This version of the form is not currently in use and is provided for reference only. Download this version of

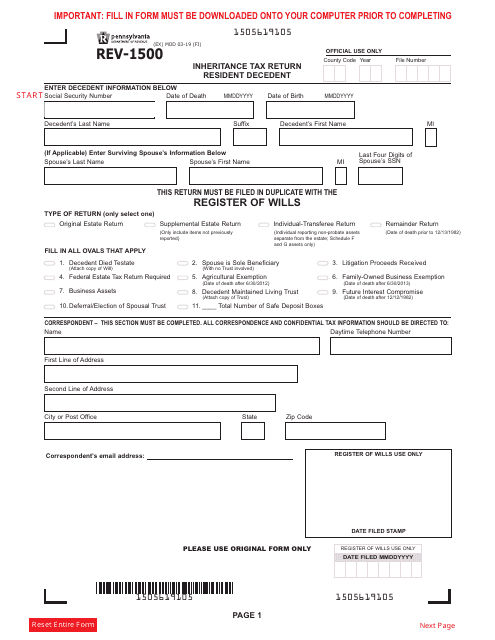

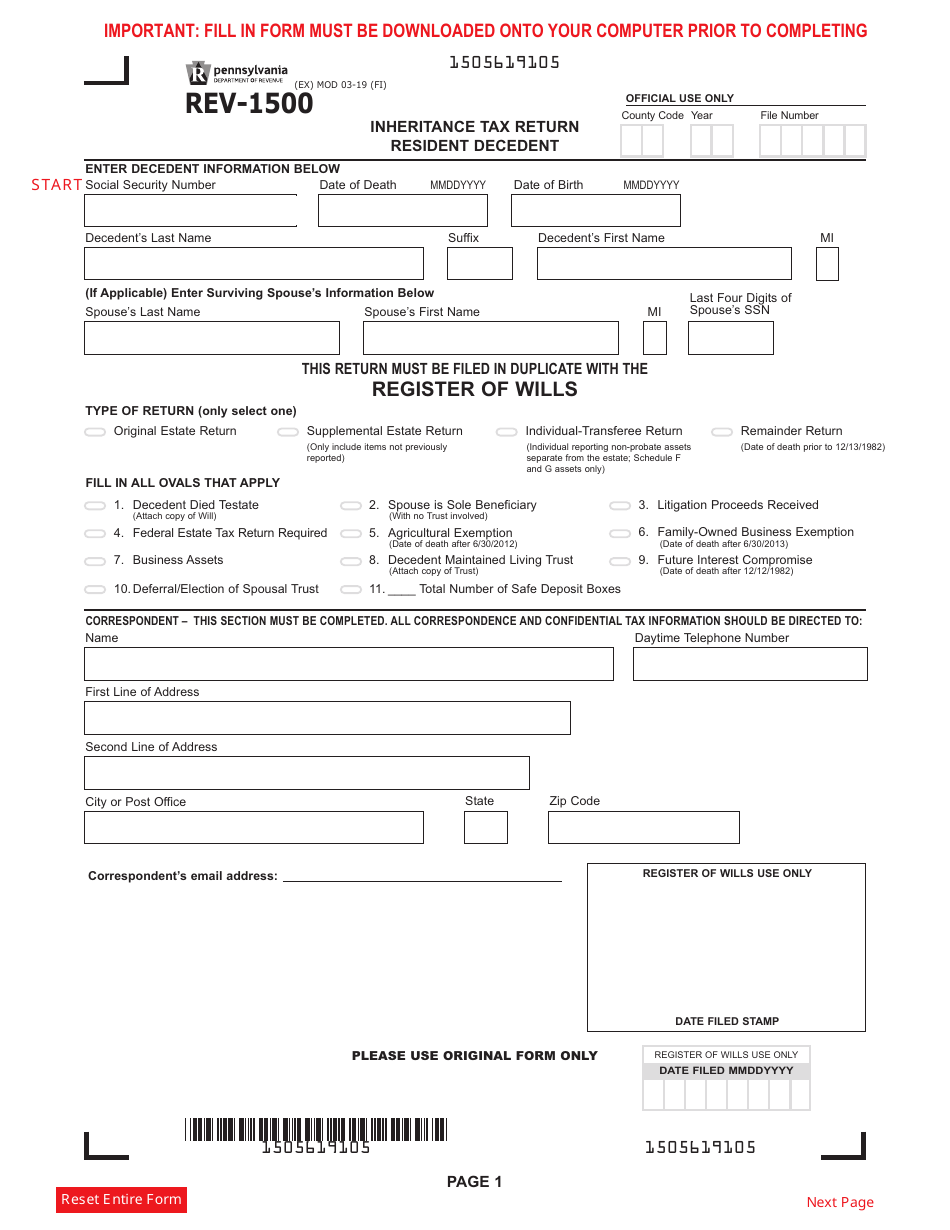

Form REV-1500

for the current year.

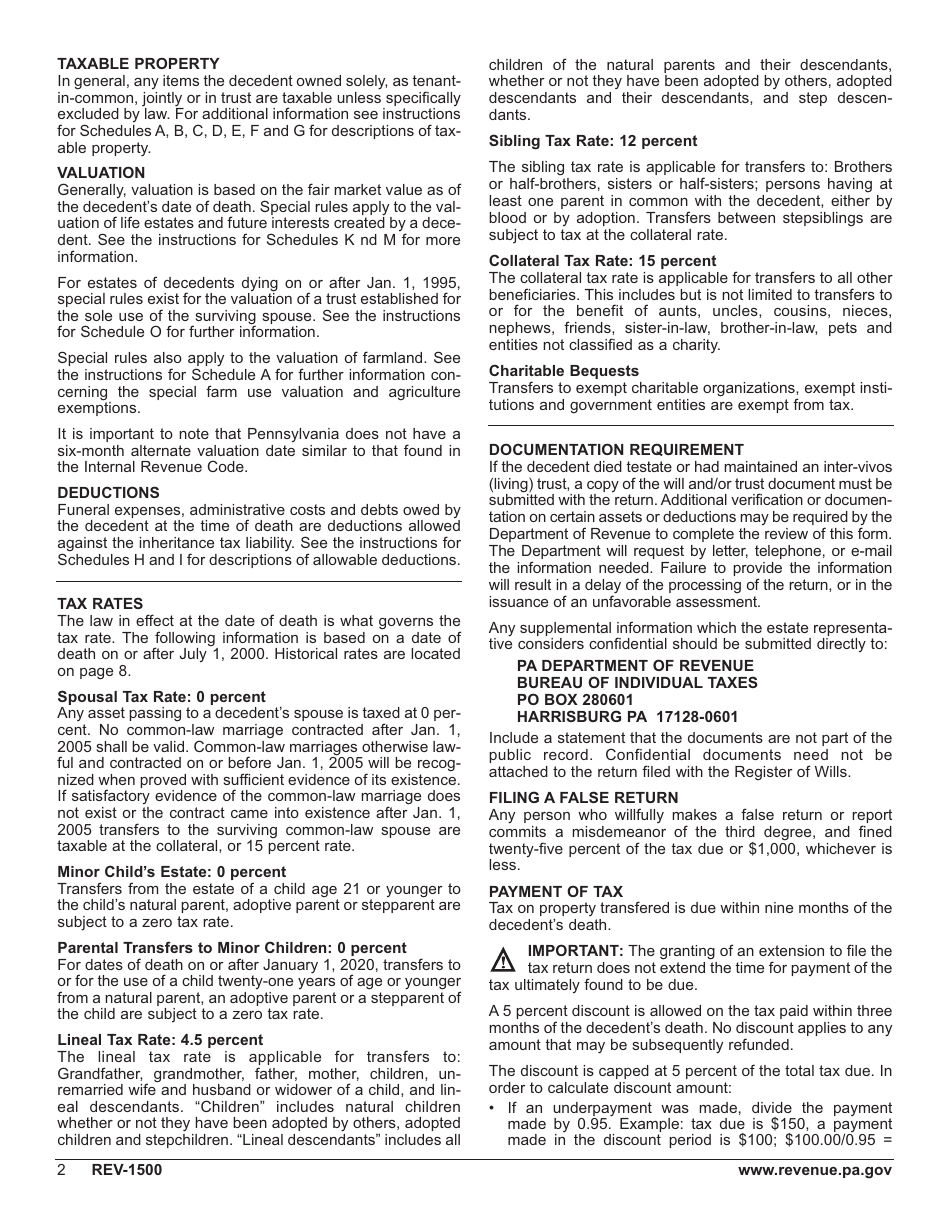

Form REV-1500 Inheritance Tax Return Resident Decedent - Pennsylvania

What Is Form REV-1500?

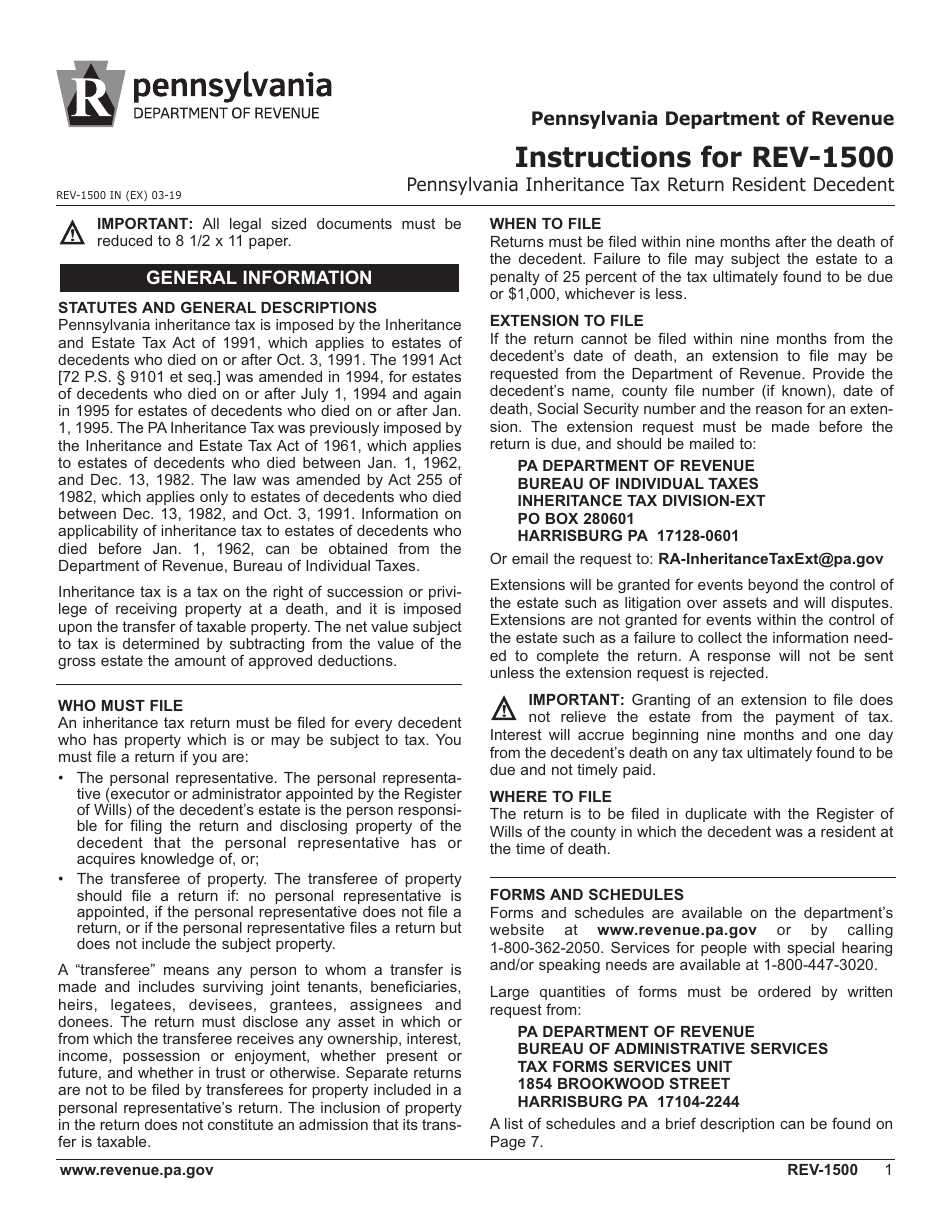

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form REV-1500?

A: Form REV-1500 is the Inheritance Tax Return specifically for resident decedents in the state of Pennsylvania.

Q: What is Inheritance Tax?

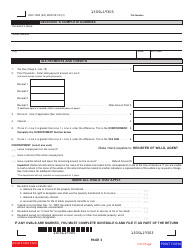

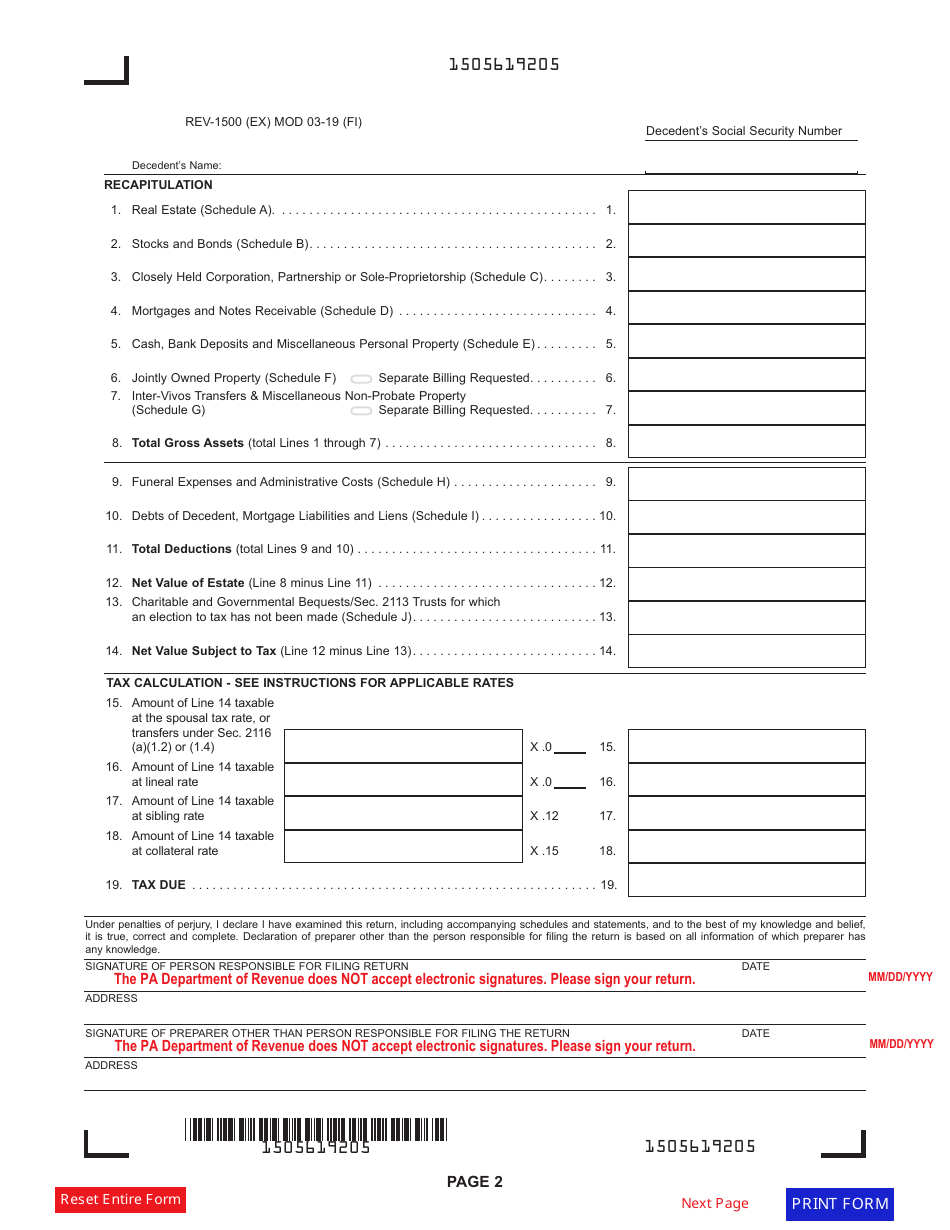

A: Inheritance Tax is a tax imposed on the transfer of property or assets from a deceased person to their heirs or beneficiaries.

Q: Who needs to file Form REV-1500?

A: Form REV-1500 must be filed by the executor or administrator of the estate of a deceased resident of Pennsylvania.

Q: When should Form REV-1500 be filed?

A: Form REV-1500 should be filed within nine months after the date of the decedent's death.

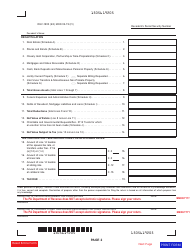

Q: What information is required on Form REV-1500?

A: Form REV-1500 requires information about the decedent, the estate, and the beneficiaries, as well as details about the assets and property being transferred.

Q: Are there any exemptions to the Inheritance Tax in Pennsylvania?

A: Yes, Pennsylvania offers some exemptions and discounts from the Inheritance Tax, such as transfers to a surviving spouse or to charitable organizations.

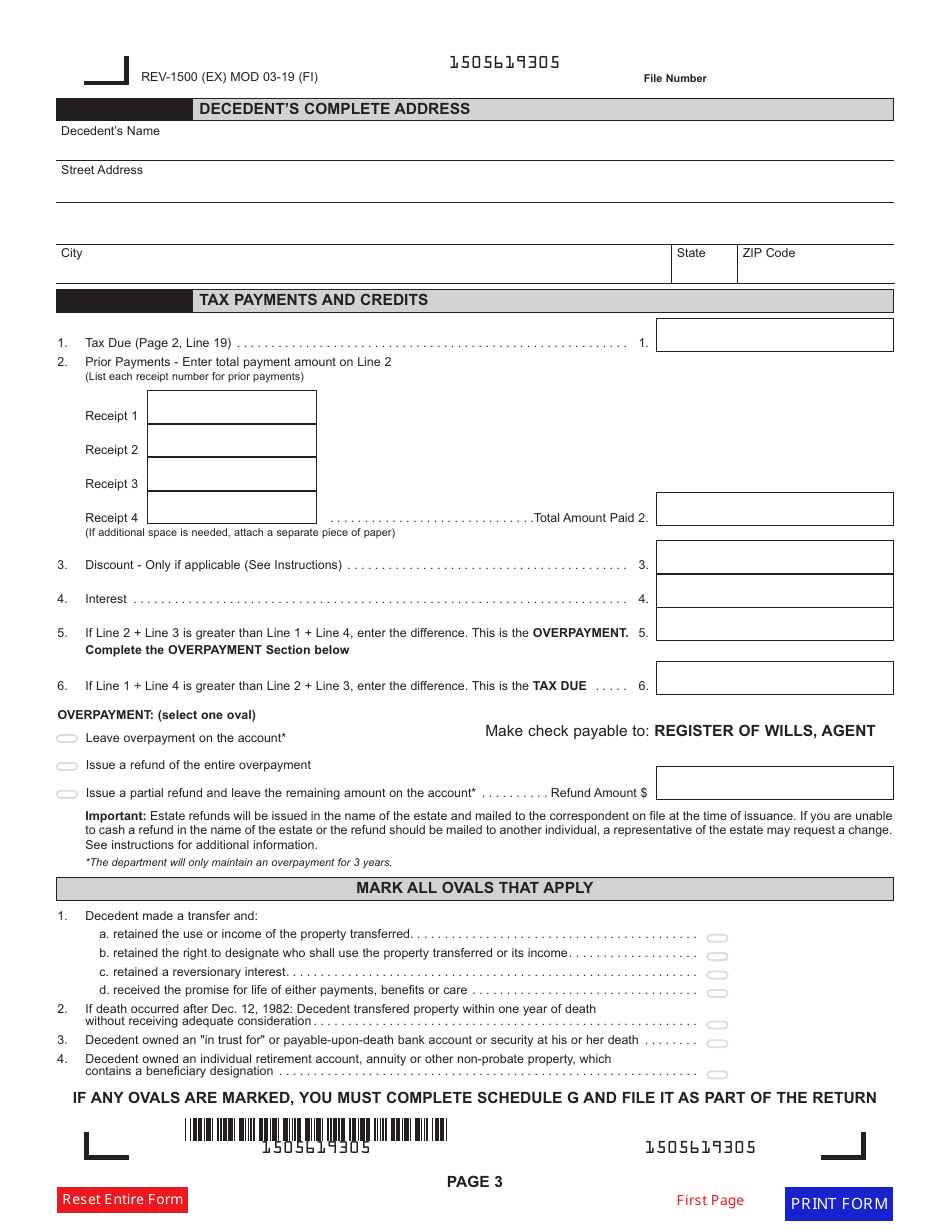

Q: Are there any penalties for late filing of Form REV-1500?

A: Yes, there are penalties for late filing of Form REV-1500, including interest on unpaid tax amounts.

Q: Is professional assistance recommended for filing Form REV-1500?

A: While it is not required, seeking professional assistance, such as from a tax attorney or accountant, may be beneficial in ensuring accurate and timely filing of Form REV-1500.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1500 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.