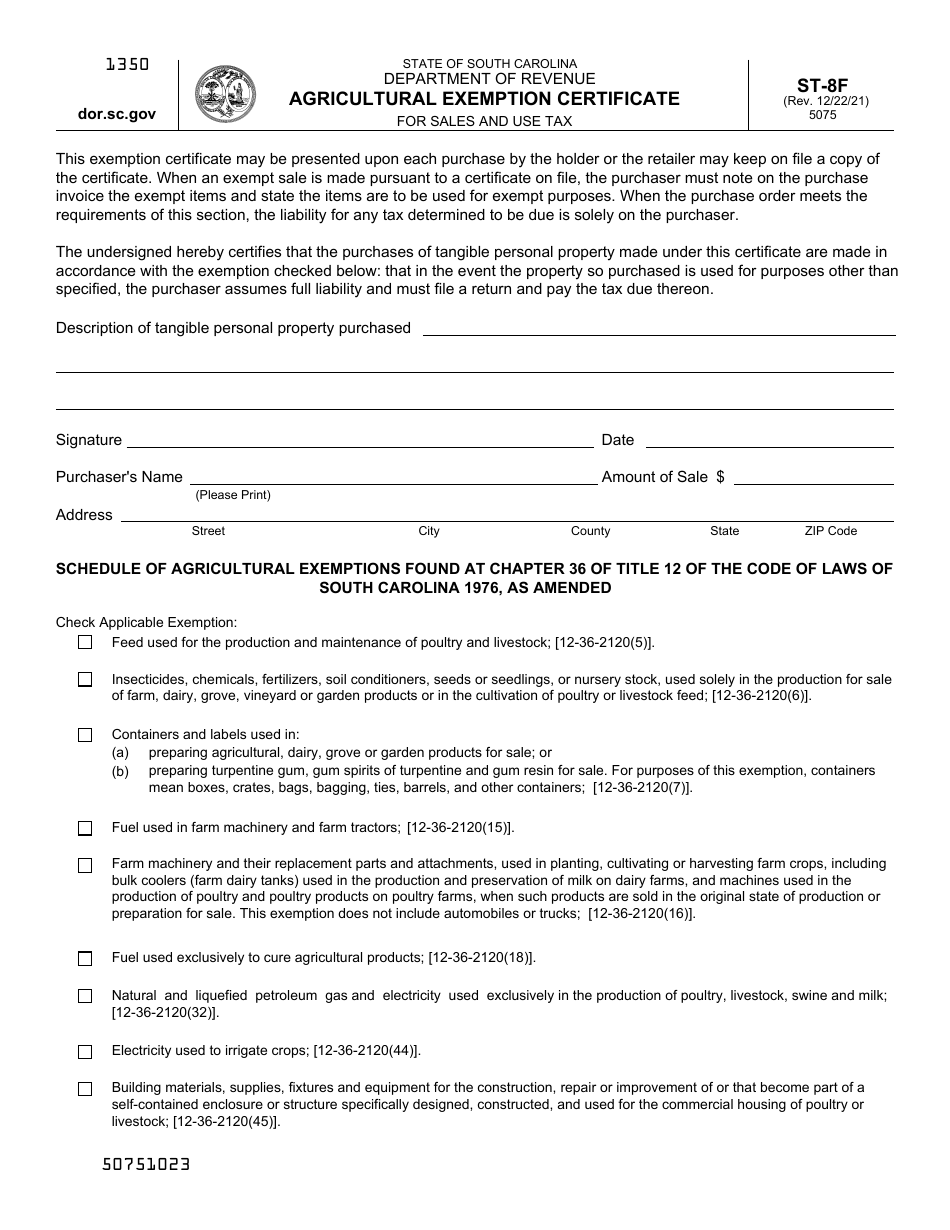

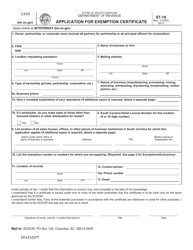

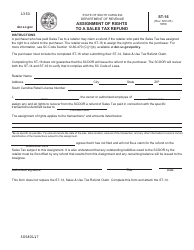

Form ST-8F Agricultural Exemption Certificate for Sales and Use Tax - South Carolina

What Is Form ST-8F?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. Check the official instructions before completing and submitting the form.

FAQ

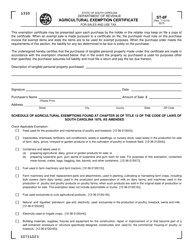

Q: What is Form ST-8F?

A: Form ST-8F is the Agricultural Exemption Certificate for Sales and Use Tax in South Carolina.

Q: What is the purpose of Form ST-8F?

A: The purpose of Form ST-8F is to claim an exemption from sales and use tax on qualifying agricultural items.

Q: Who should use Form ST-8F?

A: Farmers and other qualifying agricultural producers in South Carolina should use Form ST-8F.

Q: What qualifies for exemption under Form ST-8F?

A: Qualifying items for exemption include agricultural products, equipment, and supplies used in agricultural production.

Q: Are there any deadlines for submitting Form ST-8F?

A: Form ST-8F should be completed and submitted at the time of purchase to claim the exemption.

Q: Do I need to renew Form ST-8F?

A: No, Form ST-8F does not need to be renewed as long as the farming or agricultural production activities continue.

Q: Are there any penalties for misuse of Form ST-8F?

A: Misuse of Form ST-8F may result in penalties and interest being assessed by the South Carolina Department of Revenue.

Q: Can out-of-state farmers use Form ST-8F?

A: No, Form ST-8F is specifically for South Carolina farmers or agricultural producers.

Form Details:

- Released on December 22, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-8F by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.