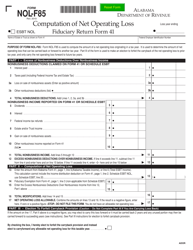

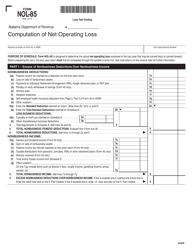

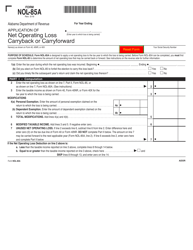

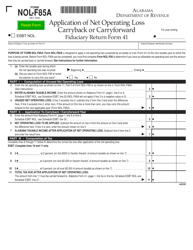

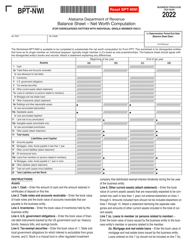

Instructions for Form NOL-F85 Computation of Net Operating Loss - Fiduciary Return - Alabama

This document contains official instructions for Form NOL-F85 , Computation of Net Operating Loss - Fiduciary Return - a form released and collected by the Alabama Department of Revenue. An up-to-date fillable Form NOL-F85 is available for download through this link.

FAQ

Q: What is Form NOL-F85?

A: Form NOL-F85 is a form used to compute the net operating loss for fiduciary returns in Alabama.

Q: Who uses Form NOL-F85?

A: Form NOL-F85 is used by fiduciaries who need to calculate their net operating loss for Alabama state tax purposes.

Q: What is a net operating loss?

A: A net operating loss occurs when a taxpayer's deductible expenses exceed their taxable income.

Q: What is a fiduciary return?

A: A fiduciary return is a tax return filed by a person or entity acting in a fiduciary capacity, such as a trustee or executor.

Q: Why would a fiduciary need to calculate a net operating loss?

A: Calculating a net operating loss can help reduce taxable income, potentially resulting in lower tax liability for the fiduciary.

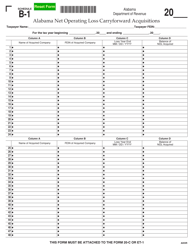

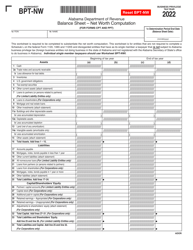

Q: Are there any additional documents or schedules required to accompany Form NOL-F85?

A: Yes, additional schedules may be required depending on the complexity of the fiduciary return. These schedules should be attached to the completed Form NOL-F85.

Q: What is the deadline for filing Form NOL-F85?

A: The deadline for filing Form NOL-F85 is usually the same as the deadline for filing the fiduciary tax return, which is usually April 15th.

Q: Can Form NOL-F85 be filed electronically?

A: Yes, Form NOL-F85 can be filed electronically using the Alabama Department of Revenue's e-filing system.

Q: Is there a fee for filing Form NOL-F85?

A: No, there is no fee for filing Form NOL-F85.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.