This version of the form is not currently in use and is provided for reference only. Download this version of

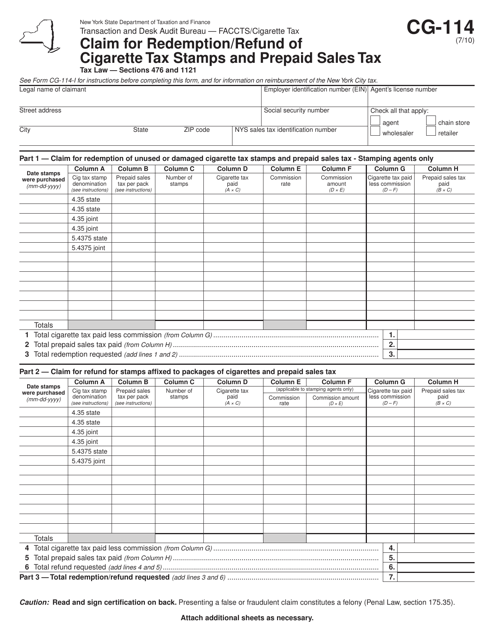

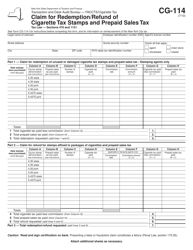

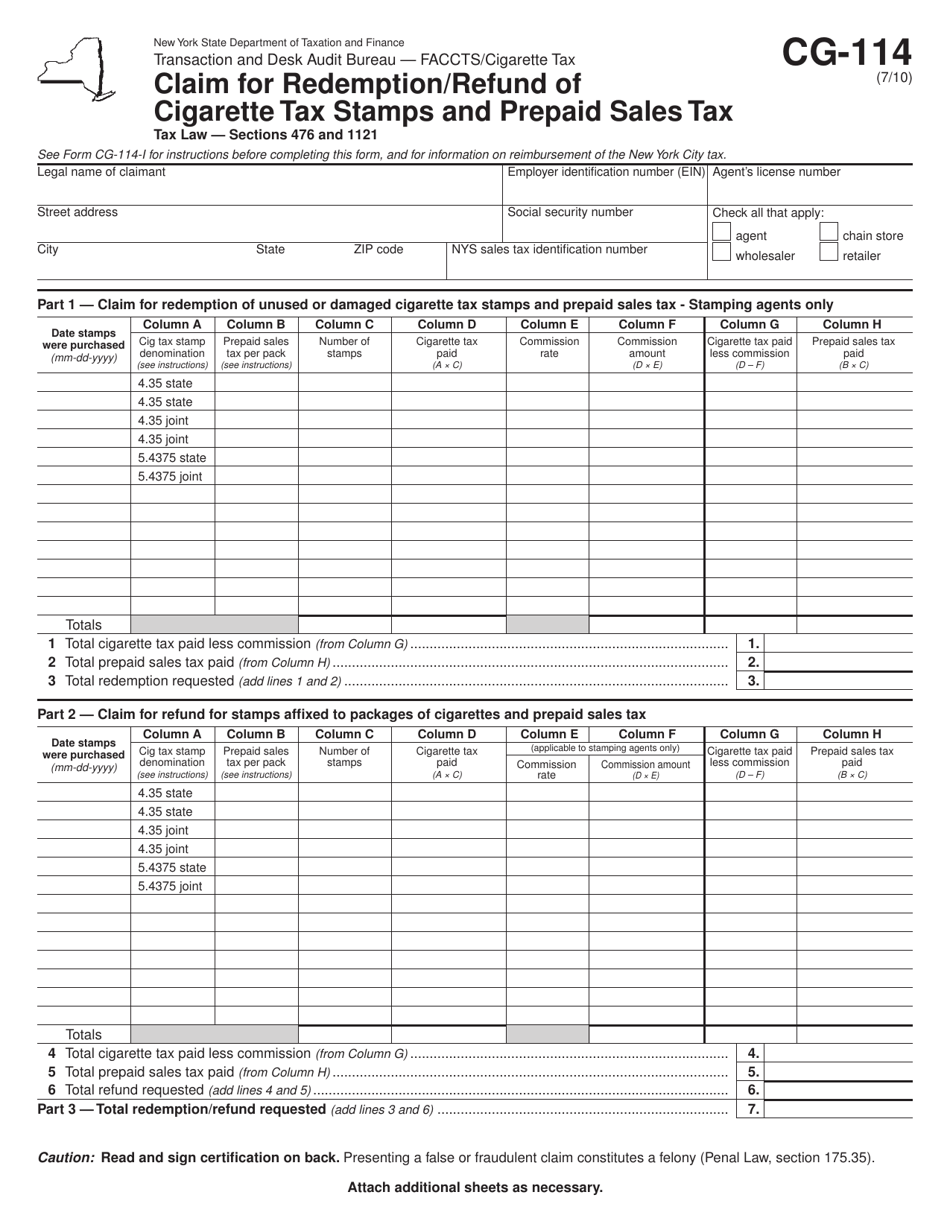

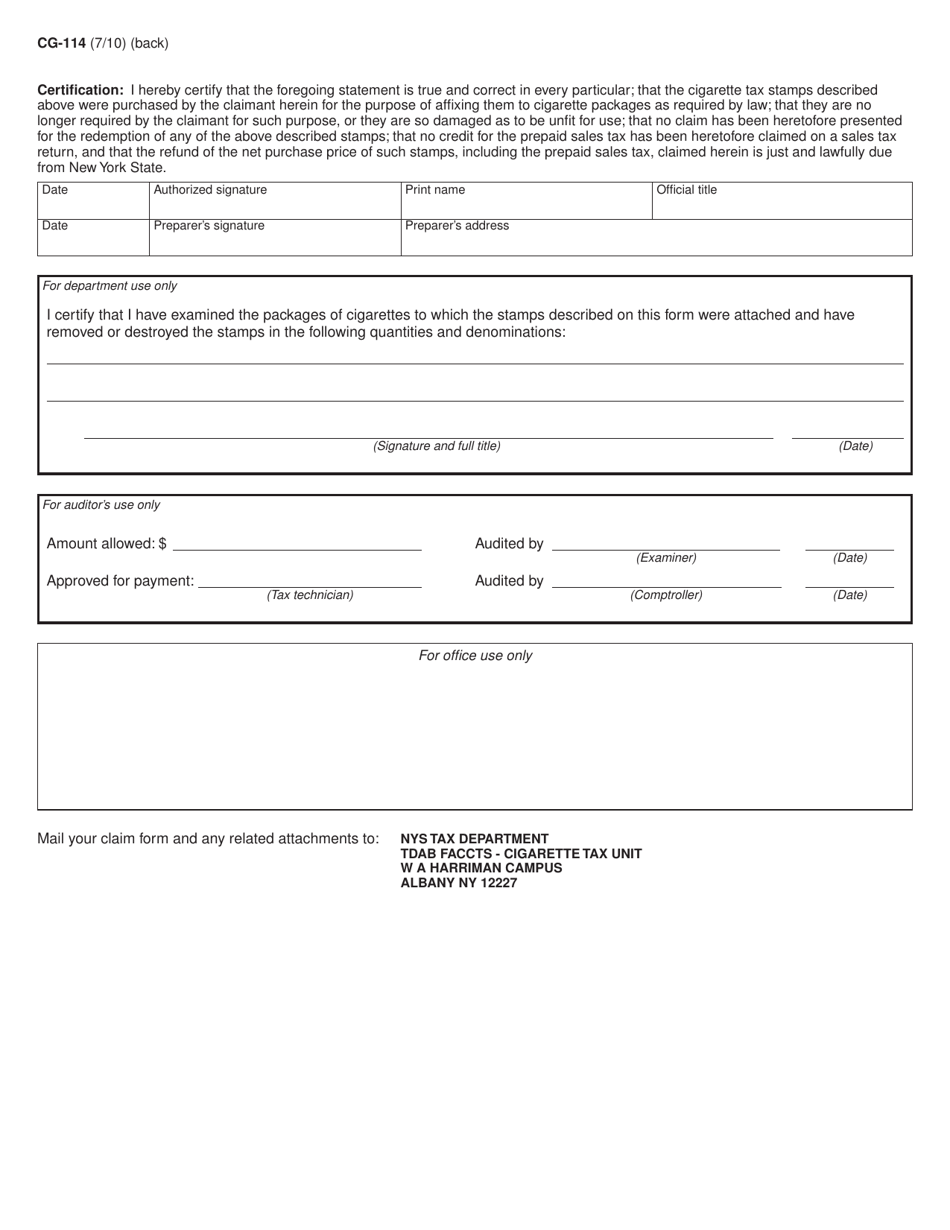

Form CG-114

for the current year.

Form CG-114 Claim for Redemption / Refund of Cigarette Tax Stamps and Prepaid Sales Tax - New York

What Is Form CG-114?

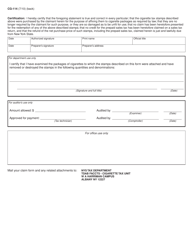

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CG-114?

A: Form CG-114 is a form used to claim redemption or refund of cigarette tax stamps and prepaid sales tax in New York.

Q: What can I use Form CG-114 for?

A: You can use Form CG-114 to claim redemption or refund of cigarette tax stamps and prepaid sales tax in New York.

Q: How do I fill out Form CG-114?

A: You need to provide the required information such as your name, contact information, details of the stamps or prepaid sales tax, and reason for the claim.

Q: Are there any deadlines for submitting Form CG-114?

A: Yes, there are specific deadlines for submitting Form CG-114. It is recommended to check the instructions provided with the form for the current deadline.

Q: Will I receive a refund if my claim is approved?

A: Yes, if your claim is approved, you will receive a refund for the eligible amount of cigarette tax stamps or prepaid sales tax.

Q: Is there a fee for filing Form CG-114?

A: No, there is no fee for filing Form CG-114.

Q: What supporting documents do I need to include with Form CG-114?

A: You may need to include supporting documents such as invoices, purchase receipts, or other relevant documents to support your claim.

Form Details:

- Released on July 1, 2010;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CG-114 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.