This version of the form is not currently in use and is provided for reference only. Download this version of

Form ARB-M1

for the current year.

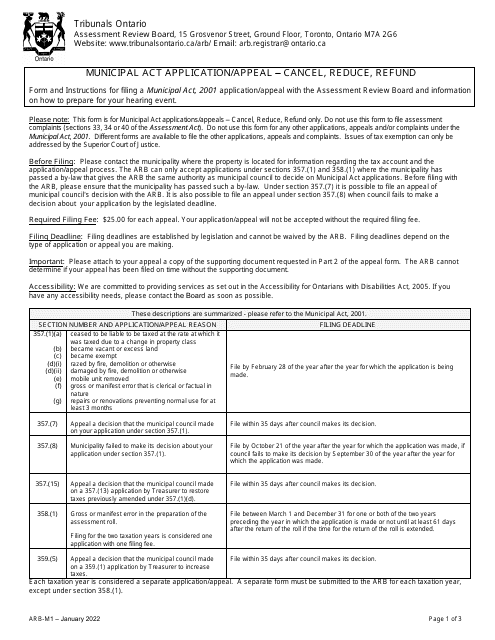

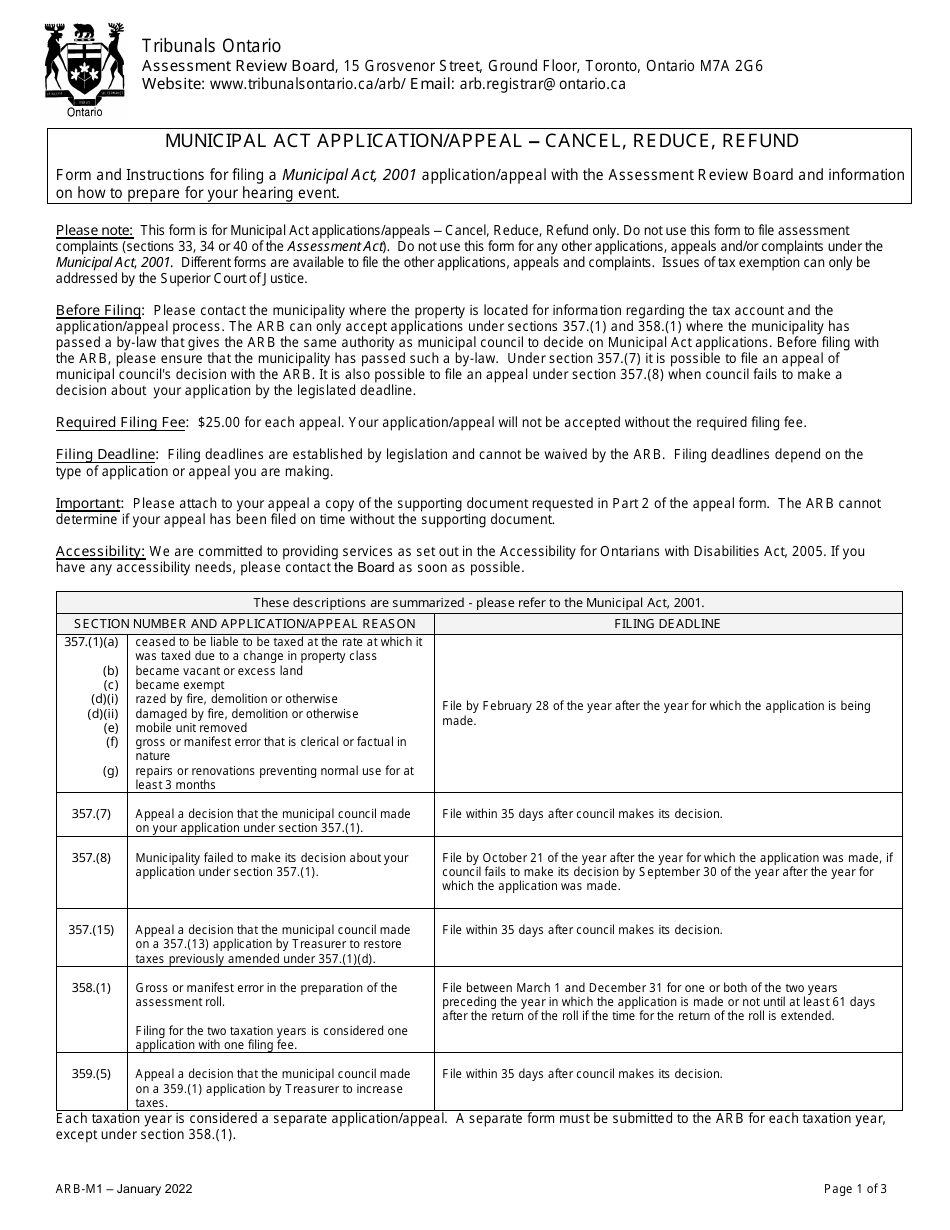

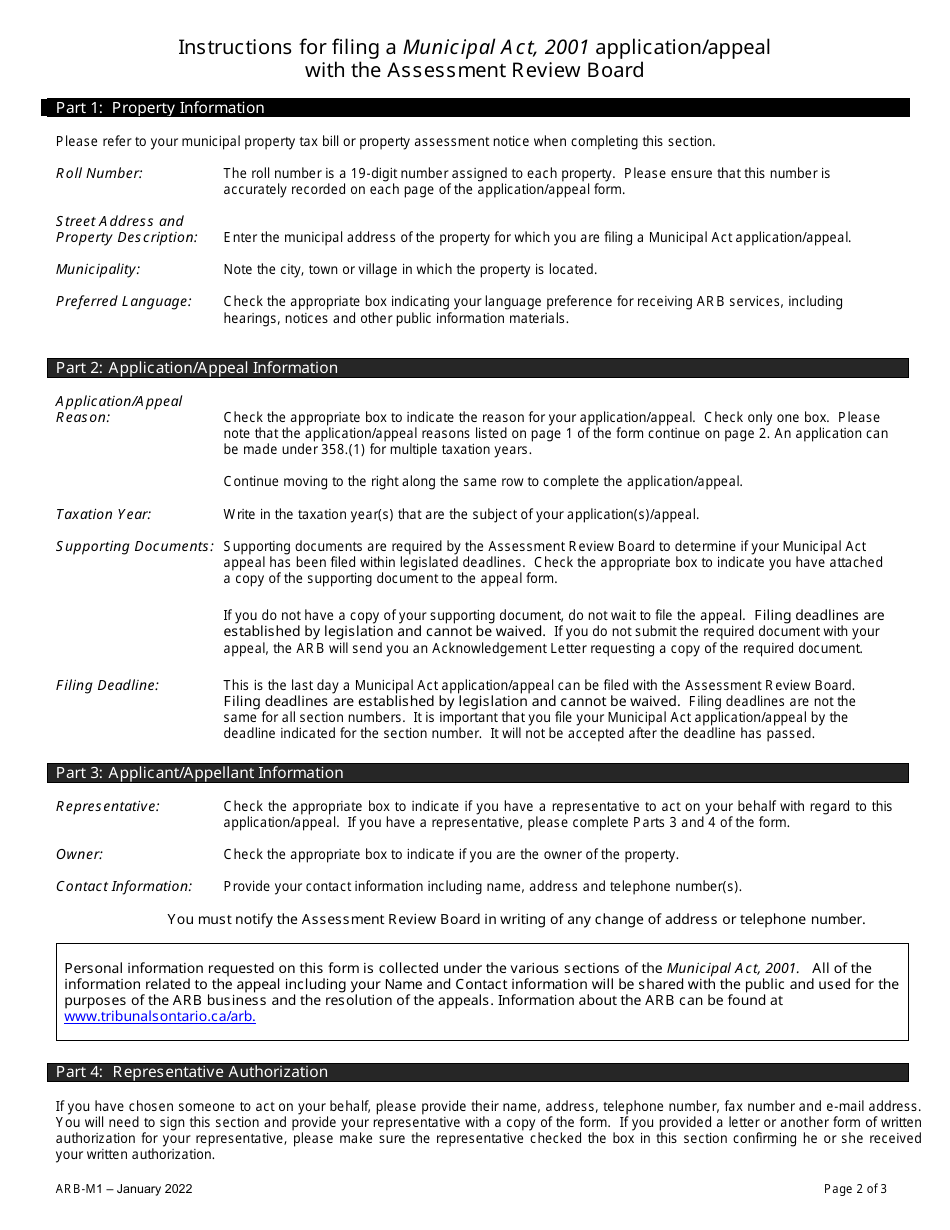

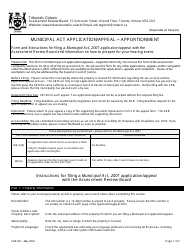

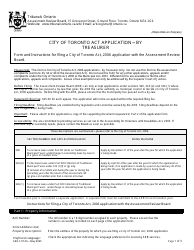

Form ARB-M1 Municipal Act Application / Appeal - Cancel, Reduce, Refund - Ontario, Canada

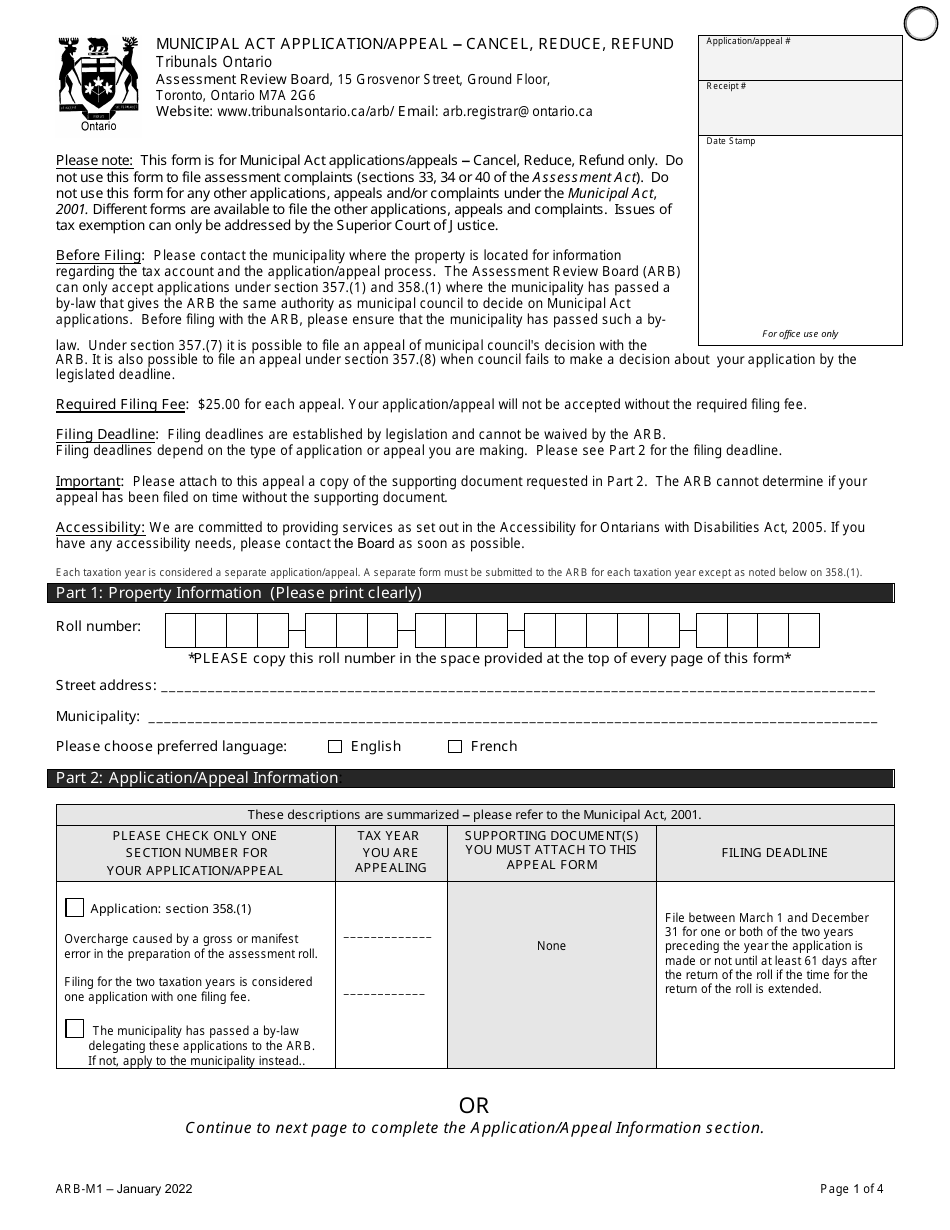

Form ARB-M1 Municipal Act Application/Appeal is used in Ontario, Canada for the purpose of applying or appealing to cancel, reduce, or seek a refund related to municipal acts. It is specifically designed for matters related to municipal assessments and tax assessments.

The property owner or their authorized representative files the Form ARB-M1 Municipal Act Application/Appeal to request a cancellation, reduction, or refund of property taxes in Ontario, Canada.

FAQ

Q: What is an ARB-M1 form?

A: The ARB-M1 form is an application/appeal form used in Ontario, Canada for requesting the cancellation, reduction, or refund of municipal taxes.

Q: Who can use the ARB-M1 form?

A: Any property owner or tenant in Ontario, Canada can use the ARB-M1 form to request the cancellation, reduction, or refund of municipal taxes.

Q: What is the purpose of the ARB-M1 form?

A: The ARB-M1 form is used to appeal to the Assessment Review Board (ARB) in Ontario, Canada to request the cancellation, reduction, or refund of municipal taxes.

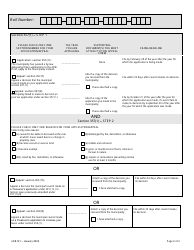

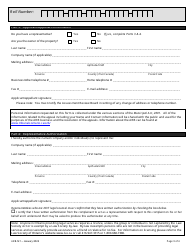

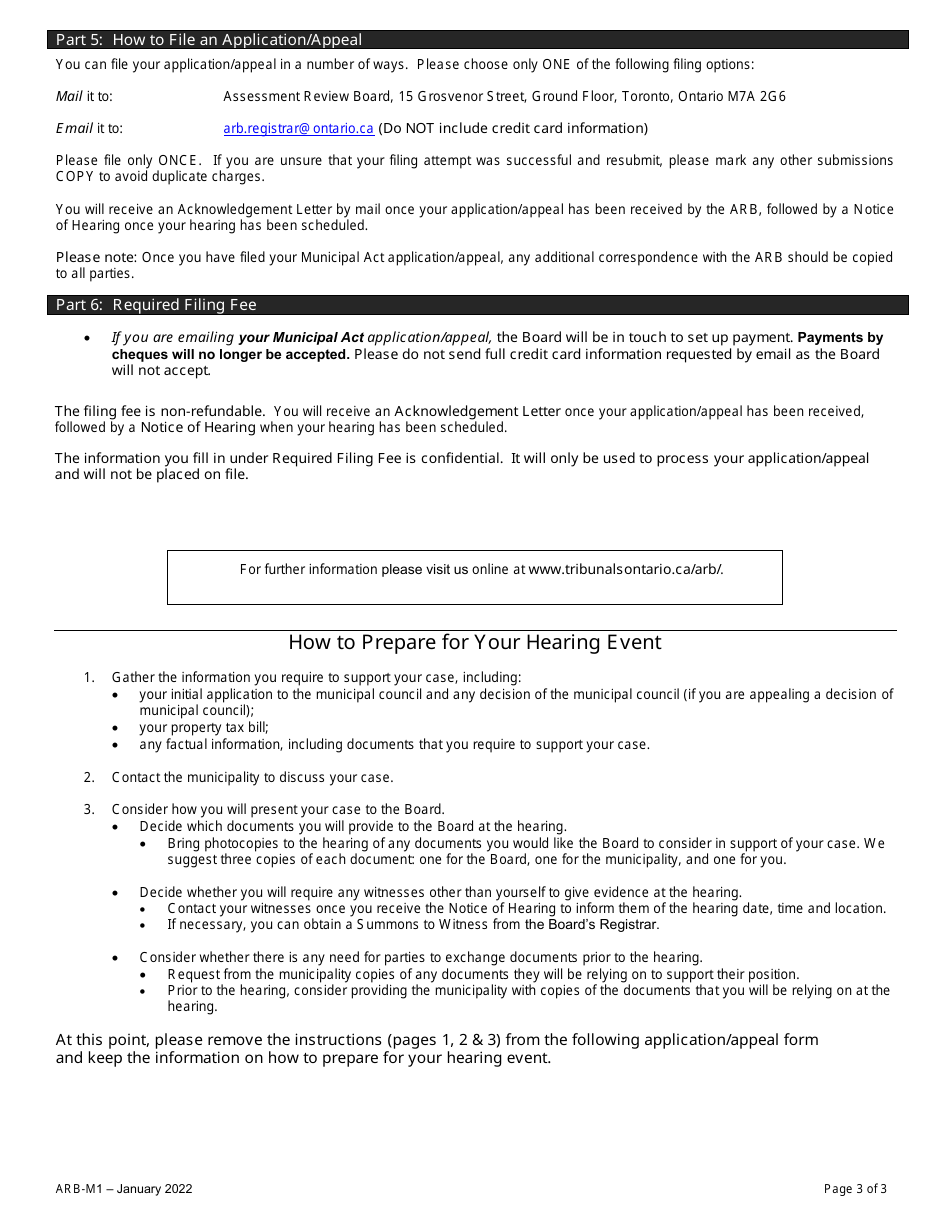

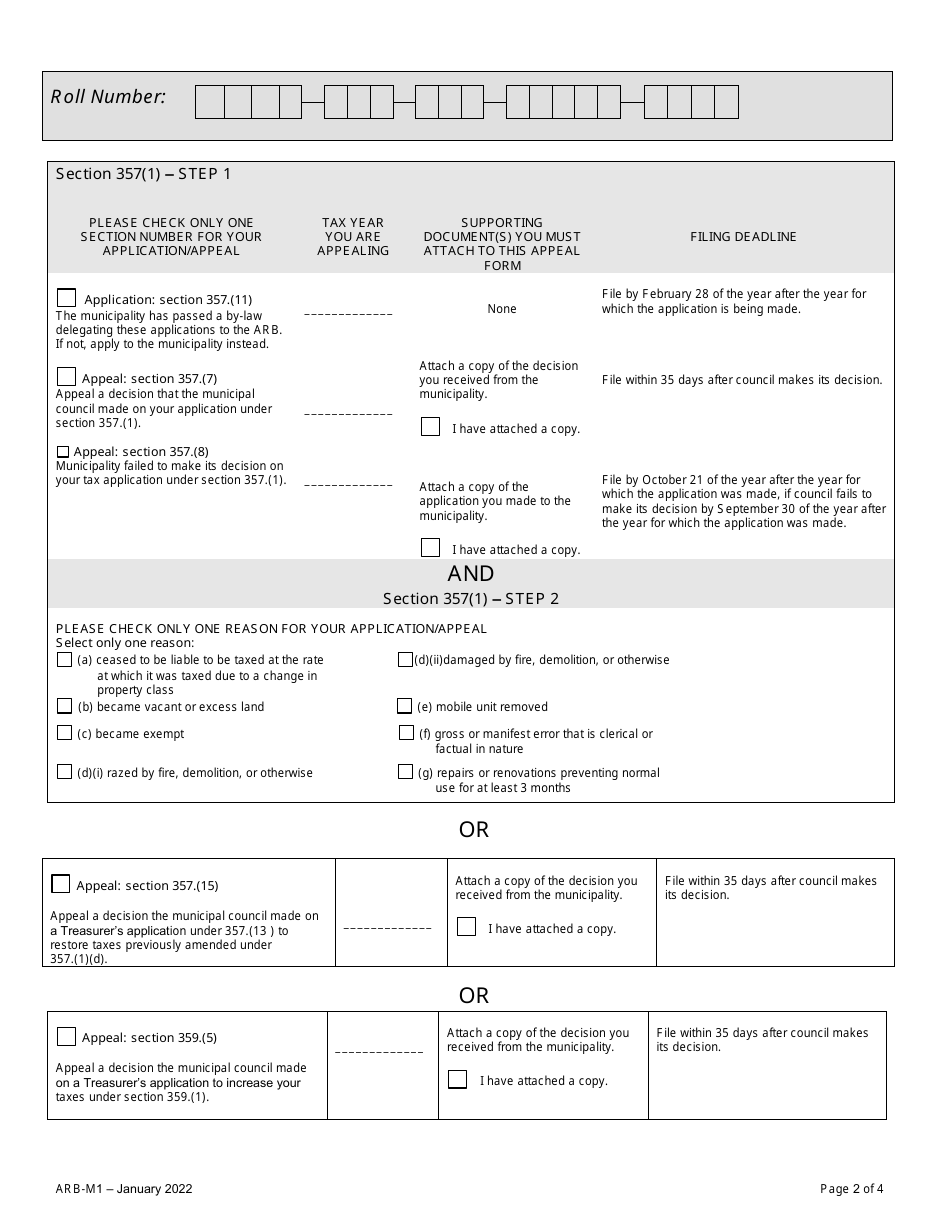

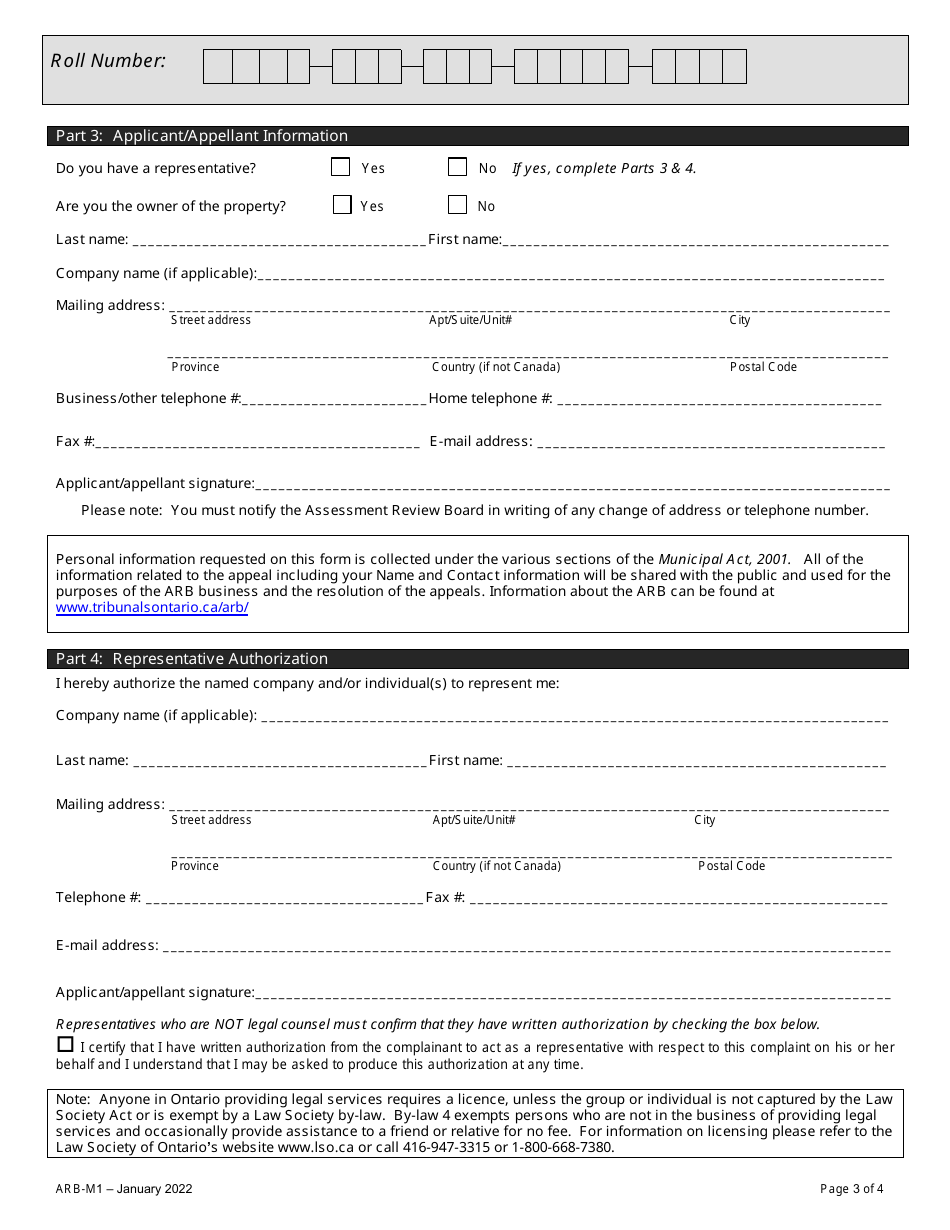

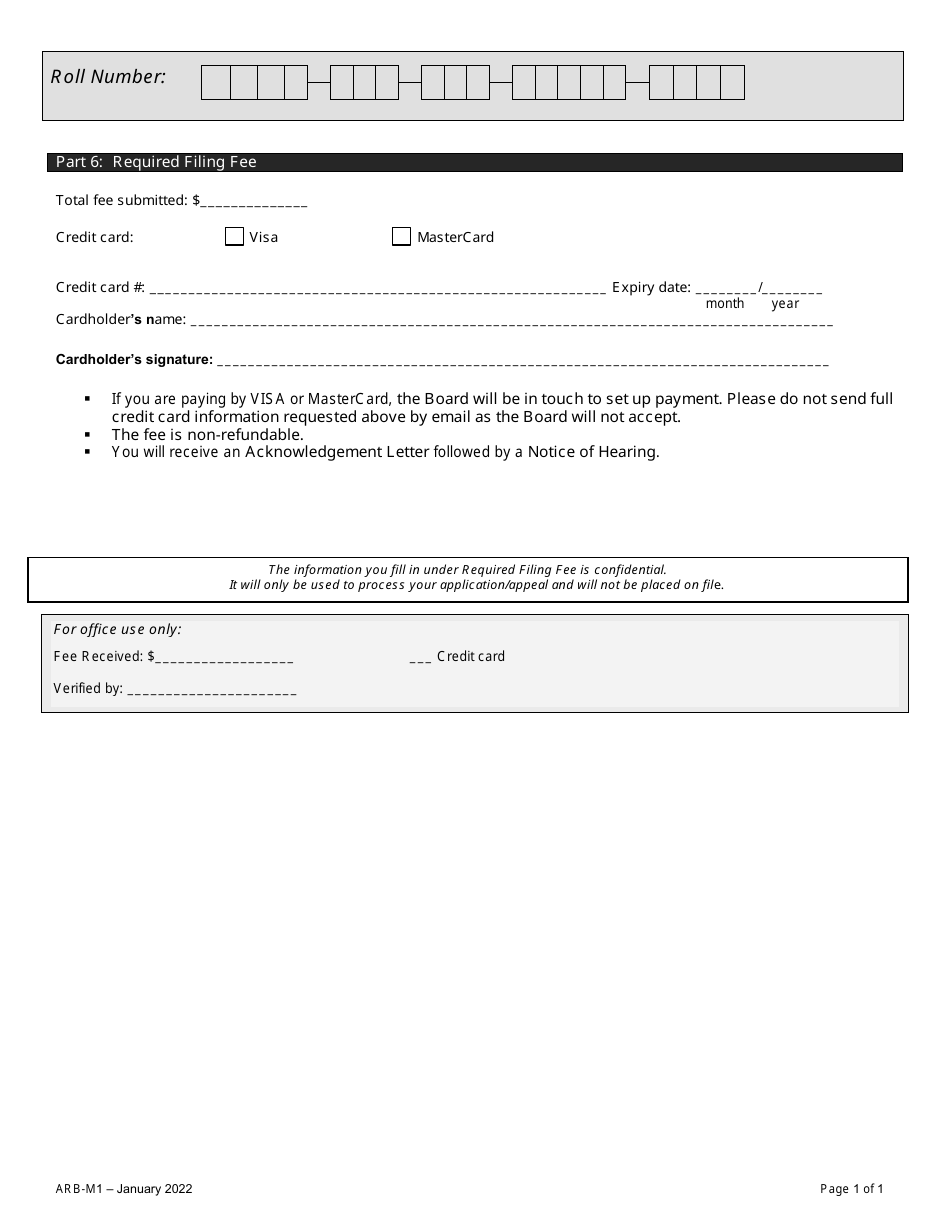

Q: How do I fill out the ARB-M1 form?

A: You need to provide your contact information, property details, reasons for the appeal, and any supporting documents like property assessments or tax invoices when filling out the ARB-M1 form.

Q: What is the deadline to submit the ARB-M1 form?

A: The deadline to submit the ARB-M1 form varies depending on the municipality, so you should check with your local municipal office for the specific deadline.

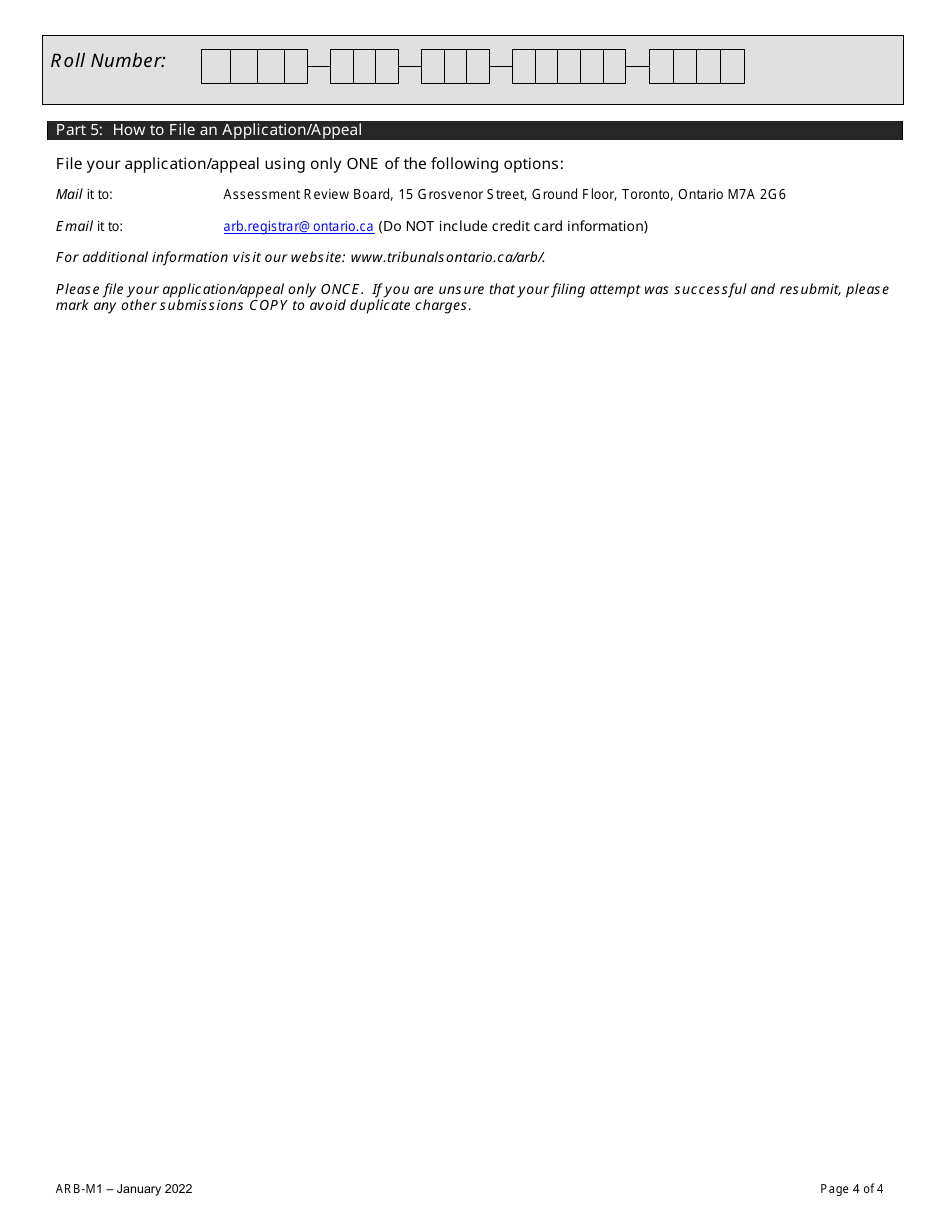

Q: What happens after I submit the ARB-M1 form?

A: After submitting the ARB-M1 form, the Assessment Review Board (ARB) will review your appeal and may schedule a hearing to further assess your request for the cancellation, reduction, or refund of municipal taxes.

Q: Can I appeal the decision made by the Assessment Review Board (ARB)?

A: Yes, if you are not satisfied with the decision made by the Assessment Review Board (ARB), you have the option to appeal further to the Superior Court of Justice in Ontario, Canada.

Q: Do I need legal representation to fill out the ARB-M1 form?

A: Legal representation is not required to fill out the ARB-M1 form. However, if you are unfamiliar with the process or feel that you need assistance, you may choose to seek legal advice or consult with a property tax professional.