This version of the form is not currently in use and is provided for reference only. Download this version of

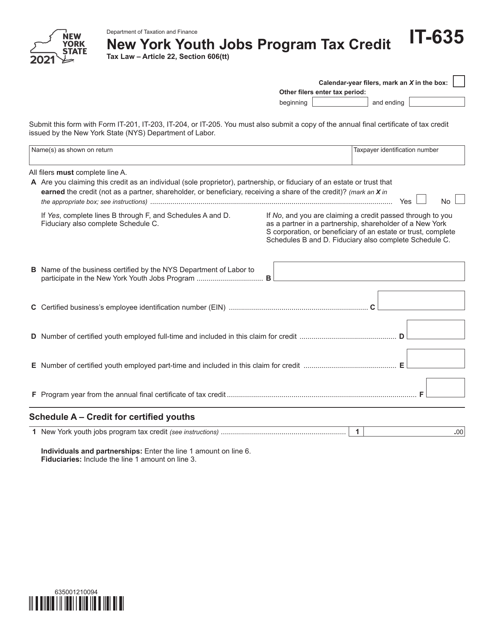

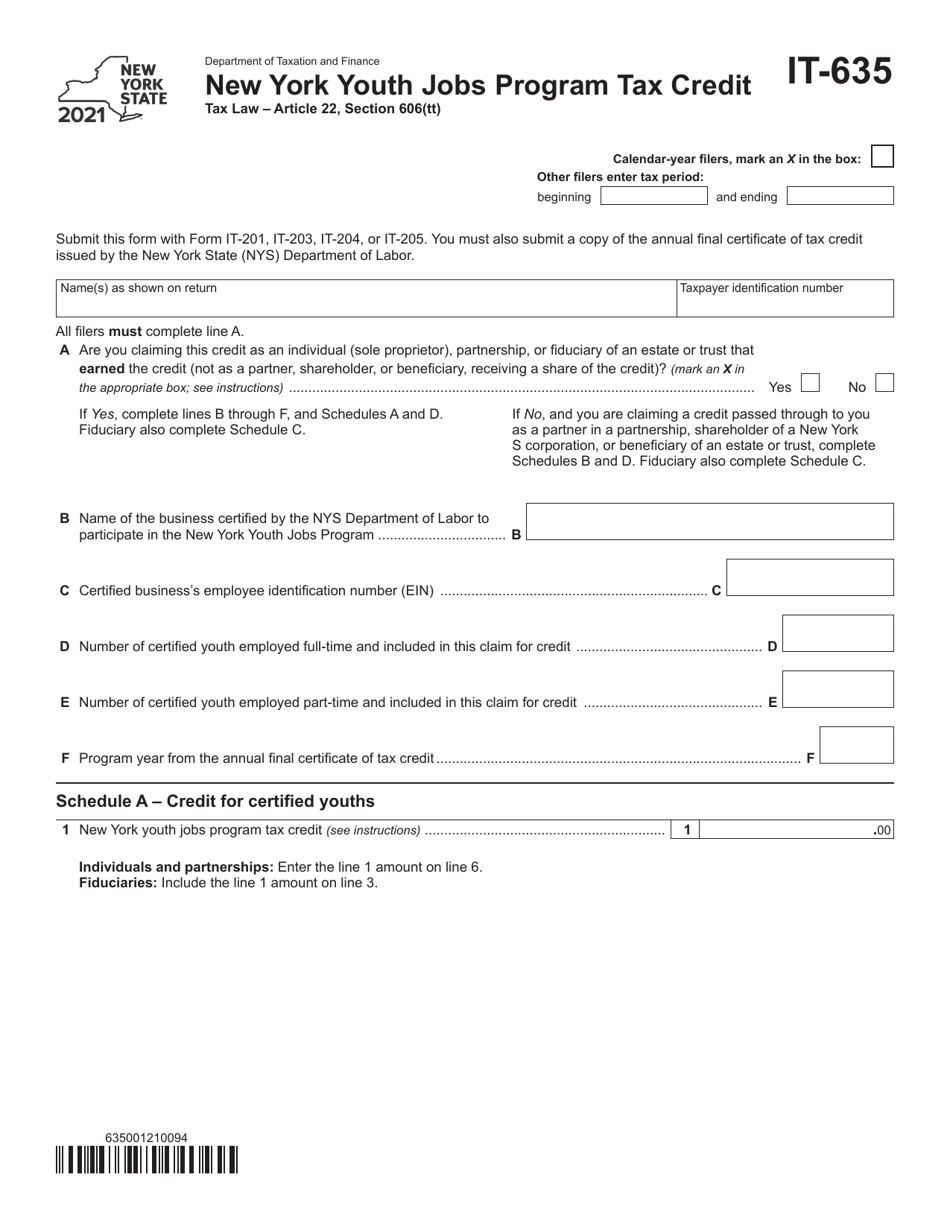

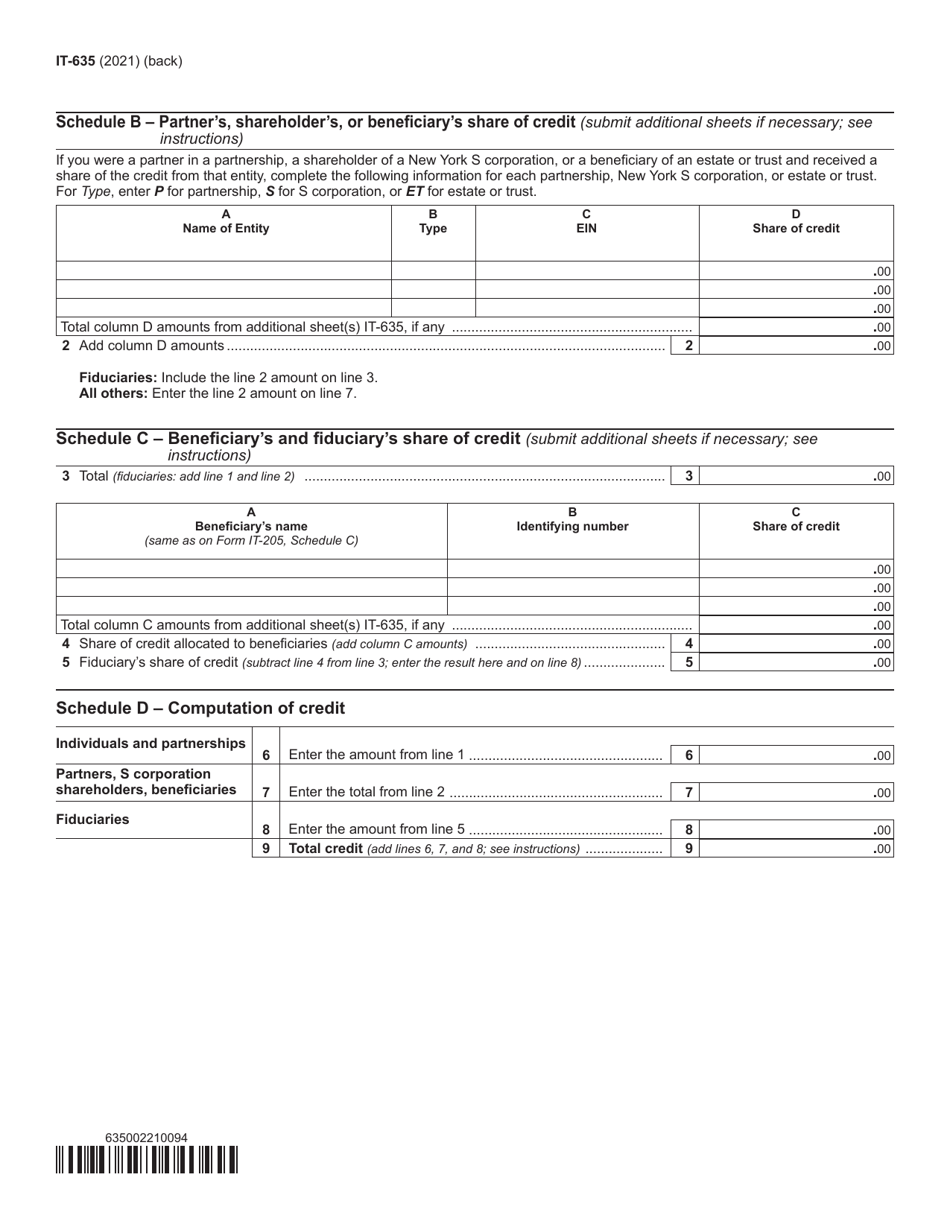

Form IT-635

for the current year.

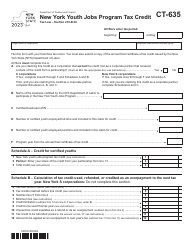

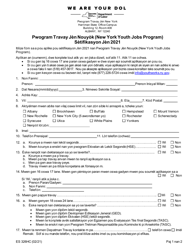

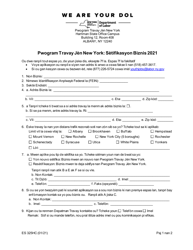

Form IT-635 New York Youth Jobs Program Tax Credit - New York

What Is Form IT-635?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-635?

A: Form IT-635 is a tax form used in New York for claiming the Youth Jobs ProgramTax Credit.

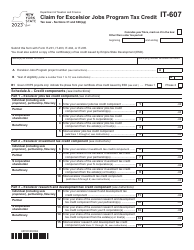

Q: What is the New York Youth Jobs Program Tax Credit?

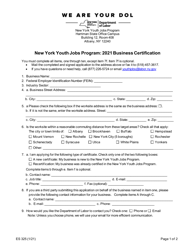

A: The New York Youth Jobs Program Tax Credit is a tax credit available for businesses that hire qualified youth in New York.

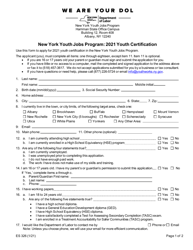

Q: Who is eligible for the New York Youth Jobs Program Tax Credit?

A: Businesses in New York that hire qualified youth between the ages of 16 and 24 may be eligible for the tax credit.

Q: What is the purpose of the New York Youth Jobs Program?

A: The New York Youth Jobs Program aims to encourage businesses to hire and train young individuals to enter the workforce.

Q: How much is the tax credit for the New York Youth Jobs Program?

A: The amount of the tax credit varies depending on the wages paid and hours worked by the qualified youth employees.

Q: When is the deadline for filing Form IT-635?

A: The deadline for filing Form IT-635 is usually the same as the deadline for filing your annual state tax return.

Q: Are there any other requirements to claim the New York Youth Jobs Program Tax Credit?

A: Yes, businesses must meet certain eligibility requirements and keep records of the qualified youth employees they hire.

Q: Can I claim the New York Youth Jobs Program Tax Credit if I hire youth from outside of New York?

A: No, the tax credit is only available for qualified youth employees hired in New York.

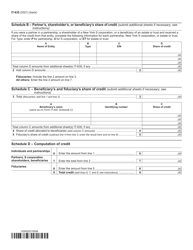

Q: What information do I need to include on Form IT-635?

A: You will need to provide details about your business, the qualified youth employees hired, and the wages and hours worked by them.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-635 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.