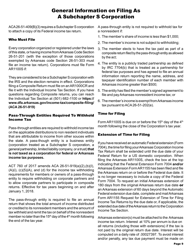

Instructions for Form AR1100S Arkansas S Corporation Income Tax Return - Arkansas

This document contains official instructions for Form AR1100S , Arkansas S Corporation Income Tax Return - a form released and collected by the Arkansas Department of Finance & Administration. An up-to-date fillable Form AR1100S is available for download through this link.

FAQ

Q: What is Form AR1100S?

A: Form AR1100S is the Arkansas S Corporation Income Tax Return.

Q: What is an S Corporation?

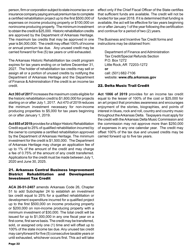

A: An S Corporation is a type of corporation that elects to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.

Q: Who needs to file Form AR1100S?

A: Any S Corporation that has income or loss derived from Arkansas sources is required to file Form AR1100S.

Q: What is the deadline for filing Form AR1100S?

A: Form AR1100S must be filed by the 15th day of the 3rd month following the close of the tax year, which is generally March 15th for calendar year taxpayers.

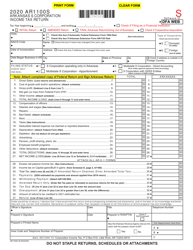

Q: What information is required on Form AR1100S?

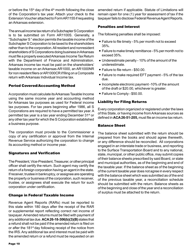

A: Some of the information required on Form AR1100S includes the S Corporation's name, address, federal employer identification number, and details of its income, deductions, and credits.

Q: Are there any penalties for late filing or non-filing?

A: Yes, there are penalties for late filing or non-filing of Form AR1100S, including penalties for failure to file, failure to pay, and accuracy-related penalties.

Instruction Details:

- This 22-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arkansas Department of Finance & Administration.