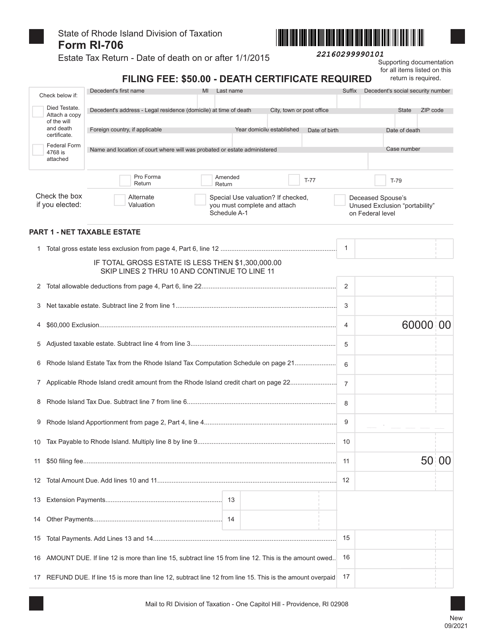

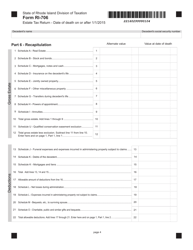

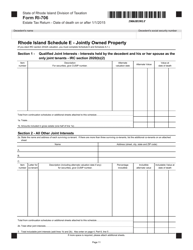

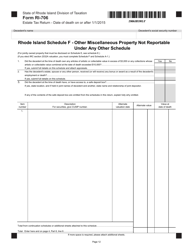

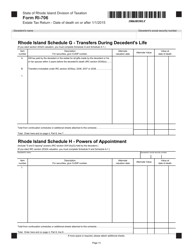

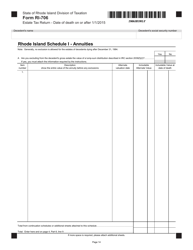

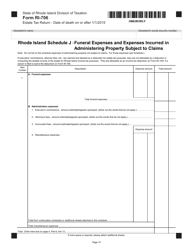

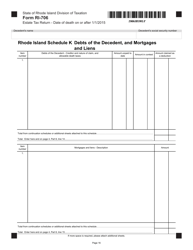

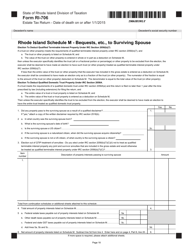

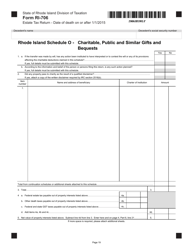

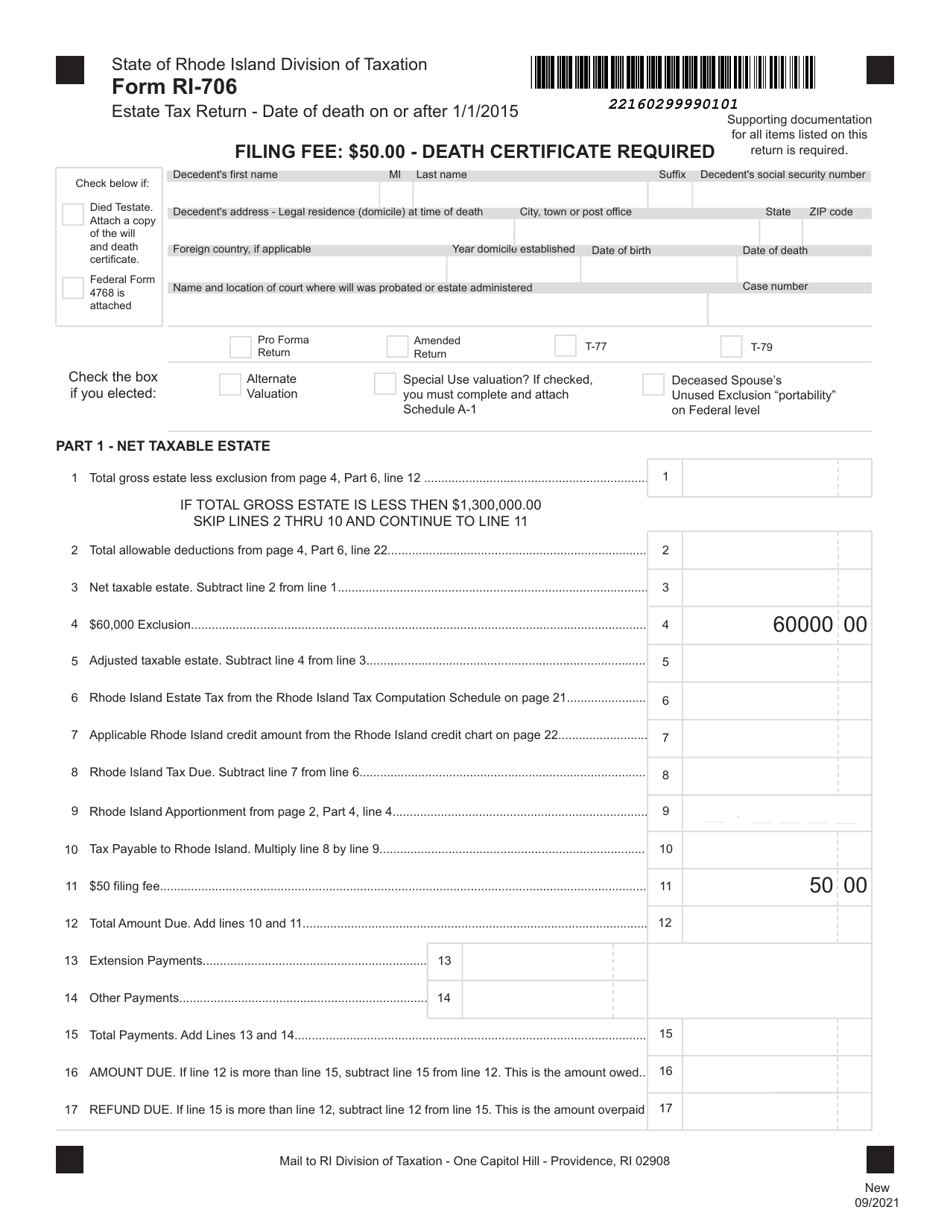

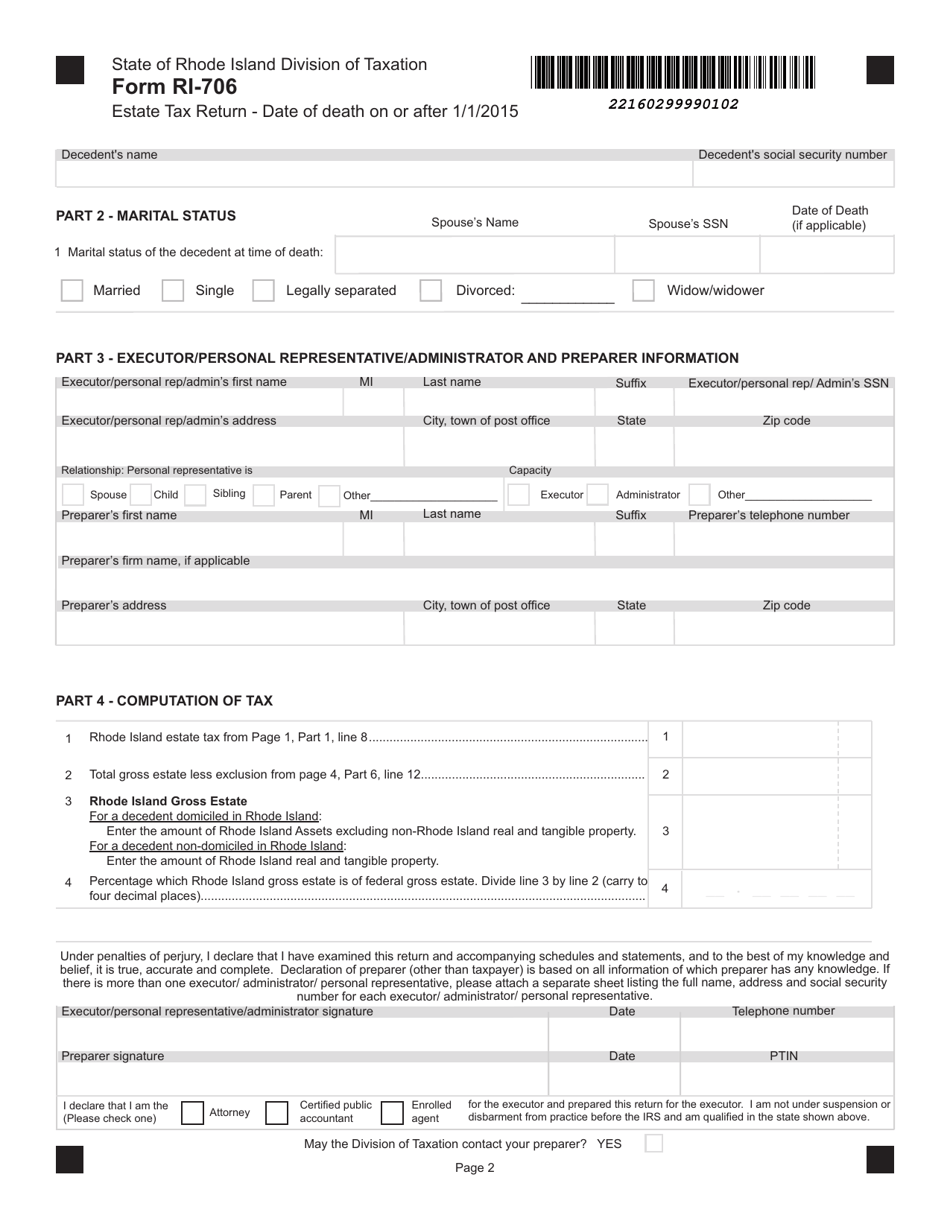

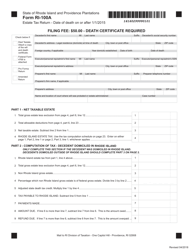

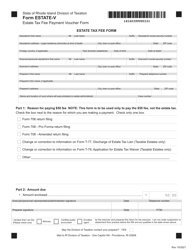

Form RI-706 Estate Tax Return - Date of Death on or After 1 / 1 / 2015 - Rhode Island

What Is Form RI-706?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-706?

A: Form RI-706 is the Estate Tax Return for the state of Rhode Island.

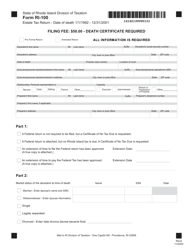

Q: Who needs to file Form RI-706?

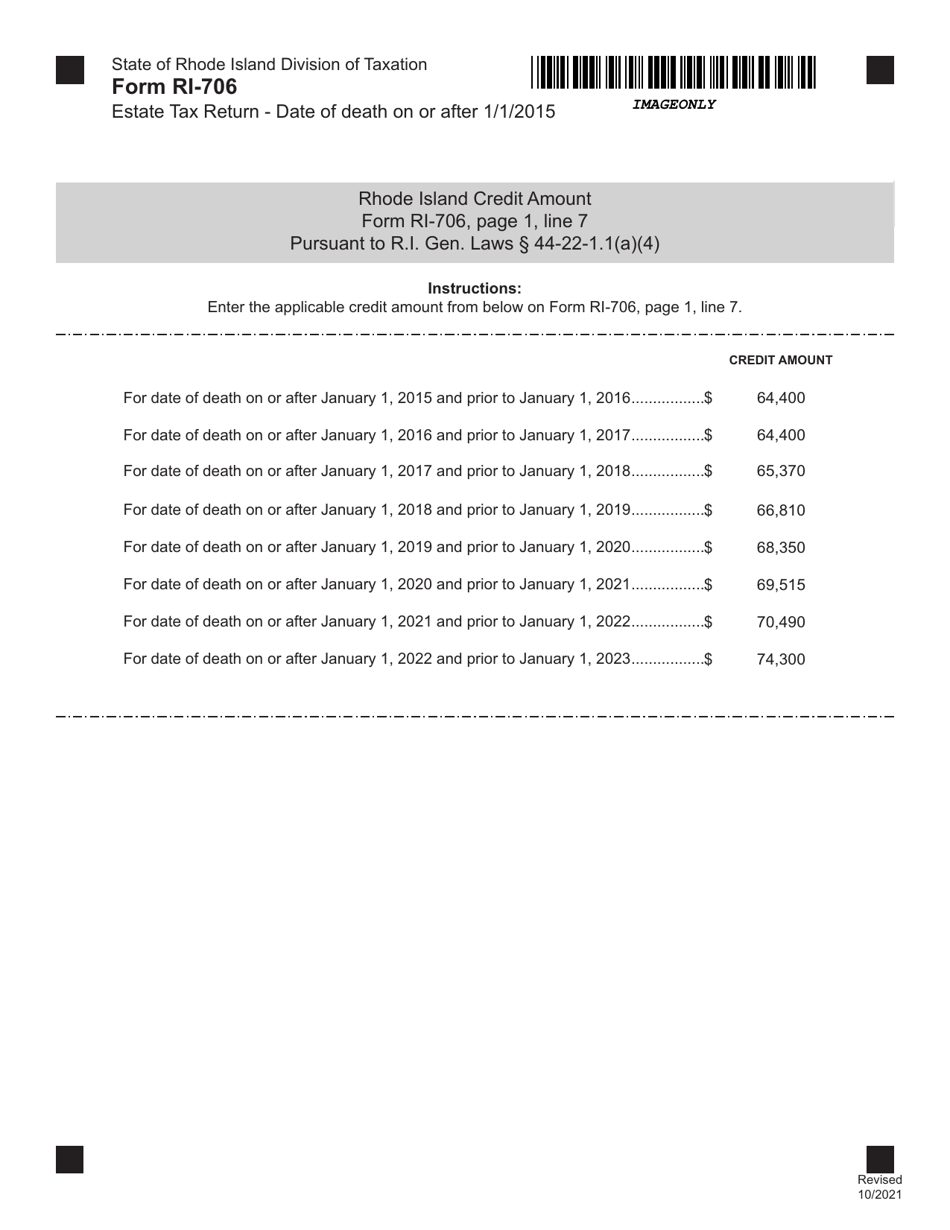

A: The executor of an estate where the date of death is on or after January 1, 2015 in Rhode Island needs to file Form RI-706.

Q: What is the purpose of Form RI-706?

A: Form RI-706 is used to report and pay estate taxes to the state of Rhode Island.

Q: What is the due date for filing Form RI-706?

A: The due date for filing Form RI-706 depends on the date of death. It is generally due within 9 months after the date of death.

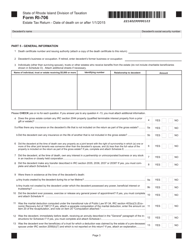

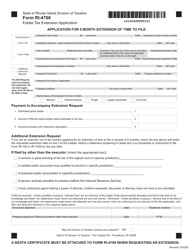

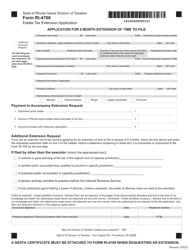

Q: Are there any extensions available for filing Form RI-706?

A: Yes, an extension of time to file Form RI-706 may be granted for up to 6 months. However, any taxes owed must still be paid by the original due date.

Q: Is there a minimum threshold for filing Form RI-706?

A: Yes, as of 2021, estates with a gross value of $1,683,706 or less are not required to file Form RI-706.

Q: What happens if Form RI-706 is not filed?

A: If Form RI-706 is not filed or filed late, penalties and interest may be assessed by the state of Rhode Island.

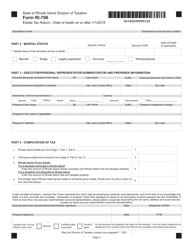

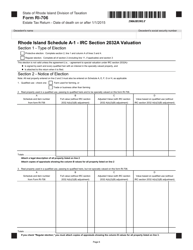

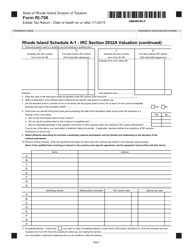

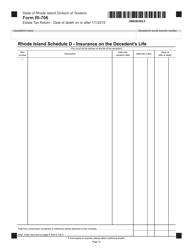

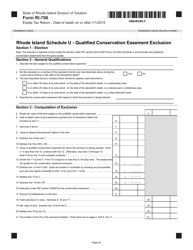

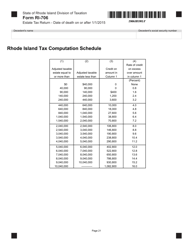

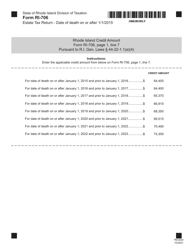

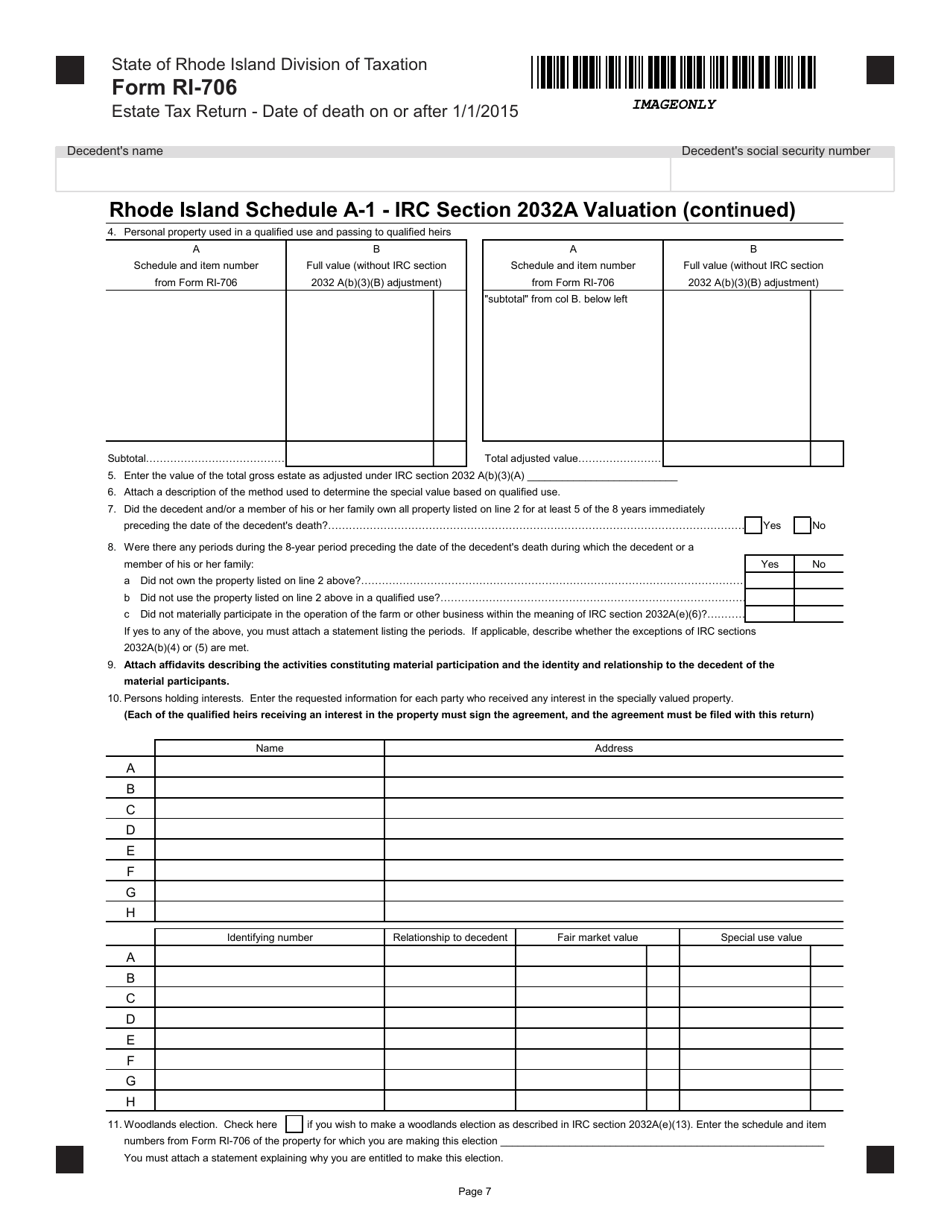

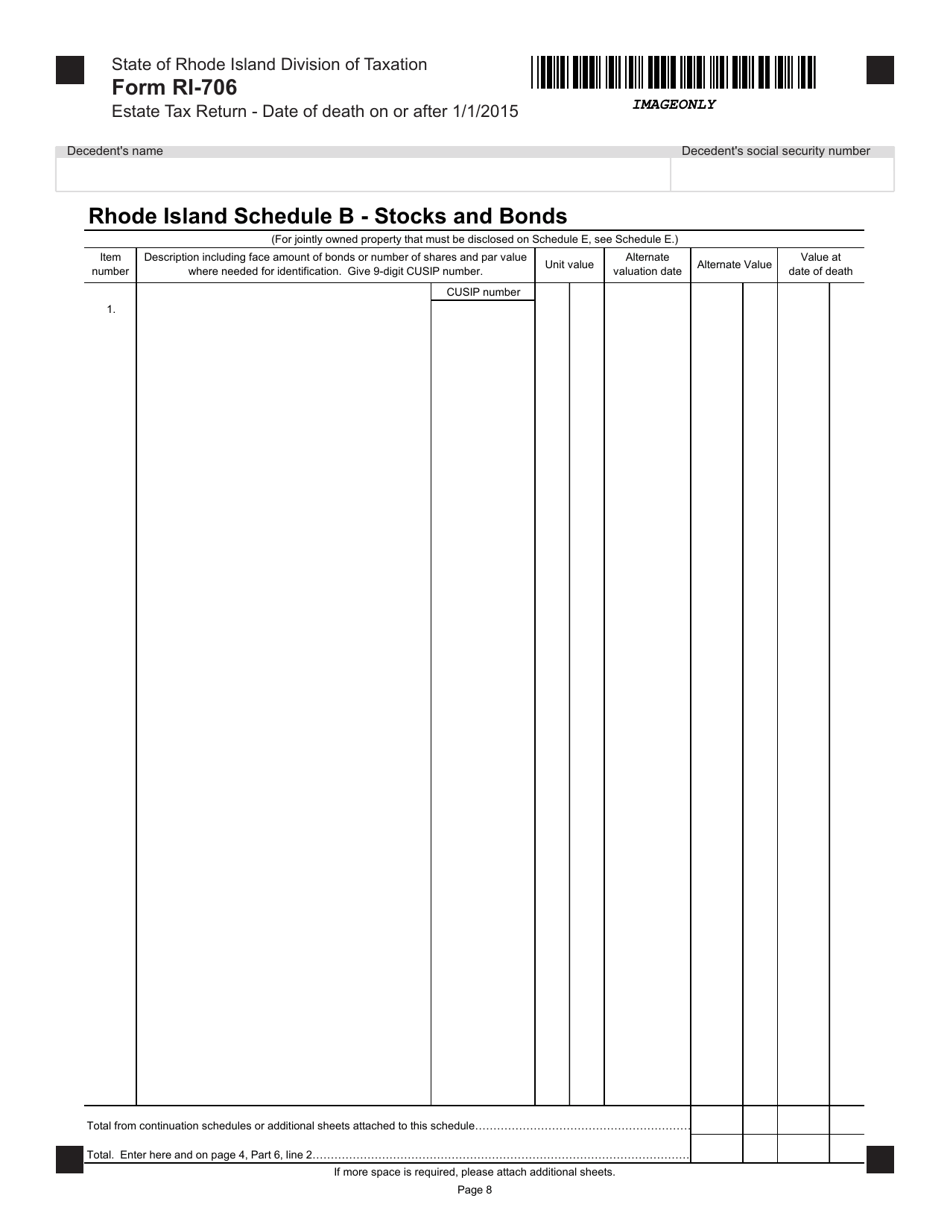

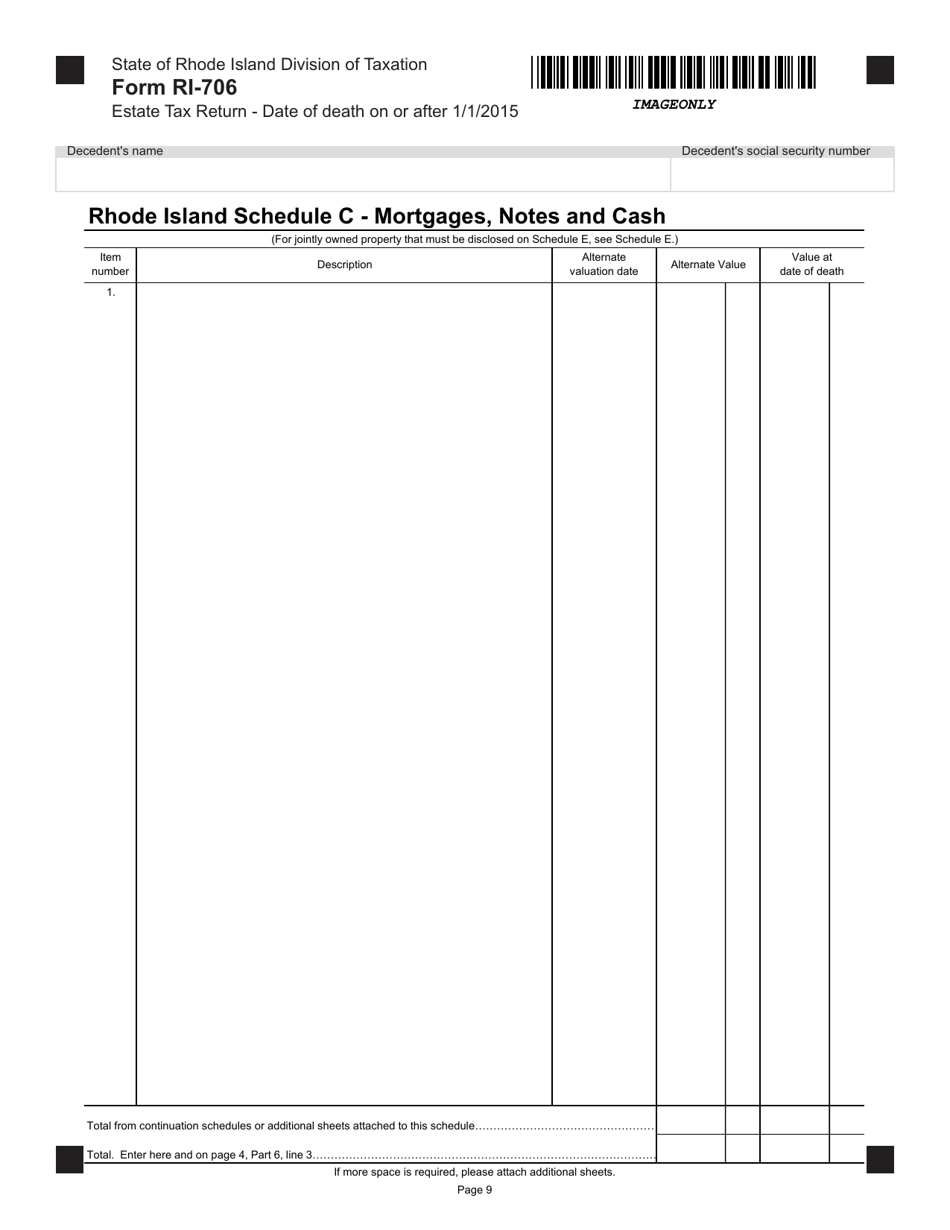

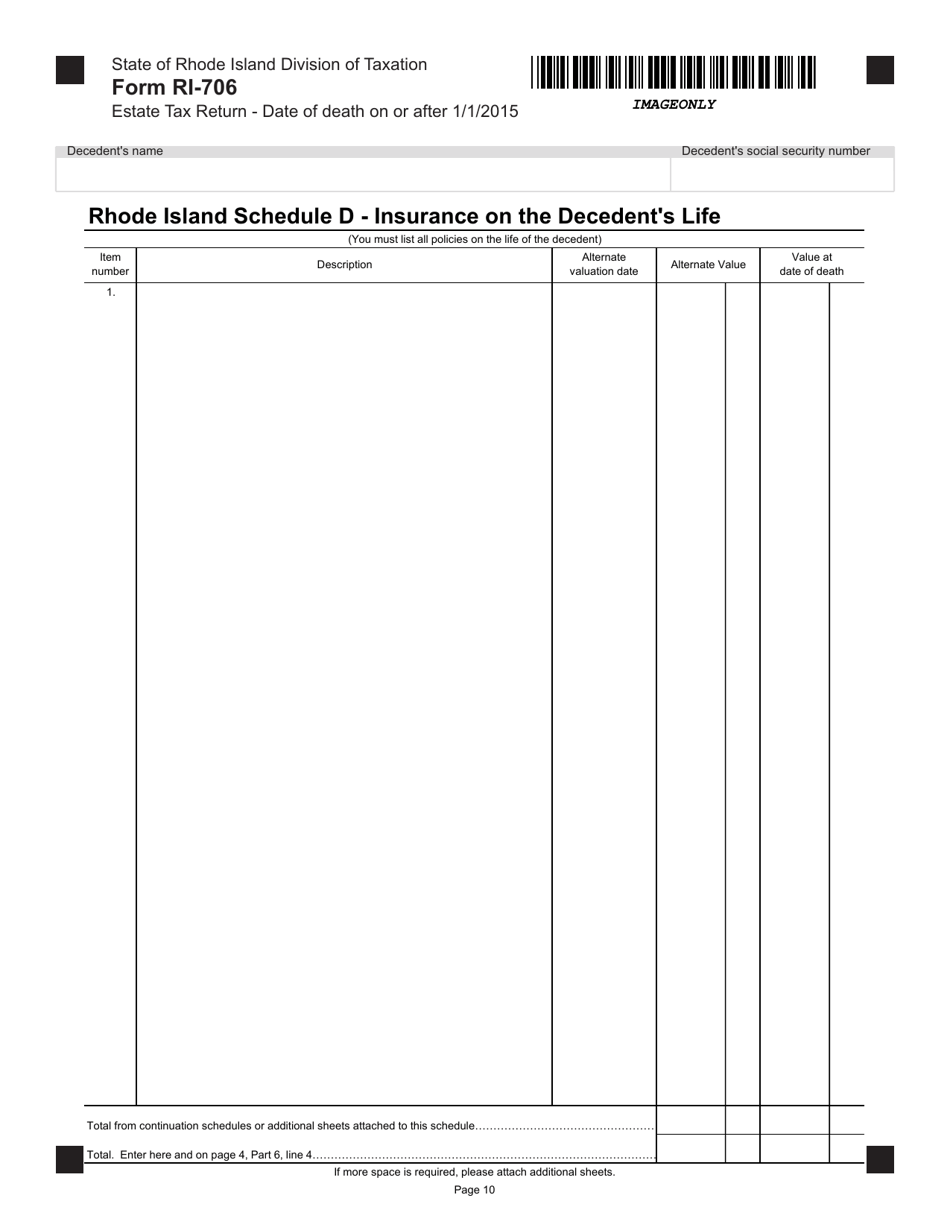

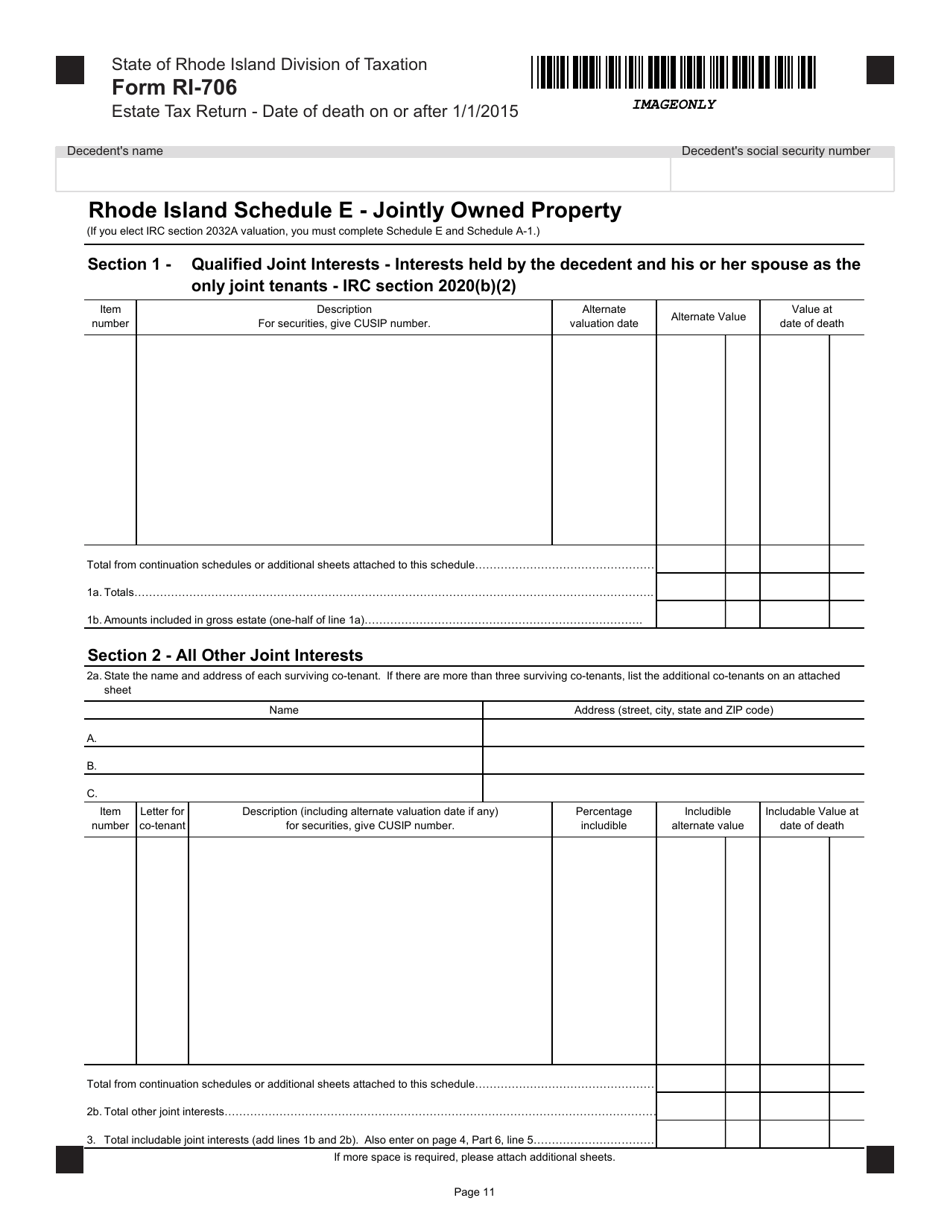

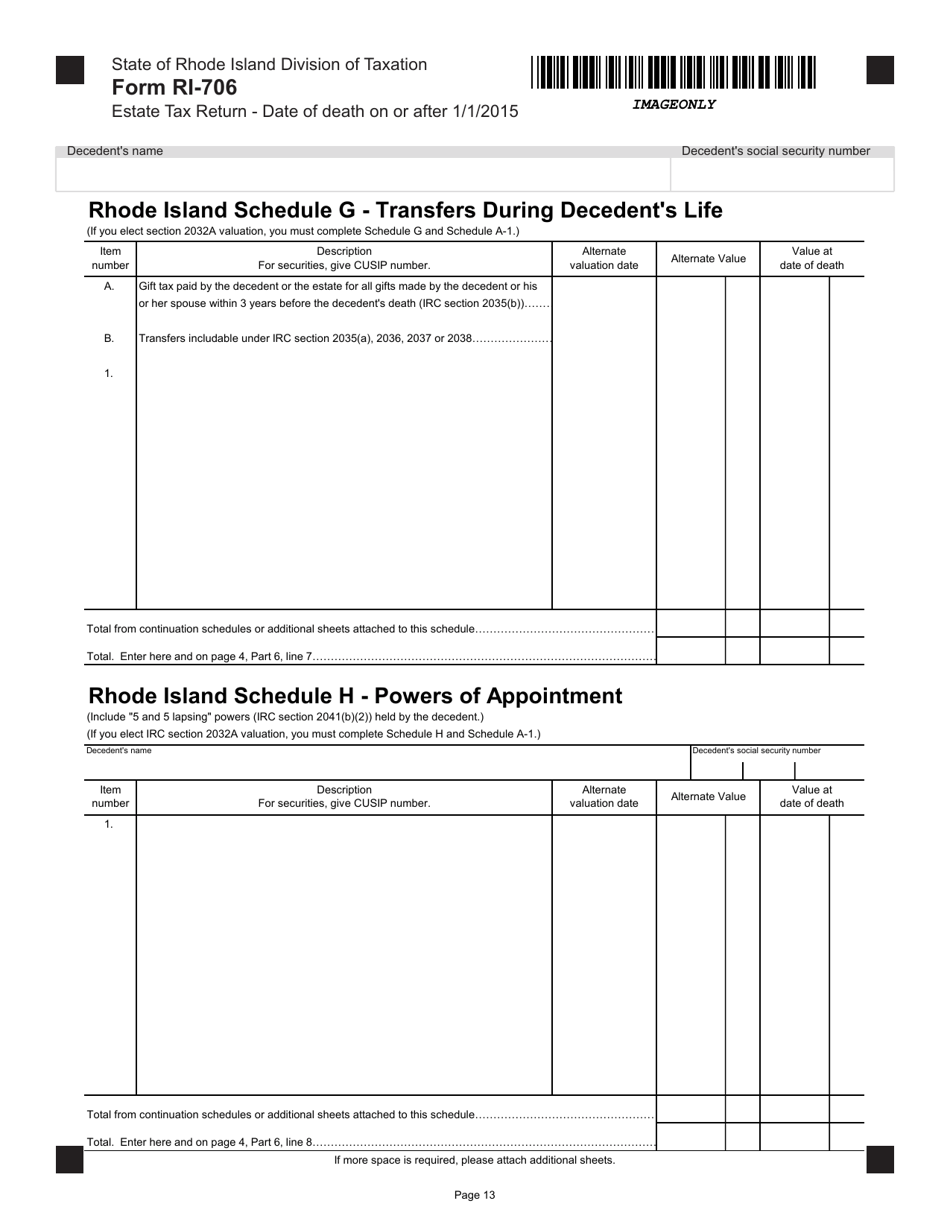

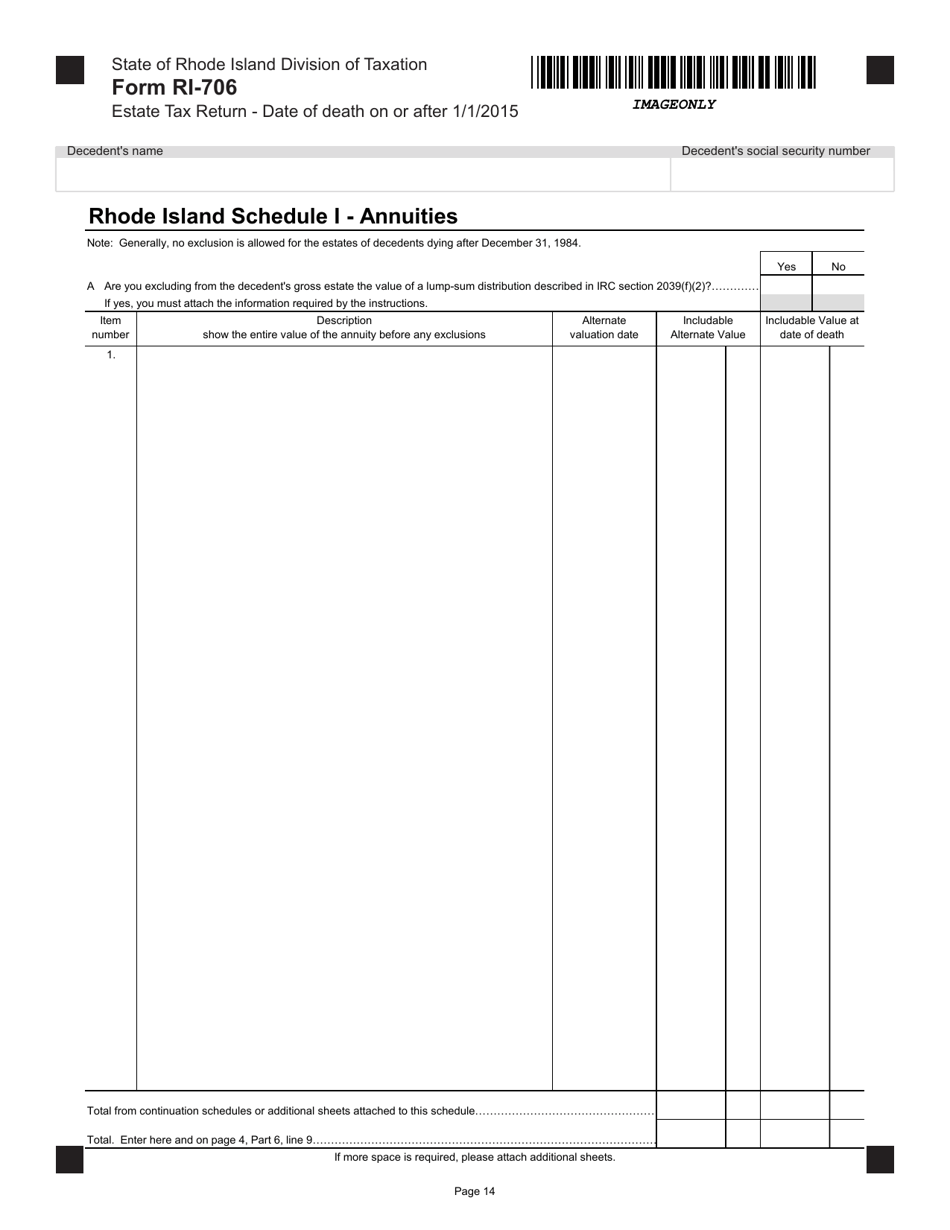

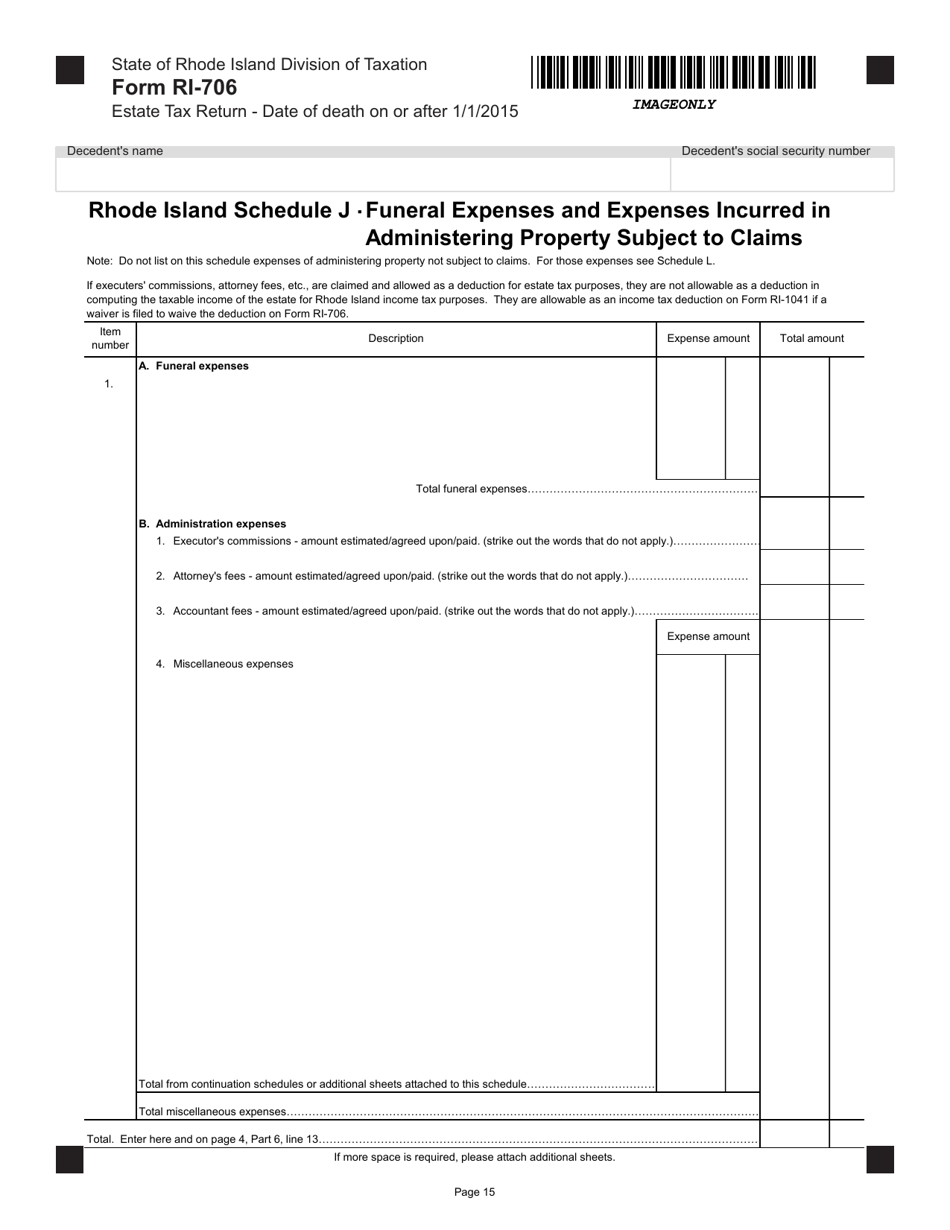

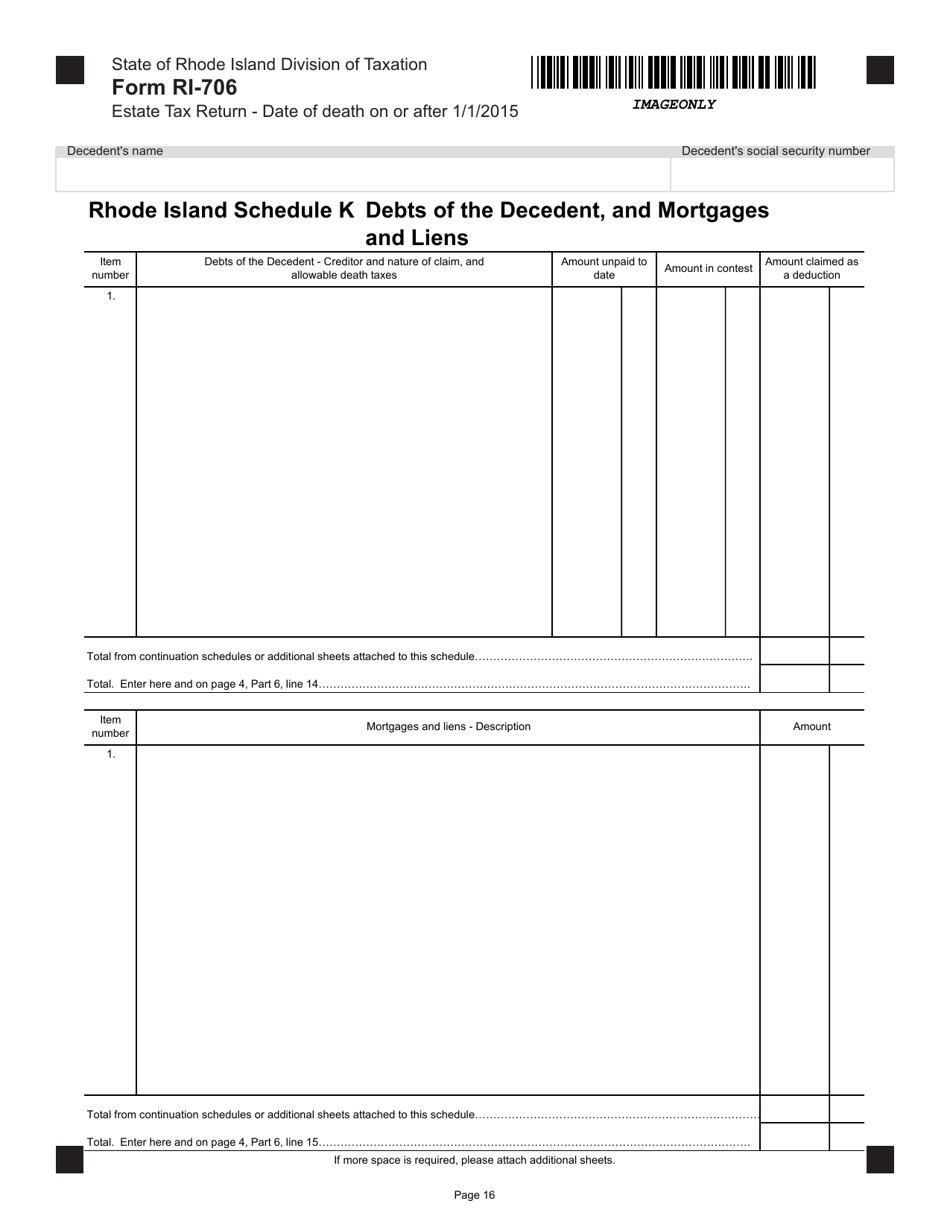

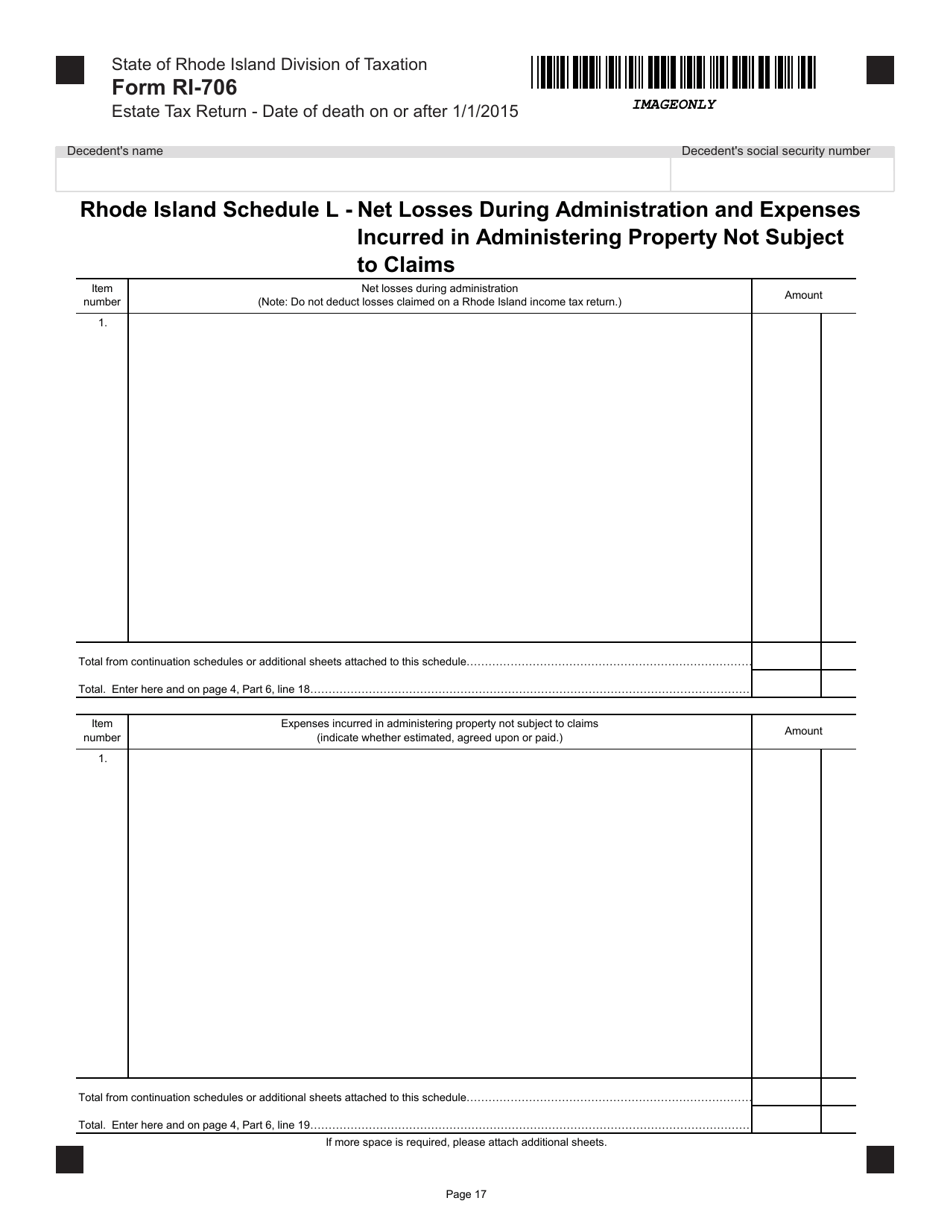

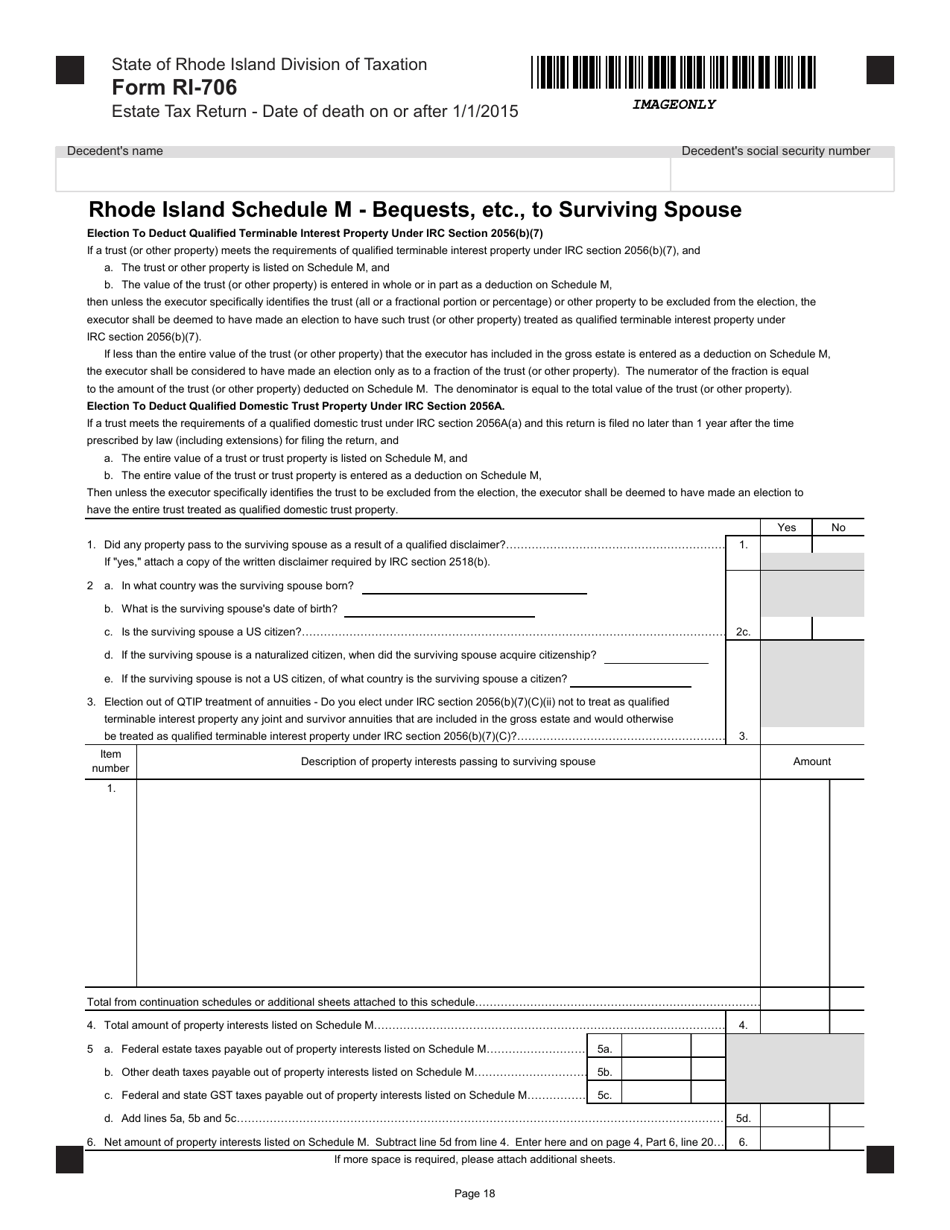

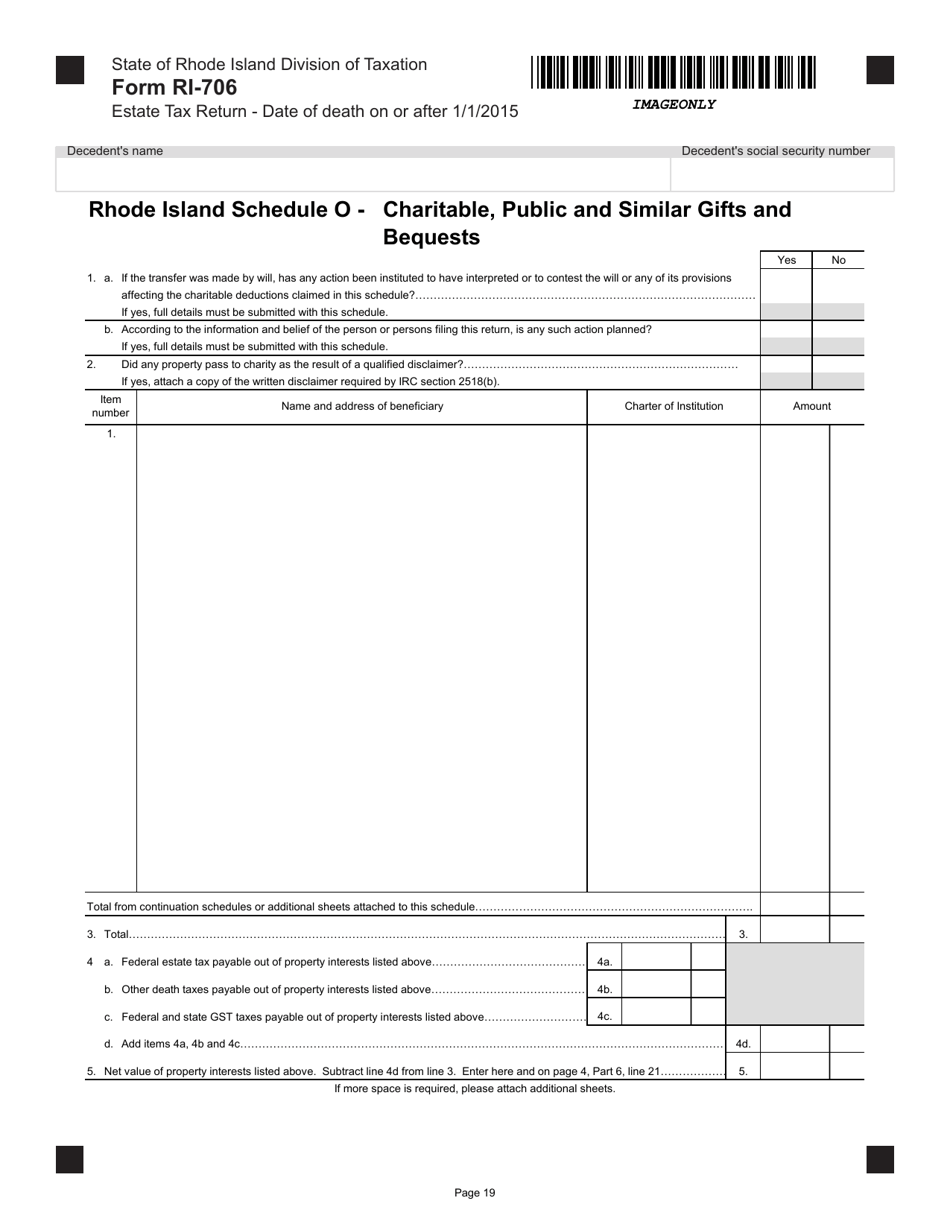

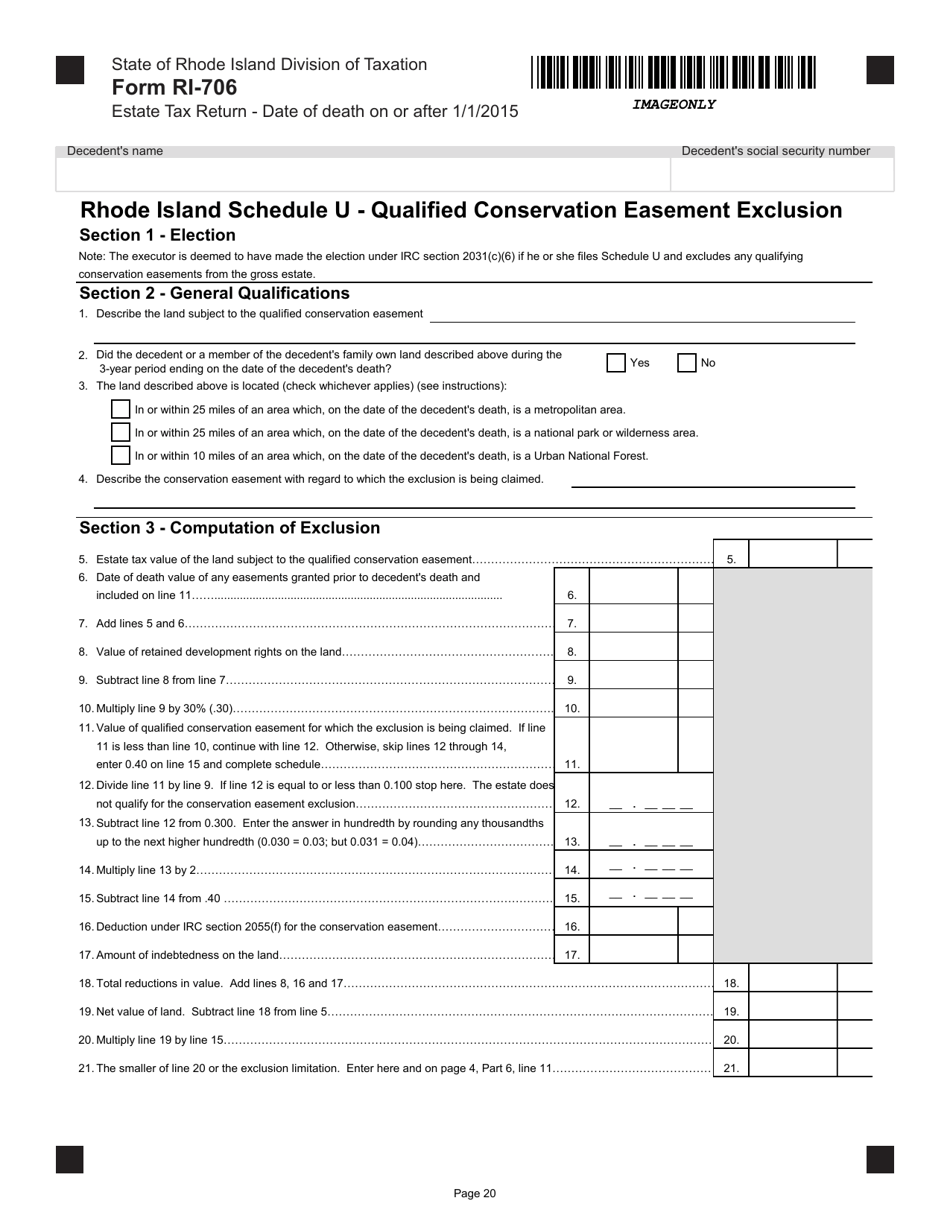

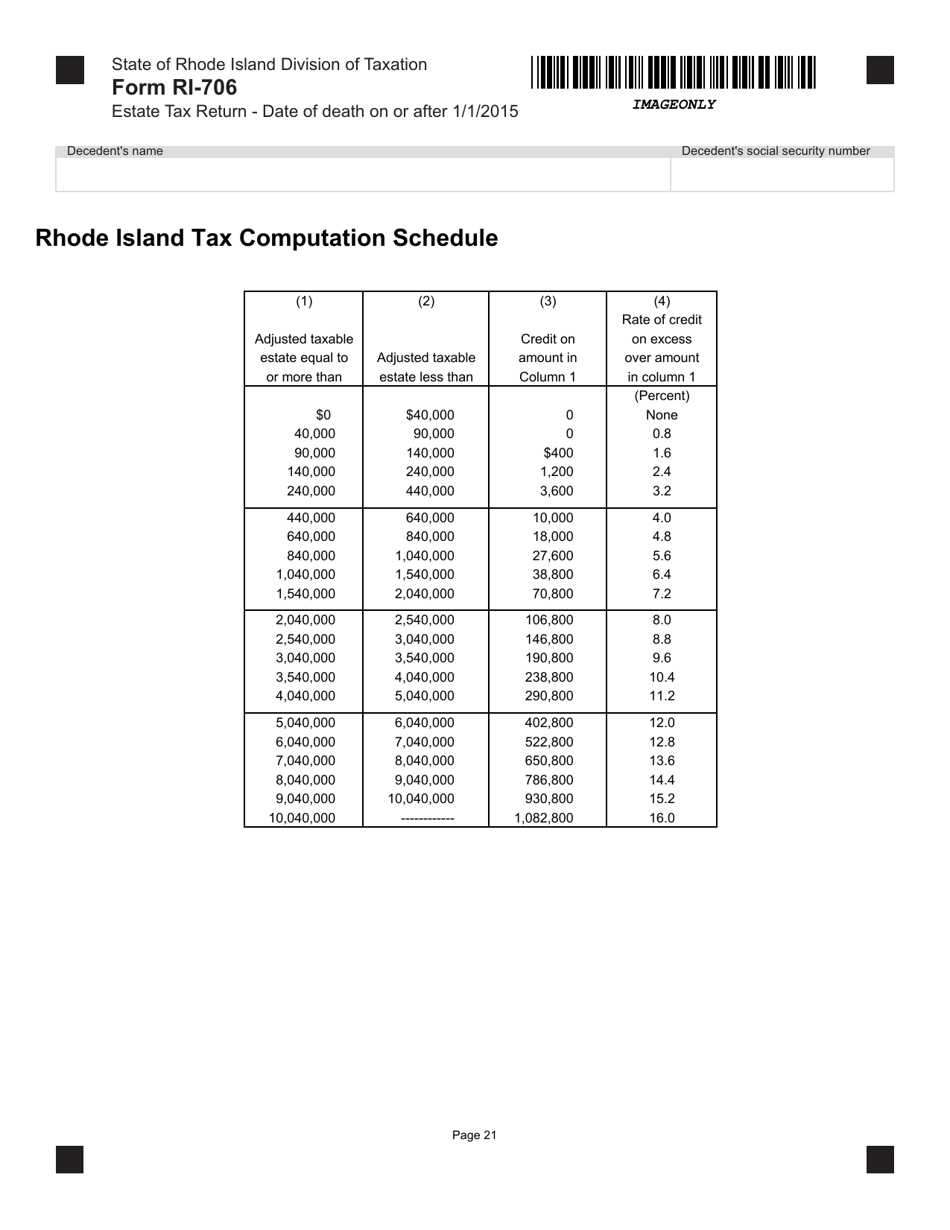

Q: Are there any additional forms or attachments required with Form RI-706?

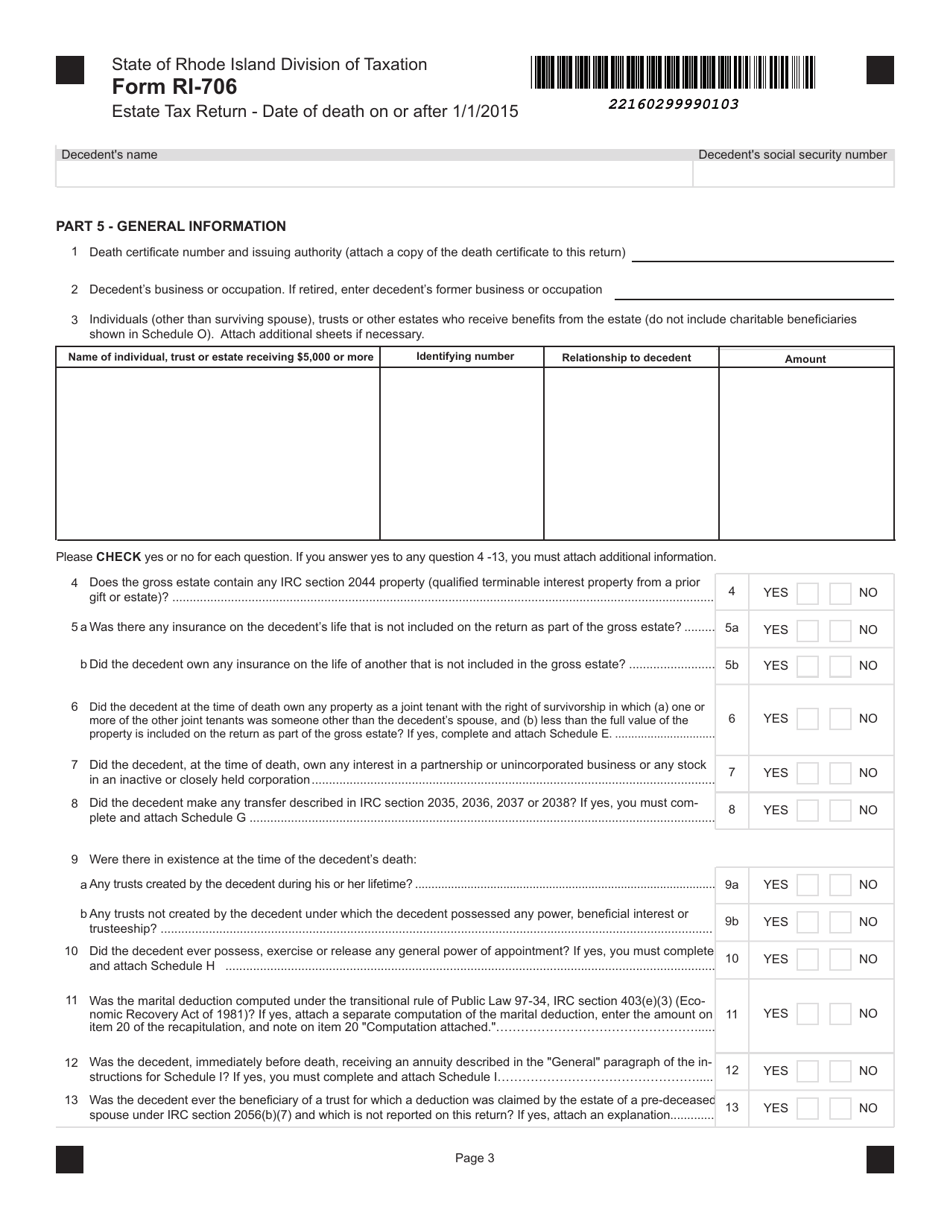

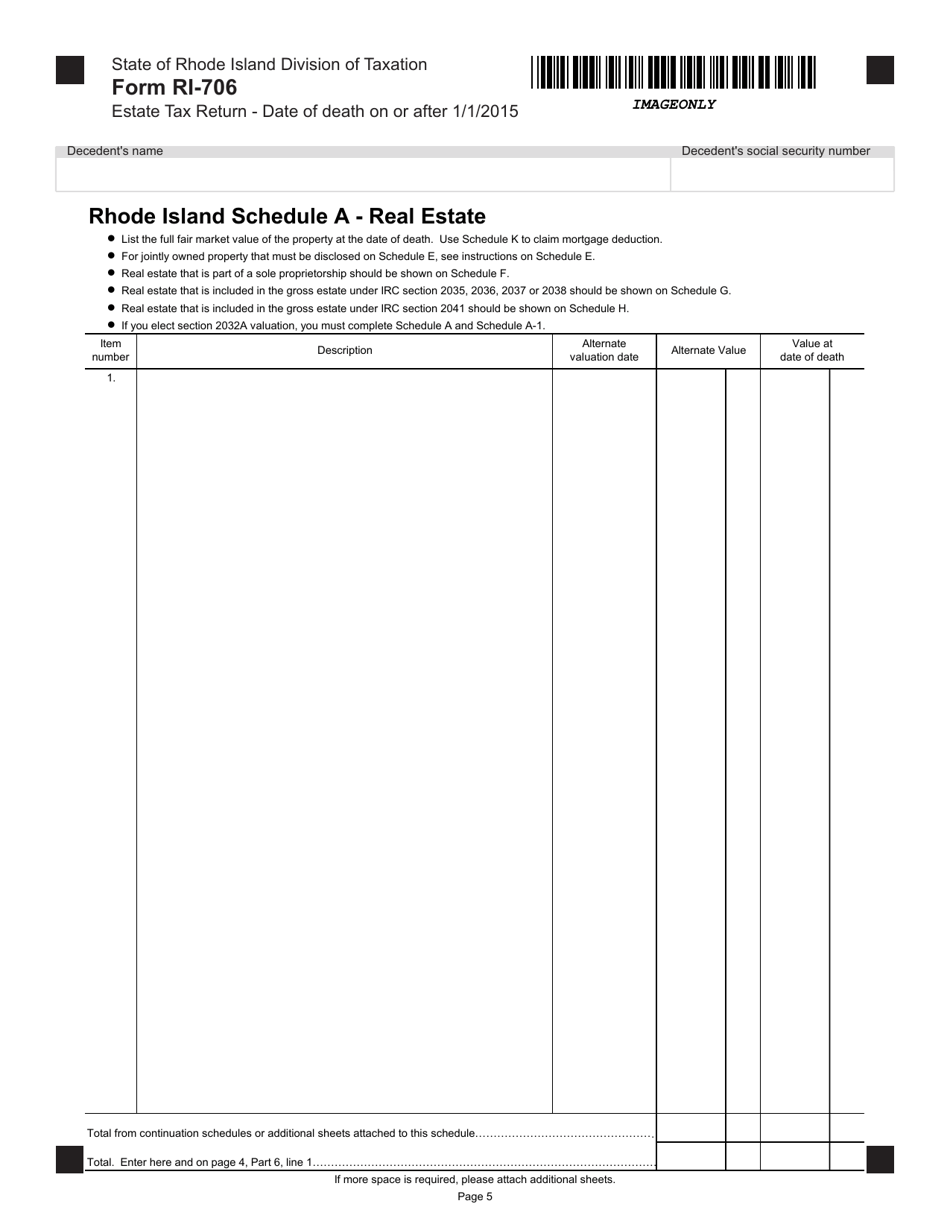

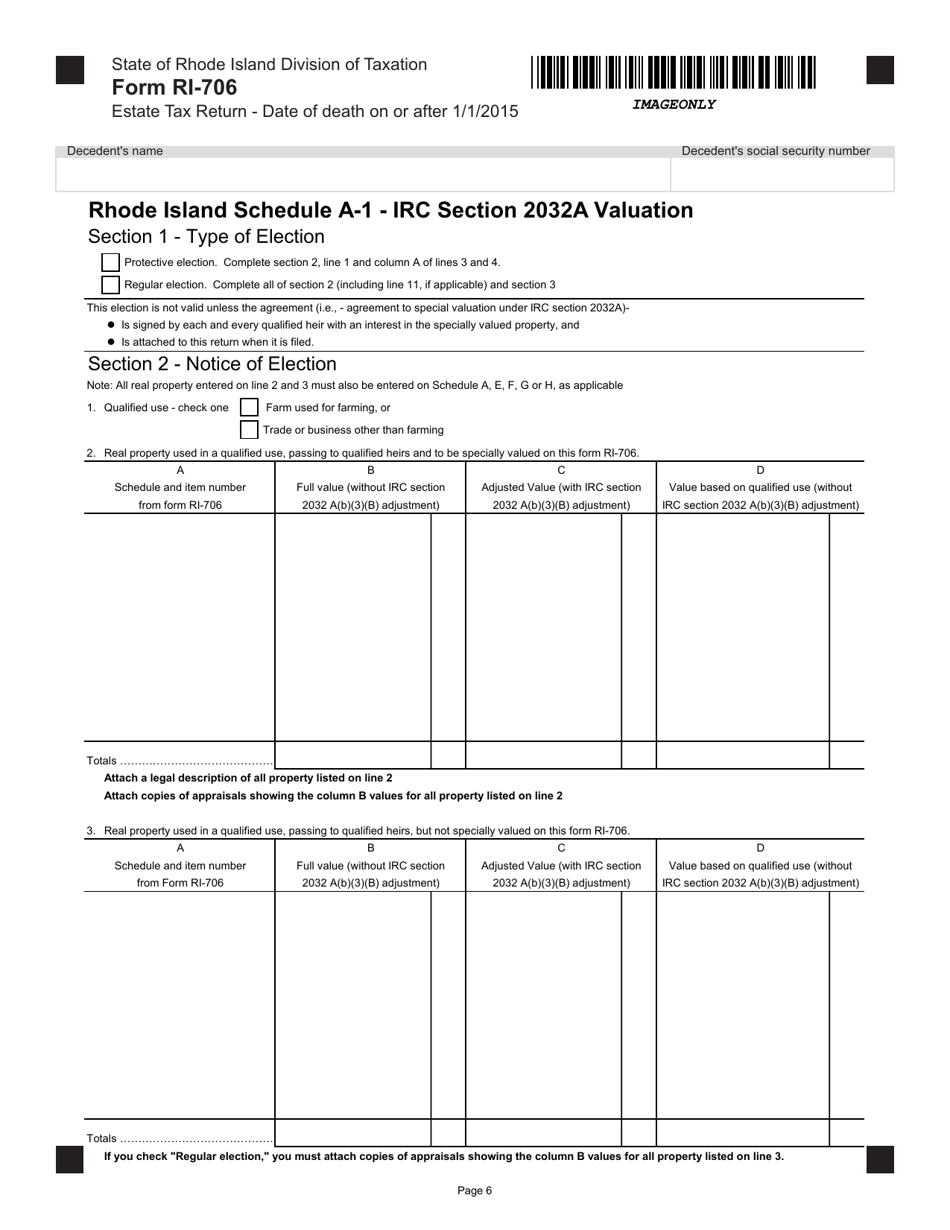

A: Yes, various schedules and attachments may be required depending on the specific circumstances of the estate. It is recommended to consult the instructions for Form RI-706 for details.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-706 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.