This version of the form is not currently in use and is provided for reference only. Download this version of

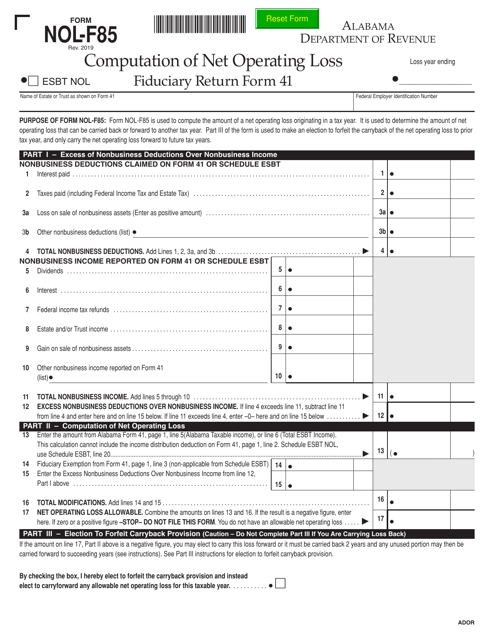

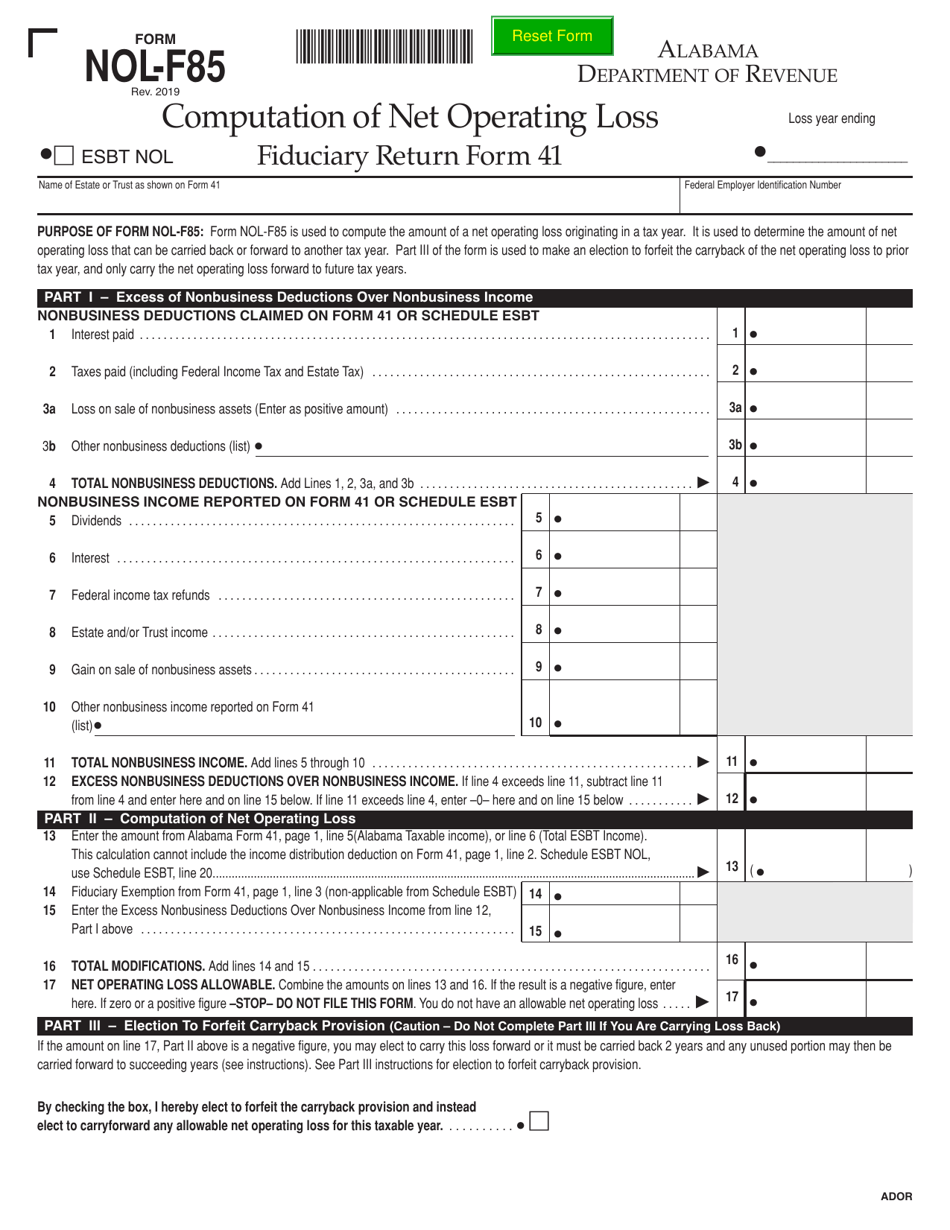

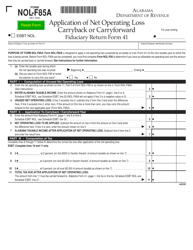

Form NOL-F85

for the current year.

Form NOL-F85 Computation of Net Operating Loss - Alabama

What Is Form NOL-F85?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NOL-F85?

A: Form NOL-F85 is the Computation of Net Operating Loss for the state of Alabama.

Q: What is a Net Operating Loss?

A: A Net Operating Loss (NOL) occurs when a business's allowable tax deductions exceed its taxable income in a given year.

Q: Who needs to file Form NOL-F85?

A: Businesses or individuals with net operating losses in Alabama need to file Form NOL-F85.

Q: How do I compute Net Operating Loss on Form NOL-F85?

A: The instructions and worksheet on Form NOL-F85 guide you through the computation of your net operating loss.

Q: Is Form NOL-F85 specific to Alabama?

A: Yes, Form NOL-F85 is specific to Alabama and is used to compute Net Operating Loss for Alabama state tax purposes.

Q: When is the deadline for filing Form NOL-F85?

A: The deadline for filing Form NOL-F85 is the same as the deadline for filing your Alabama income tax return, usually April 15th.

Q: Can I claim a Net Operating Loss on my personal income tax return?

A: Yes, individuals can claim a Net Operating Loss on their personal income tax return using Form NOL-F85.

Q: Is there a fee for filing Form NOL-F85?

A: No, there is no fee for filing Form NOL-F85.

Q: Can I file Form NOL-F85 electronically?

A: Yes, you can file Form NOL-F85 electronically using the Alabama Department of Revenue's e-filing system.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NOL-F85 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.