This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form RI-706

for the current year.

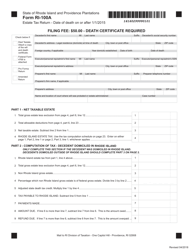

Instructions for Form RI-706 Estate Tax Return - Date of Death on or After 1 / 1 / 2015 - Rhode Island

This document contains official instructions for Form RI-706 , Estate Tax Return - Date of Death on or After 1/1/2015 - a form released and collected by the Rhode Island Department of Revenue - Division of Taxation. An up-to-date fillable Form RI-706 is available for download through this link.

FAQ

Q: What is Form RI-706 Estate Tax Return?

A: Form RI-706 Estate Tax Return is a tax form used to report and pay estate taxes in the state of Rhode Island.

Q: When is Form RI-706 Estate Tax Return used?

A: Form RI-706 Estate Tax Return is used when someone passes away on or after January 1, 2015 in Rhode Island.

Q: What is the purpose of Form RI-706 Estate Tax Return?

A: The purpose of Form RI-706 Estate Tax Return is to calculate and pay any estate taxes owed to the state of Rhode Island.

Q: What information is required on Form RI-706 Estate Tax Return?

A: Form RI-706 Estate Tax Return requires information such as the decedent's personal details, assets, liabilities, and any applicable deductions.

Q: When is the deadline to file Form RI-706 Estate Tax Return?

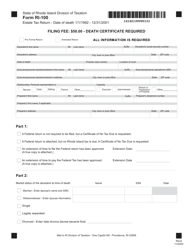

A: Form RI-706 Estate Tax Return must be filed within nine months from the date of the decedent's death.

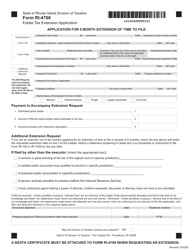

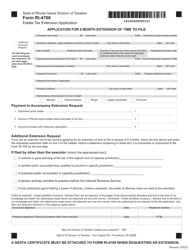

Q: Are there any extensions available for filing Form RI-706 Estate Tax Return?

A: Yes, extensions may be granted upon request, but the tax liability must be paid by the original deadline to avoid penalties and interest.

Q: How do I pay the estate tax owed on Form RI-706 Estate Tax Return?

A: The estate tax owed can be paid by check or electronic funds transfer (EFT) using the instructions provided on the form.

Q: Is professional assistance recommended for completing Form RI-706 Estate Tax Return?

A: Yes, it is recommended to seek professional assistance from an attorney or tax preparer familiar with Rhode Island estate tax laws to ensure accurate completion and compliance.

Q: What happens if I do not file Form RI-706 Estate Tax Return?

A: Failure to file Form RI-706 Estate Tax Return may result in penalties, interest, and possible legal consequences.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Rhode Island Department of Revenue - Division of Taxation.