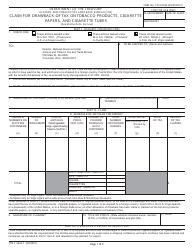

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CG-114

for the current year.

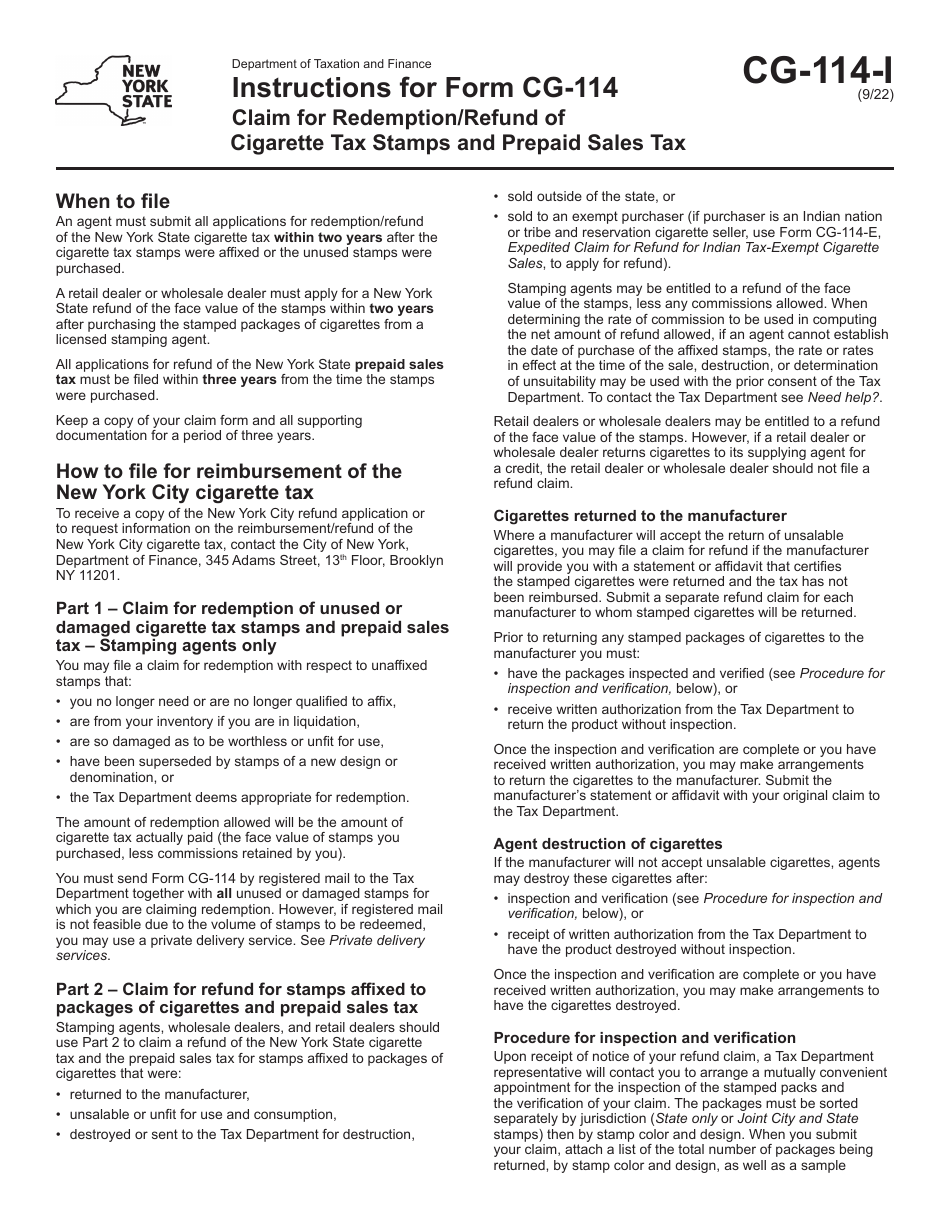

Instructions for Form CG-114 Claim for Redemption / Refund of Cigarette Tax Stamps and Prepaid Sales Tax - New York

This document contains official instructions for Form CG-114 , Claim for Redemption/Refund of Cigarette Tax Stamps and Prepaid Sales Tax - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CG-114 is available for download through this link.

FAQ

Q: What is Form CG-114?

A: Form CG-114 is a claim form for redemption/refund of cigarette tax stamps and prepaid sales tax in New York.

Q: Who should use Form CG-114?

A: Anyone who wants to claim a redemption or refund of cigarette tax stamps and prepaid sales tax in New York should use Form CG-114.

Q: What is the purpose of Form CG-114?

A: Form CG-114 is used to request a refund or redemption of cigarette tax stamps and prepaid sales tax that were improperly or mistakenly affixed.

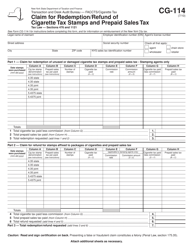

Q: What information is required on Form CG-114?

A: Form CG-114 requires information such as the claimant's name, address, tax ID number, details of the improperly or mistakenly affixed stamps, and the reason for the claim.

Q: Is there a deadline for submitting Form CG-114?

A: Yes, Form CG-114 must be filed within three years from the date the stamps were purchased or affixed, or within three years from the discovery of the improper or mistaken affixation.

Q: What supporting documentation should I include with Form CG-114?

A: You should include any supporting documentation that proves the improper or mistaken affixation of the cigarette tax stamps, such as invoices, receipts, or other relevant records.

Q: When can I expect to receive a refund or redemption?

A: The processing time for Form CG-114 varies, but you can generally expect to receive a refund or redemption within a few weeks.

Q: What should I do if my claim is denied?

A: If your claim is denied, you have the option to request a reconsideration or file an appeal with the New York State Department of Taxation and Finance.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.