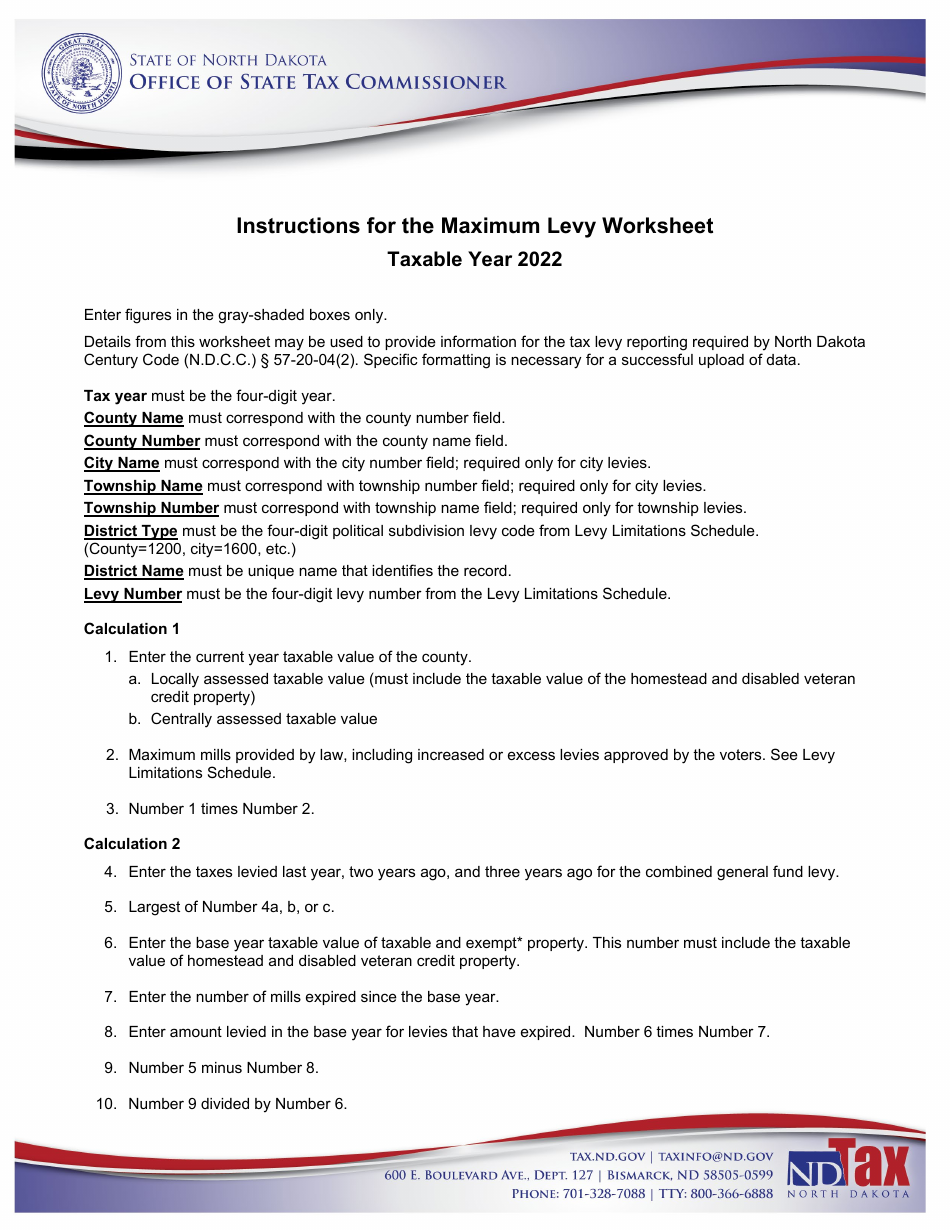

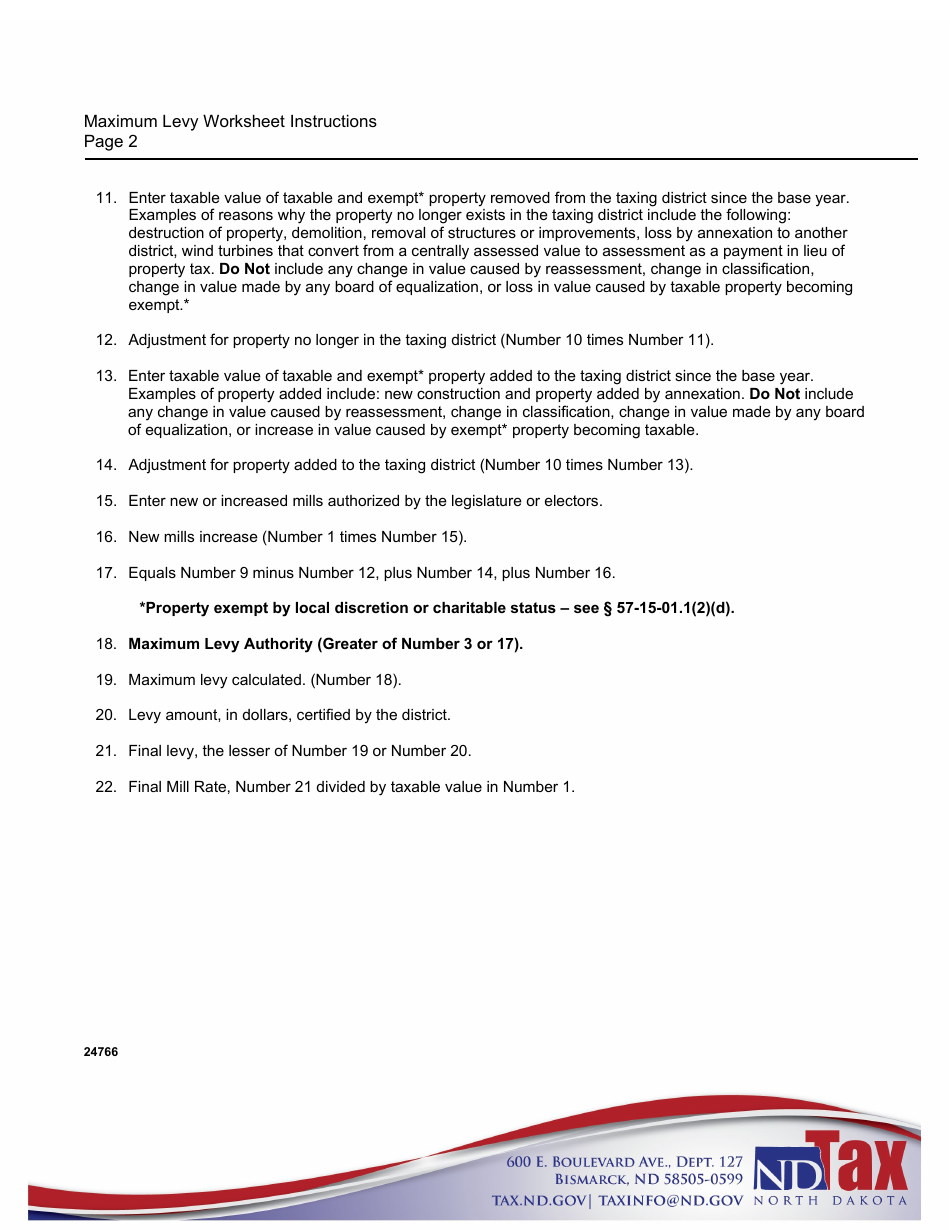

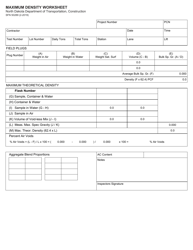

Instructions for Maximum Levy Worksheet - North Dakota

This document was released by North Dakota Office of State Tax Commissioner and contains the most recent official instructions for Maximum Levy Worksheet .

FAQ

Q: What is the Maximum Levy Worksheet?

A: The Maximum Levy Worksheet is a document used in North Dakota to calculate the maximum amount of tax revenue a local government can collect.

Q: Why is the Maximum Levy Worksheet important?

A: The Maximum Levy Worksheet is important because it helps local governments determine how much tax revenue they are allowed to collect to fund their operations.

Q: Who uses the Maximum Levy Worksheet?

A: Local governments in North Dakota use the Maximum Levy Worksheet.

Q: What information is needed to complete the Maximum Levy Worksheet?

A: The Maximum Levy Worksheet requires information such as the local government's assessed property values, existing debt obligations, and special assessments.

Q: How is the maximum levy determined?

A: The maximum levy is determined by subtracting the local government's existing debt obligations and special assessments from the total assessed property values.

Q: What happens if a local government exceeds the maximum levy?

A: If a local government exceeds the maximum levy, it may face legal consequences and may be required to refund or reduce the excess tax revenue collected.

Q: Are there any exceptions to the maximum levy limit?

A: Yes, there are certain exceptions and adjustments allowed in special circumstances, such as for emergency situations or voter-approved levies.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the North Dakota Office of State Tax Commissioner.