This version of the form is not currently in use and is provided for reference only. Download this version of

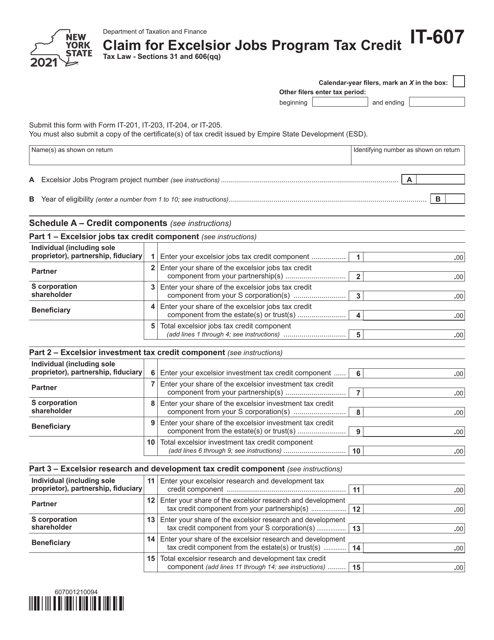

Form IT-607

for the current year.

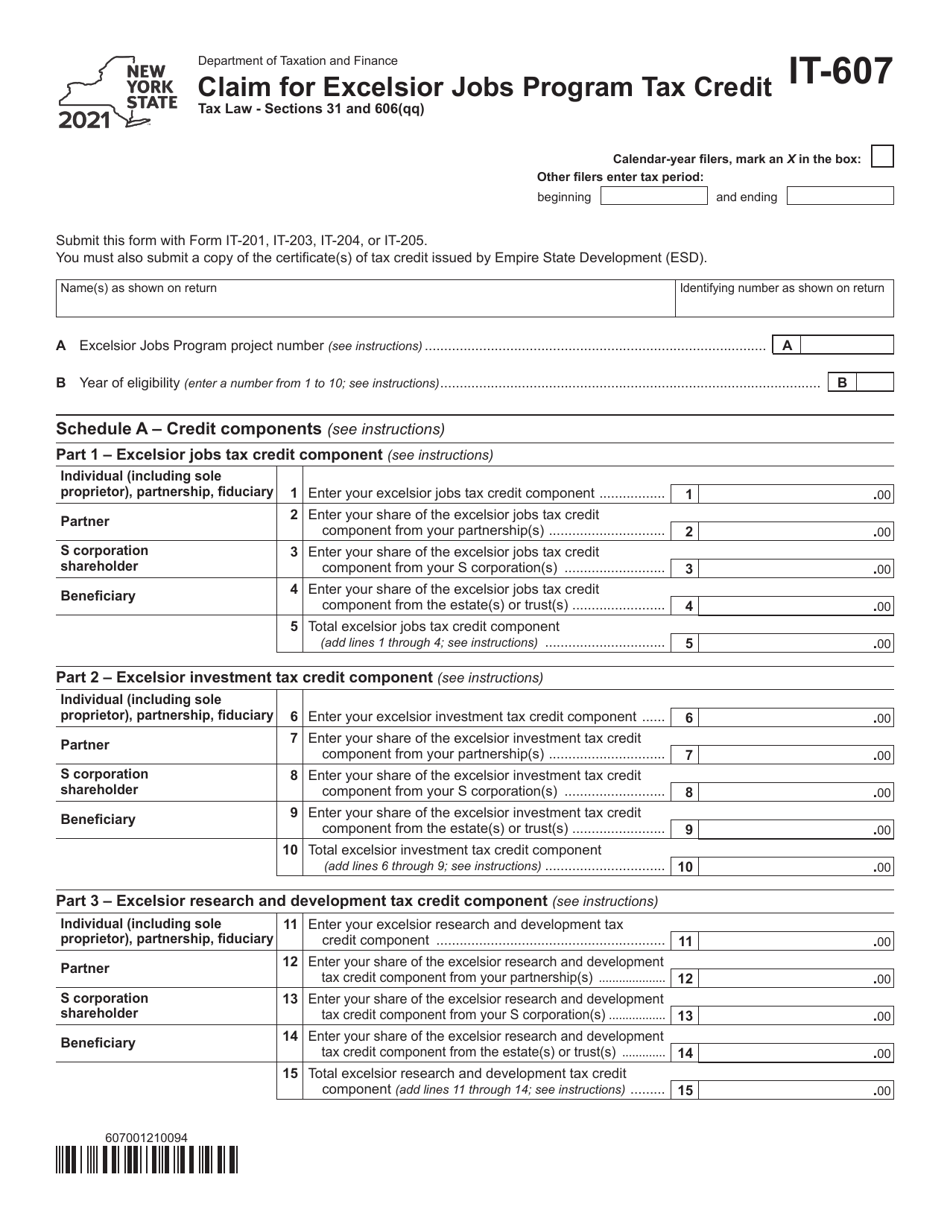

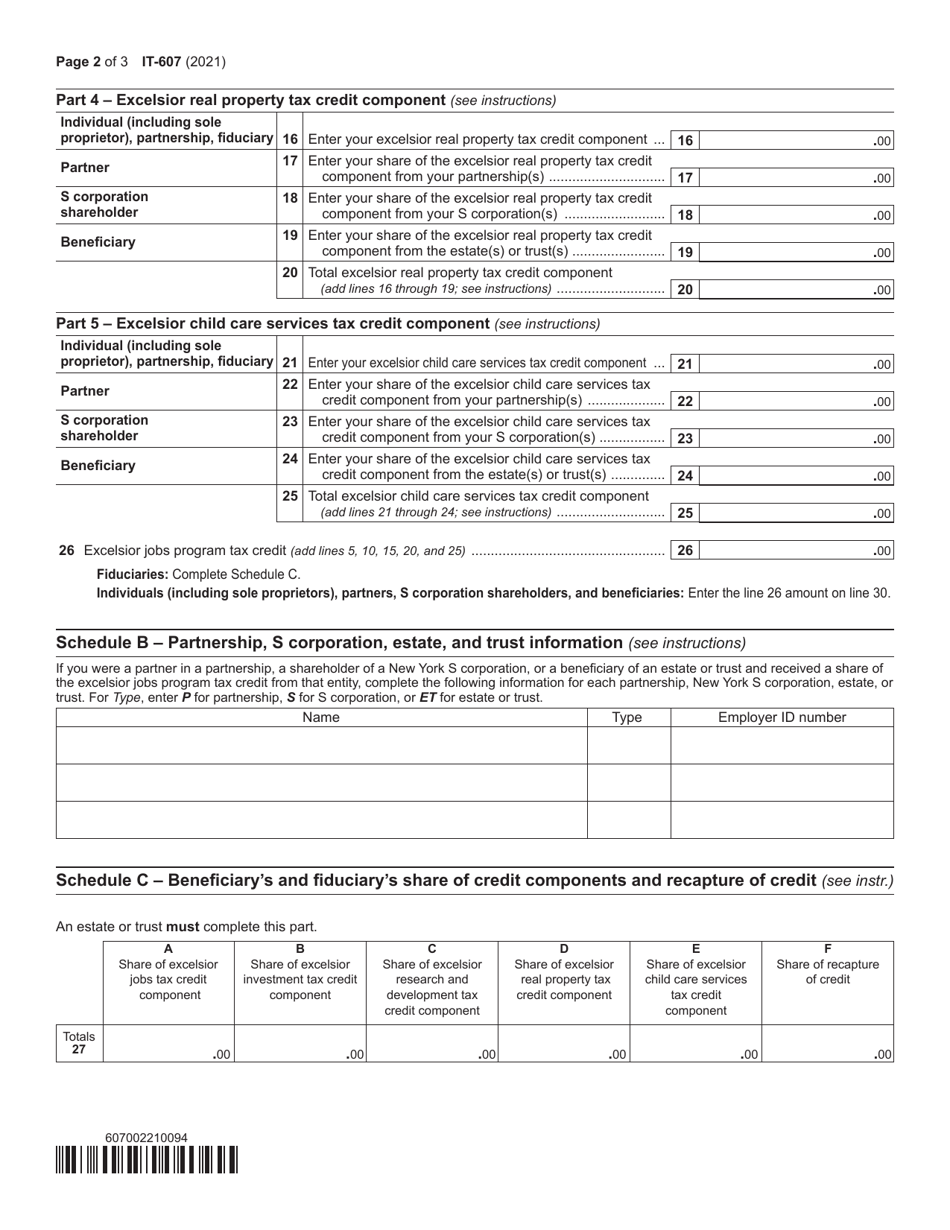

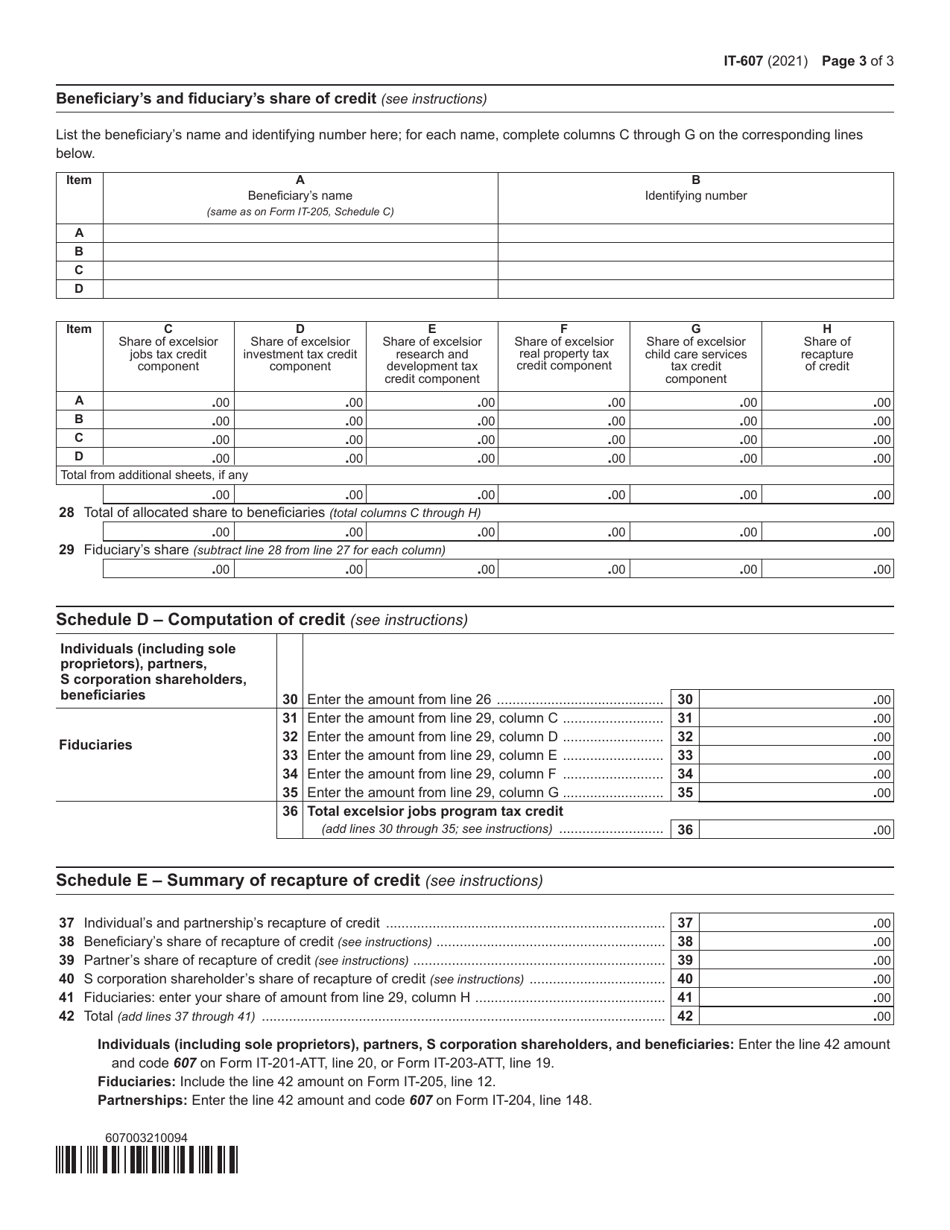

Form IT-607 Claim for Excelsior Jobs Program Tax Credit - New York

What Is Form IT-607?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-607?

A: Form IT-607 is the Claim for Excelsior Jobs Program Tax Credit in New York.

Q: Who should file Form IT-607?

A: Businesses that are eligible for the Excelsior Jobs Program Tax Credit in New York should file Form IT-607.

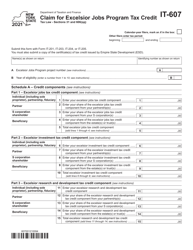

Q: What is the Excelsior Jobs Program Tax Credit?

A: The Excelsior Jobs Program Tax Credit is a program in New York that provides tax credits to businesses that create and maintain new jobs.

Q: What are the eligibility requirements for the Excelsior Jobs Program Tax Credit?

A: To be eligible for the Excelsior Jobs Program Tax Credit, businesses must meet certain criteria, such as creating new jobs in New York, meeting wage requirements, and being in an eligible industry.

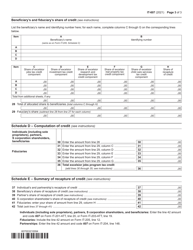

Q: When is the deadline for filing Form IT-607?

A: The deadline for filing Form IT-607 varies each year. It is important to check the instructions provided with the form or consult the New York State Department of Taxation and Finance for the specific deadline.

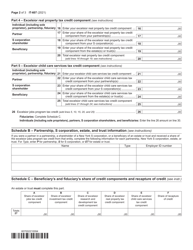

Q: What supporting documents do I need to include with Form IT-607?

A: Supporting documents that may need to be included with Form IT-607 include, but are not limited to, payroll records, job creation reports, and documentation of wages paid.

Q: Is there a fee for filing Form IT-607?

A: No, there is no fee for filing Form IT-607.

Q: What should I do if I have additional questions regarding Form IT-607?

A: If you have additional questions regarding Form IT-607, you can contact the New York State Department of Taxation and Finance for further assistance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-607 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.