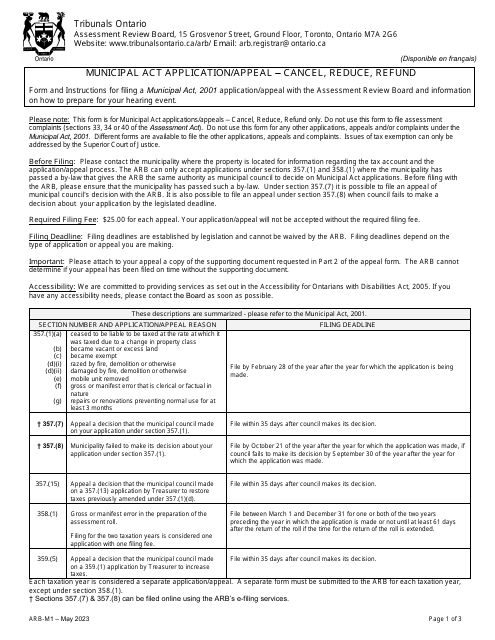

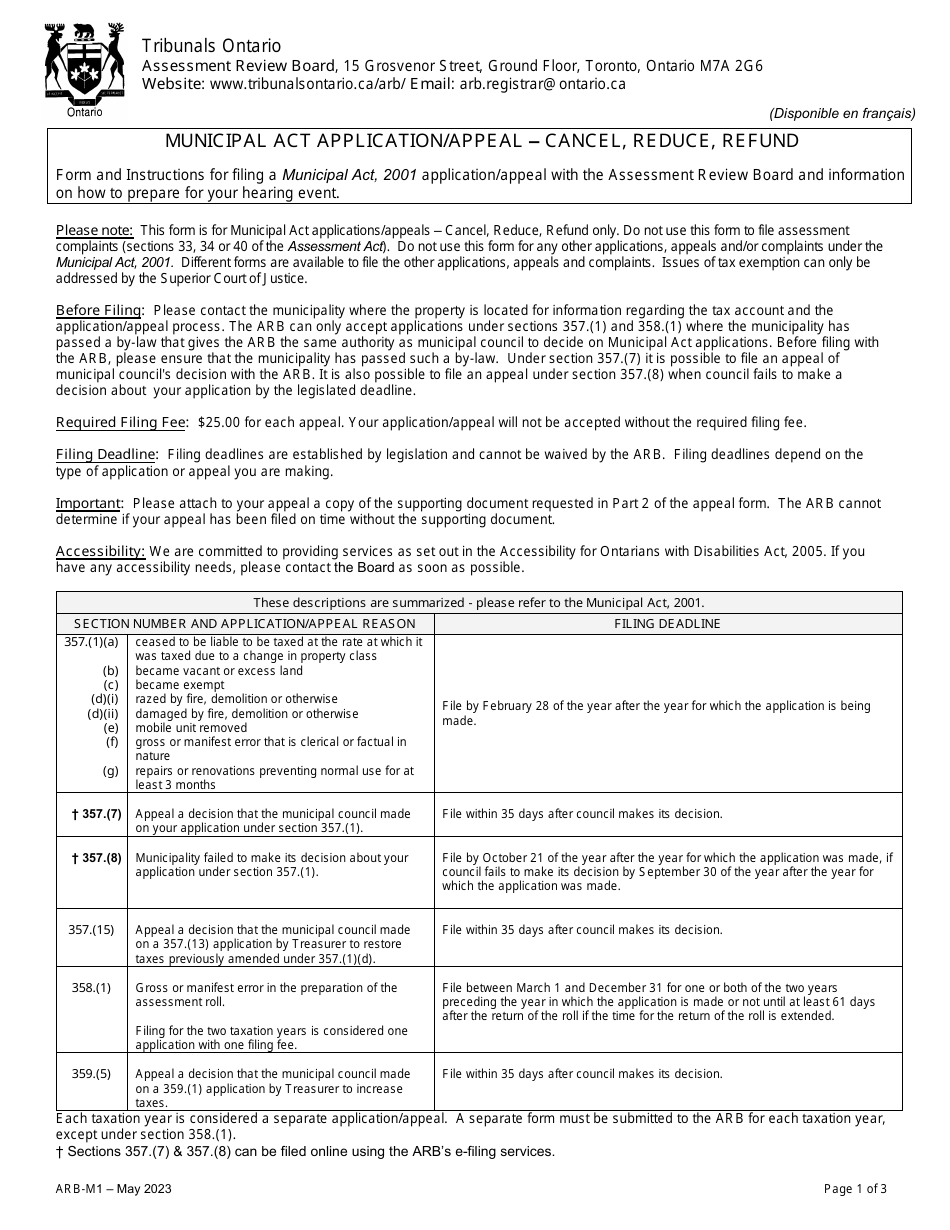

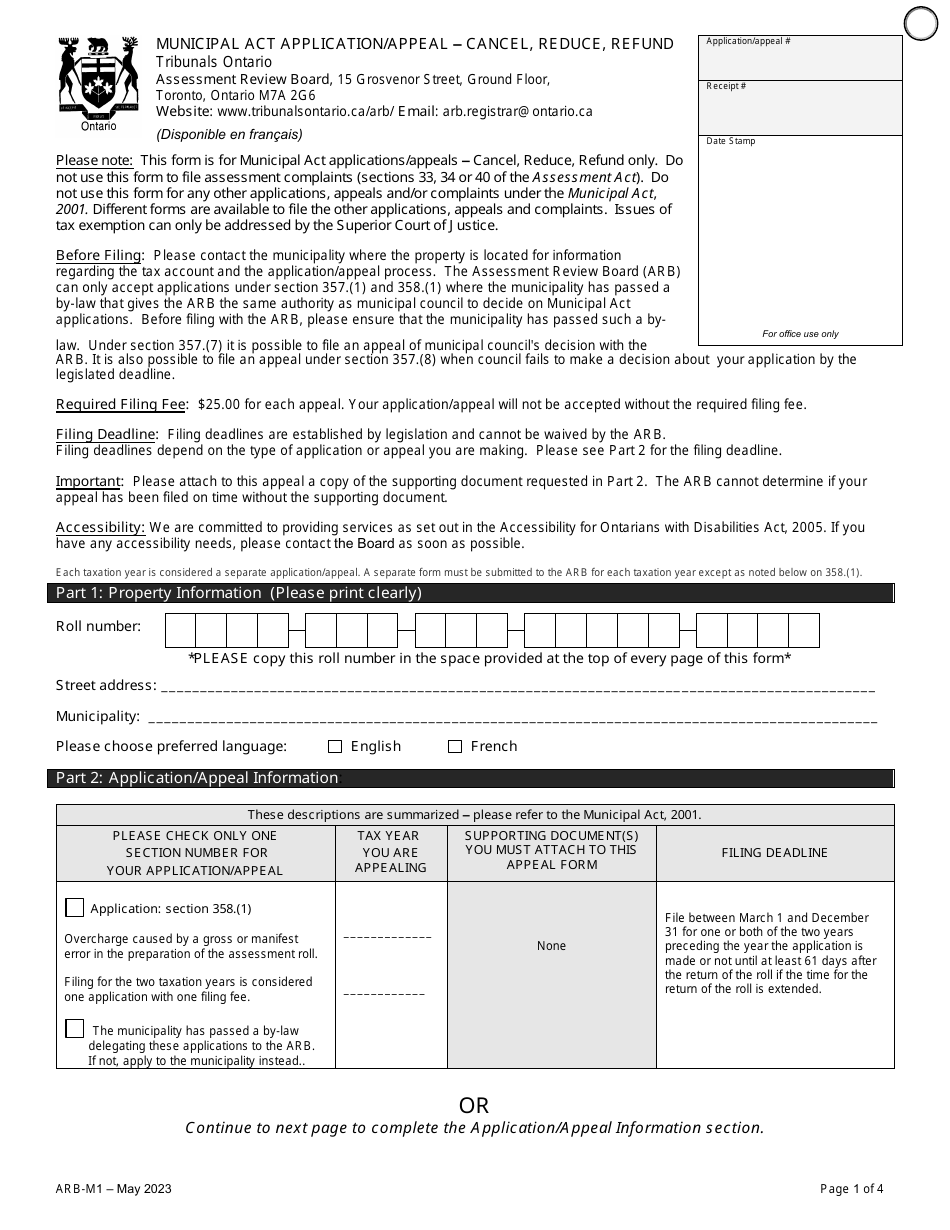

Form ARB-M1 Municipal Act Application / Appeal - Cancel, Reduce, Refund - Ontario, Canada

Form ARB-M1 Municipal Act Application/Appeal is used in the province of Ontario, Canada for applying or appealing to cancel, reduce, or seek a refund related to municipal property tax assessments. It is specifically related to matters governed by the Municipal Act in Ontario.

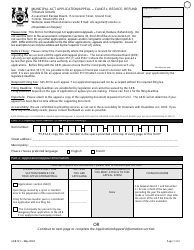

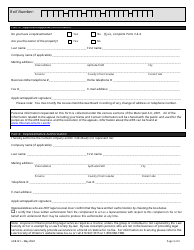

The person or organization filing the Form ARB-M1 Municipal Act Application/Appeal in Ontario, Canada would be the party seeking to cancel, reduce, or refund their municipal taxes.

Form ARB-M1 Municipal Act Application/Appeal - Cancel, Reduce, Refund - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is the ARB-M1 Municipal Act Application/Appeal form? A: The ARB-M1 form is used to apply or appeal a decision related to canceling, reducing, or refunding property taxes in Ontario, Canada.

Q: Who can use the ARB-M1 Municipal Act Application/Appeal form? A: Property owners in Ontario, Canada can use the ARB-M1 form to apply or appeal for canceling, reducing, or refunding property taxes.

Q: What is the purpose of using the ARB-M1 form? A: The ARB-M1 form is used to address issues or disputes regarding property tax assessments and to seek relief by canceling, reducing, or refunding property taxes in Ontario, Canada.

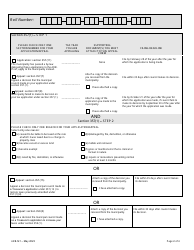

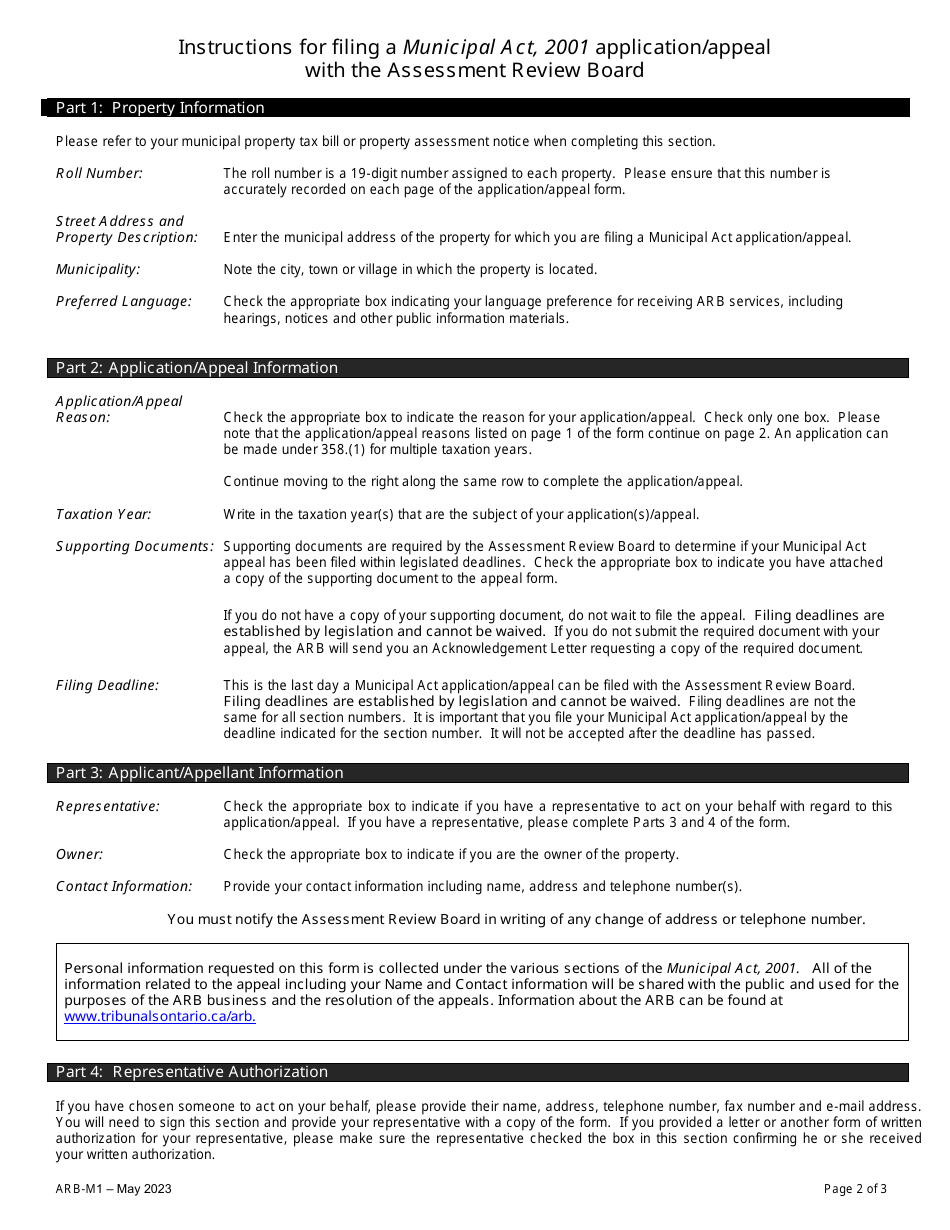

Q: What should be included in the ARB-M1 form? A: The ARB-M1 form requires information about the property assessment, reasons for the application/appeal, supporting documents, and the desired outcome (cancel, reduce, or refund property taxes).

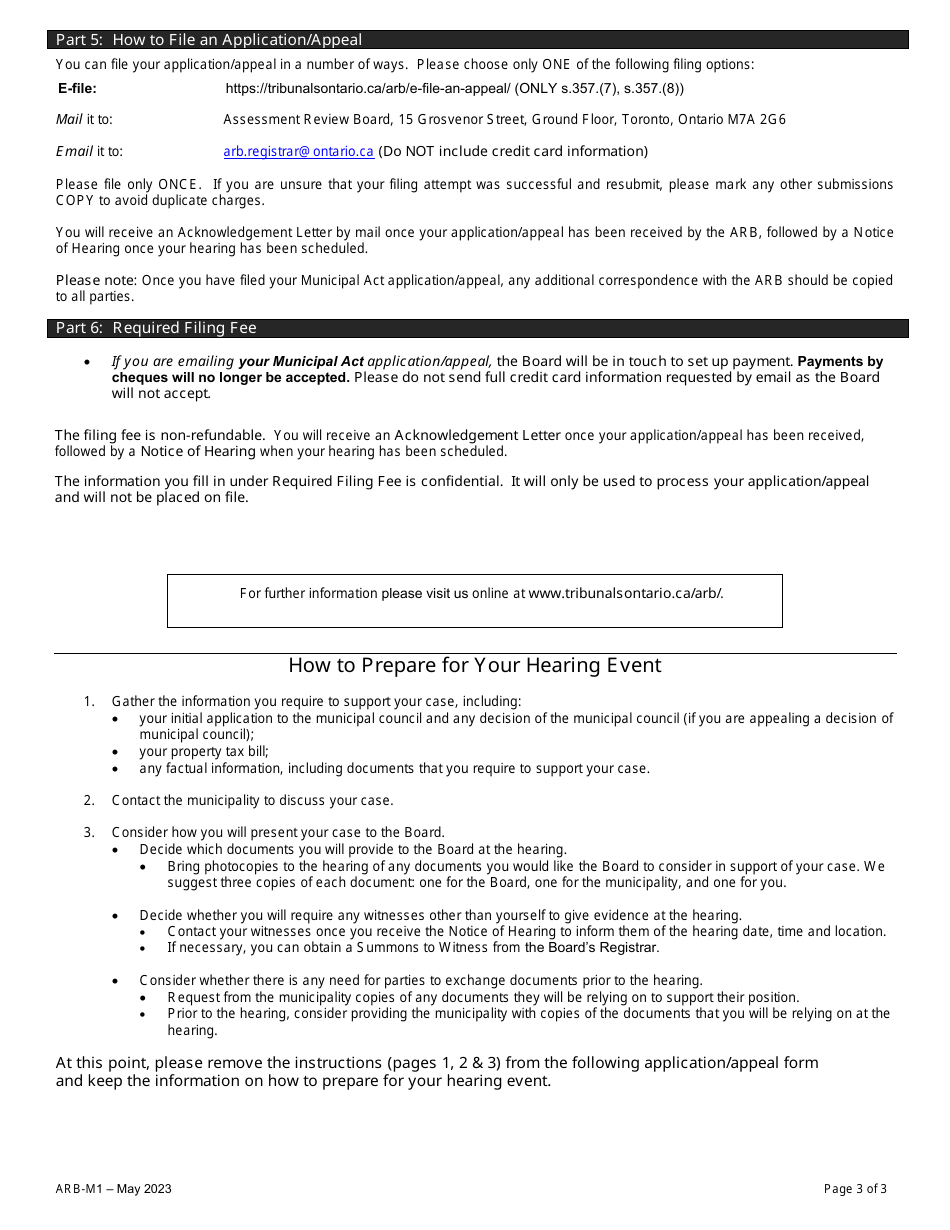

Q: What is the process after submitting the ARB-M1 form? A: After submitting the ARB-M1 form, it will be reviewed by the ARB (Assessment Review Board) or a local MPAC office. They will assess the information provided and determine if an adjustment or refund is warranted for the property taxes.

Q: Is there a deadline for submitting the ARB-M1 form? A: Yes, there is a deadline for submitting the ARB-M1 form, which is usually within specified timelines set by the Assessment Review Board (ARB) or local MPAC office in Ontario, Canada.

Q: Can I appeal the decision made after submitting the ARB-M1 form? A: Yes, if you are not satisfied with the decision made after submitting the ARB-M1 form, you have the right to further appeal to the Assessment Review Board (ARB) or pursue other legal avenues available in Ontario, Canada.

Q: Can I get professional assistance for filling out the ARB-M1 form? A: Yes, you can seek professional assistance, such as a lawyer or a tax consultant, to help you in filling out the ARB-M1 form and navigating the appeal process in Ontario, Canada.