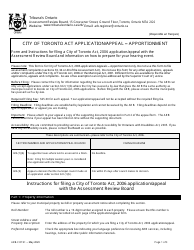

This version of the form is not currently in use and is provided for reference only. Download this version of

Form ARB-COTA5

for the current year.

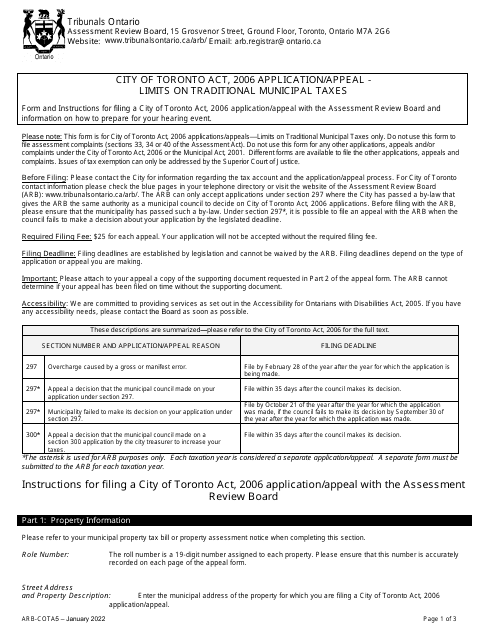

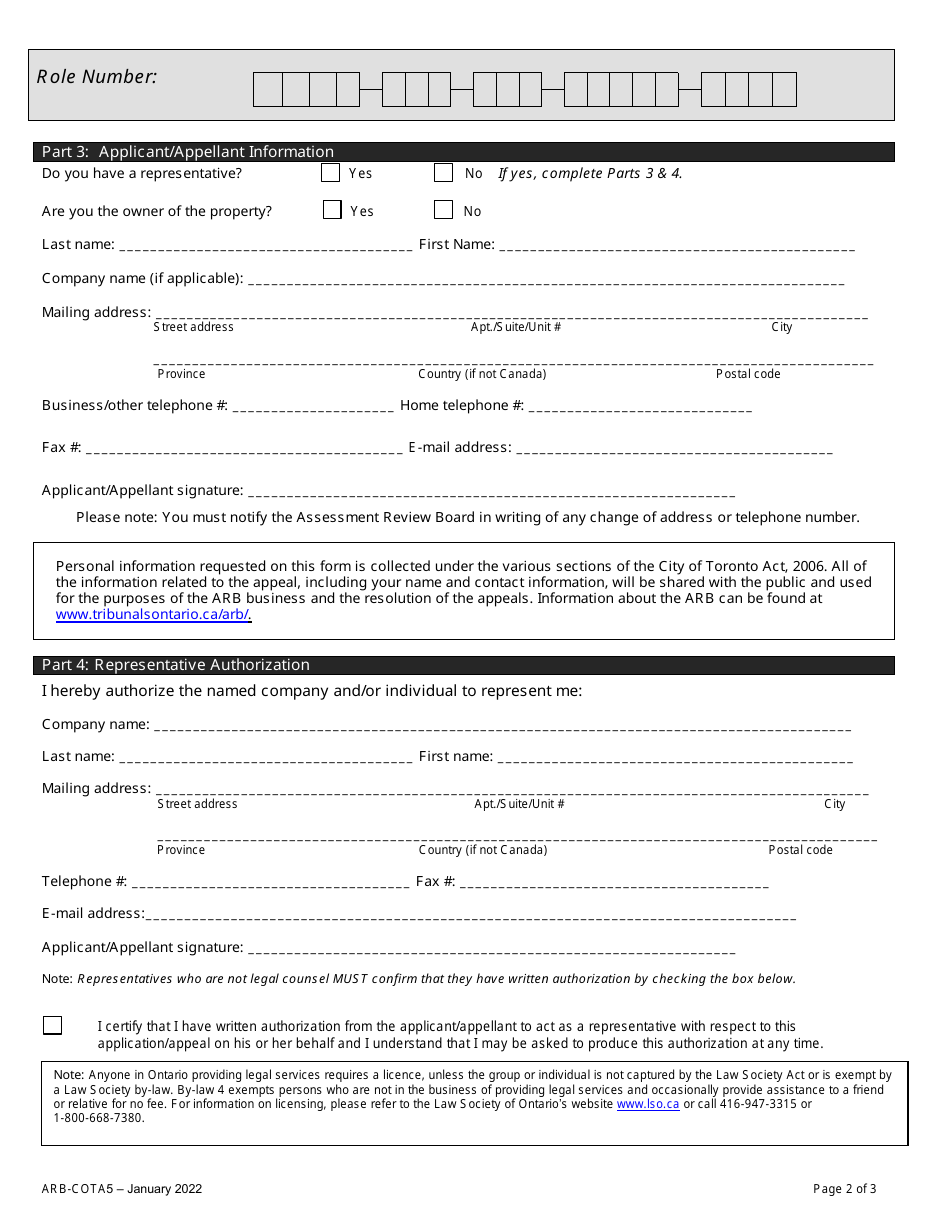

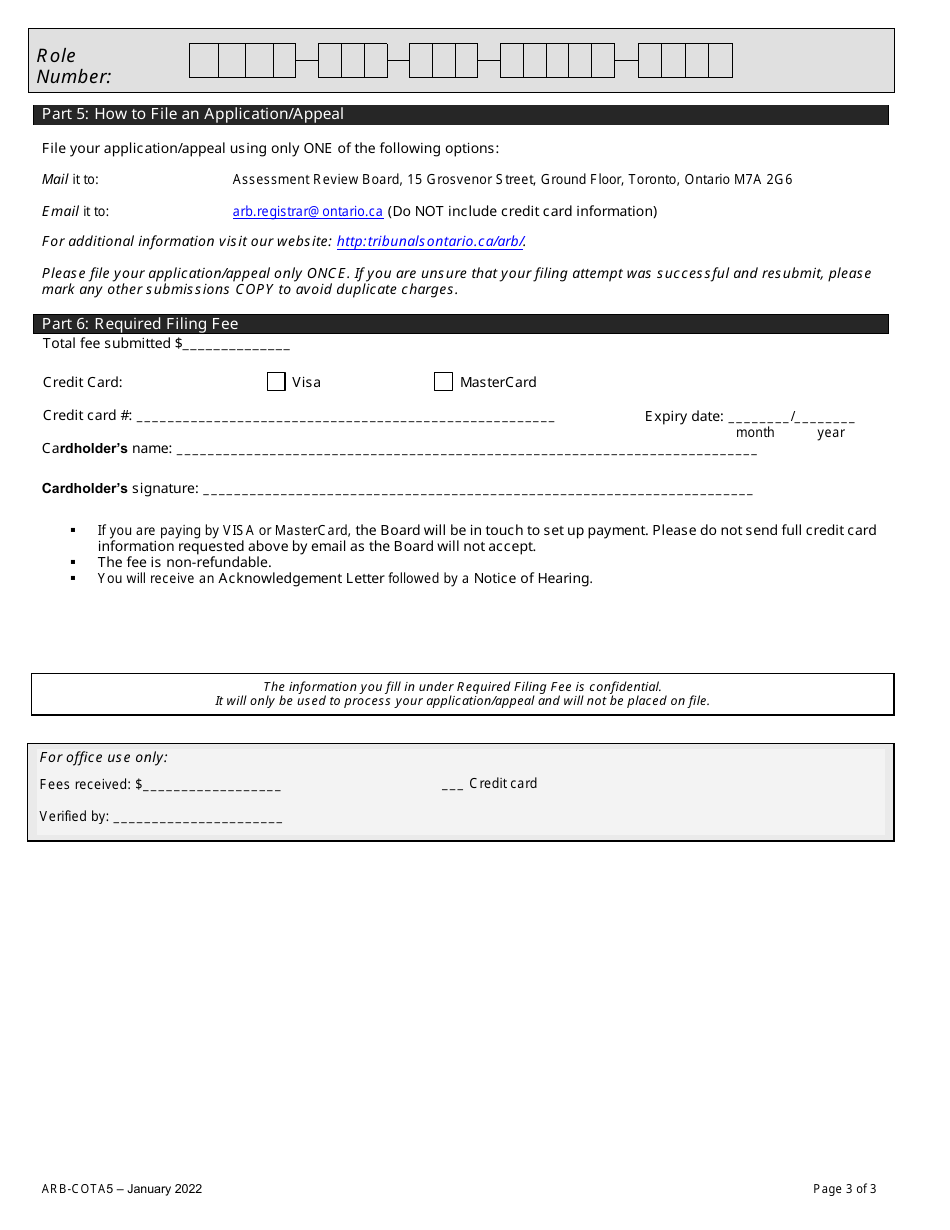

Form ARB-COTA5 City of Toronto Act Application / Appeal - Limits on Traditional Municipal Taxes - Ontario, Canada

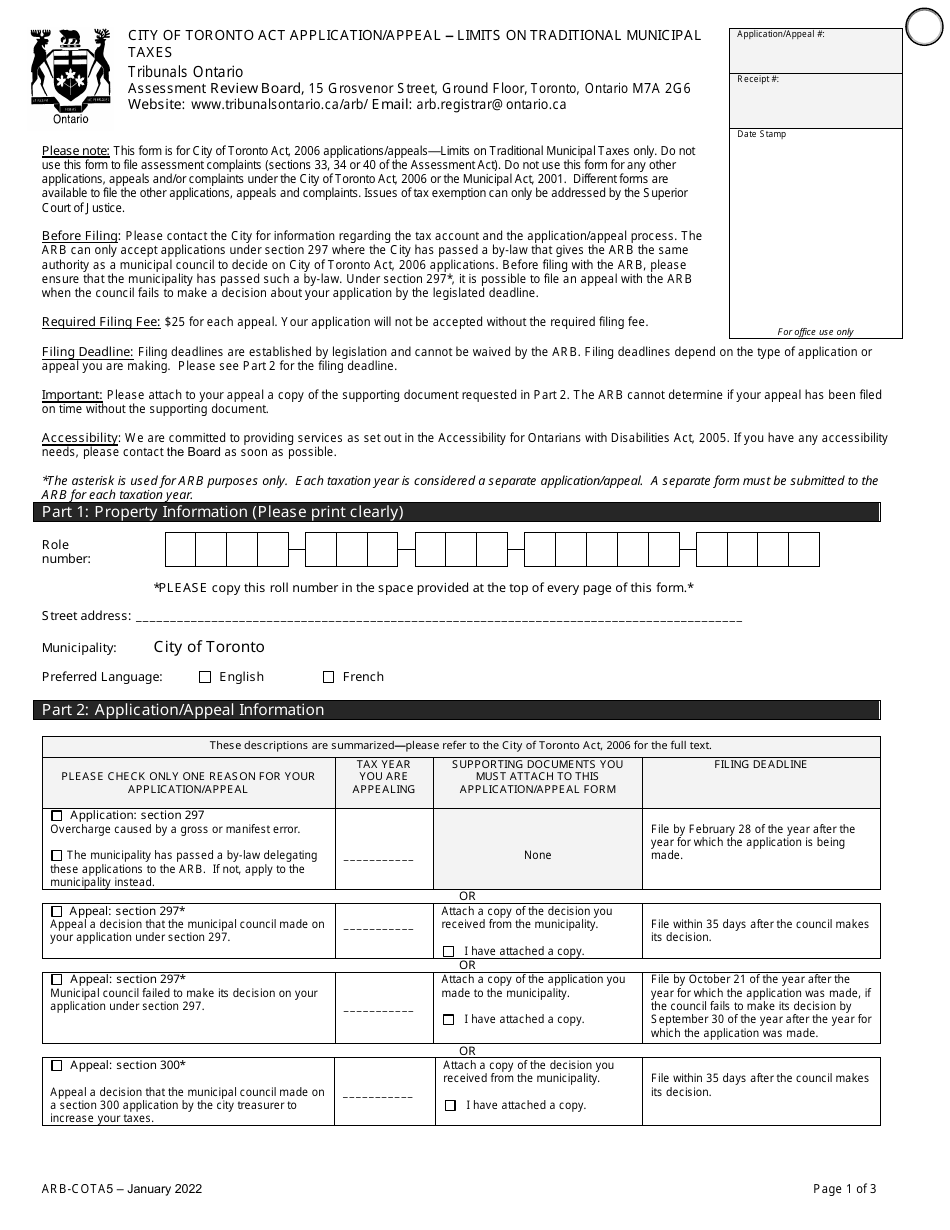

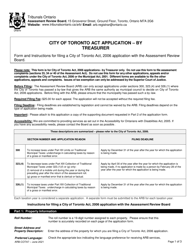

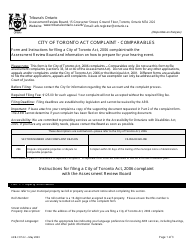

Form ARB-COTA5 is an application/appeal form used under the City of Toronto Act in Ontario, Canada. It is specifically designed to address the limits on traditional municipal taxes within the City of Toronto. This form can be used by individuals or organizations who wish to contest or appeal their property tax assessment in the city. It provides a process to challenge the taxes imposed by the municipality and potentially seek a revision or adjustment of the tax amount.

The Form ARB-COTA5 City of Toronto Act Application/Appeal for Limits on Traditional Municipal Taxes in Ontario, Canada is typically filed by property owners or taxpayers who wish to challenge their property tax assessment in the City of Toronto.

FAQ

Q: What is the Form ARB-COTA5?

A: Form ARB-COTA5 is an application/appeal form used in the City of Toronto Act to address the limits on traditional municipal taxes in Ontario, Canada.

Q: What does ARB stand for in Form ARB-COTA5?

A: ARB stands for Assessment Review Board, which is the authority responsible for reviewing property assessments and property tax appeals in Ontario.

Q: What is the City of Toronto Act?

A: The City of Toronto Act is a provincial legislation that provides the framework for governing the City of Toronto, including its taxation powers.

Q: What are traditional municipal taxes?

A: Traditional municipal taxes refer to property taxes, business taxes, and other fees collected by the municipality to fund local services and infrastructure.

Q: Why are there limits on traditional municipal taxes?

A: Limits on traditional municipal taxes help ensure that tax increases are reasonable and manageable for residents and businesses, while still allowing municipalities to generate revenue for their operations.