This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-205-J

for the current year.

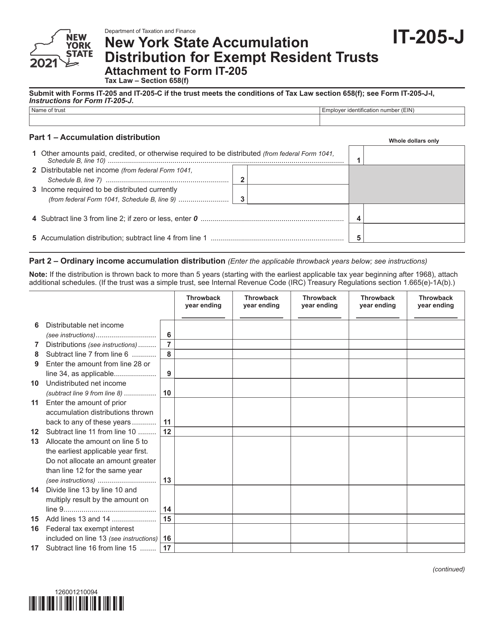

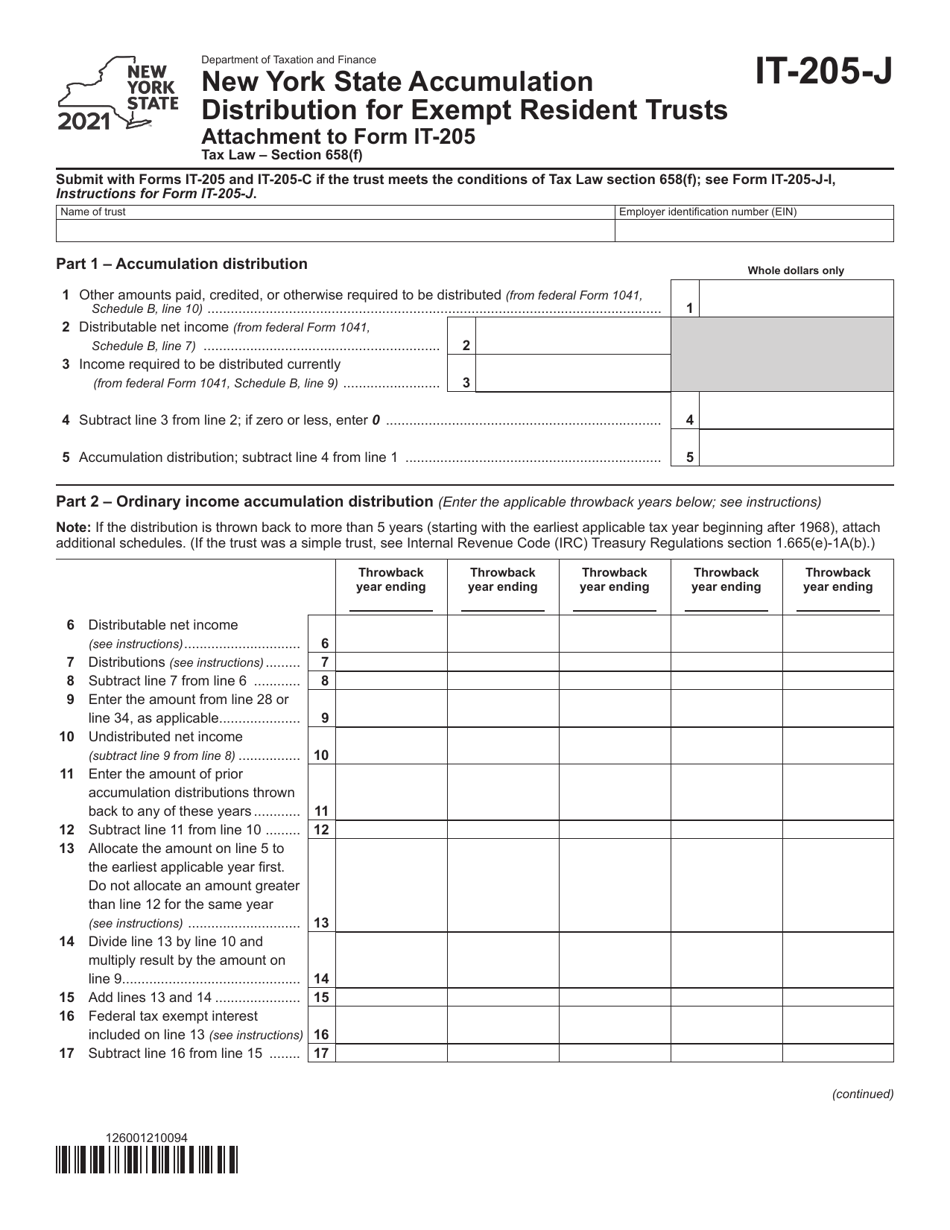

Form IT-205-J New York State Accumulation Distribution for Exempt Resident Trusts - New York

What Is Form IT-205-J?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-205-J?

A: Form IT-205-J is a New York State tax form that is used to report accumulation distribution for exempt resident trusts in New York.

Q: Who needs to file Form IT-205-J?

A: Exempt resident trusts in New York who have made an accumulation distribution during the tax year need to file Form IT-205-J.

Q: What is an accumulation distribution?

A: An accumulation distribution is the amount distributed to beneficiaries of a trust that represents the undistributed net income of the trust from prior years.

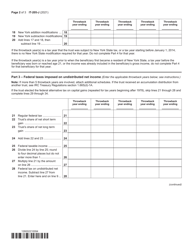

Q: When is Form IT-205-J due?

A: Form IT-205-J is due on or before March 15th of the year following the tax year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-J by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.