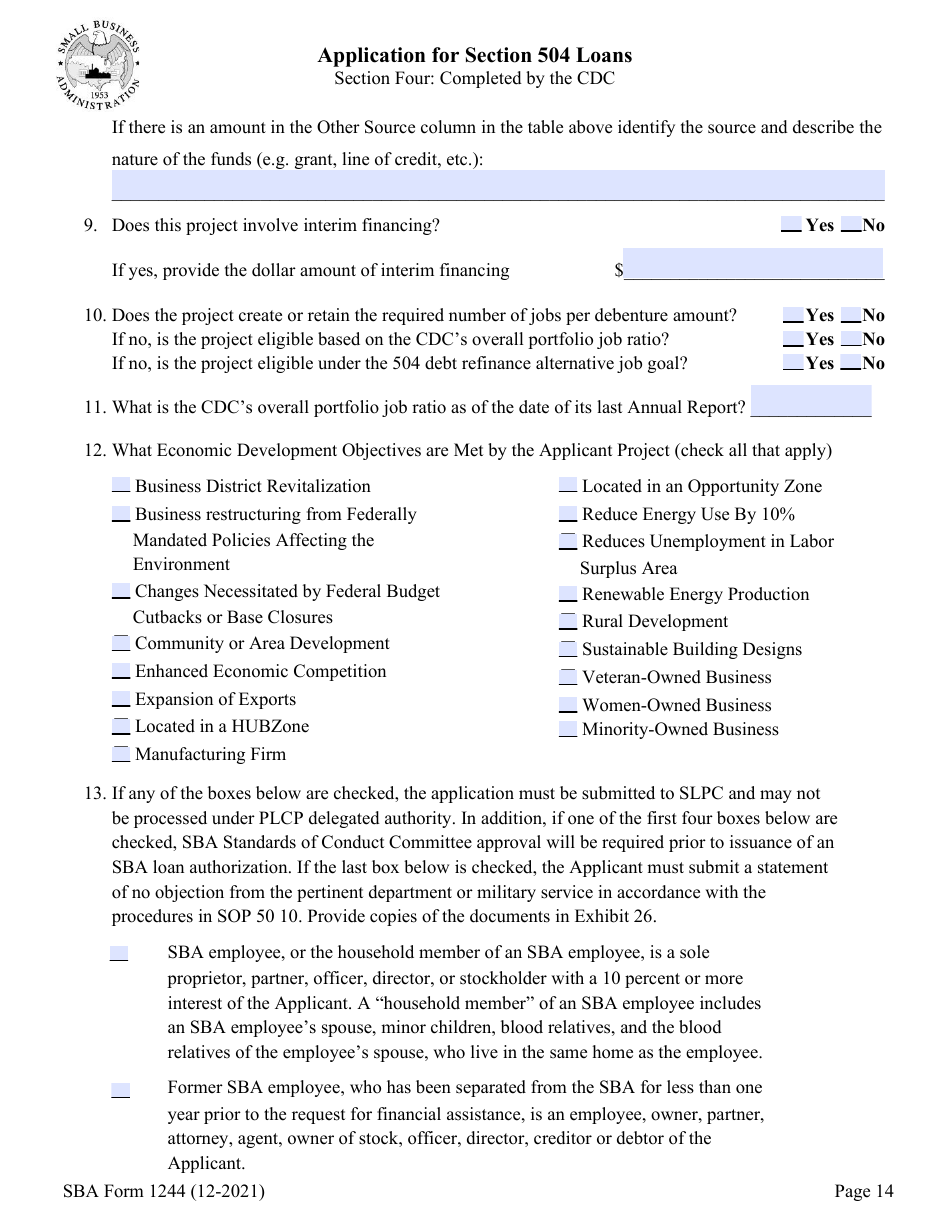

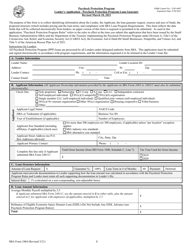

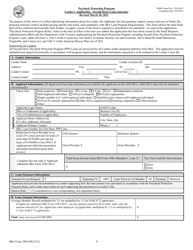

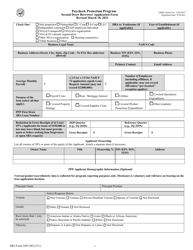

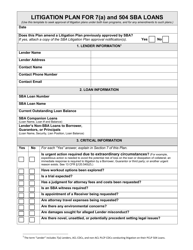

SBA Form 1244 Application for Section 504 Loans

What Is SBA Form 1244?

This is a legal form that was released by the U.S. Small Business Administration on December 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 1244?

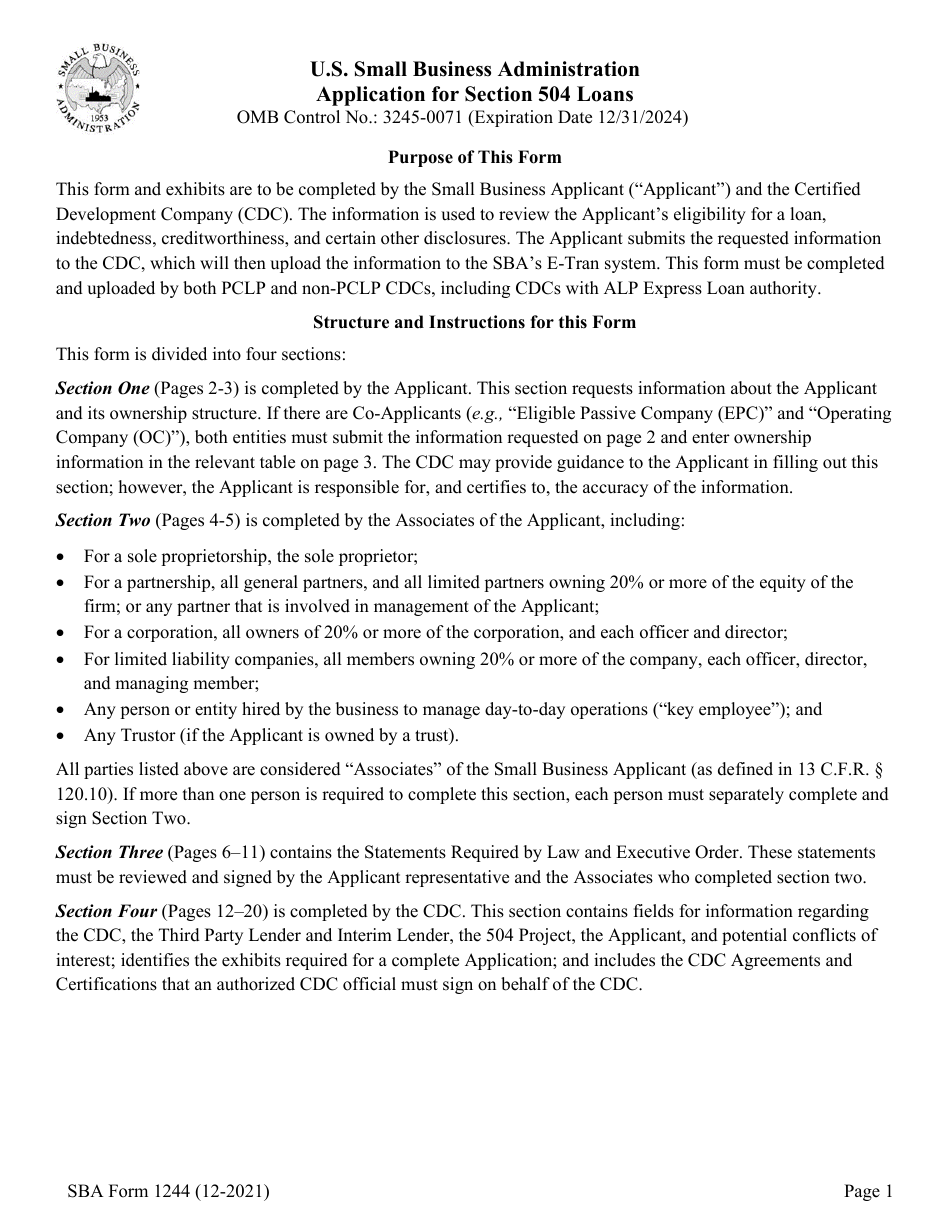

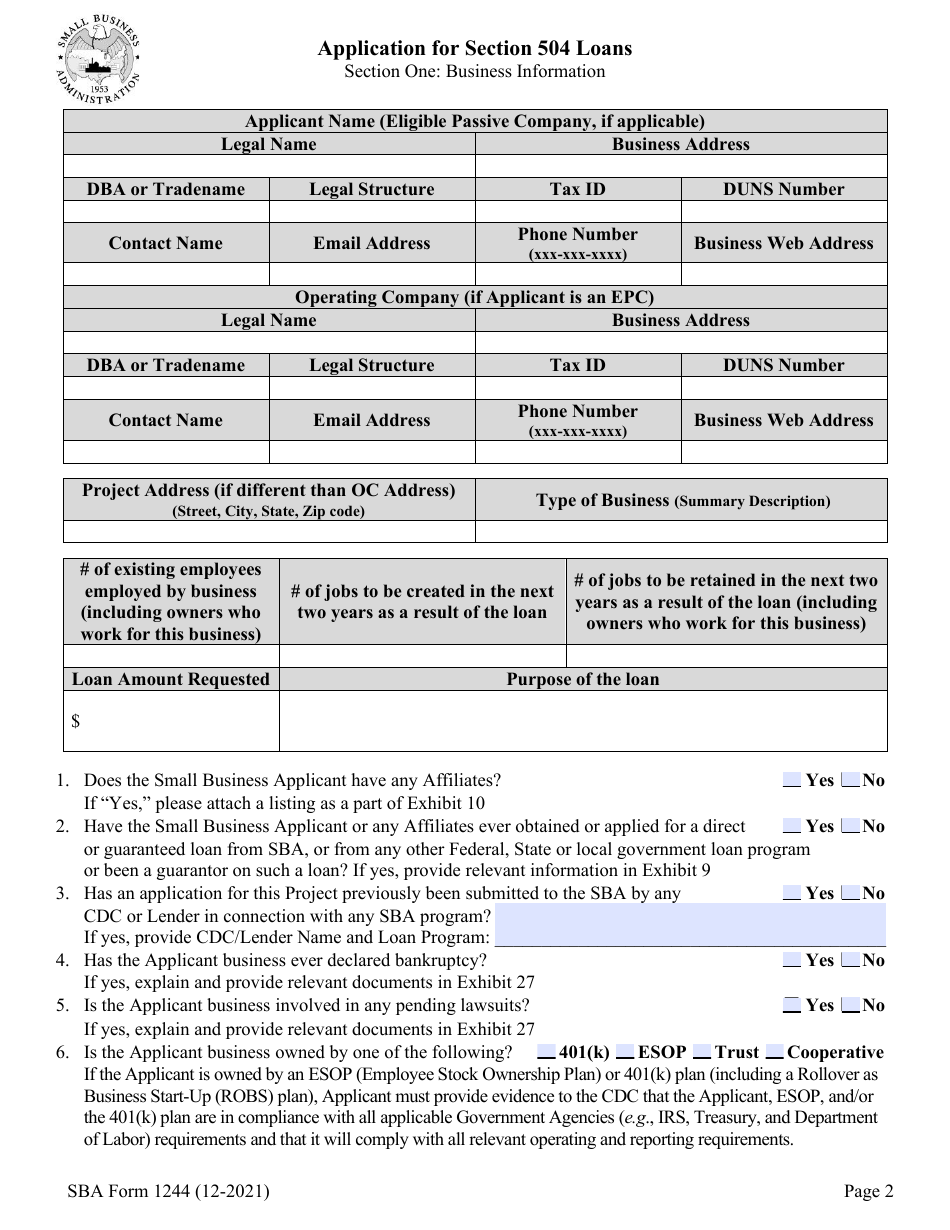

A: SBA Form 1244 is an application form for Section 504 loans administered by the Small Business Administration (SBA).

Q: What is a Section 504 loan?

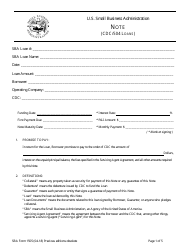

A: A Section 504 loan is a type of loan provided by the SBA to fund fixed assets for small businesses, including real estate, renovations, and equipment purchases.

Q: Who is eligible to apply for a Section 504 loan?

A: Small businesses that operate for profit and meet the SBA's size standards, as well as non-profit organizations, are eligible to apply for Section 504 loans.

Q: What can Section 504 loans be used for?

A: Section 504 loans can be used to finance various fixed assets, such as purchasing or renovating commercial real estate, buying machinery or equipment, and making energy efficiency improvements.

Q: What is the purpose of SBA Form 1244?

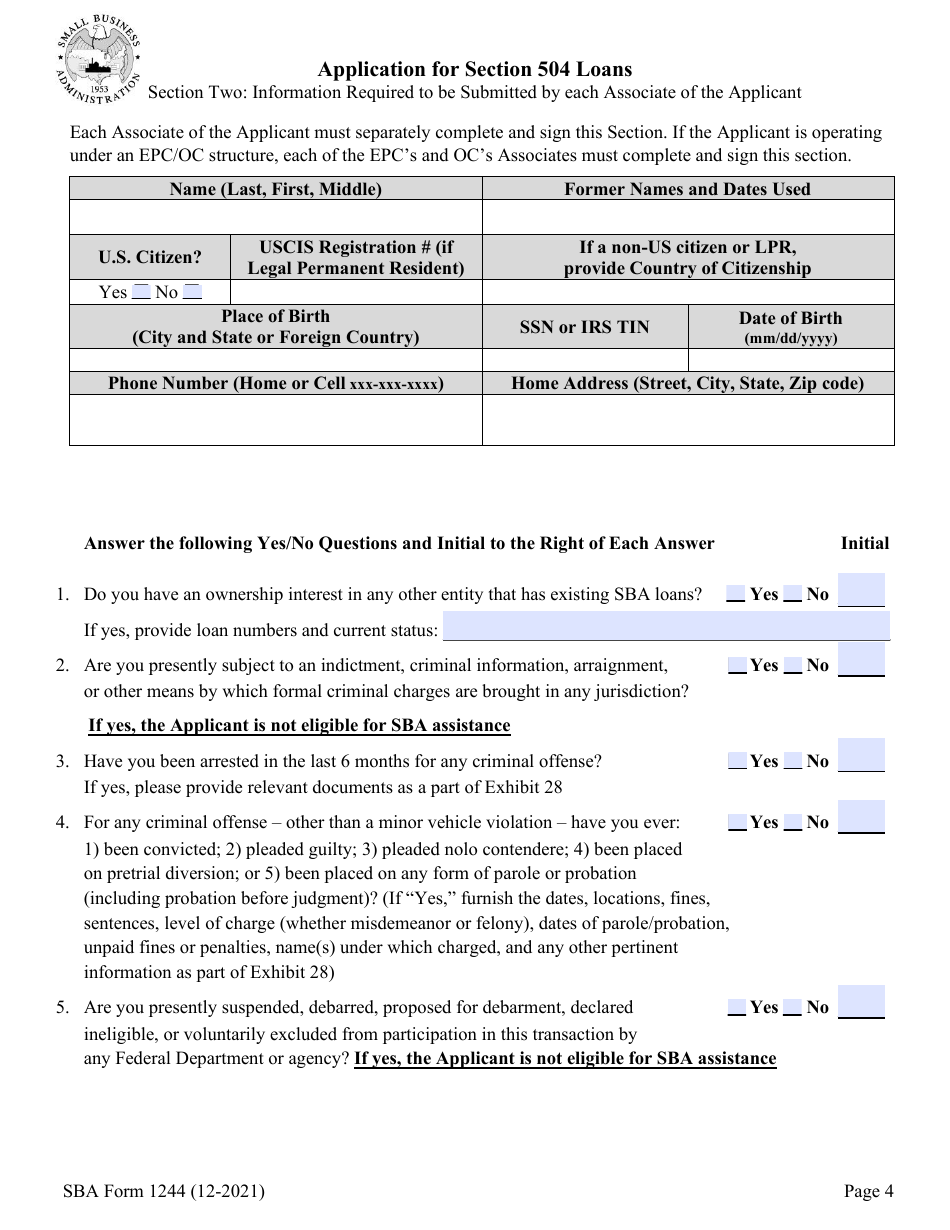

A: SBA Form 1244 is used to apply for a Section 504 loan and provides the SBA with information about the borrower, their business, and the project for which the loan is being sought.

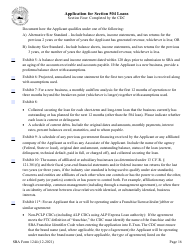

Q: Do I need to submit any supporting documents with SBA Form 1244?

A: Yes, along with SBA Form 1244, you will need to provide supporting documents such as business financial statements, tax returns, project cost estimates, and collateral information.

Q: Is there a fee to submit SBA Form 1244?

A: Yes, there is a fee associated with submitting SBA Form 1244, which covers the SBA's processing costs.

Q: How long does it take to process a Section 504 loan application?

A: The time it takes to process a Section 504 loan application can vary, but it typically ranges from several weeks to a few months, depending on the complexity of the project and the completeness of the application.

Q: Can I apply for a Section 504 loan if I have bad credit?

A: While credit history is a factor considered in the application process, having bad credit does not automatically disqualify you from getting a Section 504 loan. Other factors like collateral and business viability will also be considered.

Form Details:

- Released on December 1, 2021;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 1244 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.