This version of the form is not currently in use and is provided for reference only. Download this version of

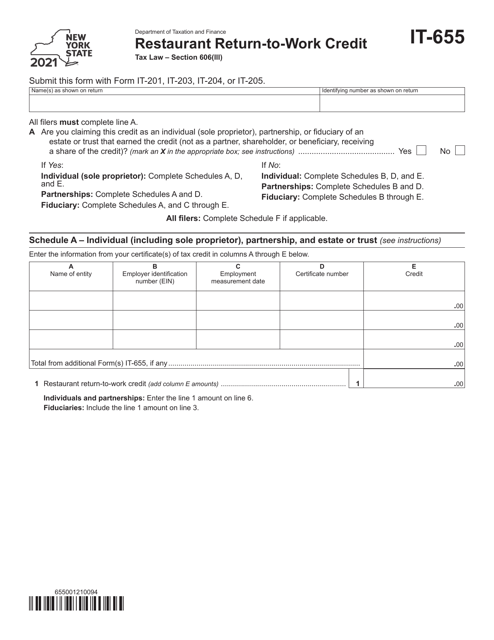

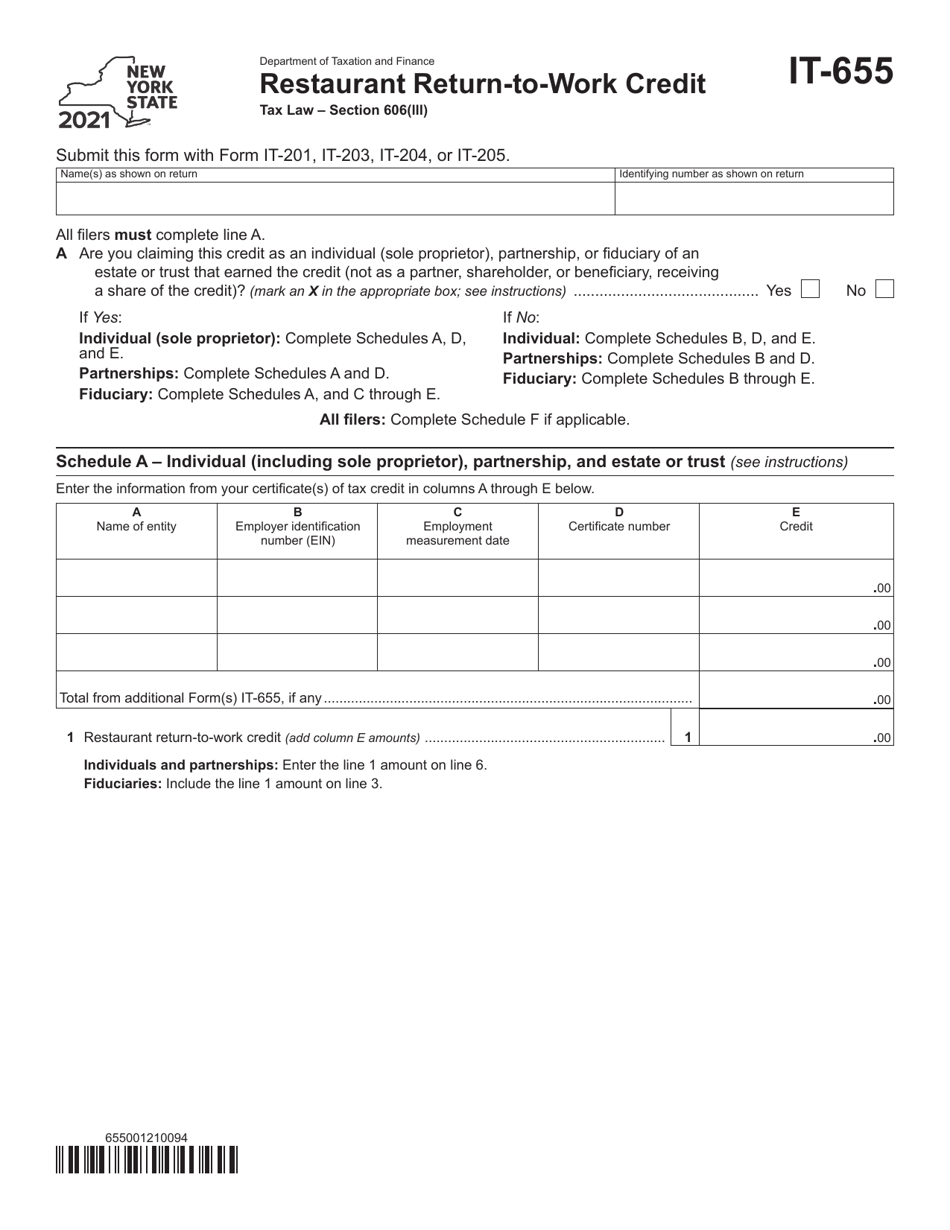

Form IT-655

for the current year.

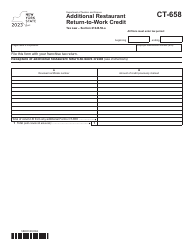

Form IT-655 Restaurant Return-To-Work Credit - New York

What Is Form IT-655?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-655?

A: Form IT-655 is the Restaurant Return-To-Work Credit form in New York.

Q: What is the purpose of Form IT-655?

A: Form IT-655 is used to claim the Restaurant Return-To-Work Credit in New York.

Q: Who should file Form IT-655?

A: Restaurants in New York that meet the eligibility criteria should file Form IT-655.

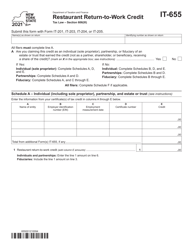

Q: What is the eligibility criteria for the Restaurant Return-To-Work Credit?

A: To be eligible, the restaurant must have experienced a reduction in employment and generate annual receipts of $1,000,000 or less.

Q: How much is the Restaurant Return-To-Work Credit?

A: The credit is equal to 10% of the return-to-work training costs incurred by the restaurant.

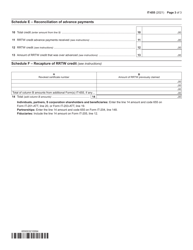

Q: Are there any deadlines for filing Form IT-655?

A: Yes, the deadline to file Form IT-655 is July 1, 2023.

Q: Can I claim the credit if I am a restaurant outside of New York?

A: No, the Restaurant Return-To-Work Credit is specific to restaurants in New York only.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-655 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.