This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form DR-908

for the current year.

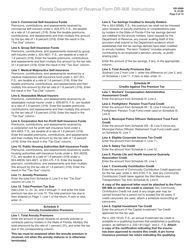

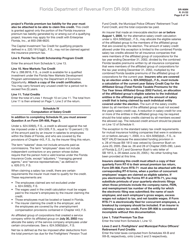

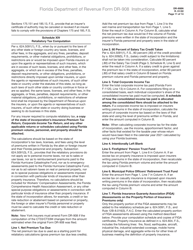

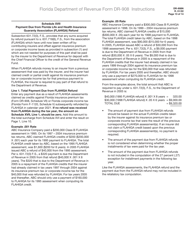

Instructions for Form DR-908 Insurance Premium Taxes and Fees Return - Florida

This document contains official instructions for Form DR-908 , Insurance Premium Taxes and Fees Return - a form released and collected by the Florida Department of Revenue. An up-to-date fillable Form DR-908 is available for download through this link.

FAQ

Q: What is Form DR-908?

A: Form DR-908 is the Insurance Premium Taxes and Fees Return for the state of Florida.

Q: Who needs to file Form DR-908?

A: Insurance companies licensed to do business in Florida, surplus lines agents, and independent or resident agents need to file Form DR-908.

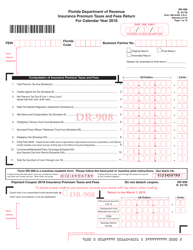

Q: What information is required on Form DR-908?

A: Form DR-908 requires information about gross premiums, refunds, and other deductible amounts related to insurance transactions in Florida.

Q: When is the deadline for filing Form DR-908?

A: Form DR-908 must be filed by March 1st of each year.

Q: Are there any penalties for late filing of Form DR-908?

A: Yes, there are penalties for late filing of Form DR-908. The penalty is 10% of the tax due or $50, whichever is greater.

Instruction Details:

- This 14-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Florida Department of Revenue.