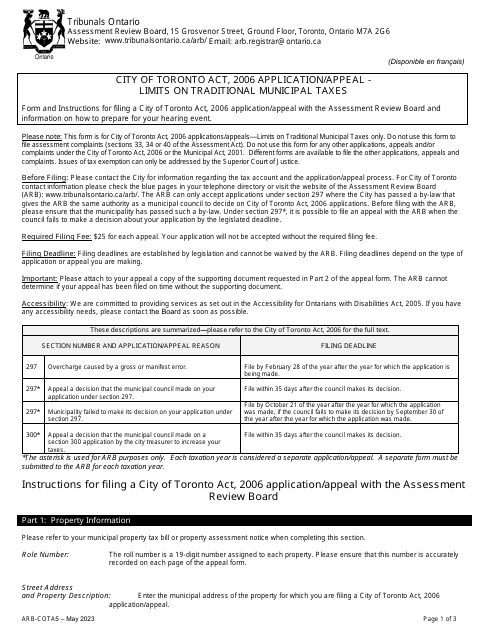

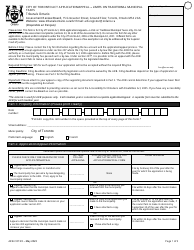

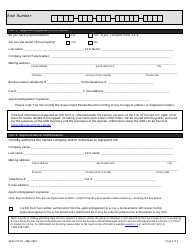

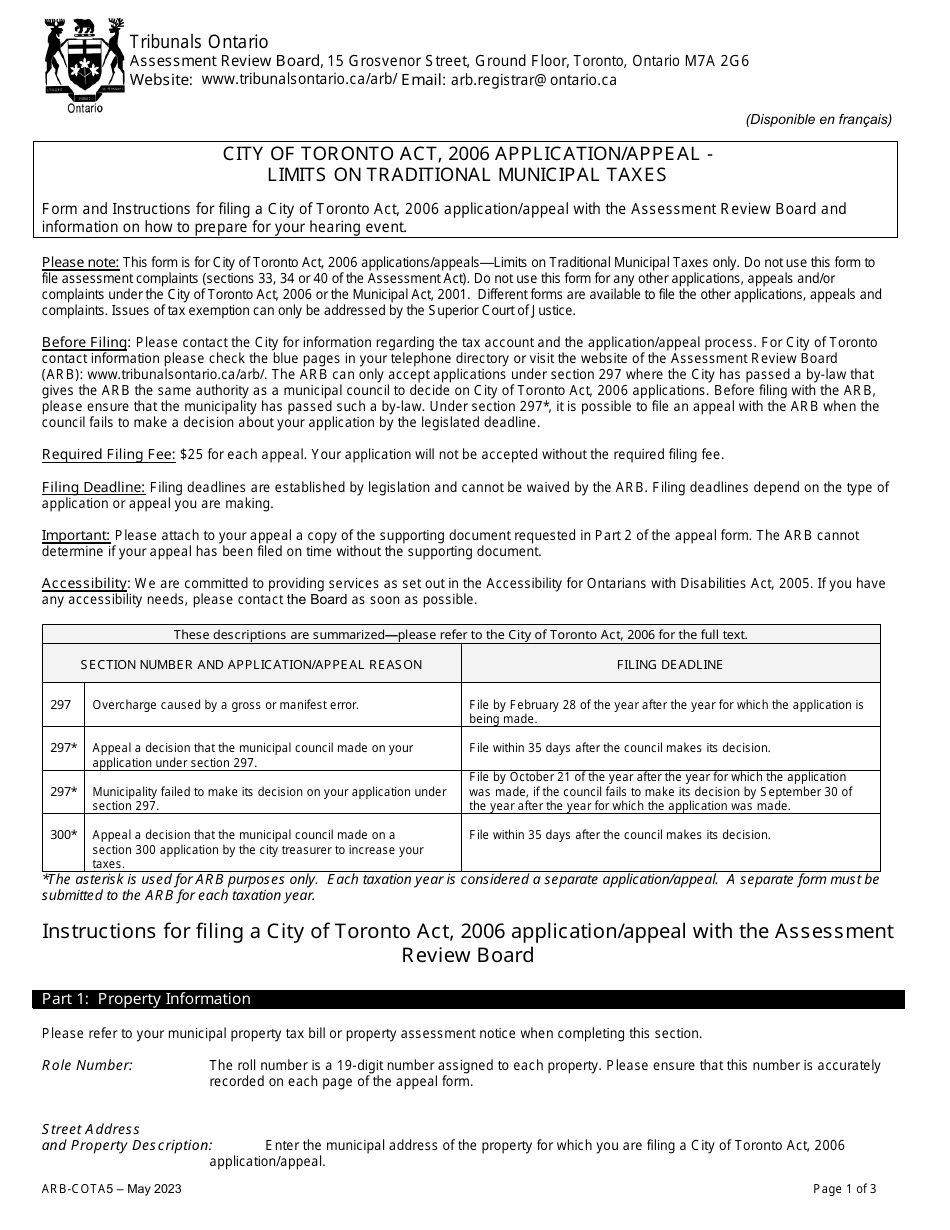

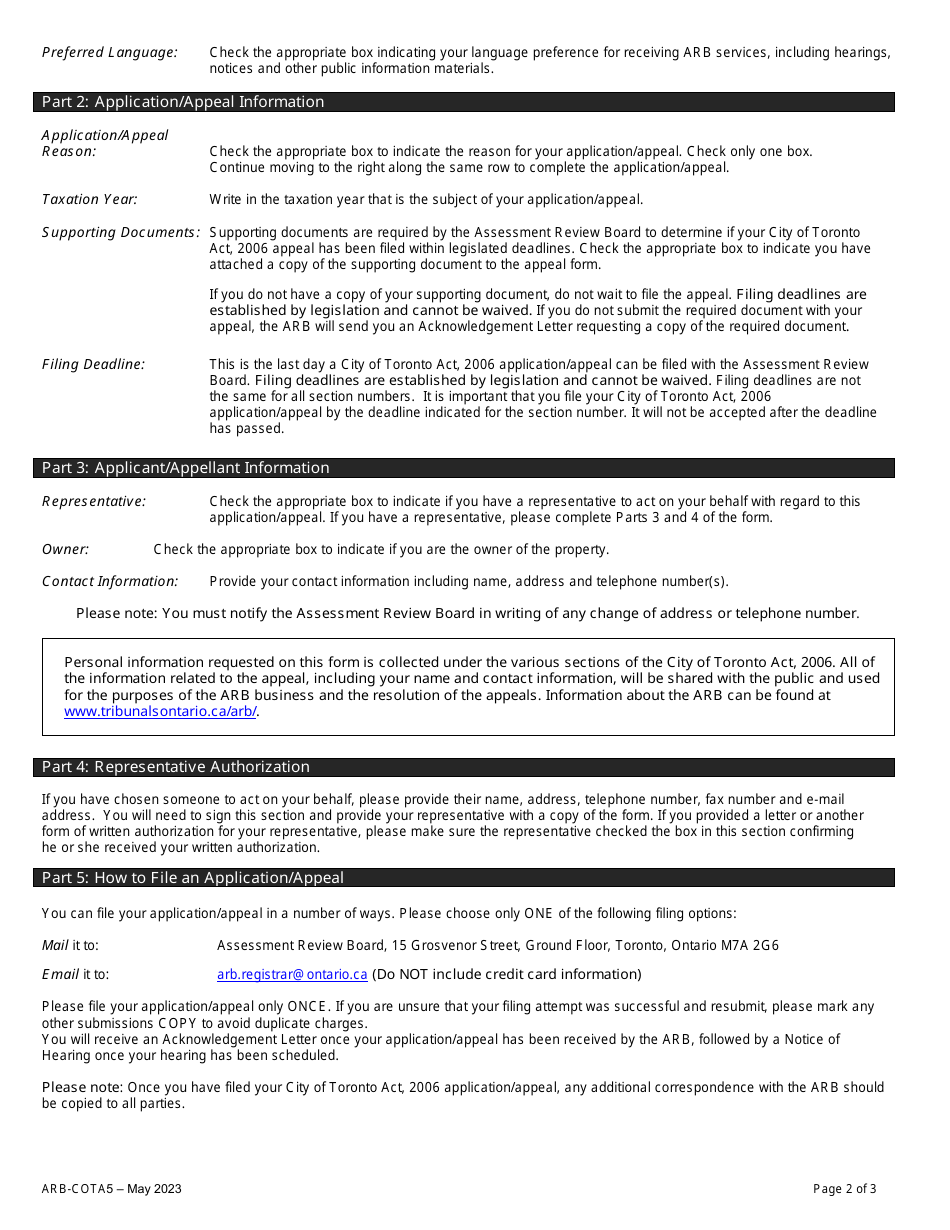

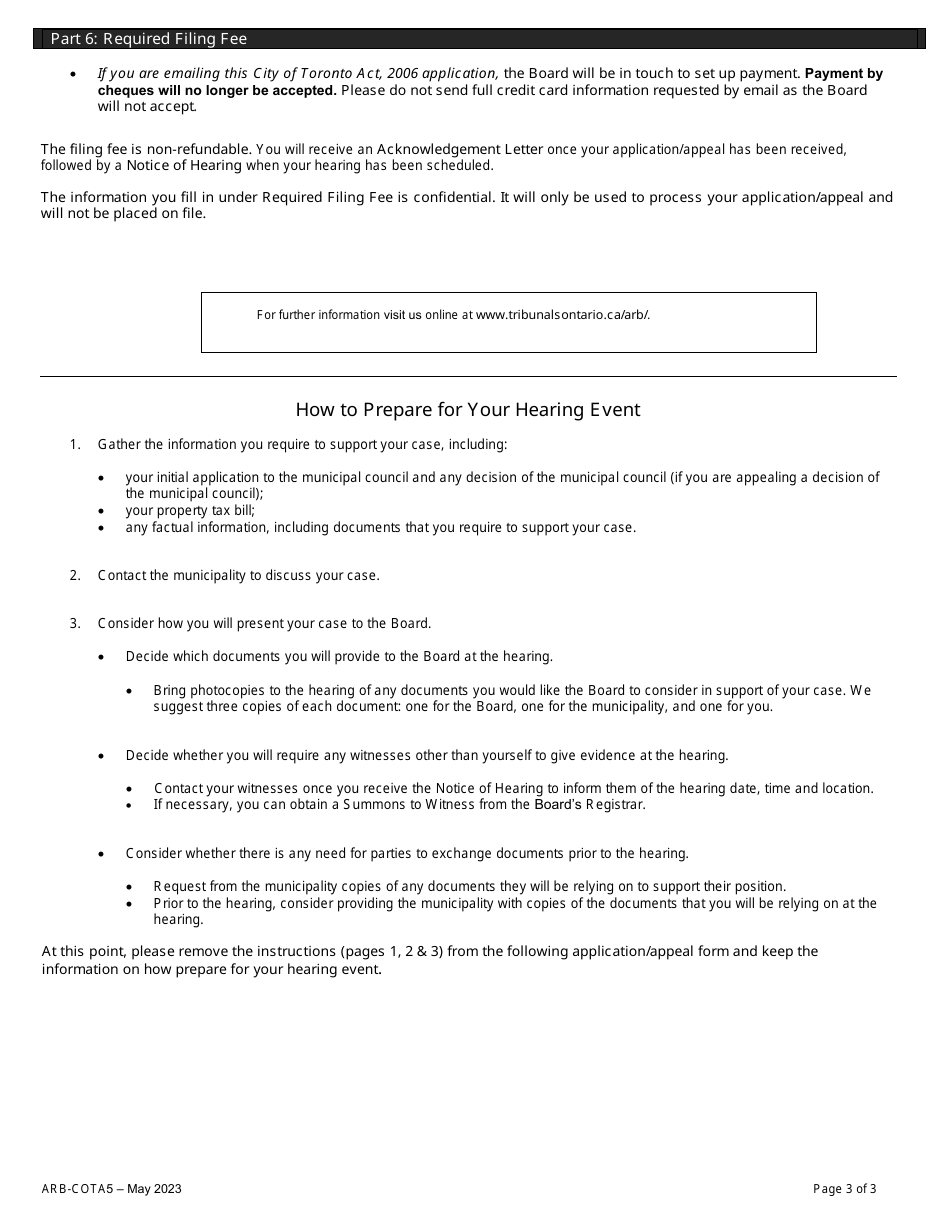

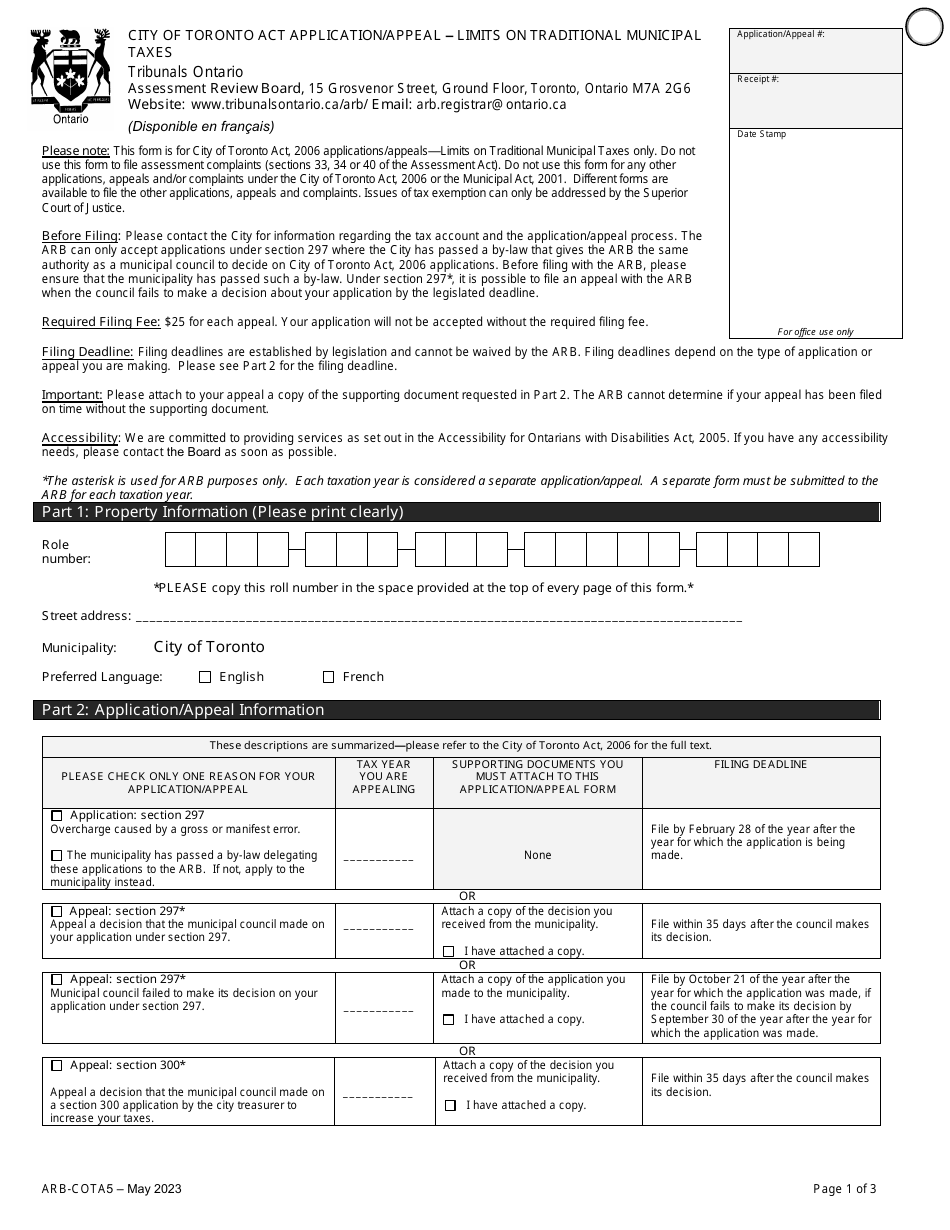

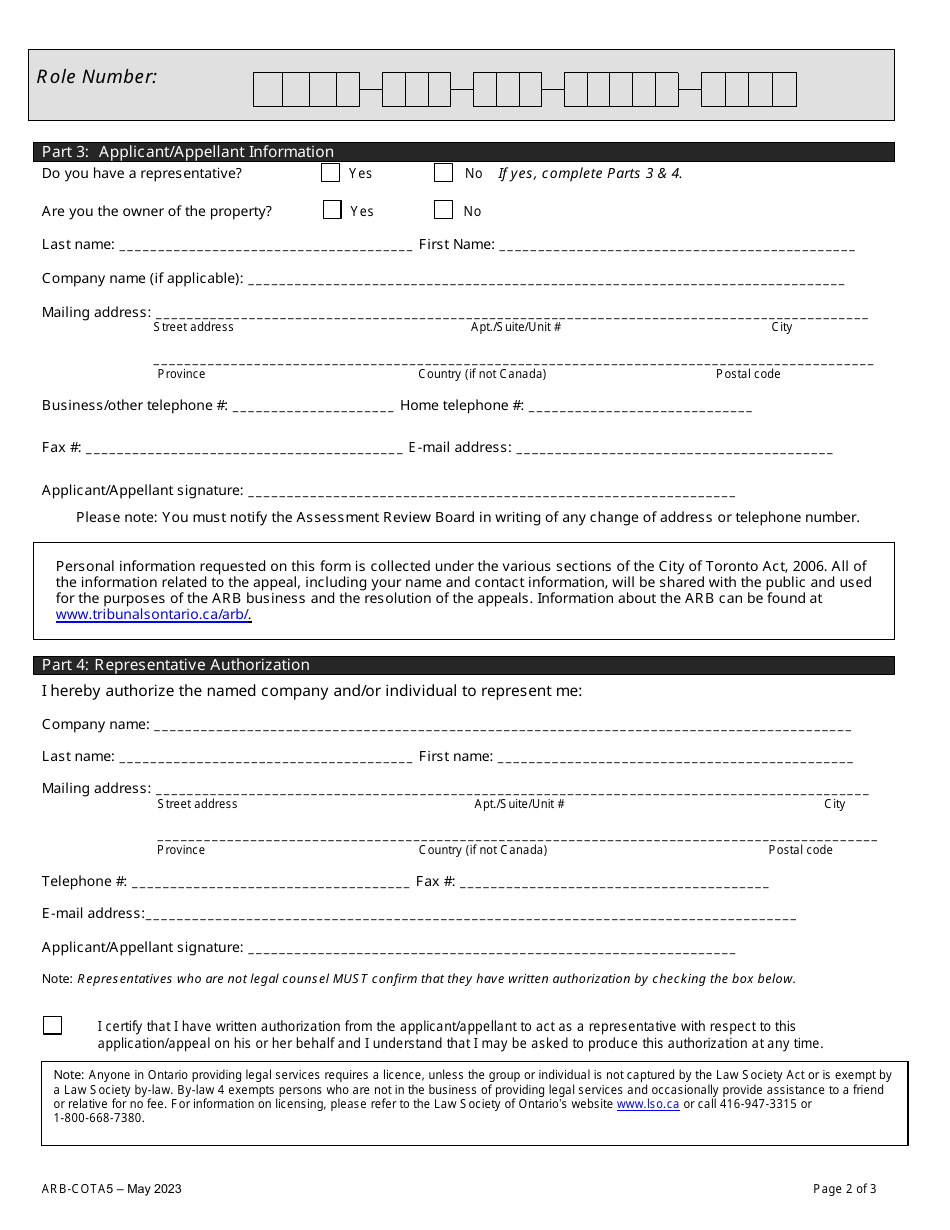

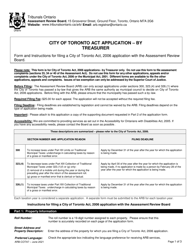

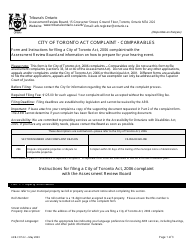

Form ARB-COTA5 City of Toronto Act Application / Appeal - Limits on Traditional Municipal Taxes - Ontario, Canada

Form ARB-COTA5 City of Toronto Act Application/Appeal - Limits on Traditional Municipal Taxes is used for applying or appealing the limits on traditional municipal taxes in the City of Toronto under the Ontario, Canada laws.

The Form ARB-COTA5 for a City of Toronto Act Application/Appeal - Limits on Traditional Municipal Taxes in Ontario, Canada is filed by the City of Toronto.

Form ARB-COTA5 City of Toronto Act Application/Appeal - Limits on Traditional Municipal Taxes - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is the ARB-COTA5 form?

A: The ARB-COTA5 form is an application/appeal form related to the City of Toronto Act in Ontario, Canada.

Q: What does the ARB-COTA5 form pertain to?

A: The ARB-COTA5 form pertains to the limits on traditional municipal taxes in the City of Toronto, Ontario, Canada.

Q: Who can use the ARB-COTA5 form?

A: The ARB-COTA5 form can be used by individuals or organizations who want to apply or appeal for limits on traditional municipal taxes in the City of Toronto.

Q: What is the purpose of the City of Toronto Act?

A: The City of Toronto Act is an Ontario legislation that provides specific powers and authorities to the City of Toronto for governing purposes.

Q: What are traditional municipal taxes?

A: Traditional municipal taxes refer to the taxes levied by the local municipal government to fund various services and infrastructure in the area, such as property taxes and utility charges.

Q: What is the ARB?

A: The ARB (Assessment Review Board) is an independent tribunal in Ontario that hears property assessment and taxation-related appeals.

Q: How can I obtain the ARB-COTA5 form?

A: You can obtain the ARB-COTA5 form by contacting the appropriate authority, such as the City of Toronto or the ARB.