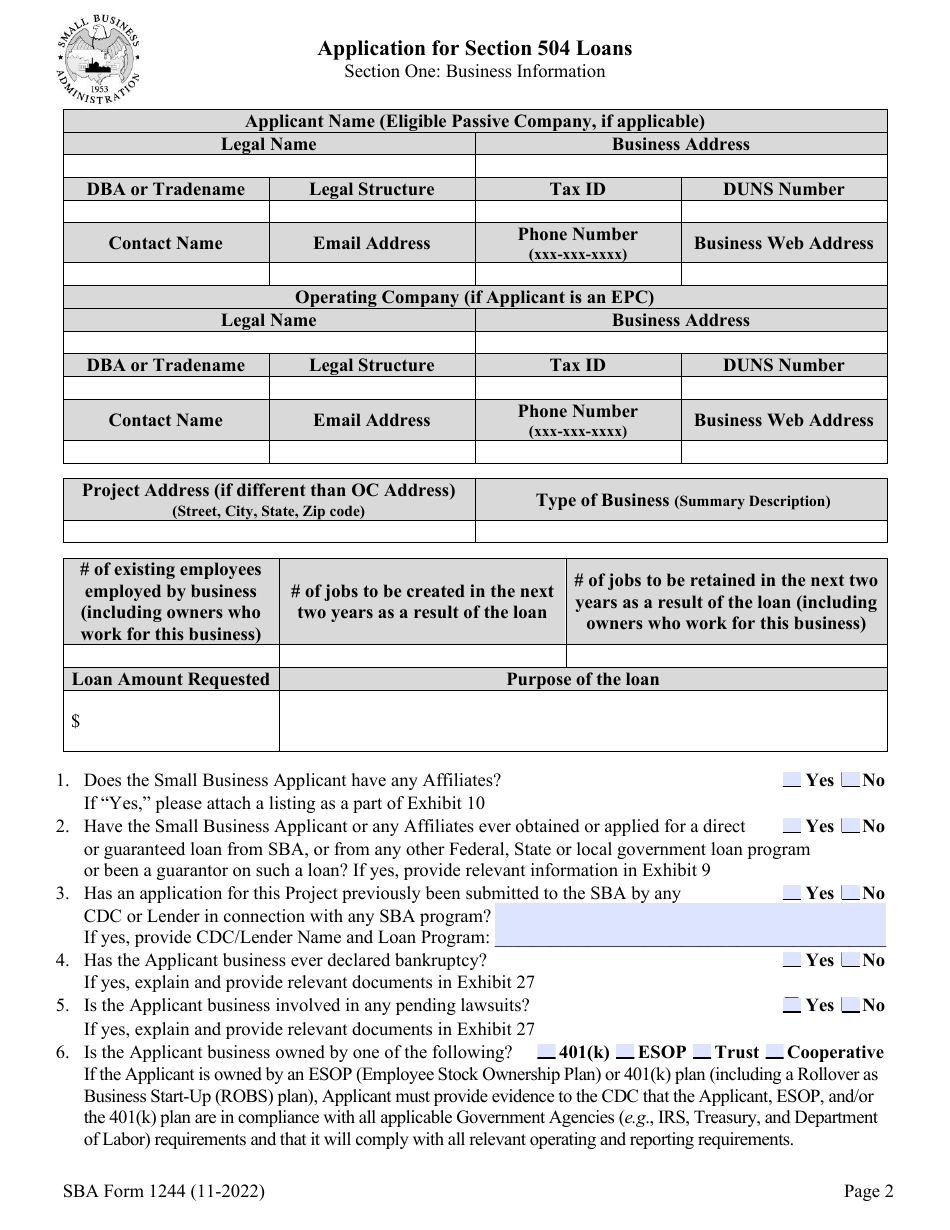

SBA Form 1244 Application for Section 504 Loans

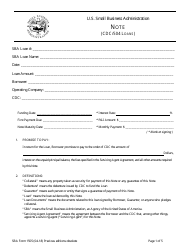

What Is SBA Form 1244?

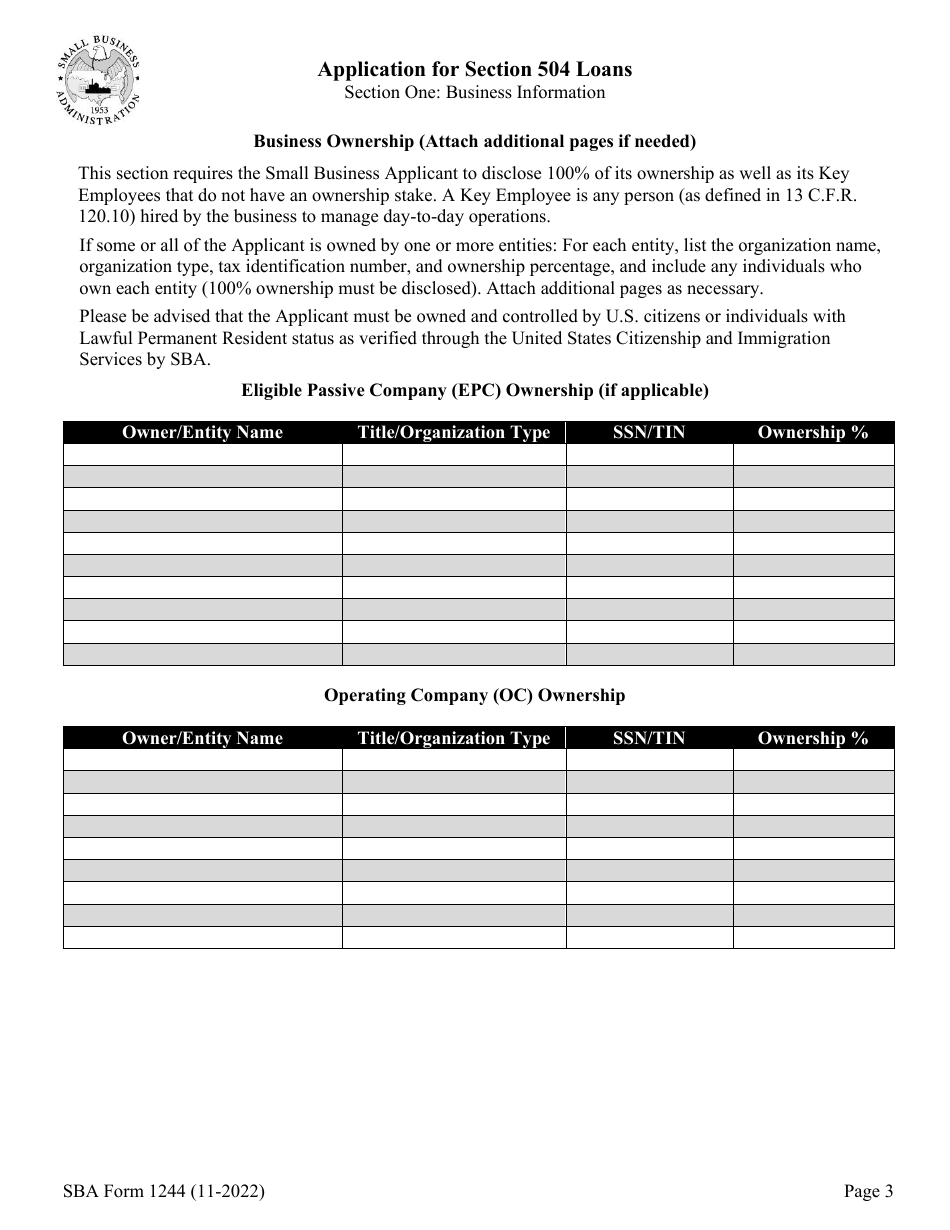

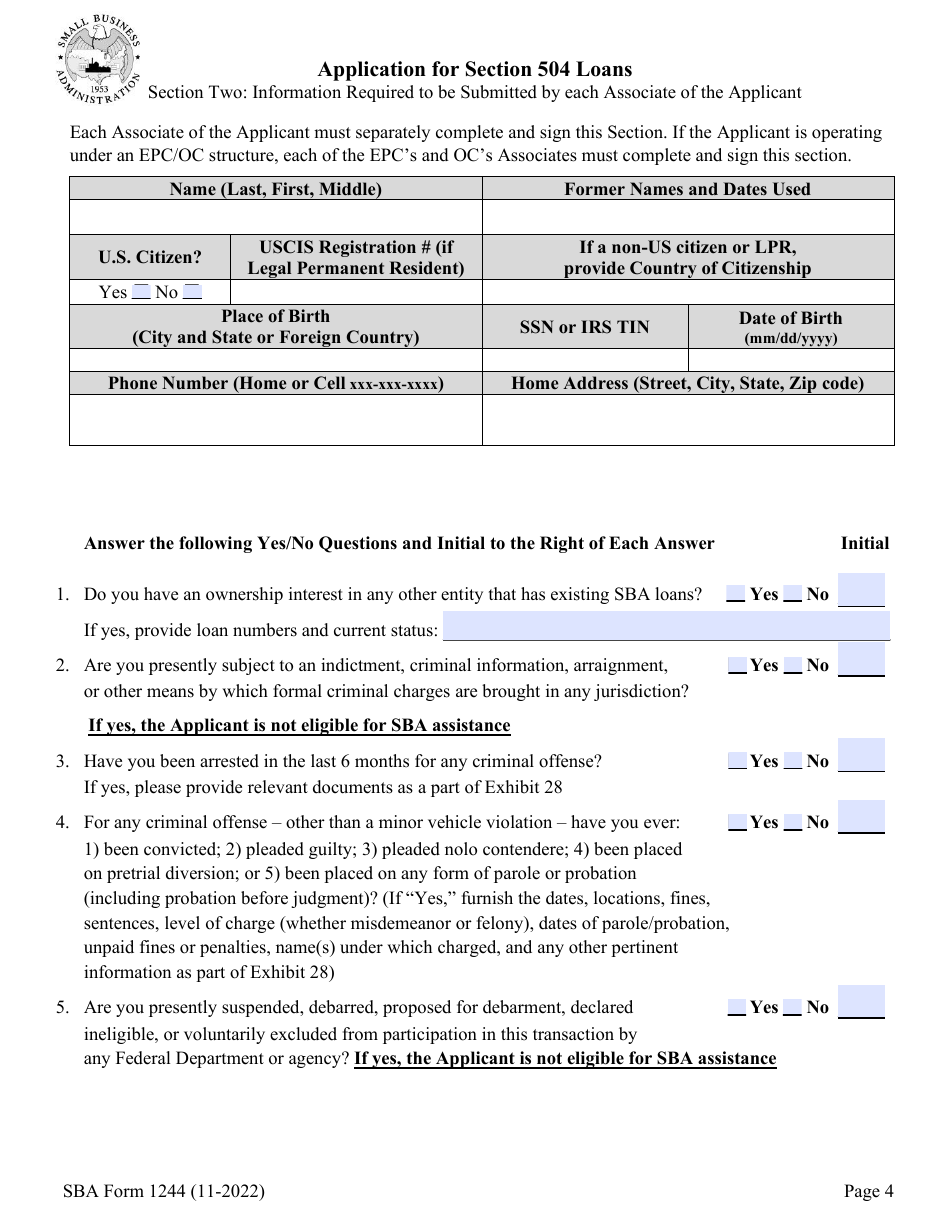

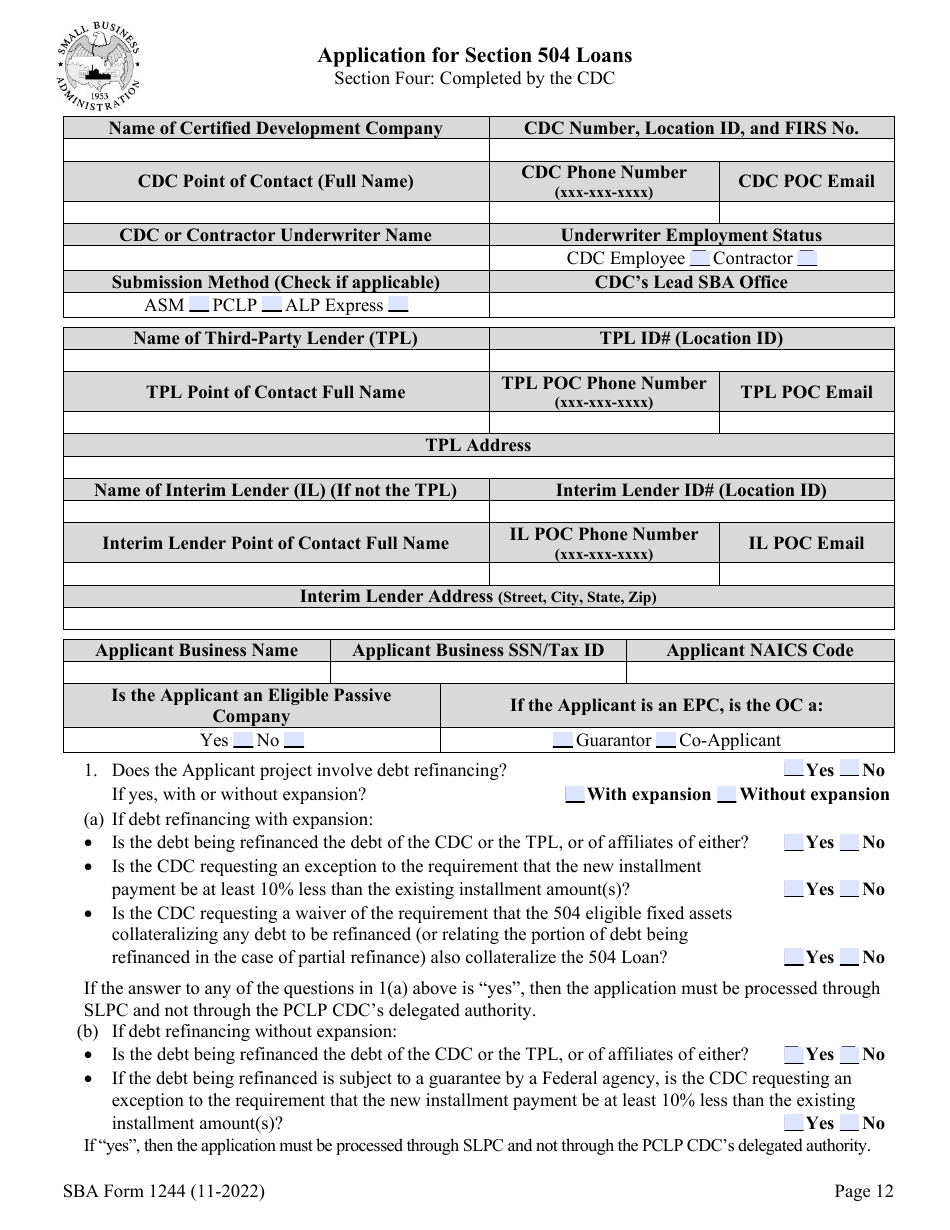

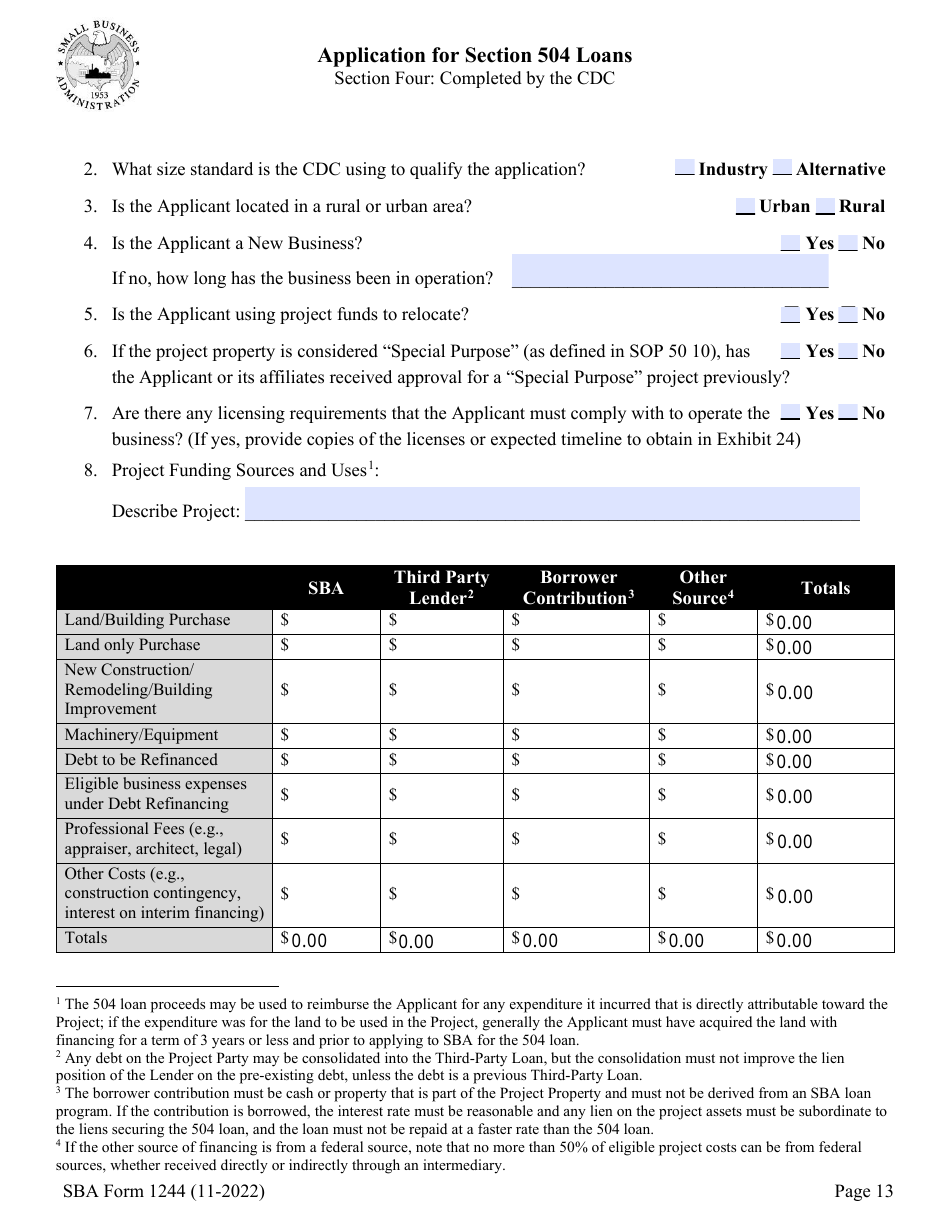

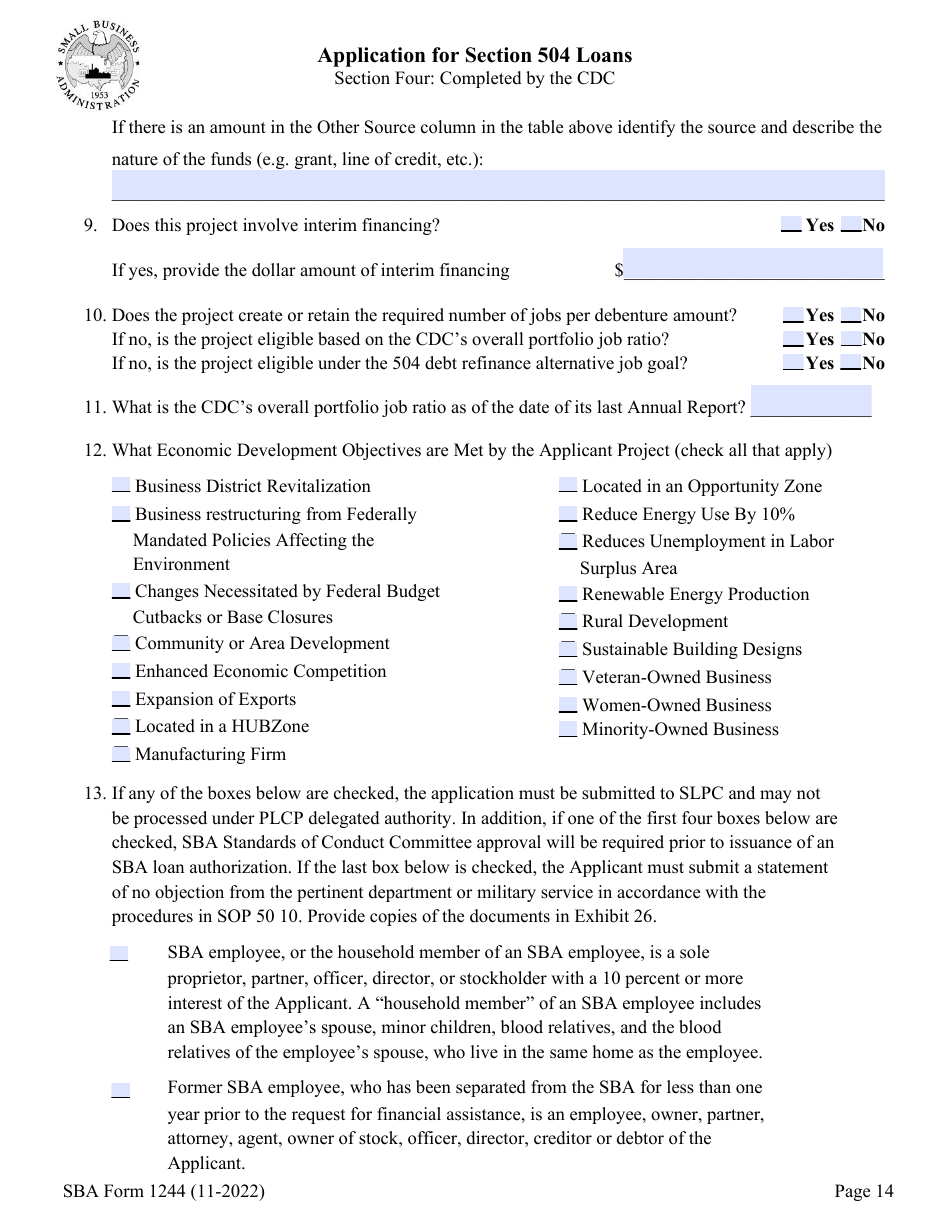

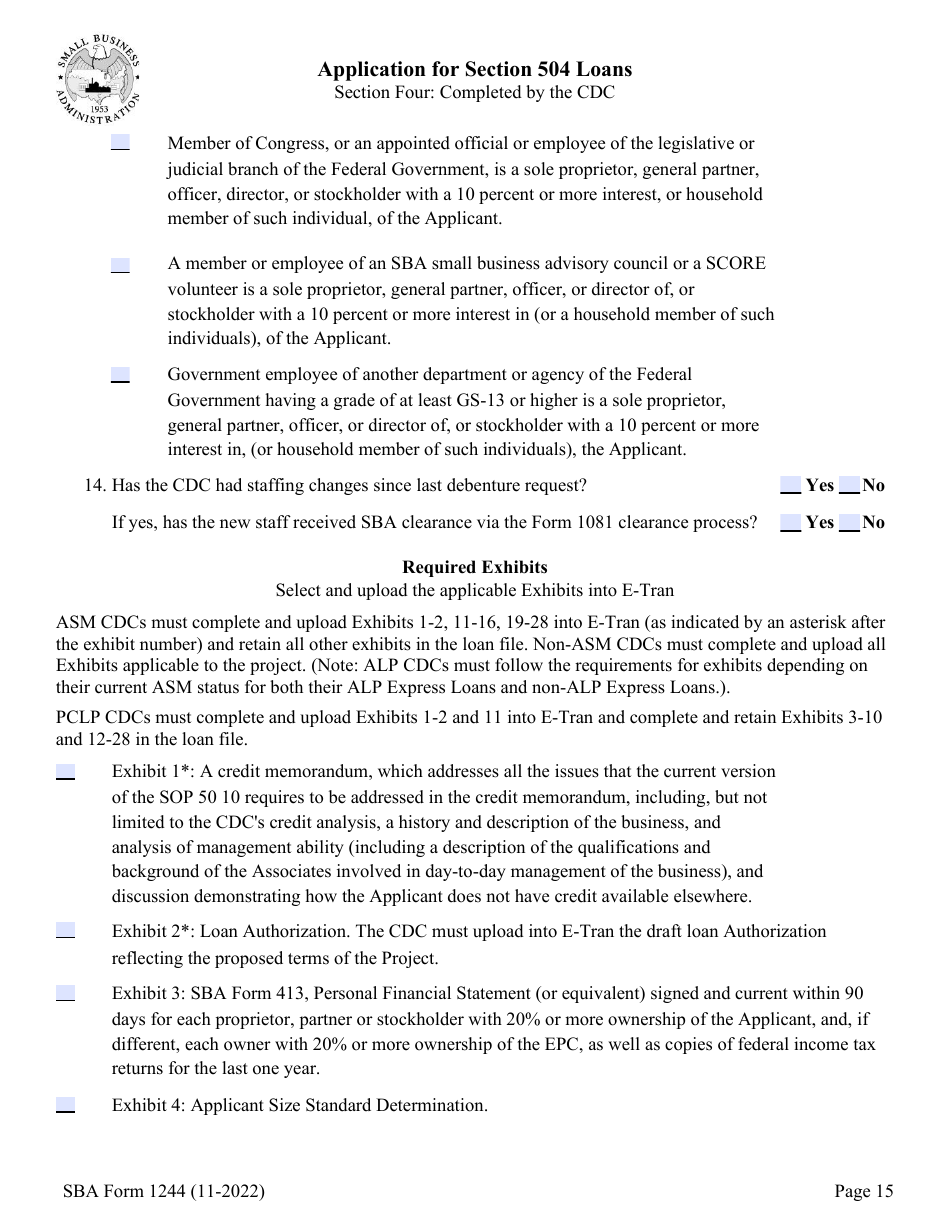

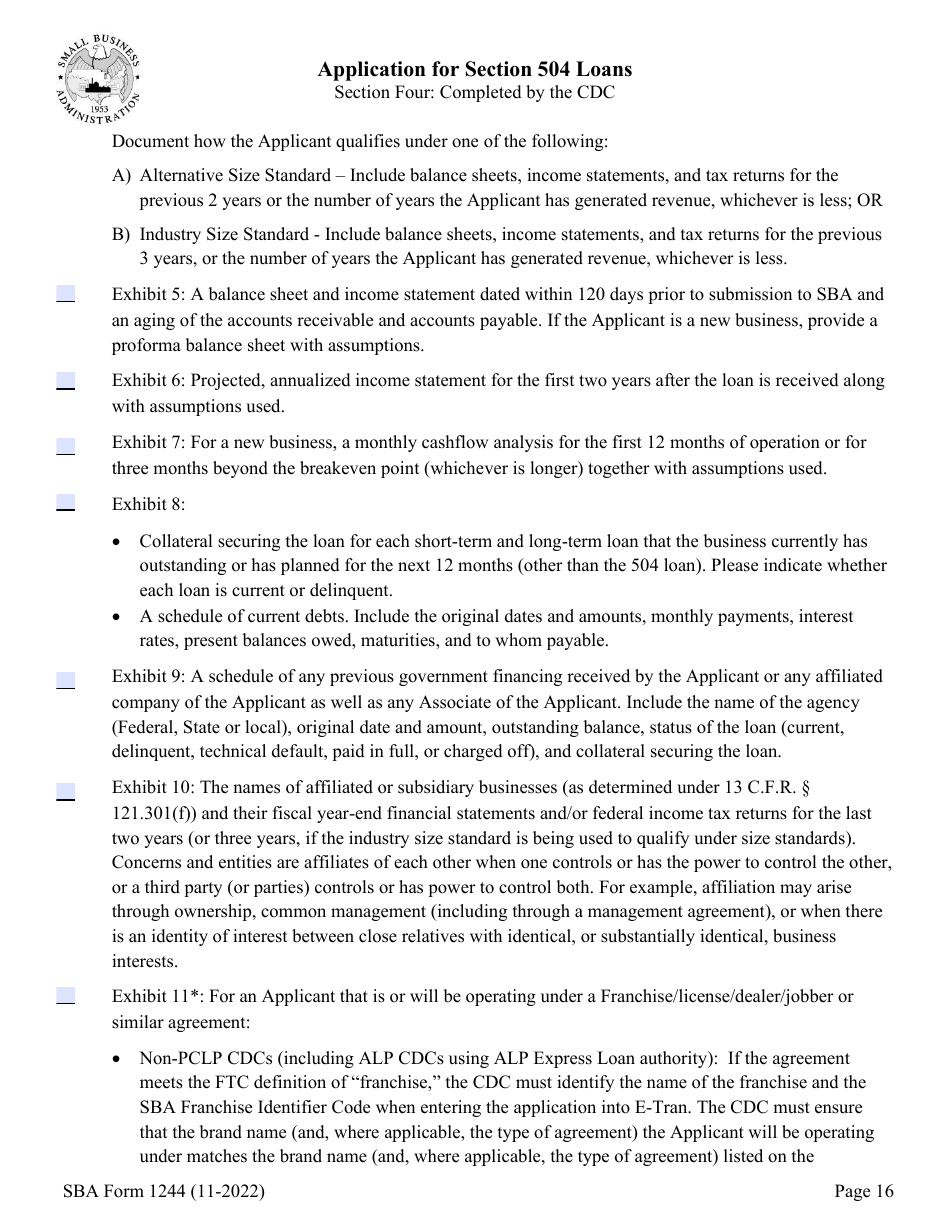

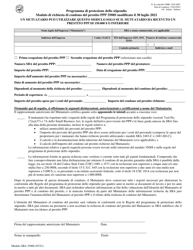

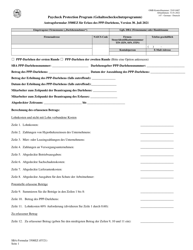

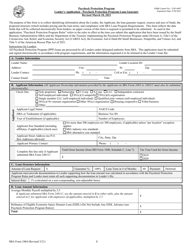

SBA Form 1244, Application for Section 504 Loan is a form used by the Small Business Administration (SBA) to obtain information necessary to determine a loan applicant's indebtedness, creditworthiness, and overall eligibility for the SBA Section 504 loan. The form and all exhibits must be completed by the applicant and the Certified Development Company (CDC) participating in the loan.

The information provided on the SBA Form 1244 form may be used by the SBA to assess the Certified Development Company's (CDC) request for a guarantee of the debenture.

The latest edition of the form was revised on November 1, 2022 , with changes related to the 504 25-year debenture and 504 Debt Refinancing. An up-to-date SBA Form 1244 fillable version is available for download below or can be found through the SBA website.

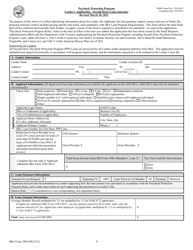

504 Loan Application Form

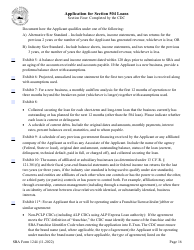

The SBA 504 Loan Application Form should be completed by the loan applicant and submitted to the CDC with the other necessary paperwork. After the CDC determines the applicant's creditworthiness, it submits the form further to the internal loan committee. If the internal loan committee approves the loan, the forms will be forwarded to the SBA's Sacramento Loan Processing Center.

If all the requires documents are provided, the applicant will be notified about the SBA's decision within two weeks.

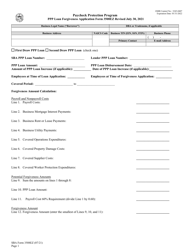

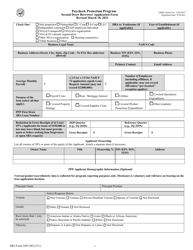

The SBA 504 Loan Program is considered to be one of the best options for small business owners because of its low interest rates and an opportunity for long-term repayment. A 504 loan - or a CDC loan - can be used for purchasing real estate or long-term equipment or machinery.

The lenders in the 504 Program finance up to 90% of a project with two separate loans - a permanent loan and a bridge loan - and the borrower contributing the other 10% of the project costs. The purchase of the real estate, construction, or a plan to buy or install equipment may be considered a project.

After the project is completed the bridge loan is then refinanced by a CDC.