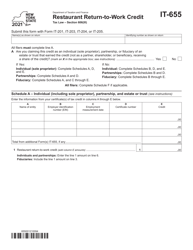

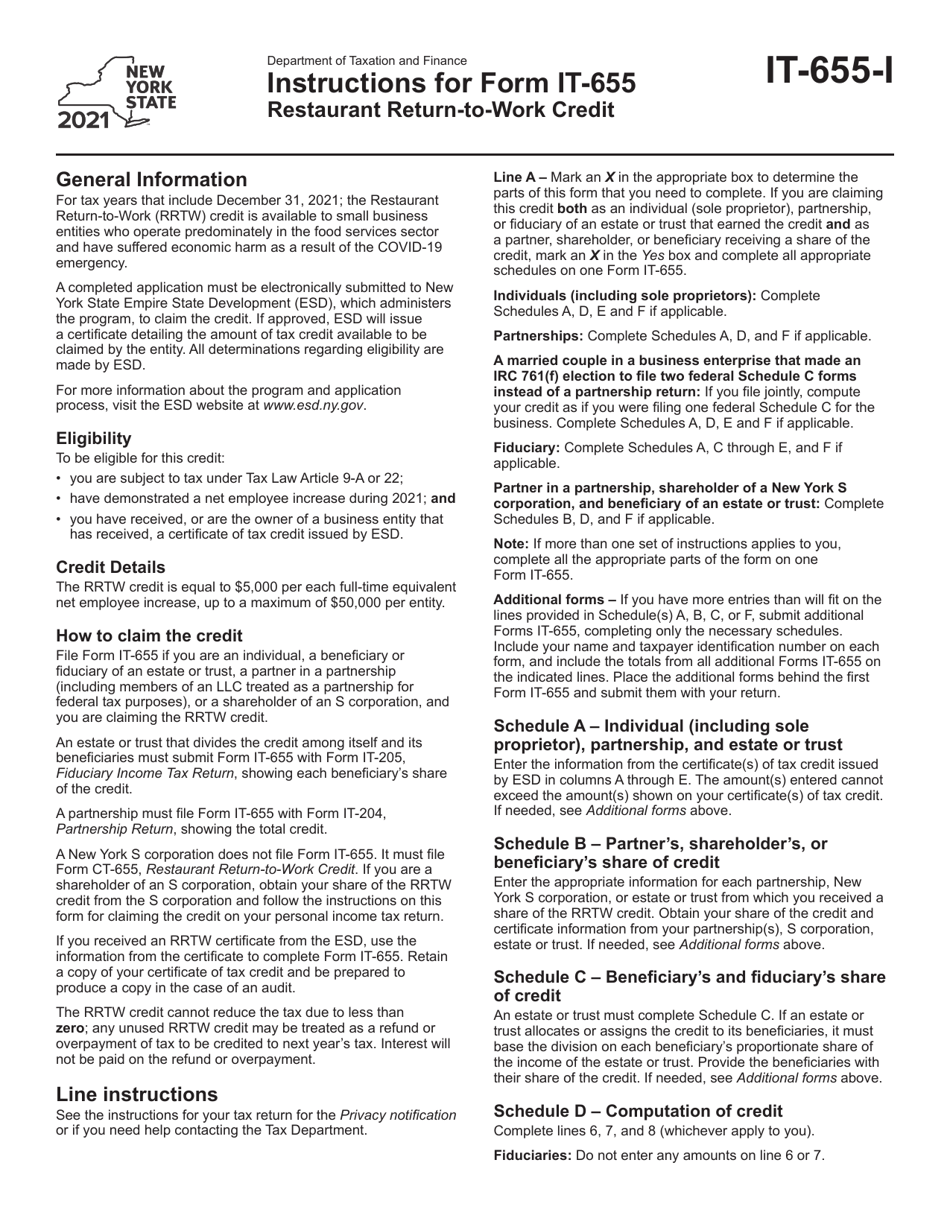

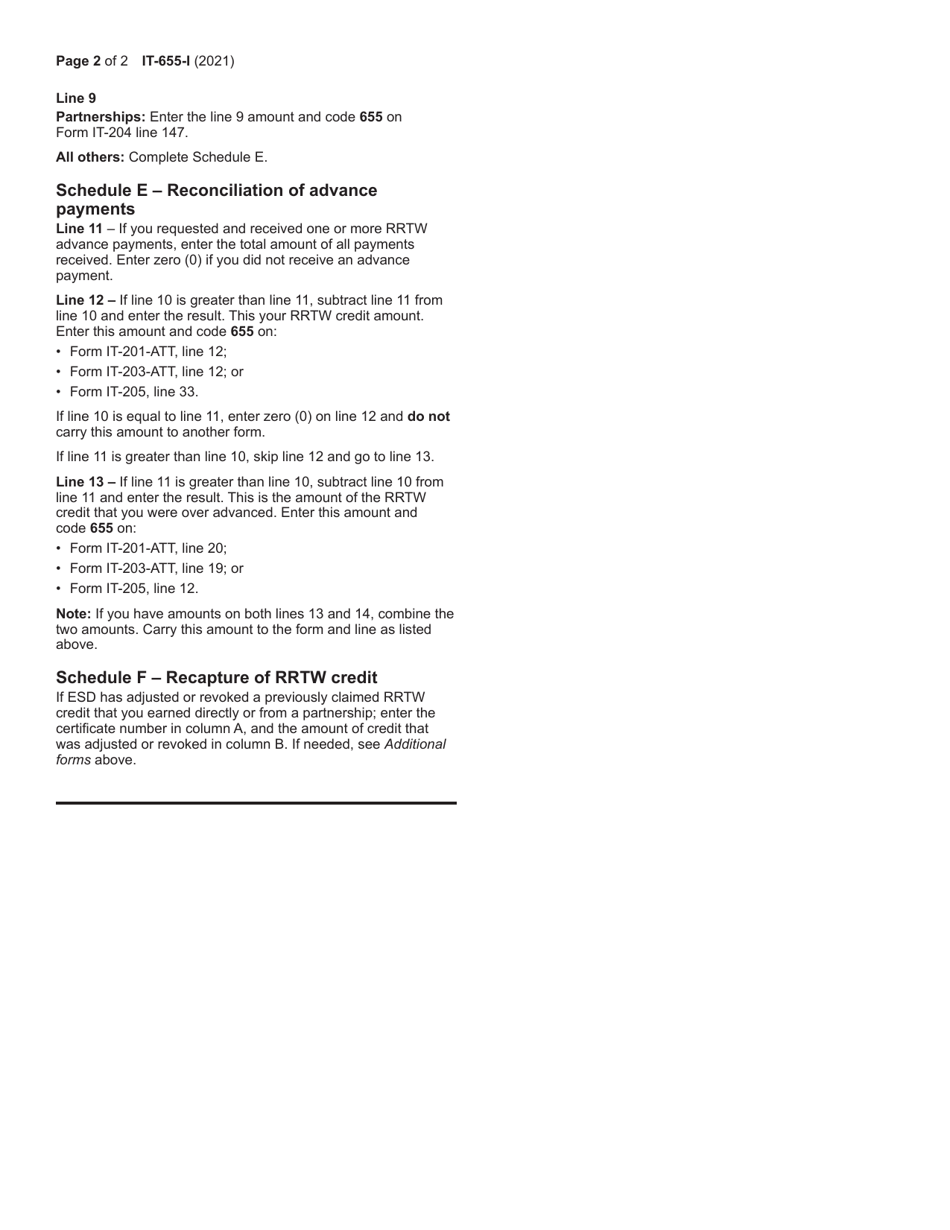

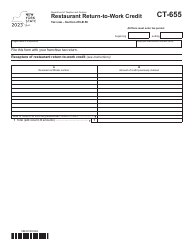

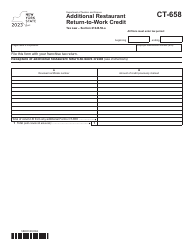

Instructions for Form IT-655 Restaurant Return-To-Work Credit - New York

This document contains official instructions for Form IT-655 , Restaurant Return-To-Work Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-655 is available for download through this link.

FAQ

Q: What is Form IT-655?

A: Form IT-655 is a tax form used to claim the Restaurant Return-To-Work Credit in New York.

Q: Who is eligible to claim the Restaurant Return-To-Work Credit?

A: Eligible taxpayers include restaurants, bars, food trucks, and other establishments that prepare and sell food or beverages.

Q: What is the purpose of the Restaurant Return-To-Work Credit?

A: The credit is designed to provide financial relief to these establishments that have been impacted by the COVID-19 pandemic.

Q: What expenses can be used to claim the credit?

A: Qualified expenses include wages paid to employees hired on or after March 1, 2021, as well as costs related to personal protective equipment (PPE) and technology upgrades.

Q: How much is the credit?

A: The credit is equal to 25% of qualified expenses, up to a maximum of $5,000 per eligible employee.

Q: Is there a deadline to file Form IT-655?

A: Yes, the form must be filed by January 15, 2022.

Q: Can the Restaurant Return-To-Work Credit be carried forward or refunded?

A: No, the credit cannot be carried forward or refunded.

Q: Are there any other requirements or considerations for claiming the credit?

A: Yes, taxpayers must meet certain criteria, such as maintaining employment levels and submitting required documentation.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.