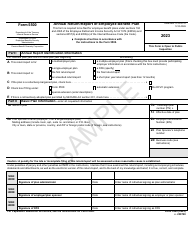

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 5300

for the current year.

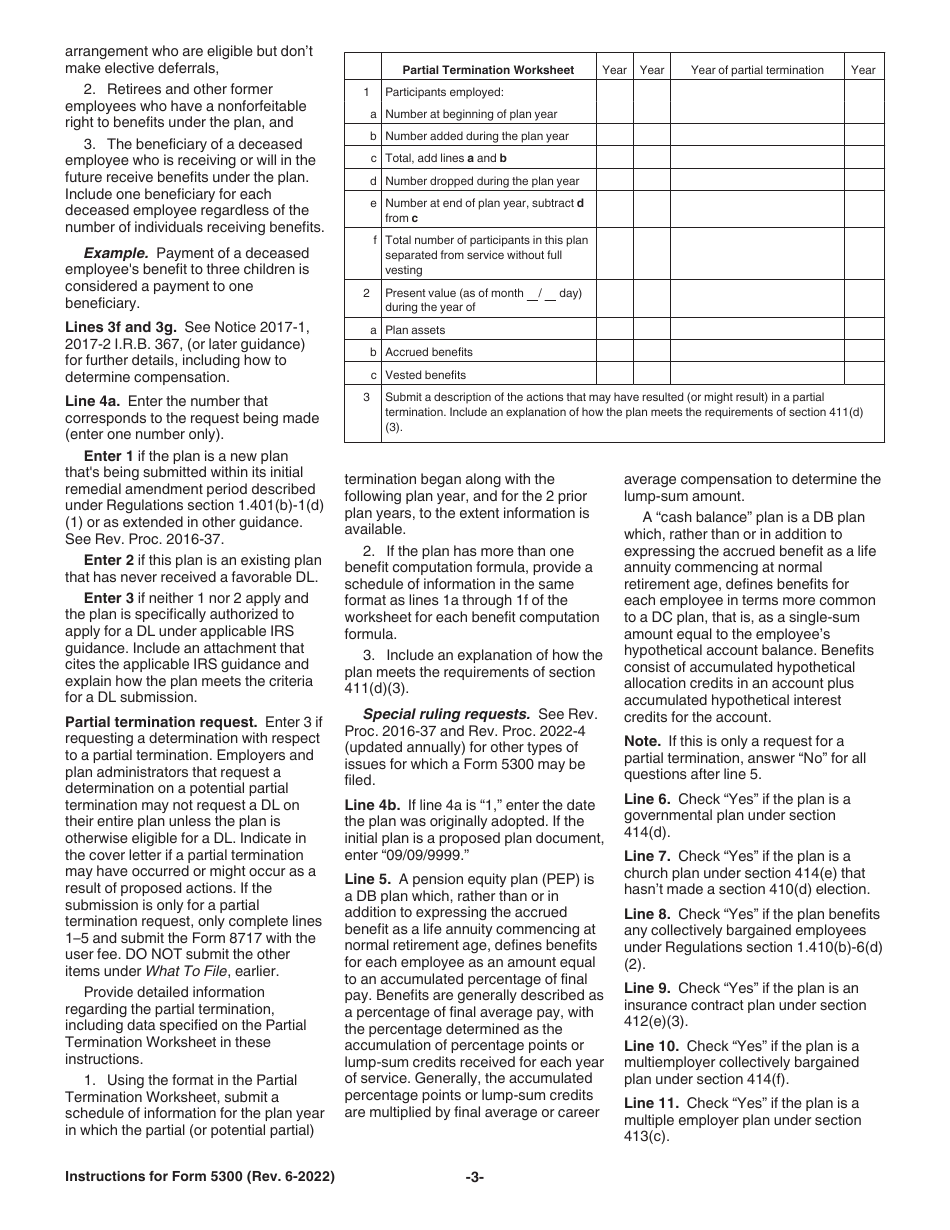

Instructions for IRS Form 5300 Application for Determination for Employee Benefit Plan

This document contains official instructions for IRS Form 5300 , Application for Determination for Employee Benefit Plan - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5300 is available for download through this link.

FAQ

Q: What is the IRS Form 5300?

A: IRS Form 5300 is an application for determination for an employee benefit plan.

Q: Who needs to file IRS Form 5300?

A: The plan administrator of an employee benefit plan needs to file IRS Form 5300.

Q: What is the purpose of filing IRS Form 5300?

A: The purpose of filing IRS Form 5300 is to request a determination letter from the IRS regarding the tax-exempt status of an employee benefit plan.

Q: What information is required on IRS Form 5300?

A: IRS Form 5300 requires information about the plan sponsor, plan administrator, plan provisions, and financial information.

Q: Are there any filing fees for IRS Form 5300?

A: Yes, there are filing fees for IRS Form 5300. The fees vary depending on the type and size of the plan.

Q: When should I file IRS Form 5300?

A: IRS Form 5300 should be filed at least 12 months before the plan's effective date or the date on which the plan is first implemented.

Q: What happens after I file IRS Form 5300?

A: After you file IRS Form 5300, the IRS will review your application and issue a determination letter regarding the plan's tax-exempt status.

Q: Can I file IRS Form 5300 electronically?

A: No, IRS Form 5300 cannot be filed electronically. It must be mailed to the appropriate IRS address.

Q: What should I do if I need help with IRS Form 5300?

A: If you need help with IRS Form 5300, you can contact the IRS or consult a qualified tax professional.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.