This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-205-J

for the current year.

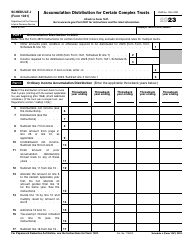

Instructions for Form IT-205-J New York State Accumulation Distribution for Exempt Resident Trusts - New York

This document contains official instructions for Form IT-205-J , New York State Accumulation Distribution for Exempt Resident Trusts - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-205-J is available for download through this link.

FAQ

Q: What is Form IT-205-J?

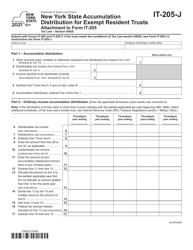

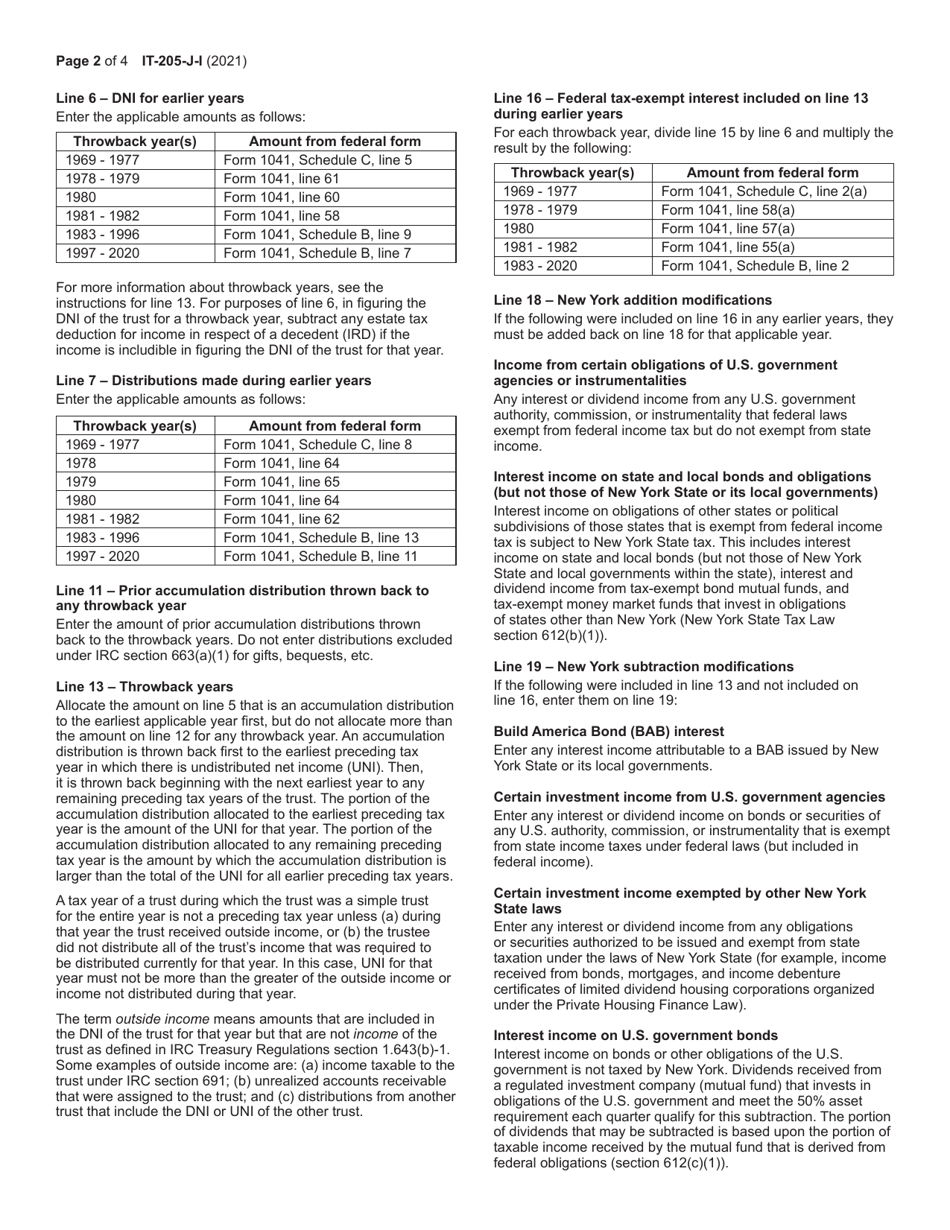

A: Form IT-205-J is a specific tax form used in New York State for reporting accumulation distributions of exempt resident trusts.

Q: Who needs to file Form IT-205-J?

A: Exempt resident trusts in New York State that have made accumulation distributions are required to file this form.

Q: What are accumulation distributions?

A: Accumulation distributions are the portions of trust income that have been accumulated or retained by the trust instead of being distributed to beneficiaries.

Q: When is the deadline for filing Form IT-205-J?

A: The deadline for filing Form IT-205-J is usually April 15th, unless it falls on a weekend or holiday, in which case it would be the next business day.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing. It is important to file the form by the deadline to avoid any potential penalties or interest charges.

Q: Do I need to include any supporting documents with Form IT-205-J?

A: Yes, you may need to include certain supporting documents, such as schedules and attachments, depending on the specifics of your trust and the accumulation distributions.

Q: Can I e-file Form IT-205-J?

A: No, you cannot e-file Form IT-205-J. It must be filed by mail to the address specified in the form instructions.

Q: How can I get help with filling out Form IT-205-J?

A: You can refer to the instructions provided with the form or contact the New York State Department of Taxation and Finance for assistance.

Q: Is there a fee for filing Form IT-205-J?

A: No, there is no fee for filing Form IT-205-J. It is simply a reporting requirement for exempt resident trusts in New York State.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.