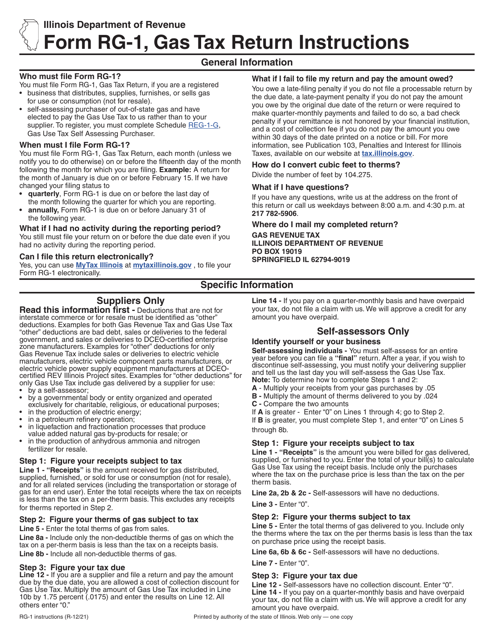

Instructions for Form RG-1, 423 Gas Tax Return - Illinois

This document contains official instructions for Form RG-1 , and Form 423 . Both forms are released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form RG-1?

A: Form RG-1 is the Gas Tax Return form used in Illinois.

Q: Who needs to file Form RG-1?

A: Anyone who sells or distributes gasoline in Illinois needs to file Form RG-1.

Q: What is the purpose of Form RG-1?

A: Form RG-1 is used to report and pay the Illinois gas tax.

Q: When is Form RG-1 due?

A: Form RG-1 is due on the last day of the month following the end of the tax period.

Q: What information do I need to complete Form RG-1?

A: You will need to provide information about the amount of gasoline sold or distributed in Illinois and calculate the corresponding tax amount.

Q: Are there any penalties for late filing of Form RG-1?

A: Yes, there are penalties for late filing of Form RG-1, including potential interest charges on unpaid tax amounts.

Q: Are there any exemptions or deductions available for Form RG-1?

A: Yes, there are certain exemptions and deductions available for Form RG-1, such as exemptions for sales to the federal government or fuel used for agricultural purposes.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.