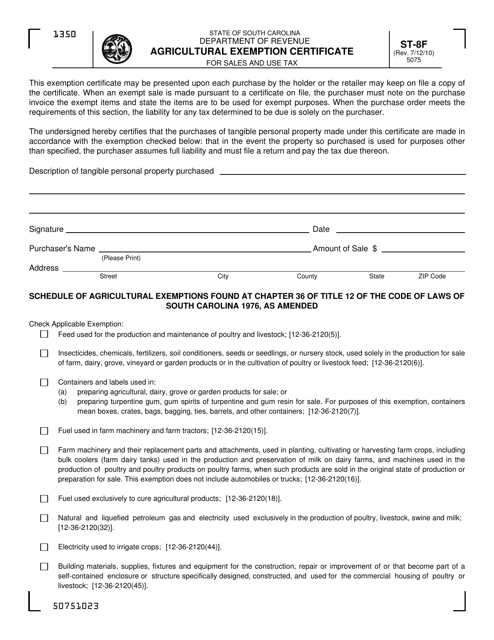

Instructions for Form ST-8F Agricultural Exemption Certificate for Sales and Use Tax - South Carolina

This document contains official instructions for Form ST-8F , Agricultural Exemption Certificate for Sales and Use Tax - a form released and collected by the South Carolina Department of Revenue. An up-to-date fillable Form ST-8F is available for download through this link.

FAQ

Q: What is Form ST-8F?

A: Form ST-8F is the Agricultural Exemption Certificate for Sales and Use Tax in South Carolina.

Q: Who needs to use Form ST-8F?

A: Farmers and agricultural producers in South Carolina who are exempt from sales and use tax on certain purchases related to agricultural production.

Q: What is the purpose of Form ST-8F?

A: The purpose of Form ST-8F is to provide proof of exempt status for qualifying purchases made by farmers and agricultural producers.

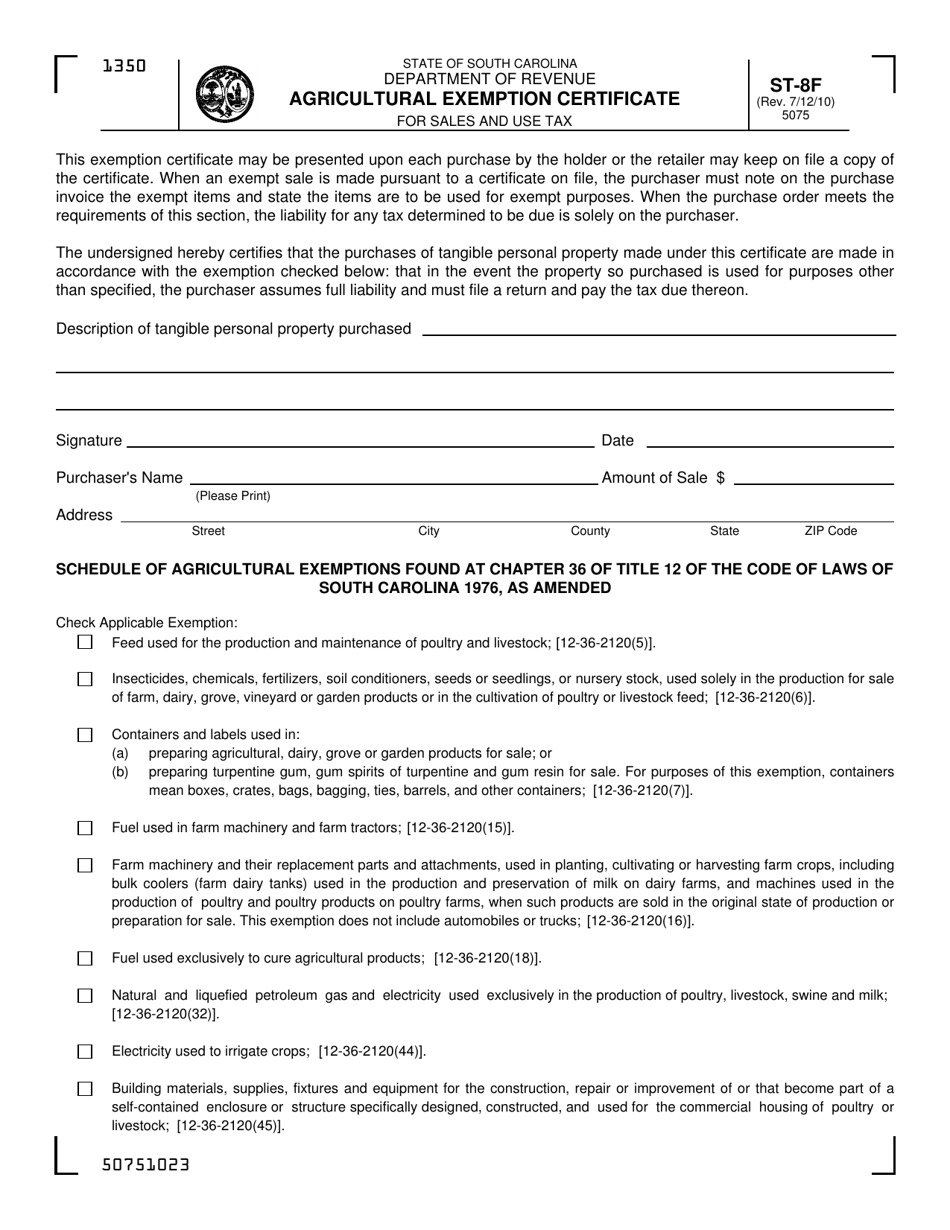

Q: What purchases are exempt with Form ST-8F?

A: Purchases of qualifying items used directly in agricultural production, such as farm machinery, seed, fertilizer, and animal feed, are exempt from sales and use tax with Form ST-8F.

Q: How do I fill out Form ST-8F?

A: You must provide your name, address, and South Carolina tax identification number, and then list the exempt purchases made during the reporting period.

Q: When is Form ST-8F due?

A: Form ST-8F is due on or before the 20th day of the month following the close of the reporting period.

Q: Are there any penalties for misuse of Form ST-8F?

A: Yes, misusing or fraudulently using Form ST-8F may result in penalties, including fines or imprisonment.

Q: Who should I contact for more information about Form ST-8F?

A: You can contact the South Carolina Department of Revenue for more information about Form ST-8F and its requirements.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the South Carolina Department of Revenue.