This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-635

for the current year.

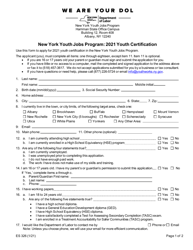

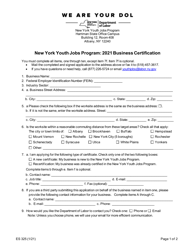

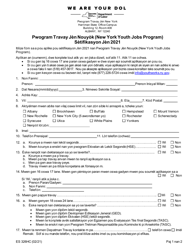

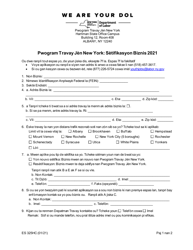

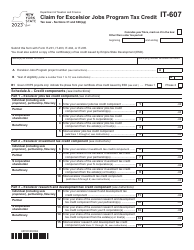

Instructions for Form IT-635 New York Youth Jobs Program Tax Credit - New York

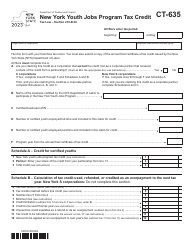

This document contains official instructions for Form IT-635 , New York Youth Jobs Program Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-635 is available for download through this link.

FAQ

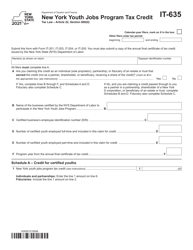

Q: What is Form IT-635?

A: Form IT-635 is a tax form specifically for claiming the New York Youth Jobs Program Tax Credit.

Q: What is the New York Youth Jobs Program Tax Credit?

A: The New York Youth Jobs Program Tax Credit is a tax credit available to businesses that hire qualified youth employees.

Q: Who is eligible for the New York Youth Jobs Program Tax Credit?

A: Businesses that hire eligible youth employees aged 16 to 24 in designated areas of New York State are eligible for the tax credit.

Q: How does the New York Youth Jobs Program Tax Credit work?

A: Businesses can claim a tax credit of up to $5,000 per eligible youth employee hired.

Q: How do I fill out Form IT-635?

A: You must provide information about the business, the number of eligible youth employees hired, and calculate the tax credit amount.

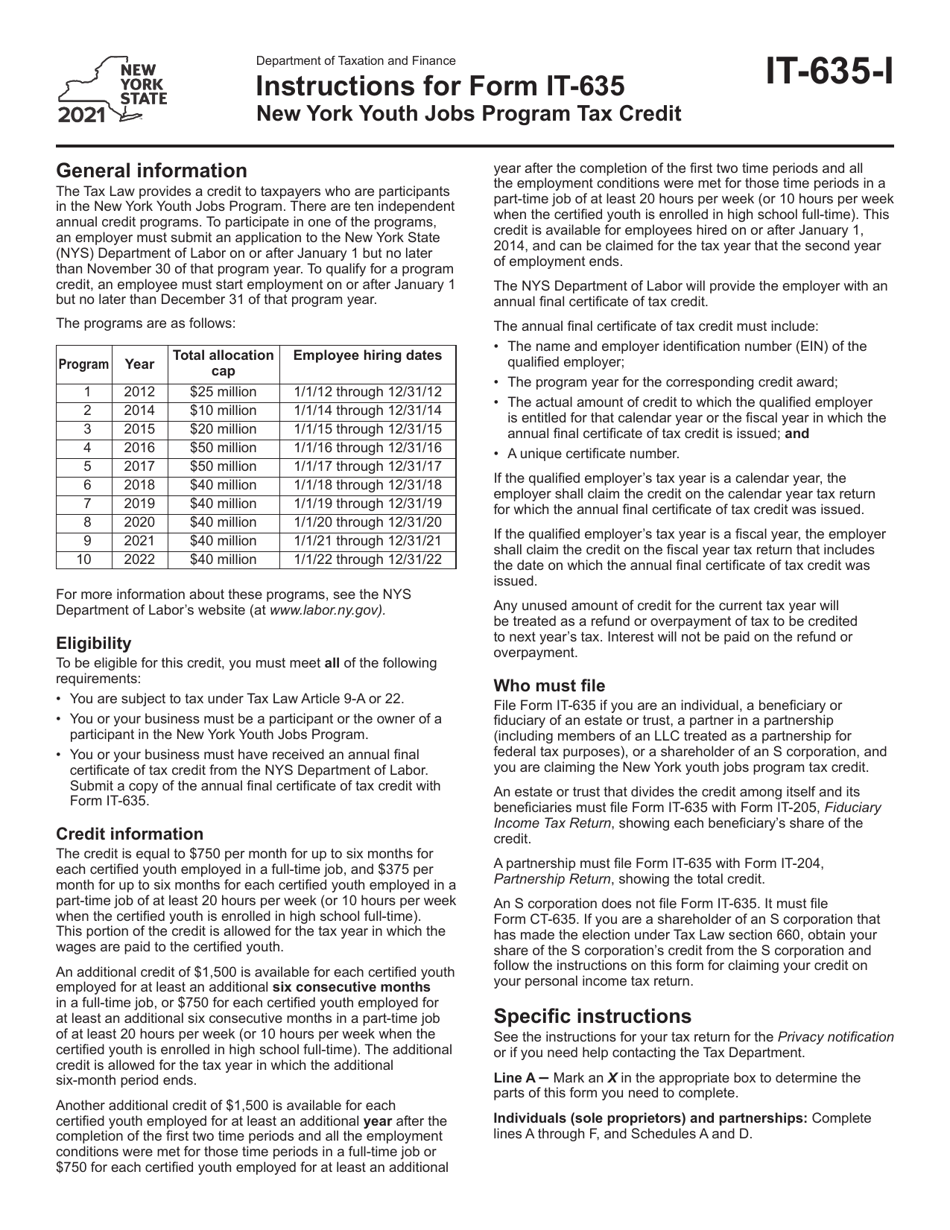

Q: When is the deadline for filing Form IT-635?

A: The deadline for filing Form IT-635 is the same as the deadline for filing your New York State corporate or personal income tax return.

Q: Is the New York Youth Jobs Program Tax Credit refundable?

A: No, the tax credit is not refundable. It can only be used to offset the business's tax liability.

Q: Are there any additional requirements or limitations for claiming the New York Youth Jobs Program Tax Credit?

A: Yes, there are additional requirements and limitations that businesses need to meet in order to claim the tax credit. These include maintaining employment levels and being in compliance with certain labor laws.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.