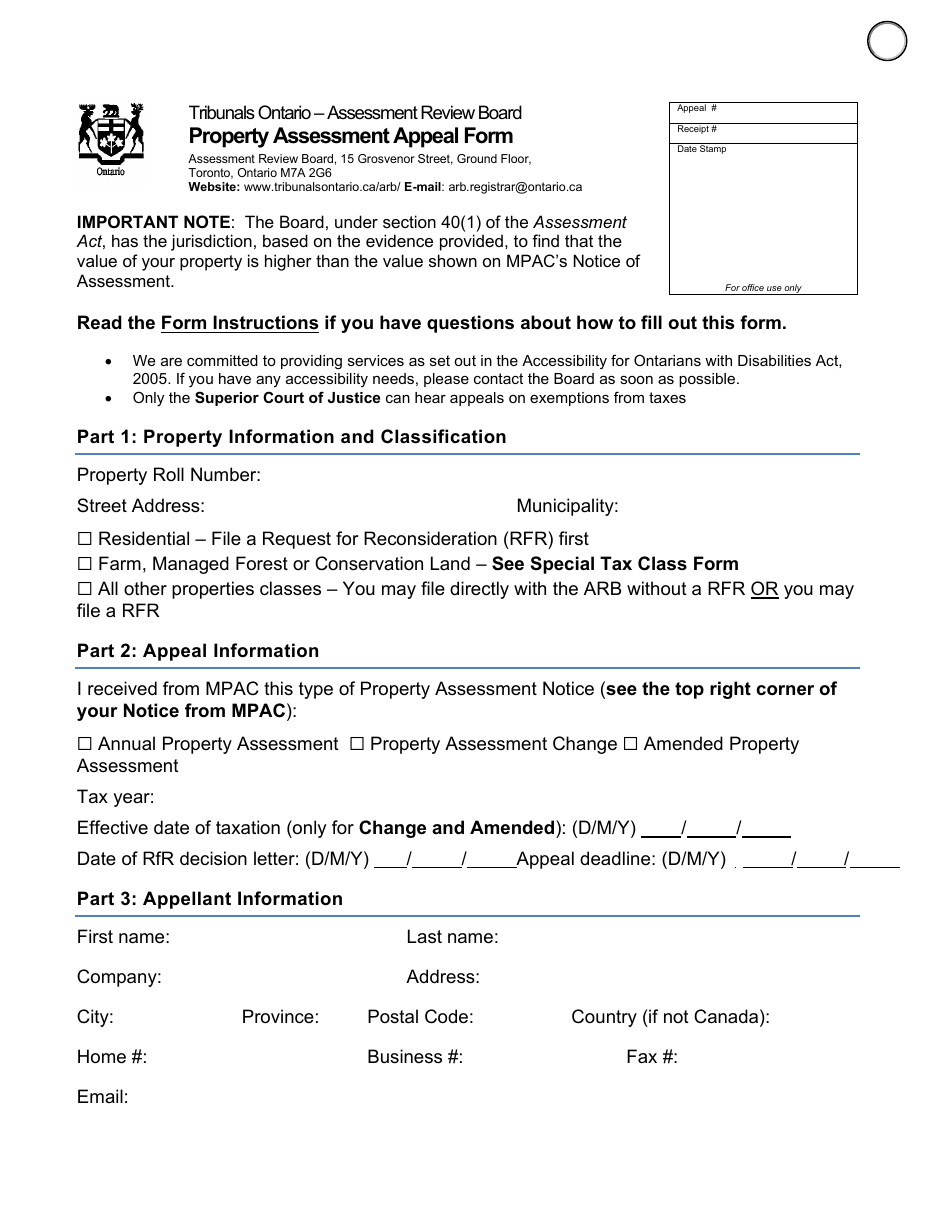

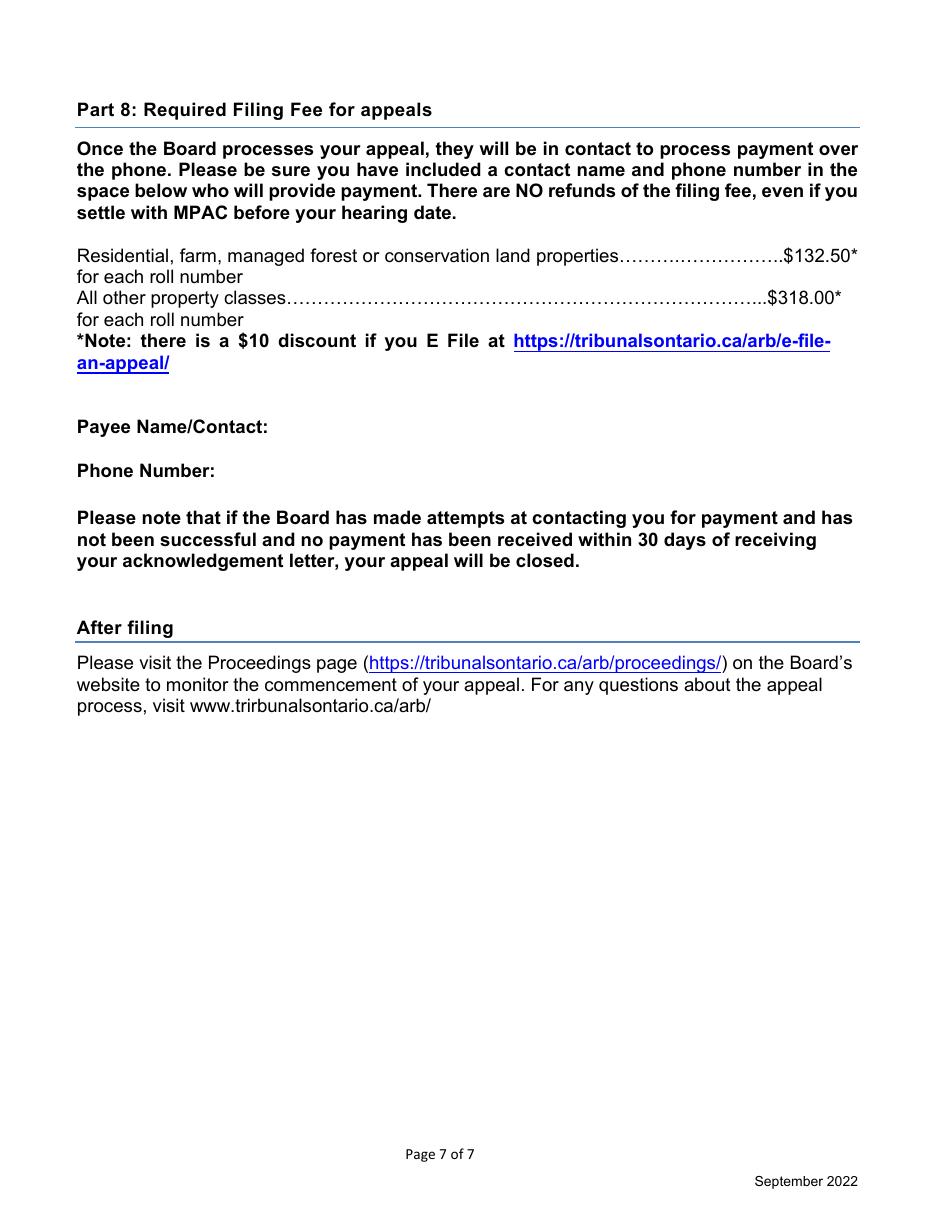

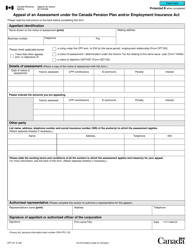

Property Assessment Appeal Form - Ontario, Canada

The Property Assessment Appeal Form in Ontario, Canada is used to request a review of the assessment value assigned to a property for property tax purposes. It allows property owners to challenge the assessed value if they believe it is incorrect or unfair.

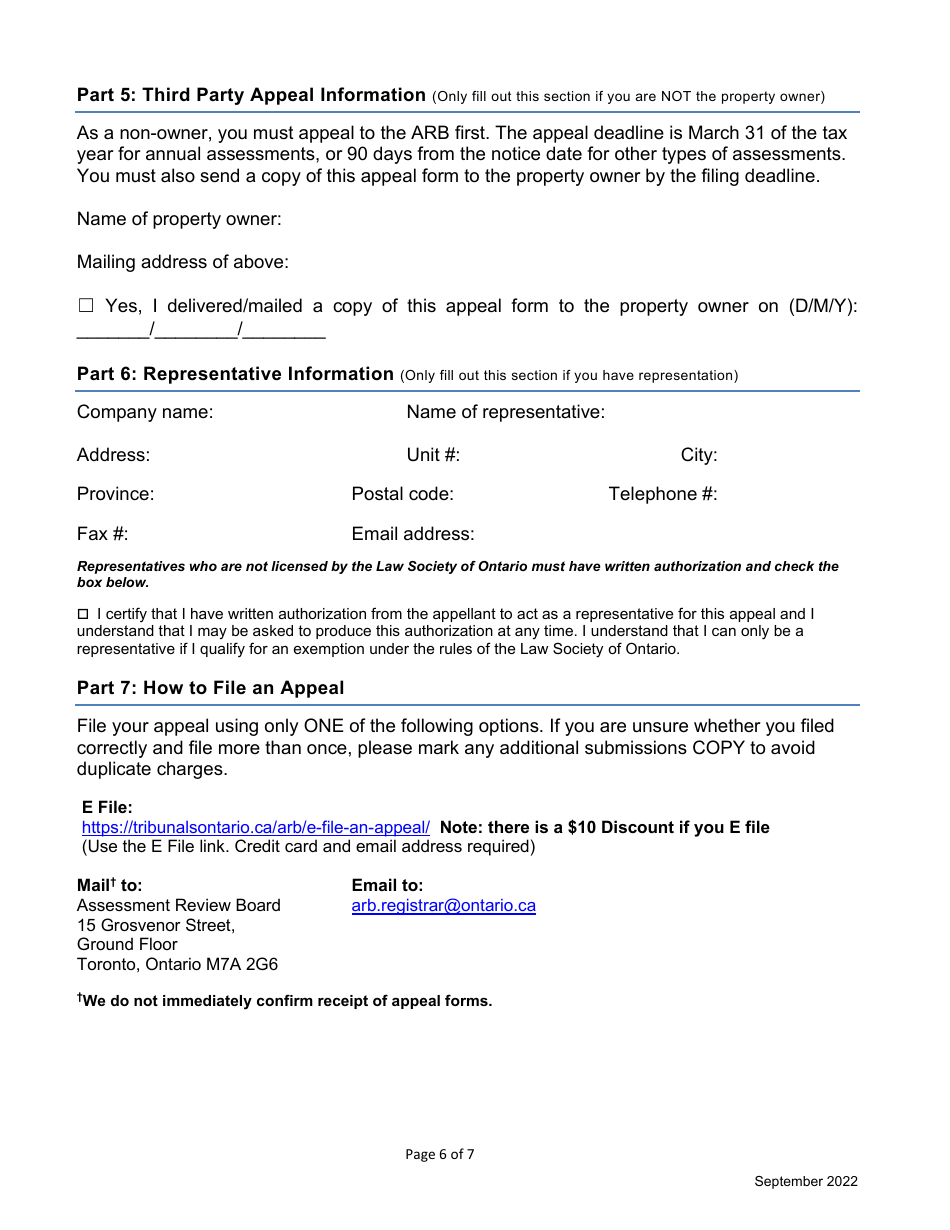

In Ontario, Canada, the property assessment appeal form is typically filed by the property owner or their authorized representative.

Property Assessment Appeal Form - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is a property assessment appeal form?

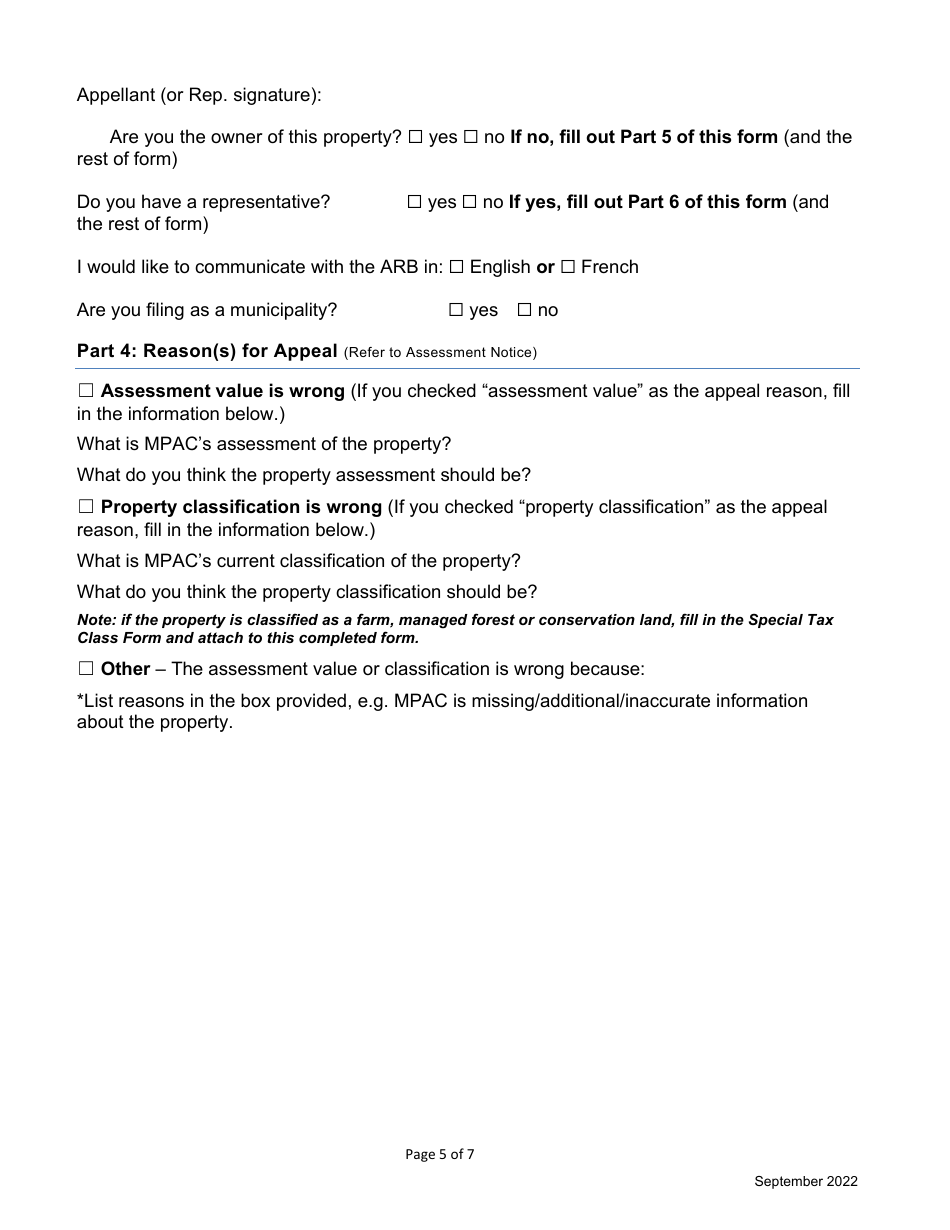

A: A property assessment appeal form is a document that allows property owners in Ontario, Canada, to challenge the assessed value of their property for tax or assessment purposes.

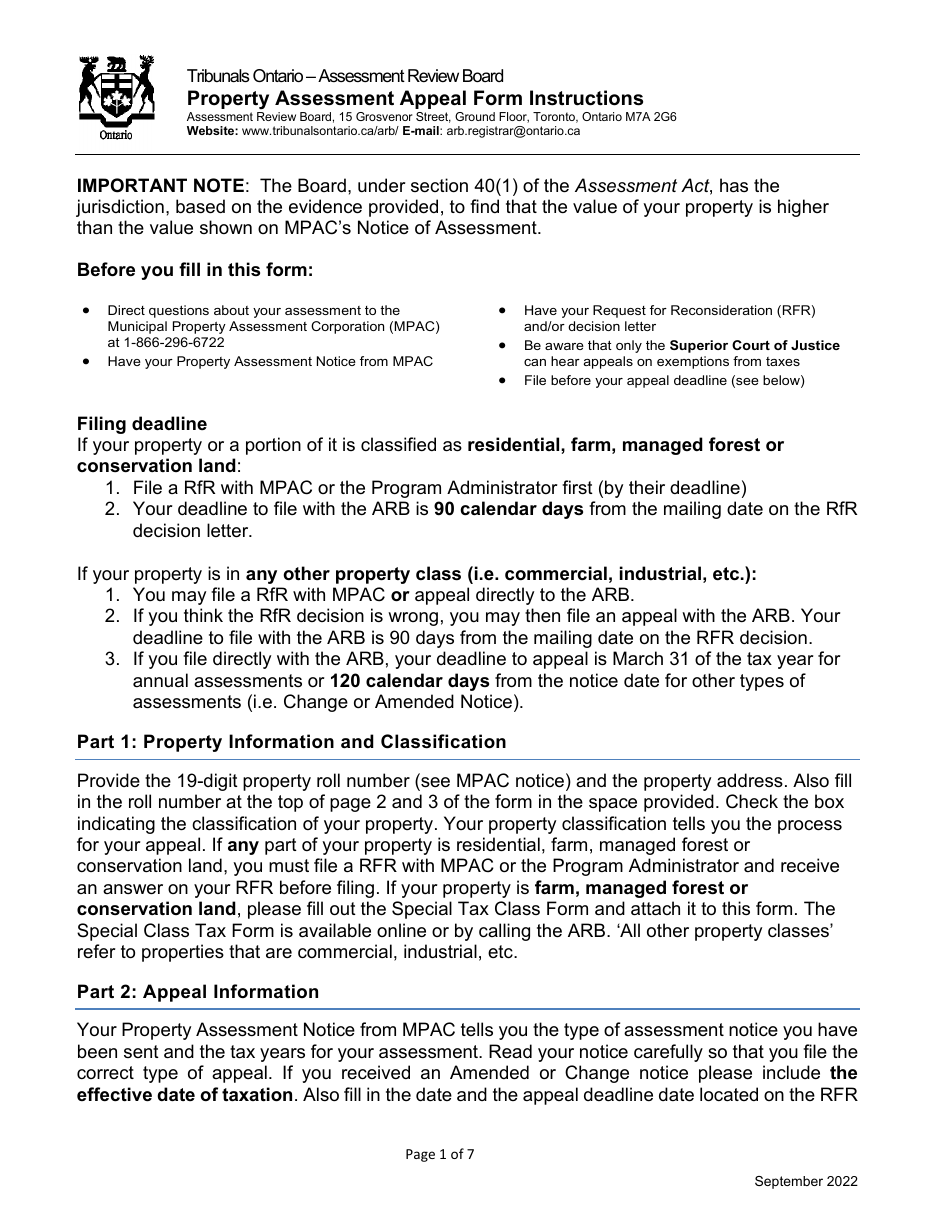

Q: What information do I need to provide on the property assessment appeal form?

A: On the property assessment appeal form, you will typically need to provide details about your property, such as the address, the reason for the appeal, and any supporting evidence or documentation.

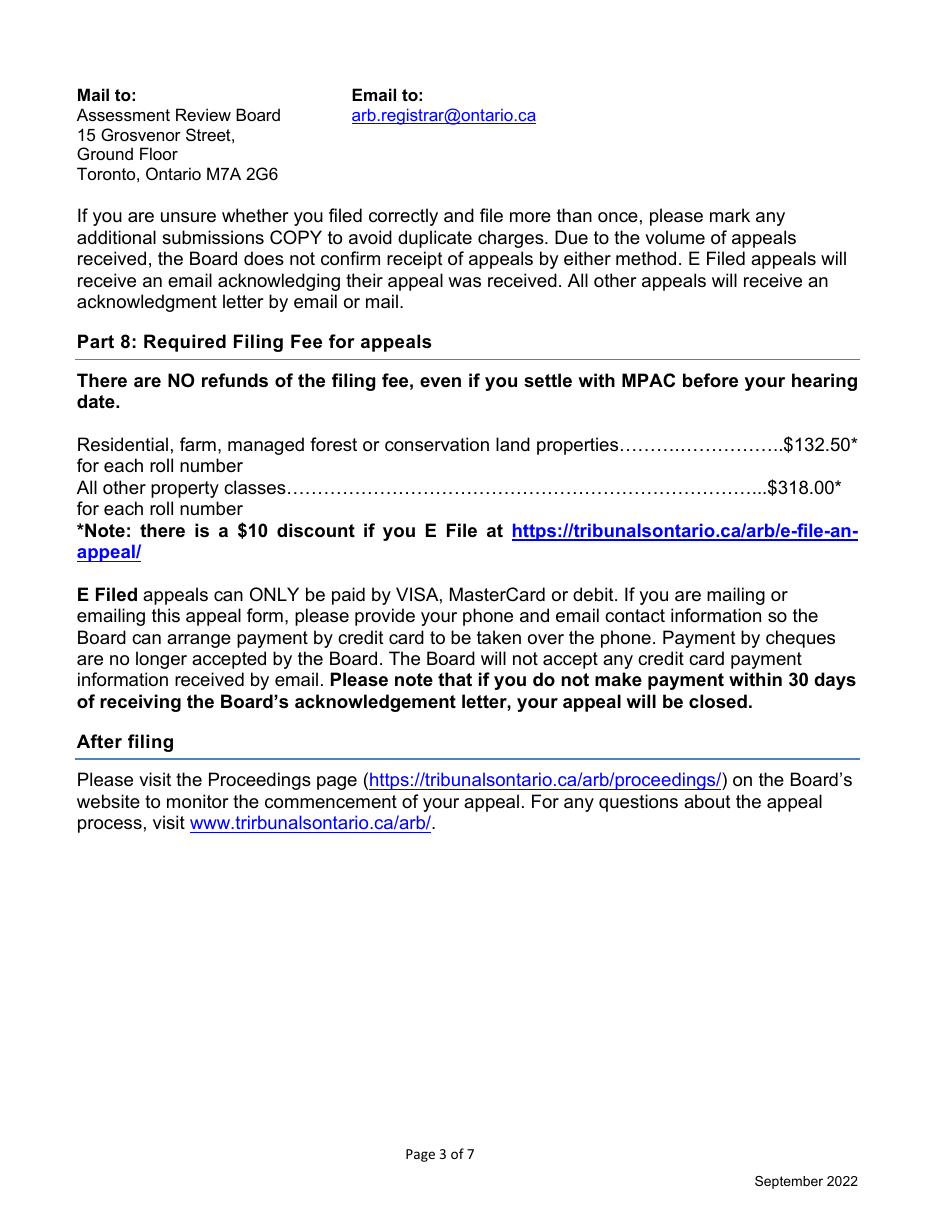

Q: What should I do after I complete the property assessment appeal form?

A: After completing the property assessment appeal form, you should submit it to the appropriate office indicated on the form, along with any required supporting documents. Make sure to keep a copy of the form for your records.

Q: Is there a deadline for submitting a property assessment appeal form in Ontario?

A: Yes, there is typically a deadline for submitting a property assessment appeal form in Ontario. The specific deadline will be indicated on the form or can be obtained from the Municipal Property Assessment Corporation (MPAC).

Q: Can I appeal my property assessment every year?

A: Yes, you can appeal your property assessment every year if you believe there are valid reasons to do so. However, keep in mind that there may be specific requirements and deadlines for each appeal.

Q: How long does it take to receive a decision on a property assessment appeal?

A: The amount of time it takes to receive a decision on a property assessment appeal can vary. It depends on factors such as the volume of appeals being processed and the complexity of the case. It is best to contact the appropriate office for an estimate.

Q: What happens if my property assessment appeal is successful?

A: If your property assessment appeal is successful, the assessed value of your property may be adjusted, which can impact your property taxes or other assessments. You will be notified of the decision and any resulting changes.

Q: What happens if my property assessment appeal is denied?

A: If your property assessment appeal is denied, the assessed value of your property will remain unchanged. You may have the option to further appeal the decision through a designated tribunal or court, depending on the circumstances.

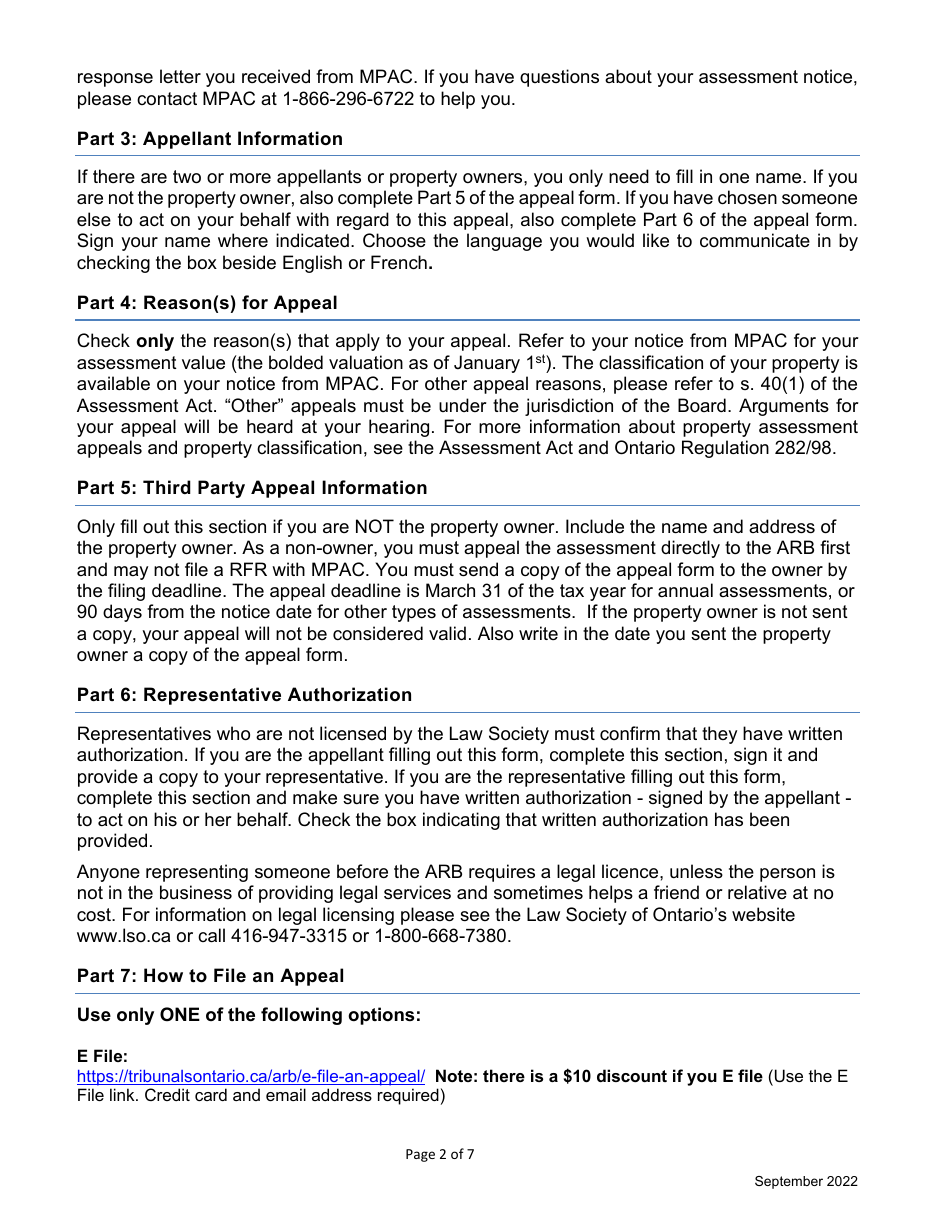

Q: Can I hire a professional to help me with my property assessment appeal?

A: Yes, you can hire a professional, such as a real estate appraiser or a property assessment consultant, to assist you with your property assessment appeal. They can provide guidance and expertise throughout the process.