This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

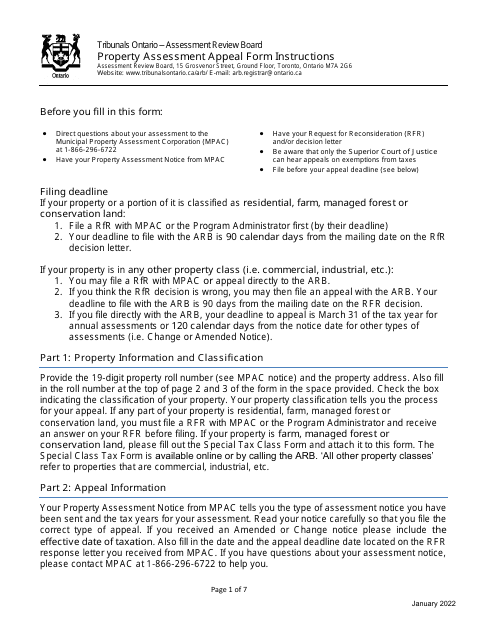

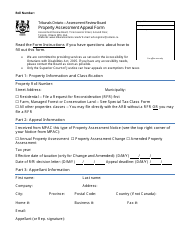

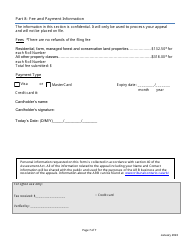

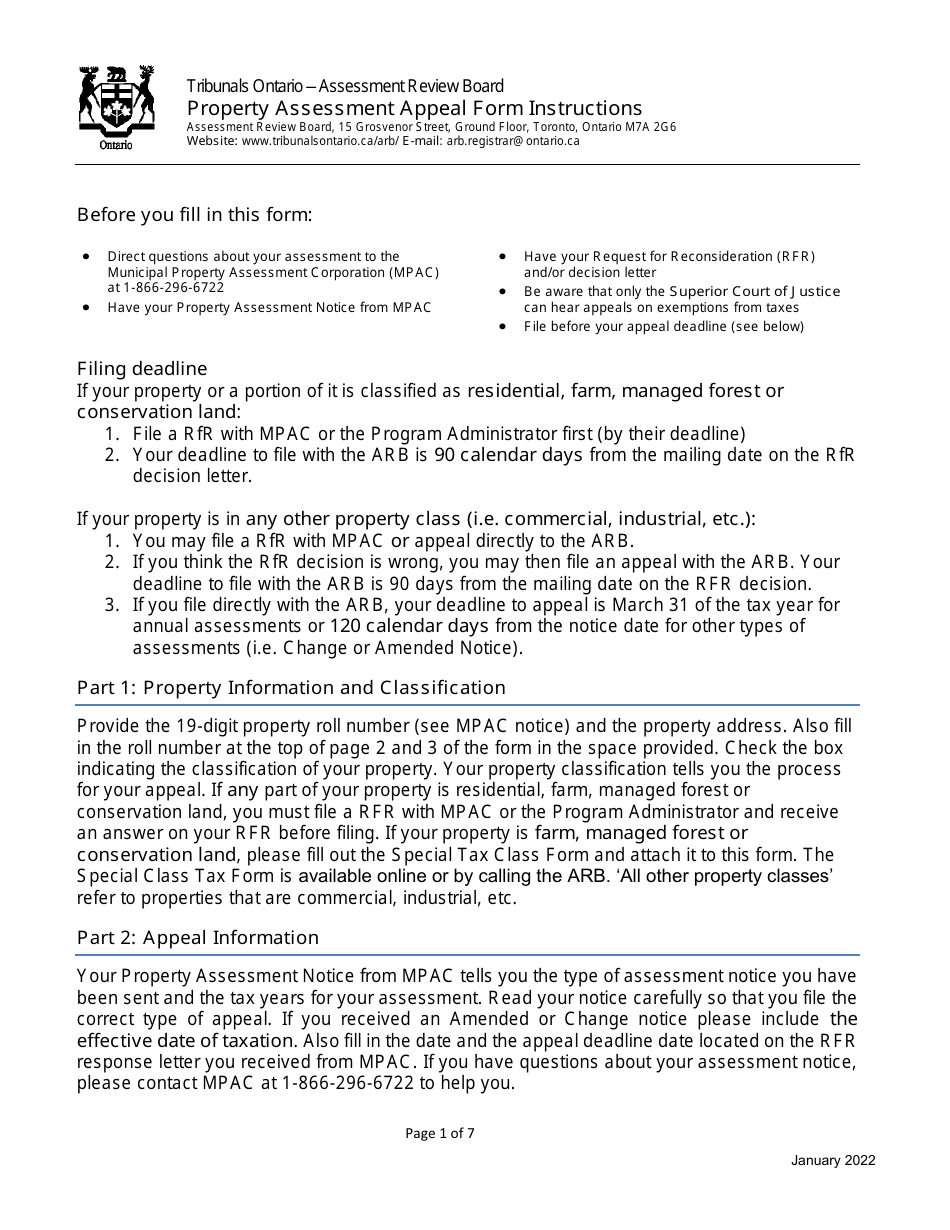

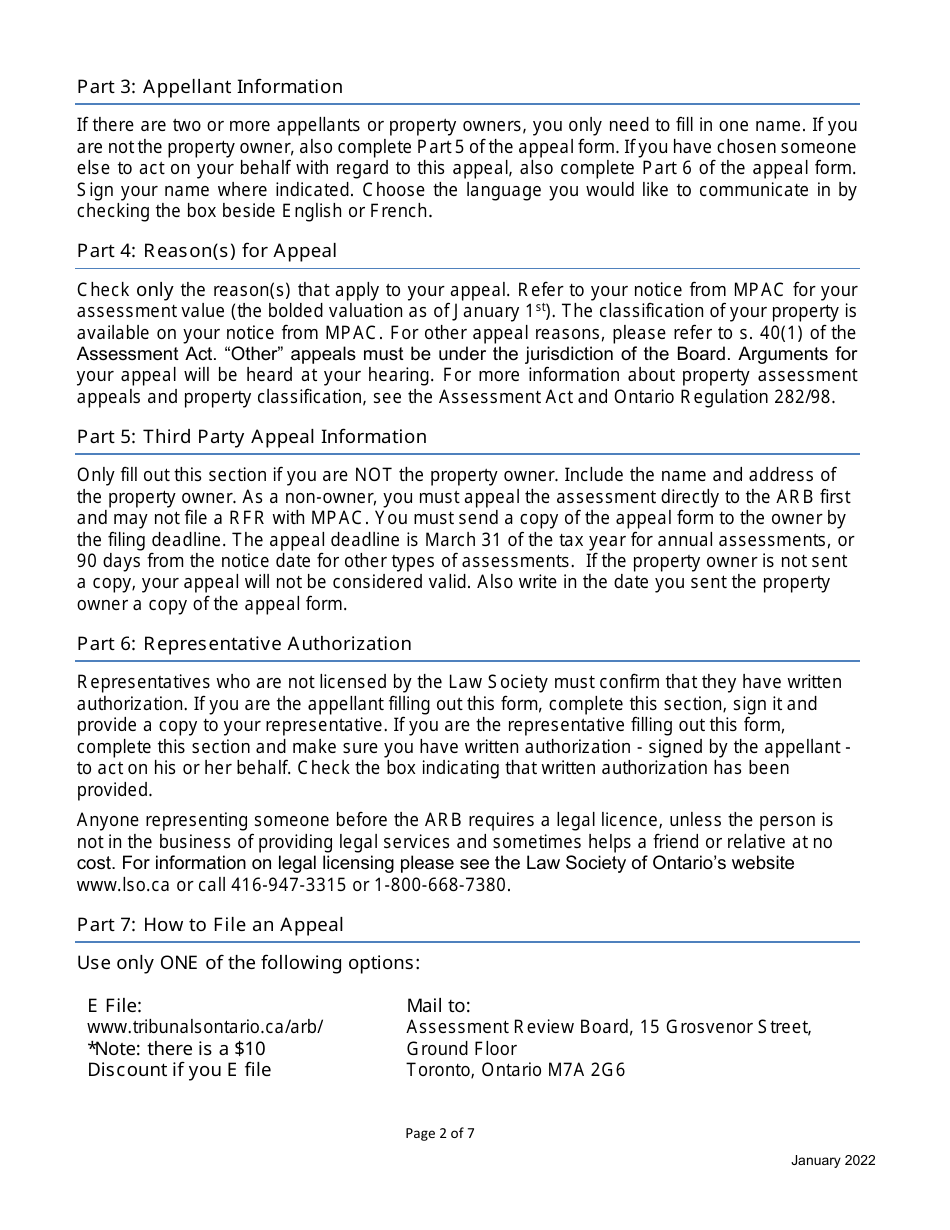

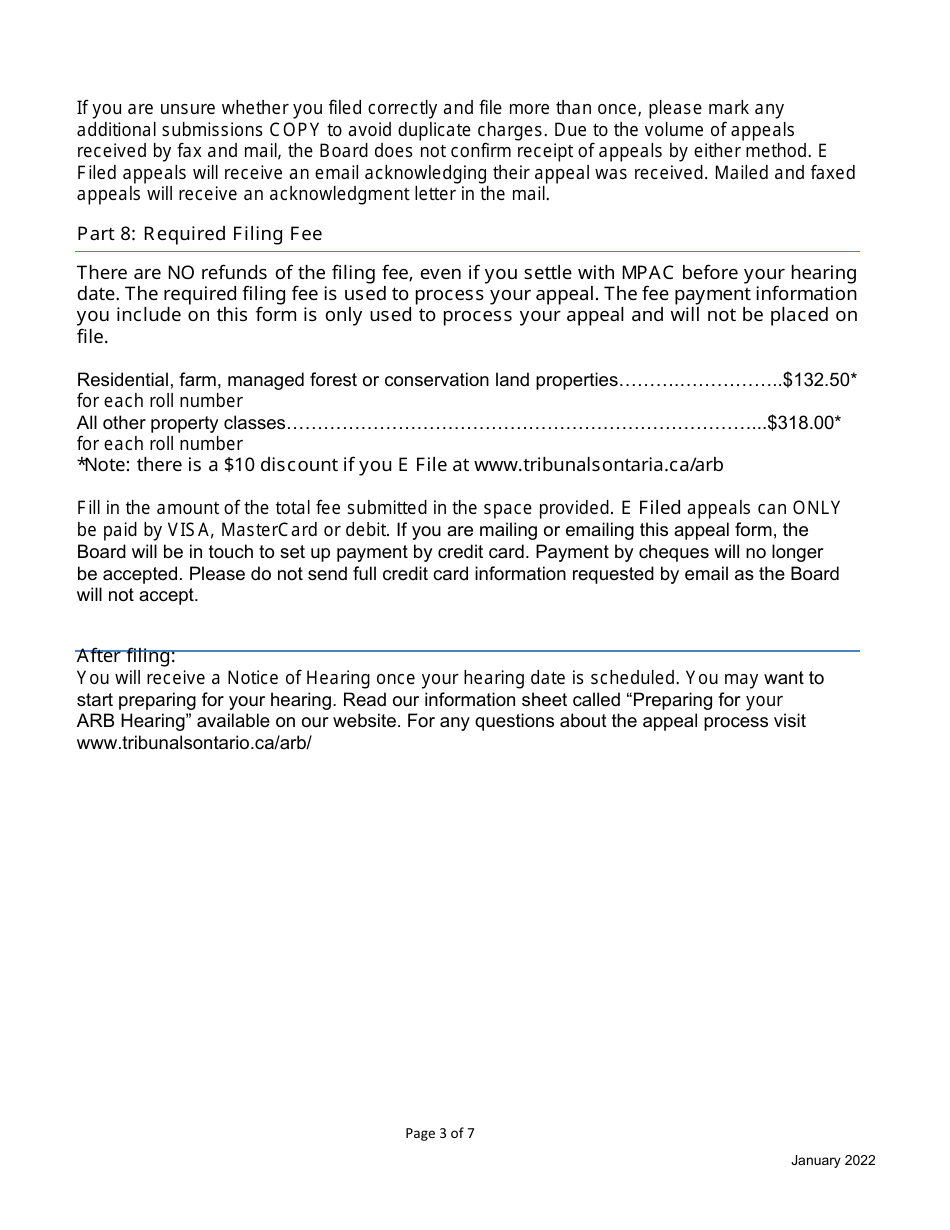

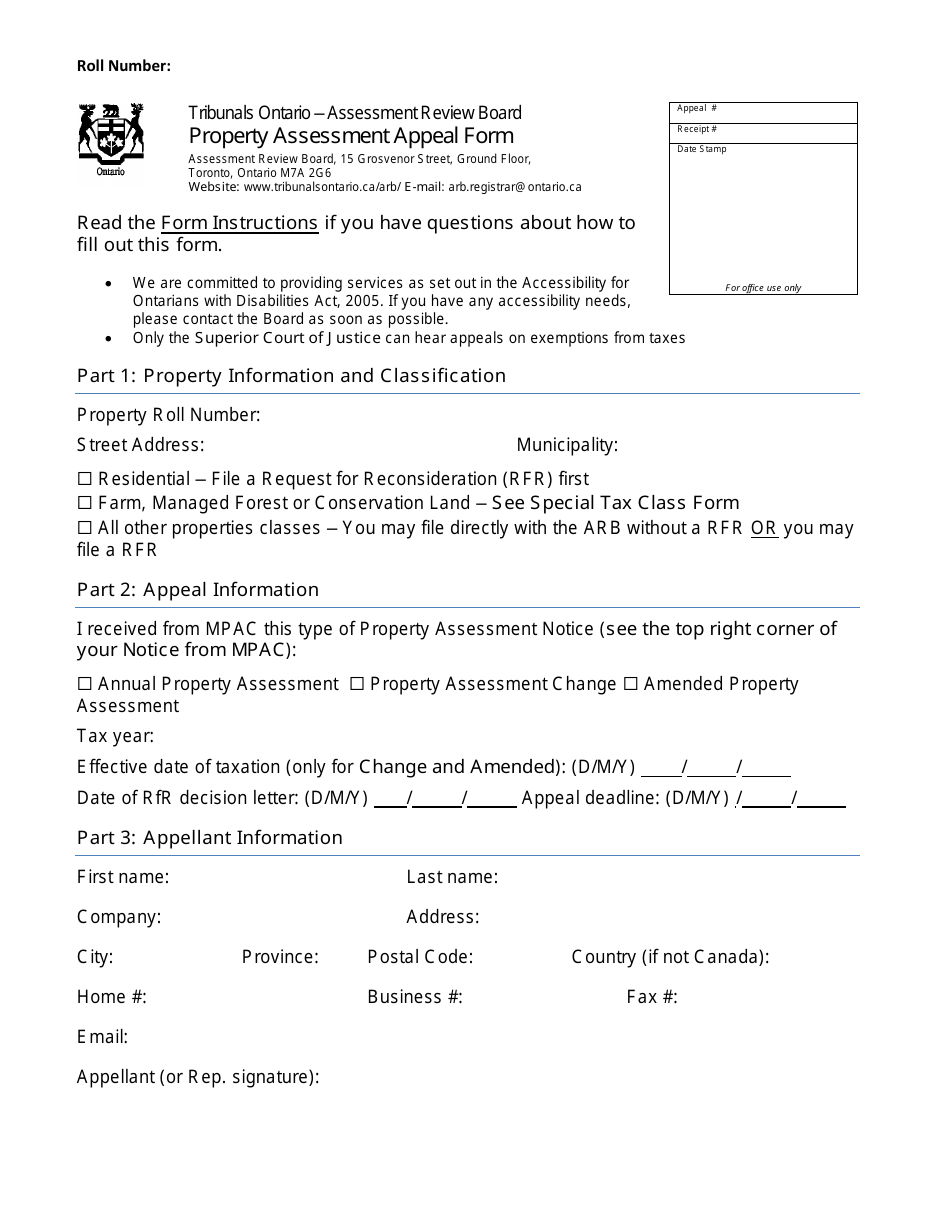

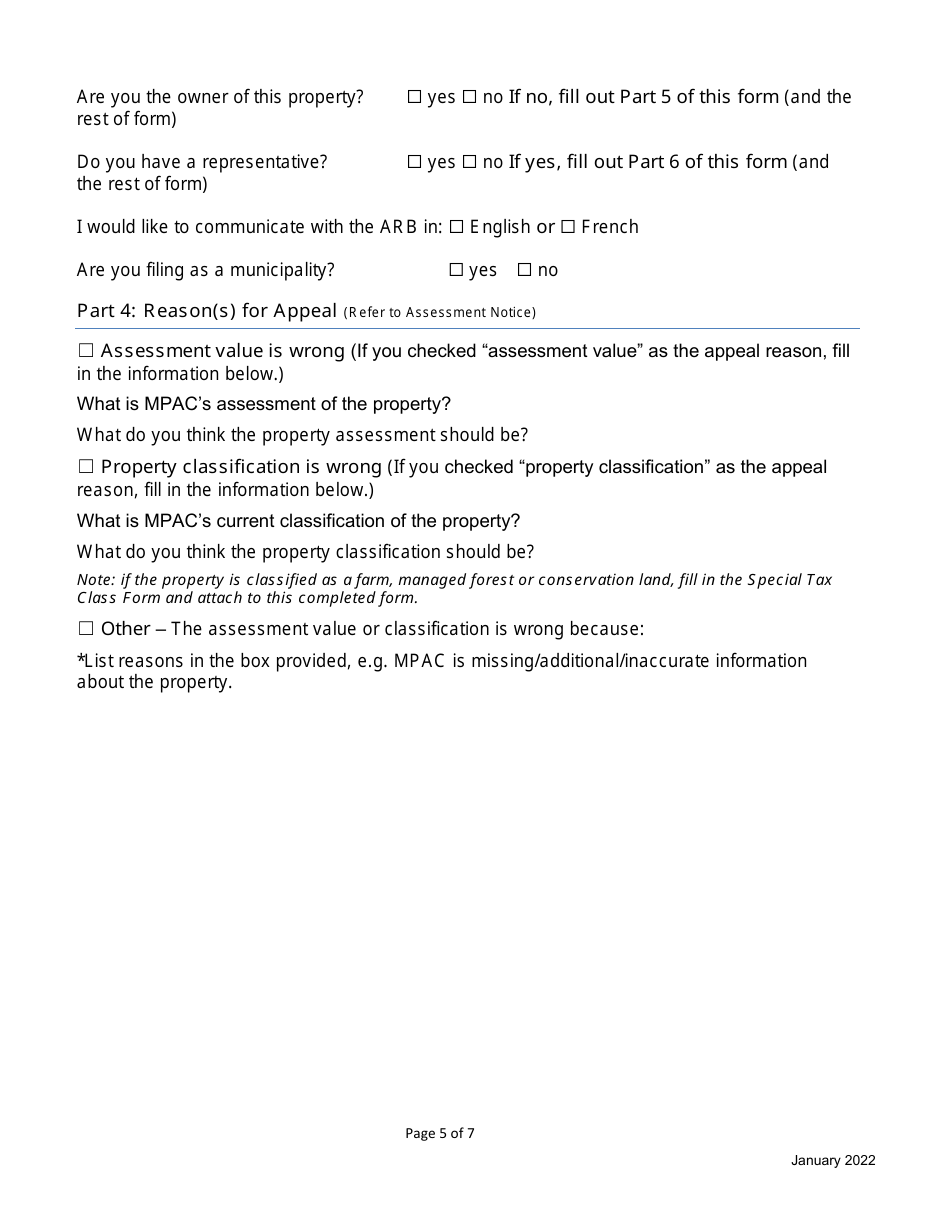

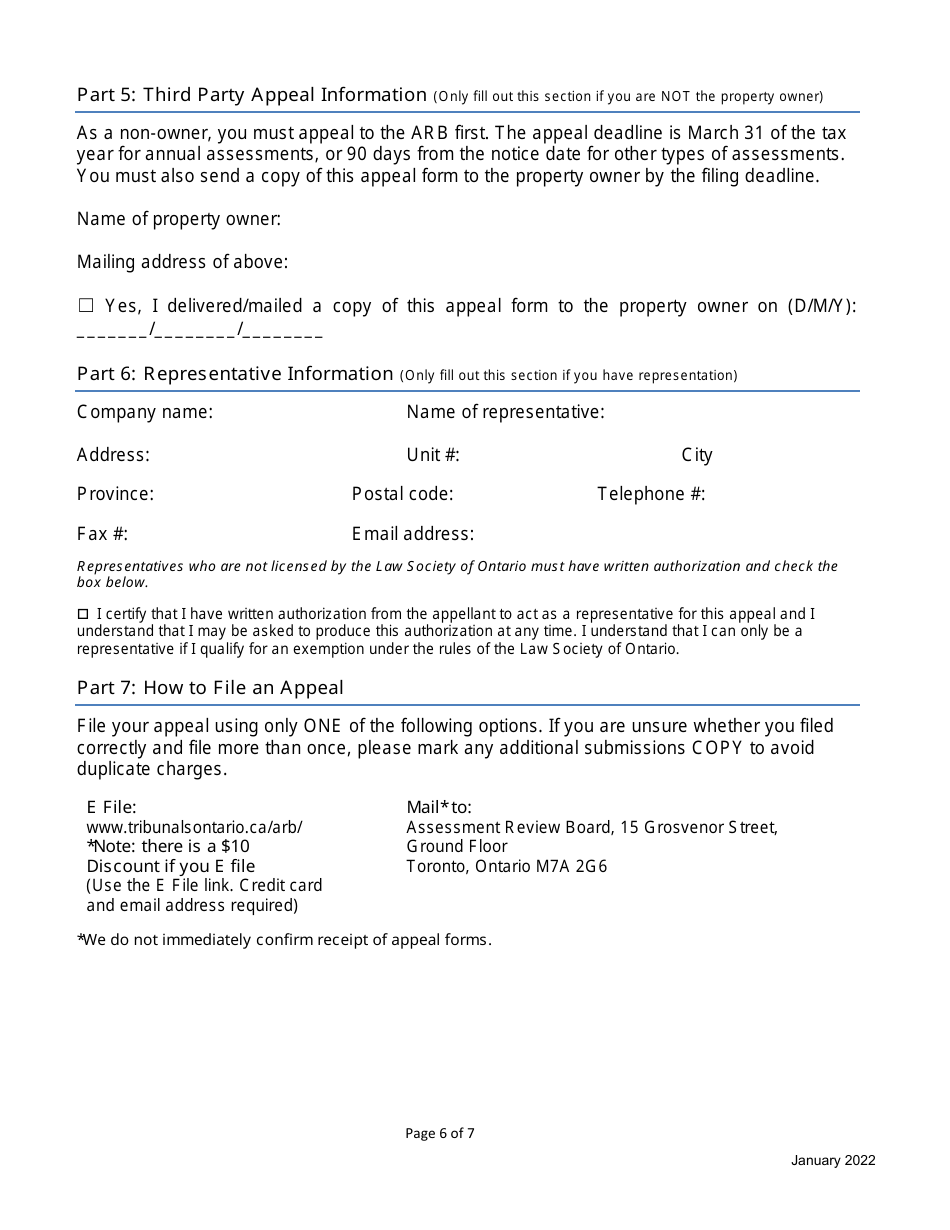

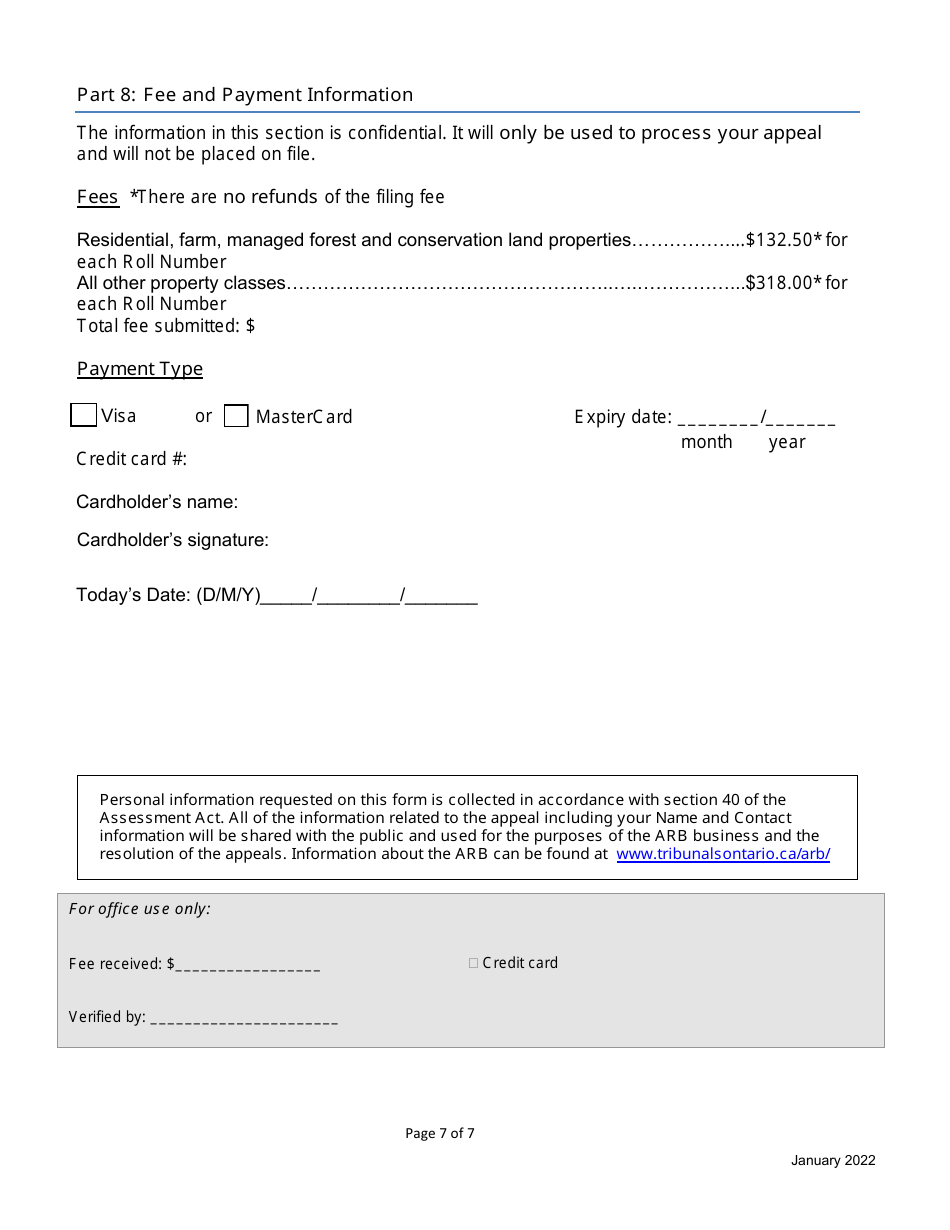

Property Assessment Appeal Form - Ontario, Canada

The Property Assessment Appeal Form in Ontario, Canada is used for appealing the assessed value of a property for tax purposes. If a property owner believes that the assessment is incorrect or unfair, they can fill out this form to request a reassessment.

In Ontario, Canada, the property owner typically files the Property Assessment Appeal Form.

FAQ

Q: Why would I need to file a property assessment appeal form?

A: You may need to file a property assessment appeal form if you believe that the assessed value of your property is inaccurate or unfair.

Q: What information do I need to provide on the property assessment appeal form?

A: You will need to provide details about your property, such as the address, assessment roll number, and reasons for your appeal.

Q: Is there a deadline for submitting a property assessment appeal form?

A: Yes, there is a deadline for submitting a property assessment appeal form. The deadline is typically within 120 days of the date of your assessment notice.

Q: What happens after I submit a property assessment appeal form?

A: After you submit a property assessment appeal form, your appeal will be reviewed by the Assessment Review Board (ARB) or the Assessment Review Tribunal (ART), depending on the type of property.

Q: Can I represent myself during the property assessment appeal process?

A: Yes, you can represent yourself during the property assessment appeal process. However, you also have the option to hire a representative, such as a lawyer or a property tax consultant.

Q: What is the purpose of a property assessment appeal?

A: The purpose of a property assessment appeal is to ensure that your property is assessed accurately and fairly, which can affect your property taxes.

Q: What are some common reasons for filing a property assessment appeal?

A: Some common reasons for filing a property assessment appeal include significant changes to your property, errors in the assessment process, or discrepancies in comparable properties.

Q: Will filing a property assessment appeal guarantee a reduction in my property taxes?

A: Filing a property assessment appeal does not guarantee a reduction in your property taxes. The outcome of your appeal will depend on the evidence and arguments presented.

Q: Can I still file a property assessment appeal if I have missed the deadline?

A: If you have missed the deadline for filing a property assessment appeal, you may still be able to file a late appeal with the permission of the ARB or the ART.