This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form MO-1120S

for the current year.

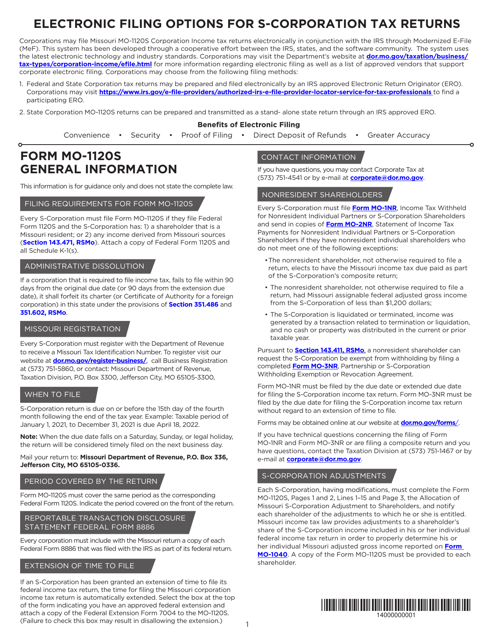

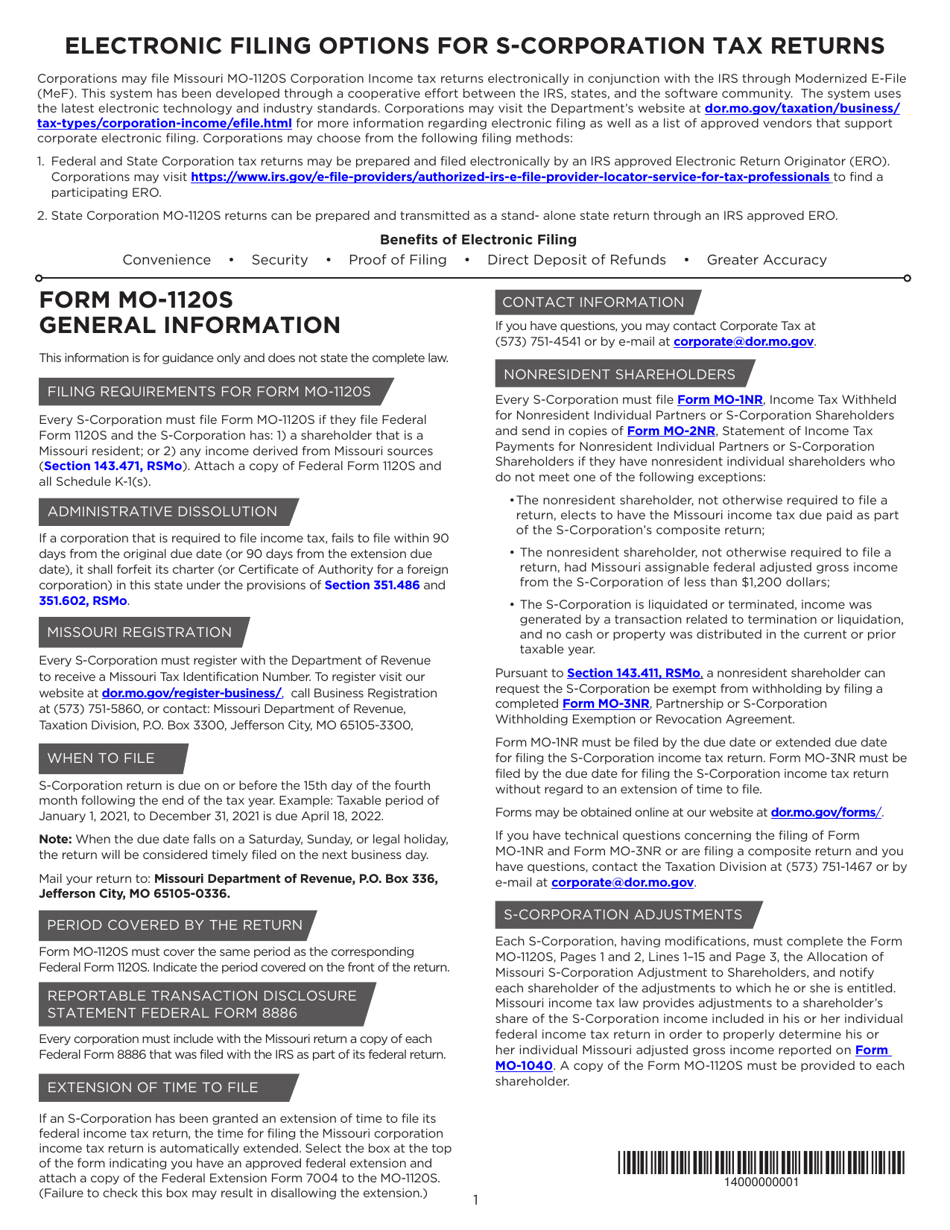

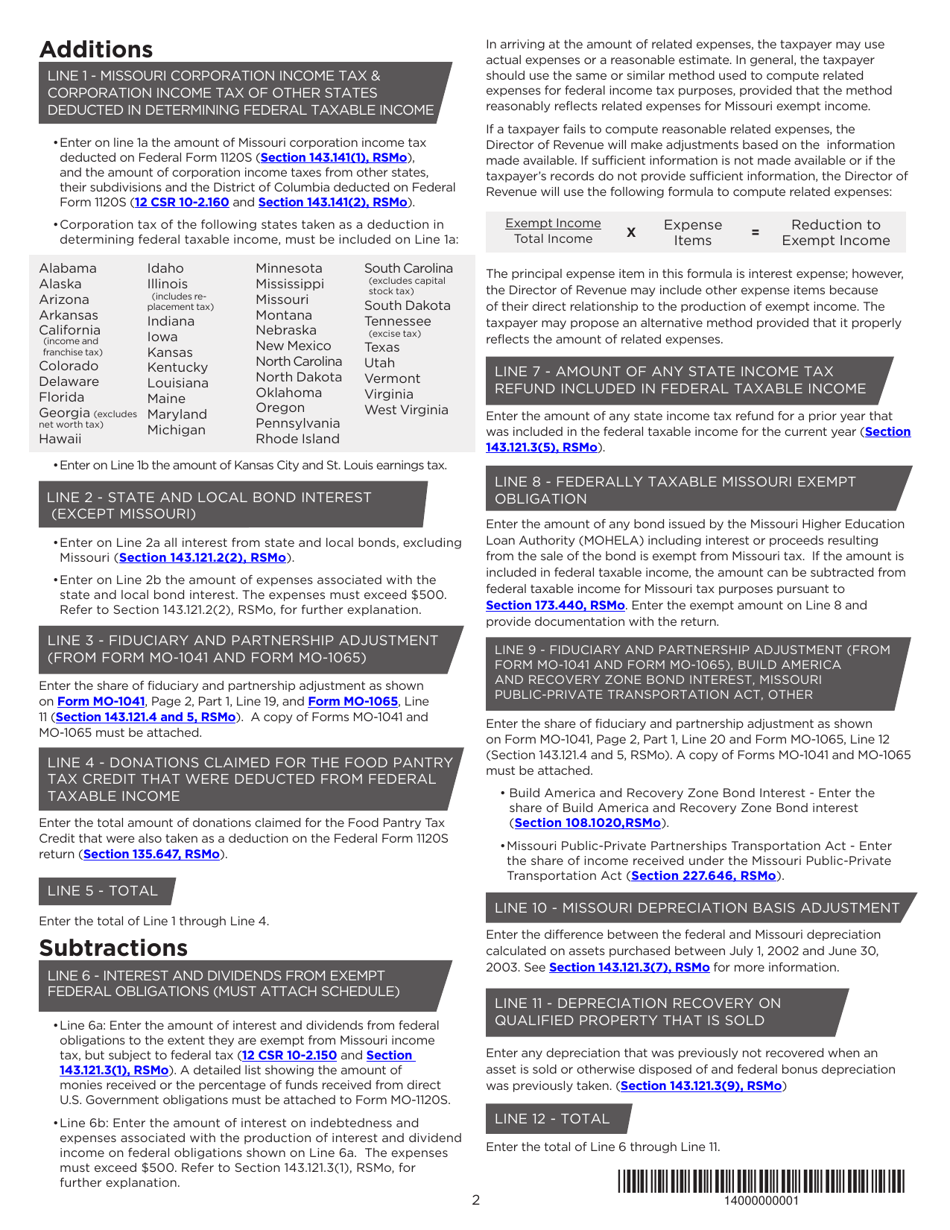

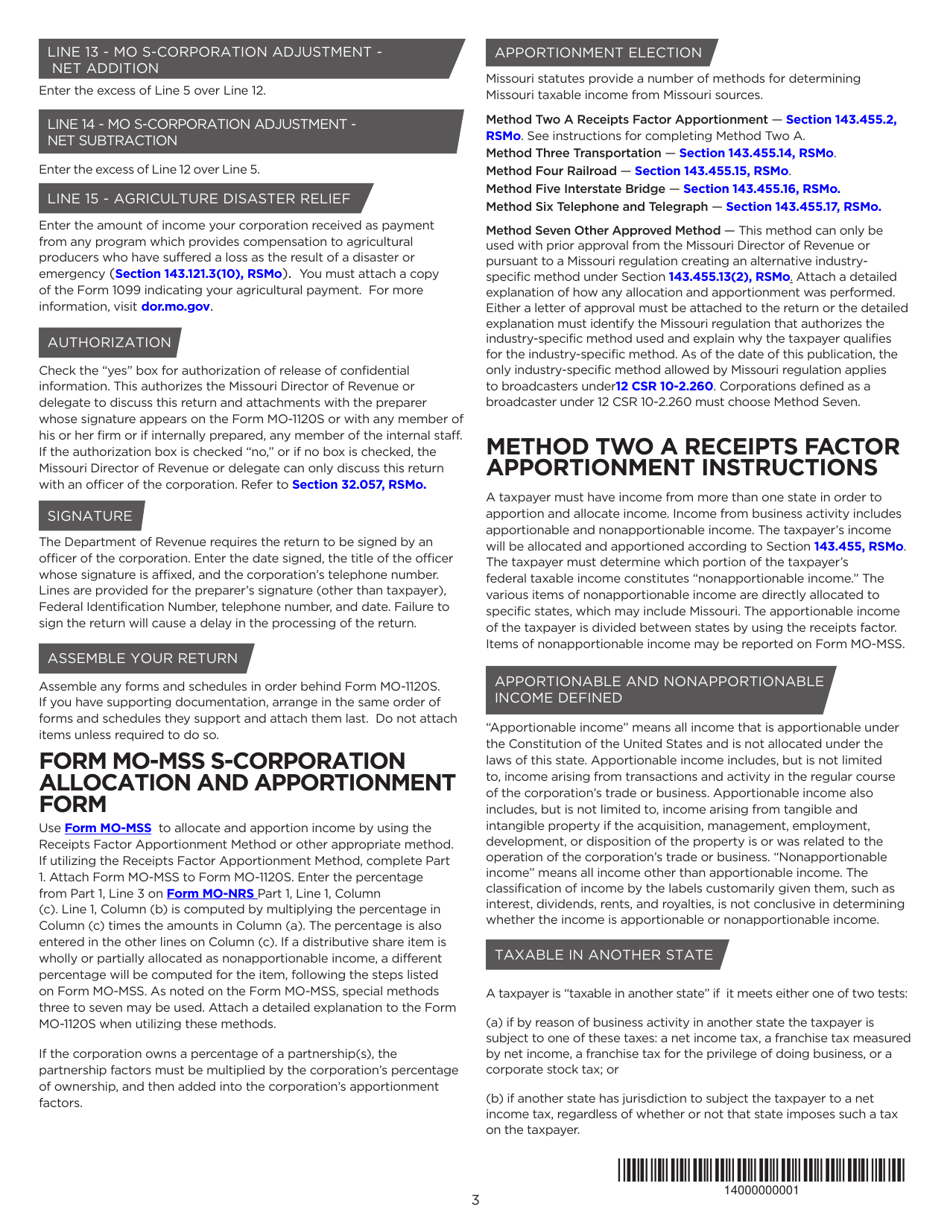

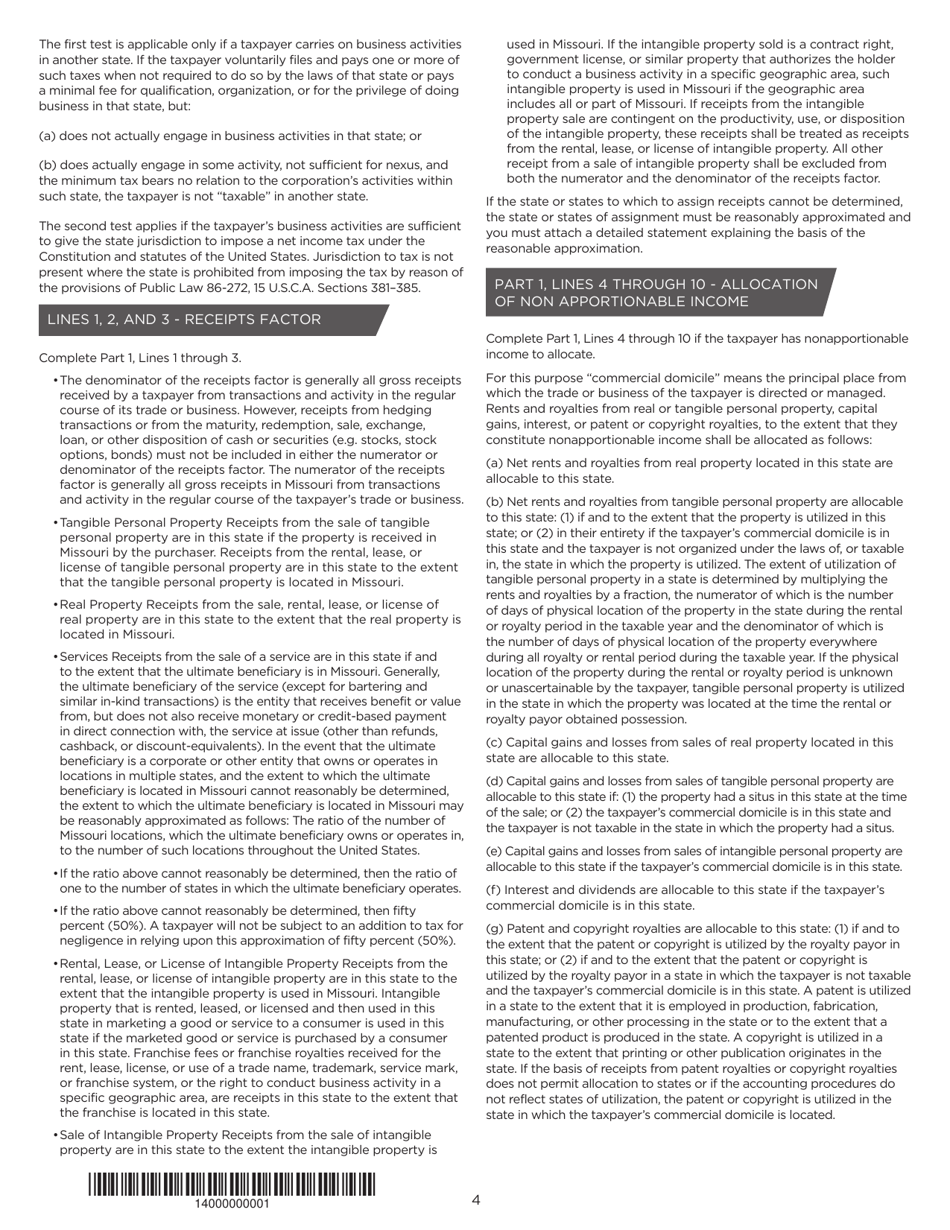

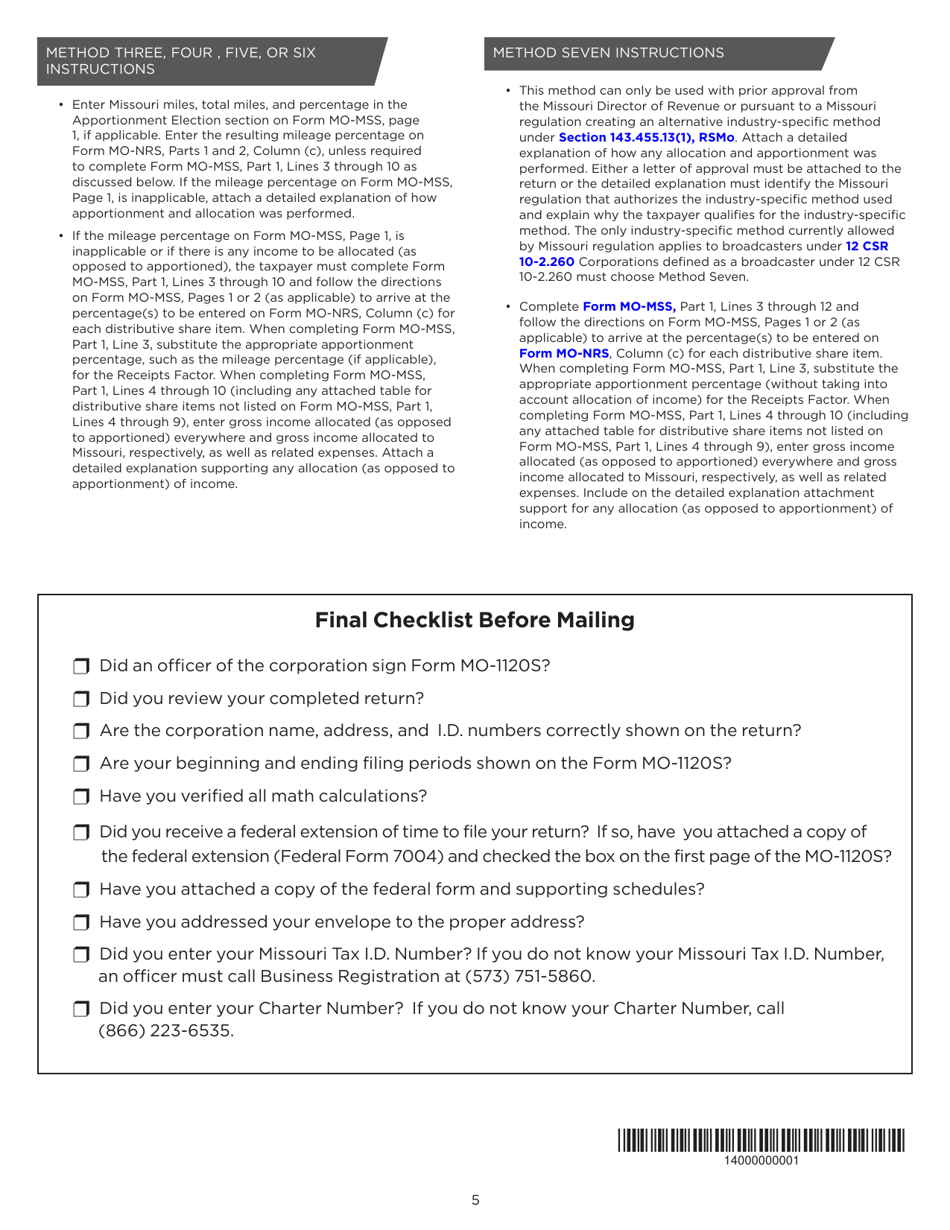

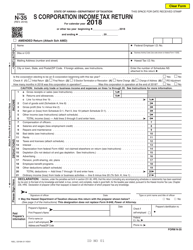

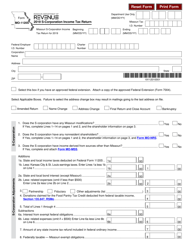

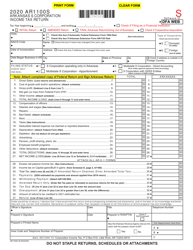

Instructions for Form MO-1120S S-Corporation Income Tax Return - Missouri

This document contains official instructions for Form MO-1120S , S-Corporation Income Tax Return - a form released and collected by the Missouri Department of Revenue.

FAQ

Q: Who needs to file Form MO-1120S?

A: S-Corporations in Missouri need to file Form MO-1120S.

Q: What is Form MO-1120S used for?

A: Form MO-1120S is used to report income, deductions, and credits for S-Corporations in Missouri.

Q: When is the due date for Form MO-1120S?

A: Form MO-1120S is due on the 15th day of the third month following the end of the tax year.

Q: Are there any penalties for filing Form MO-1120S late?

A: Yes, there are penalties for filing Form MO-1120S late. The penalty is based on the amount of tax due and the number of days late.

Q: Do I need to include Schedule K-1 with Form MO-1120S?

A: Yes, you need to include Schedule K-1, which shows each shareholder's share of the S-Corporation's income, deductions, and credits.

Q: Are there any specific instructions for completing Form MO-1120S?

A: Yes, the Missouri Department of Revenue provides detailed instructions for completing Form MO-1120S. It is important to follow these instructions carefully.

Q: Can I amend Form MO-1120S if I make a mistake?

A: Yes, you can amend Form MO-1120S if you make a mistake. Fill out a new Form MO-1120S and check the box indicating that it is an amended return.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Missouri Department of Revenue.