This version of the form is not currently in use and is provided for reference only. Download this version of

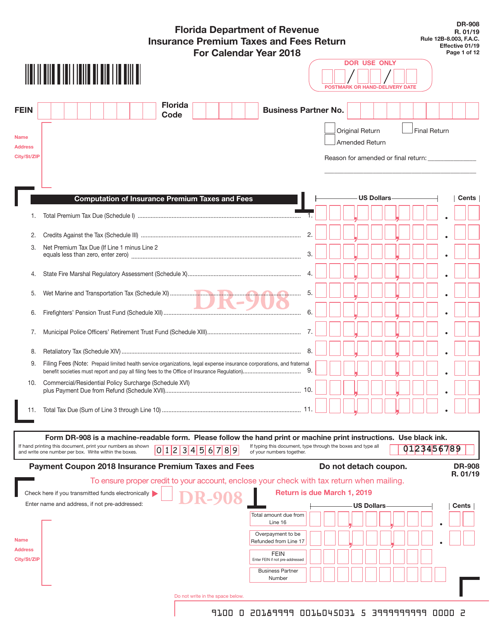

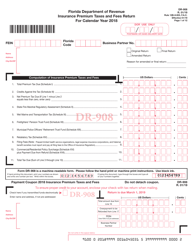

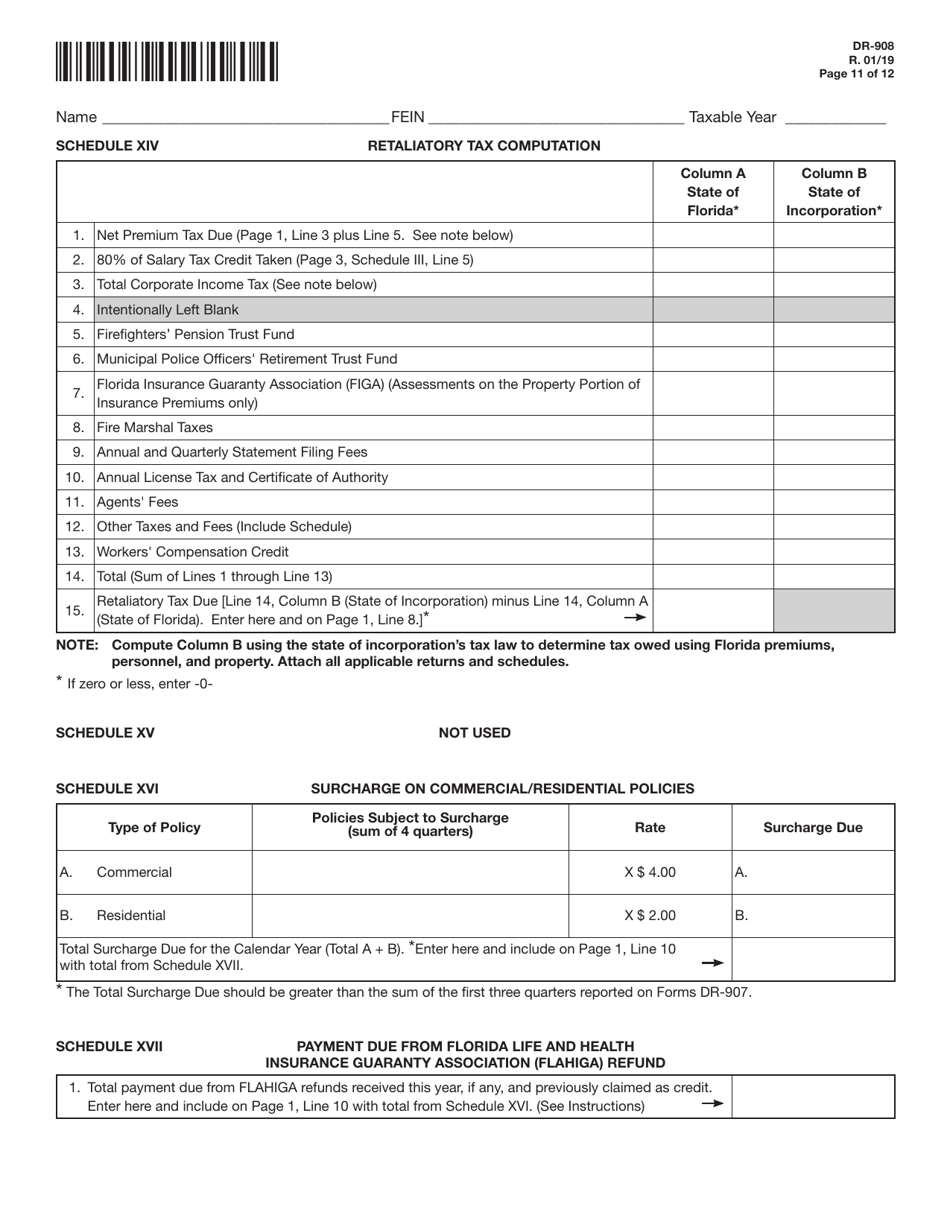

Form DR-908

for the current year.

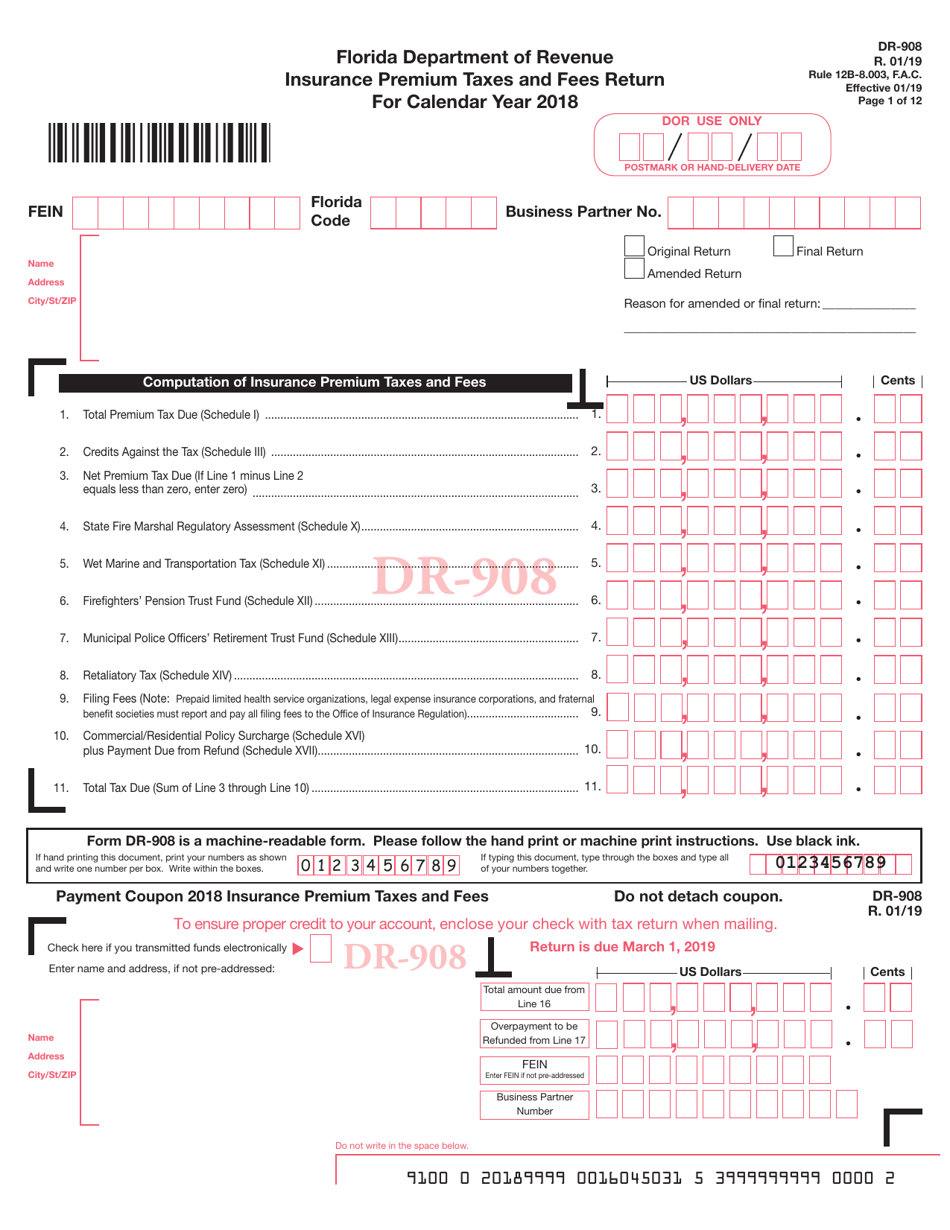

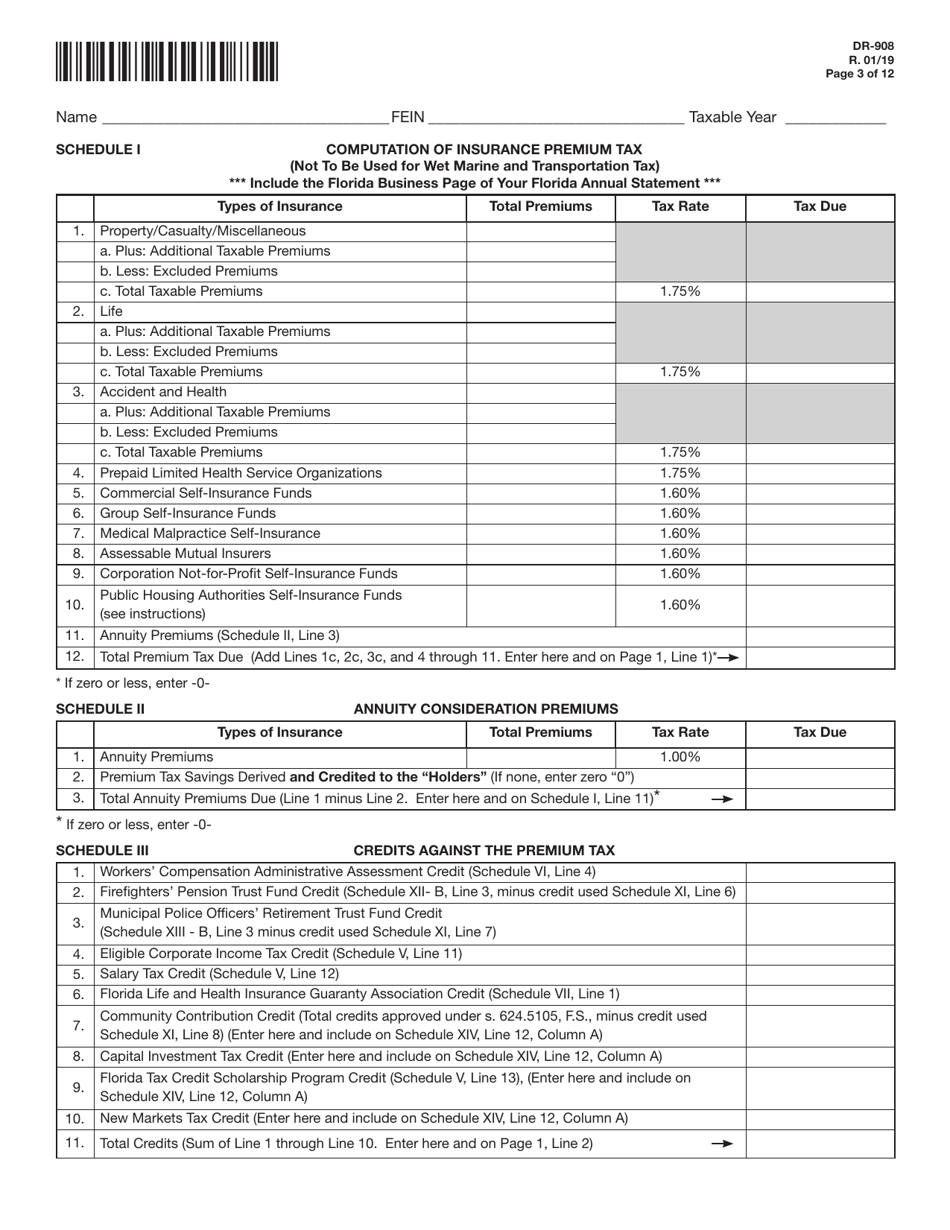

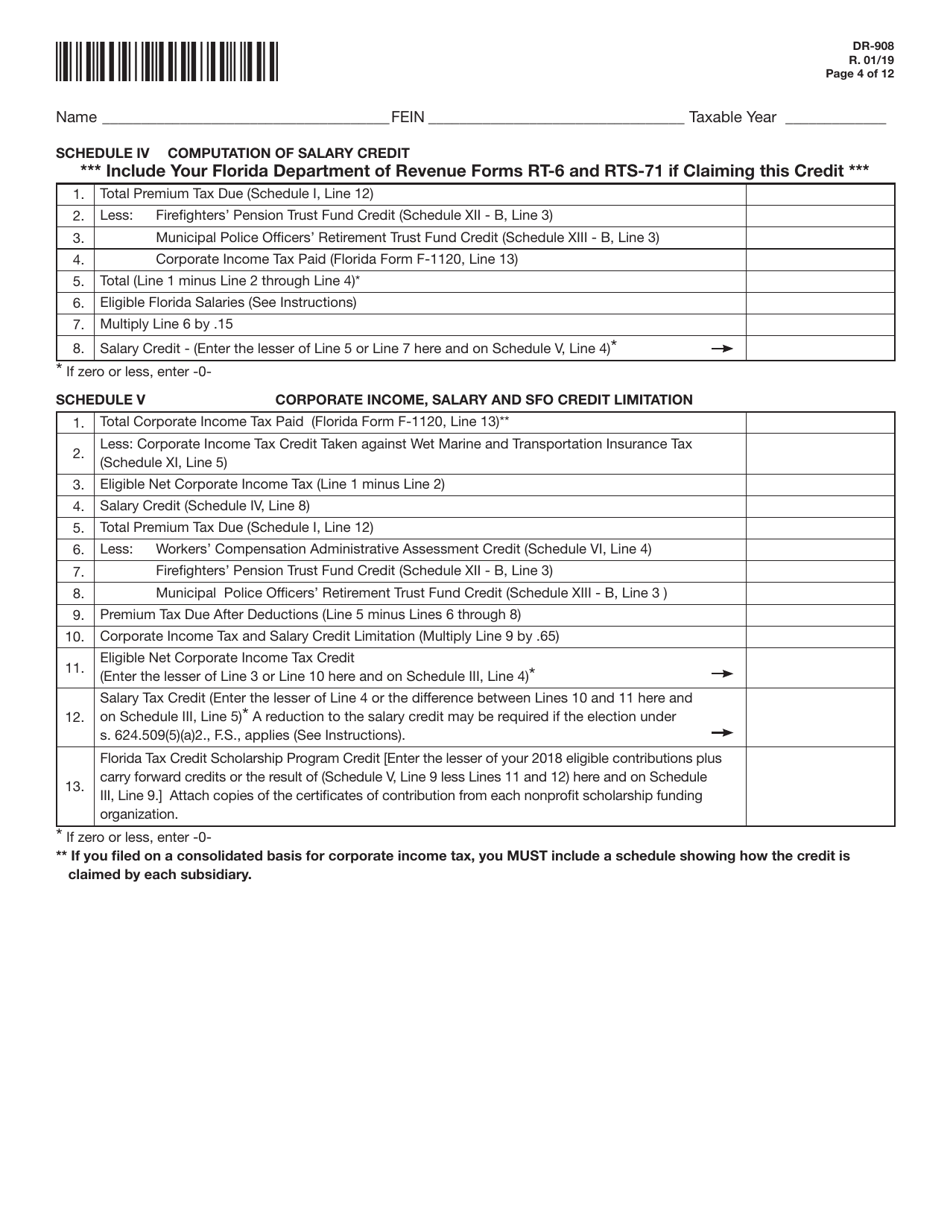

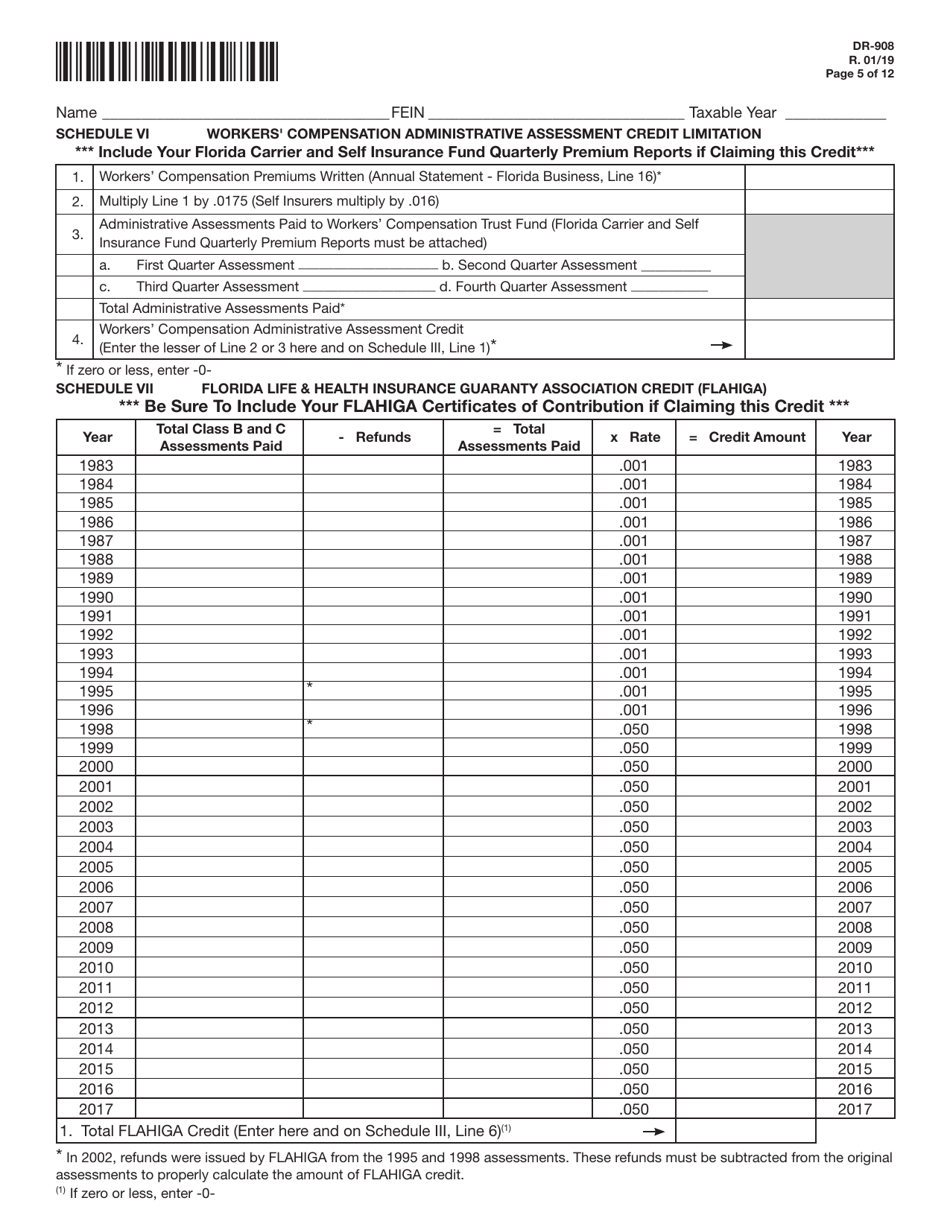

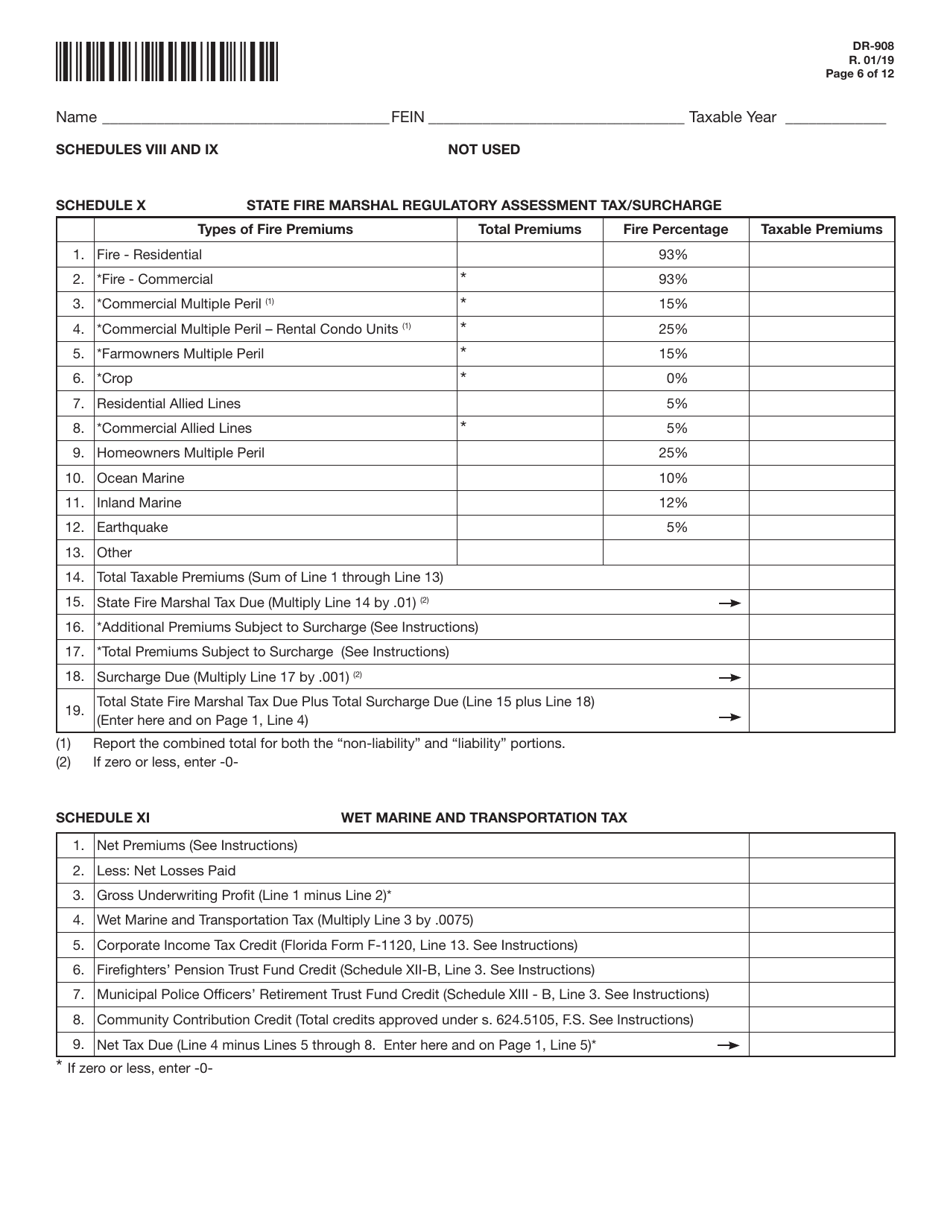

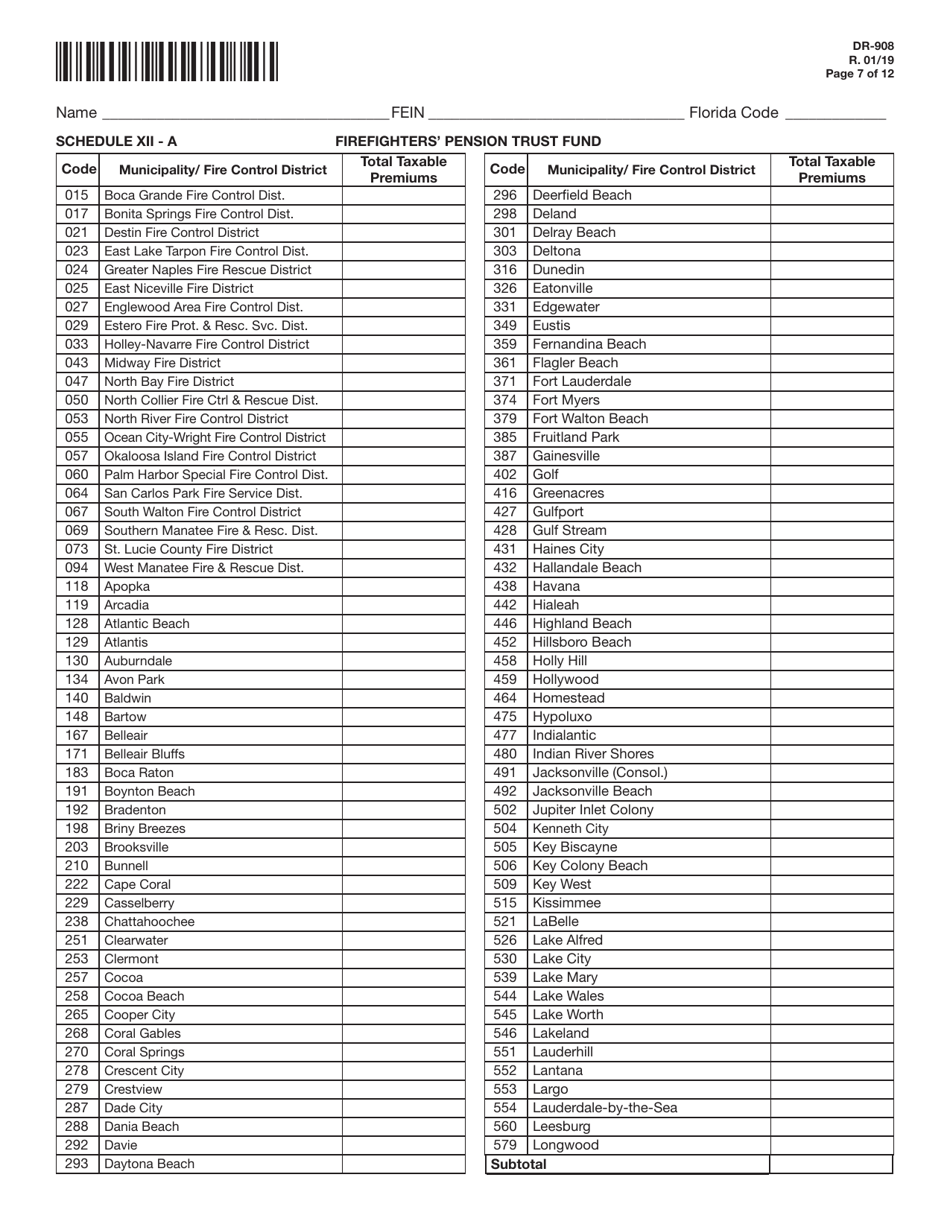

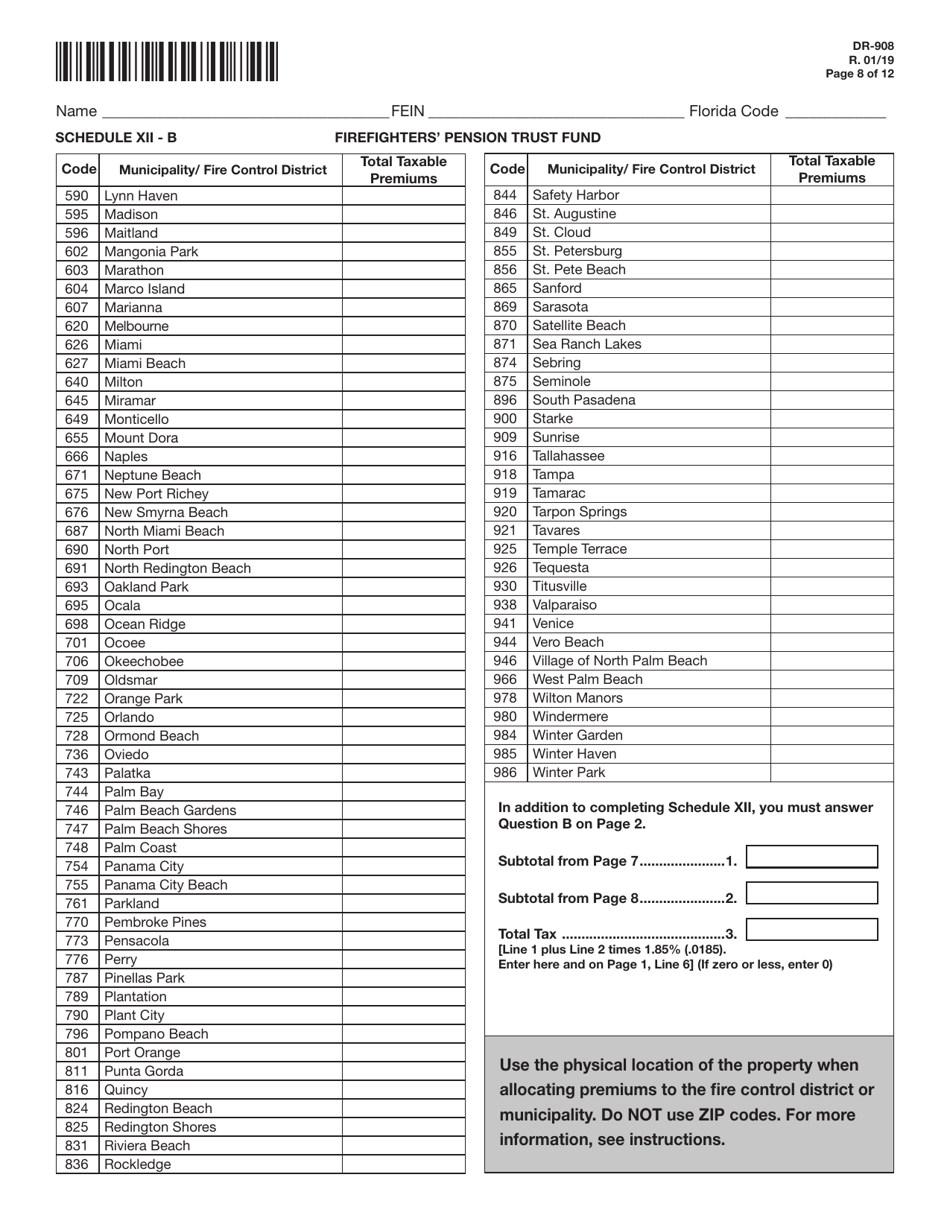

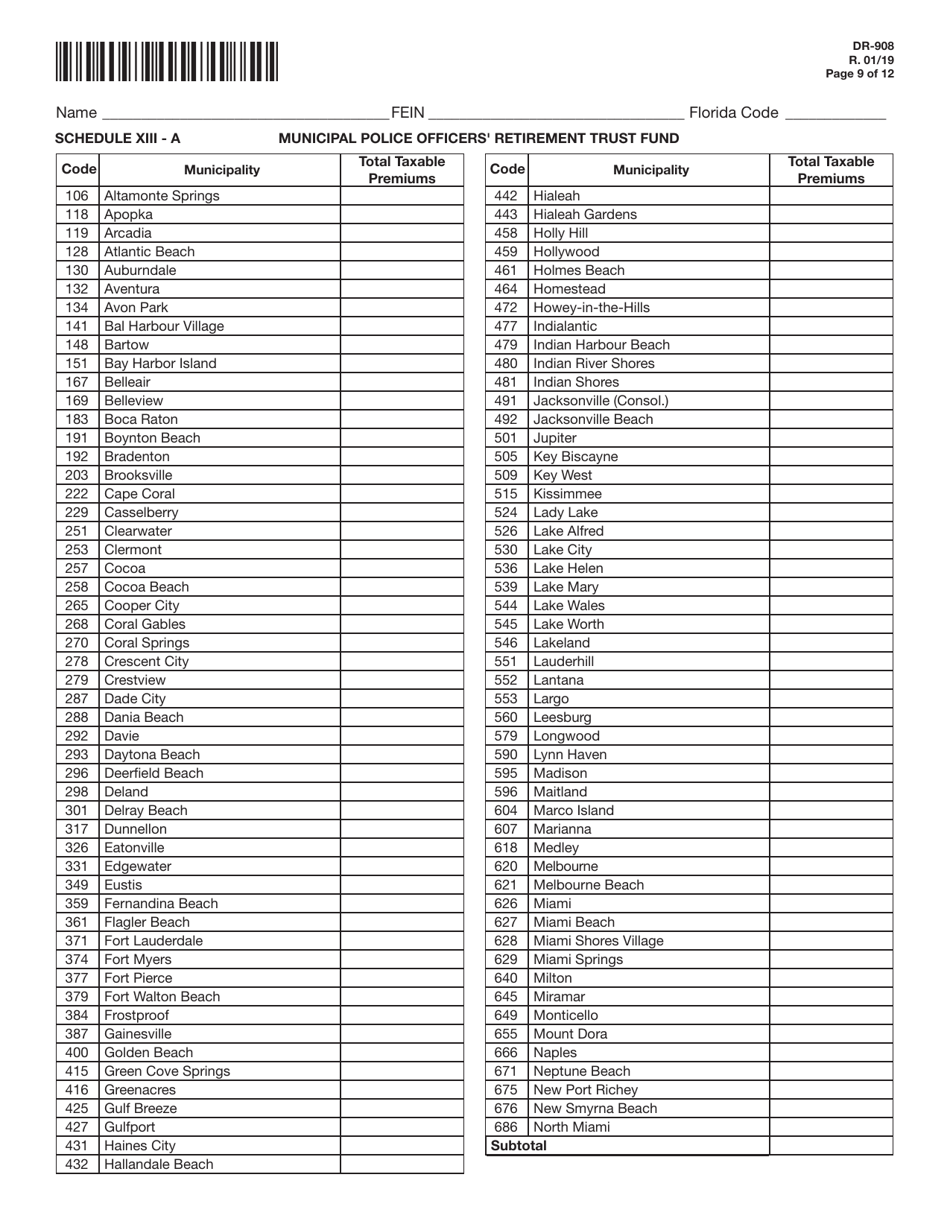

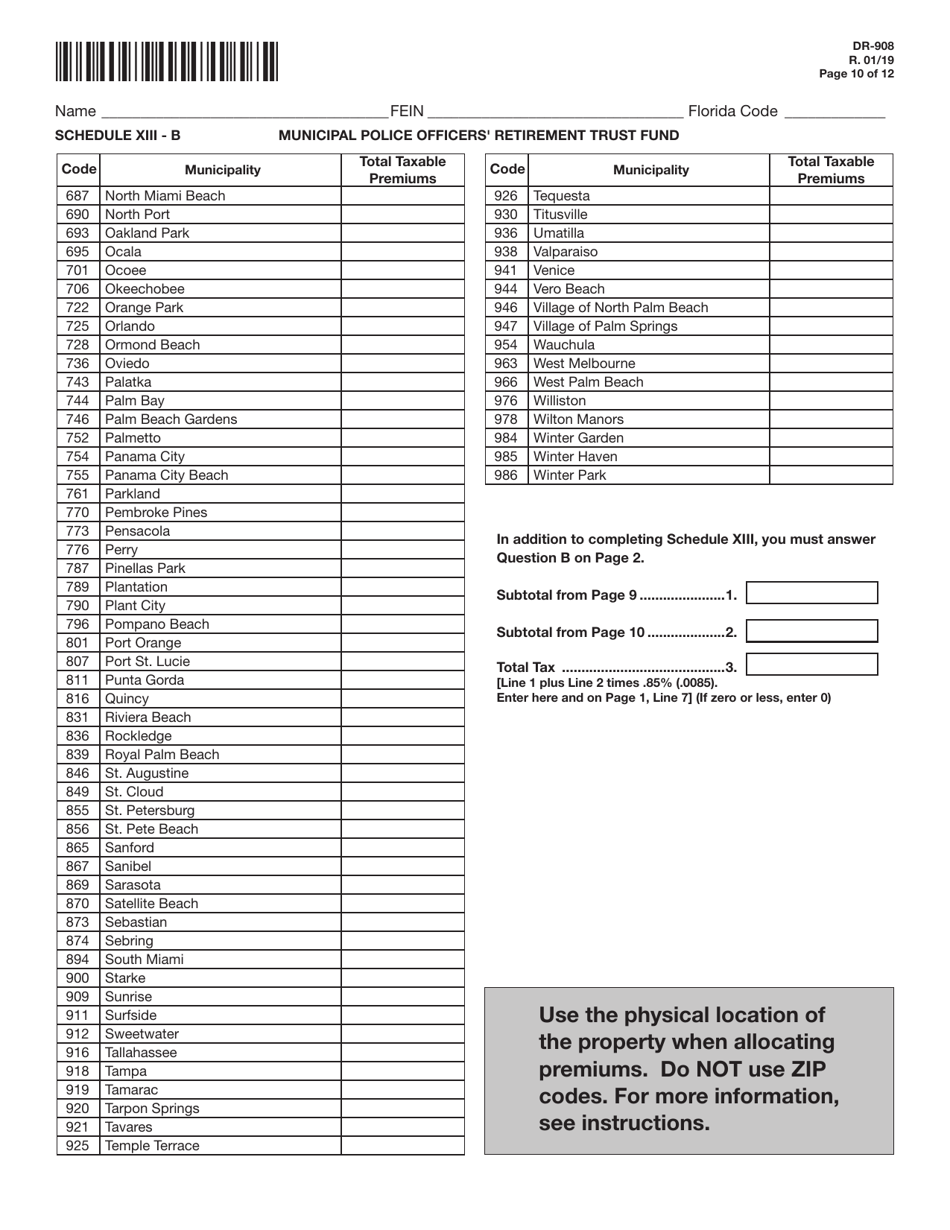

Form DR-908 Insurance Premium Taxes and Fees Return - Florida

What Is Form DR-908?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DR-908?

A: Form DR-908 is the Insurance Premium Taxes and Fees Return used in the state of Florida.

Q: Who needs to file Form DR-908?

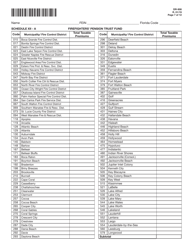

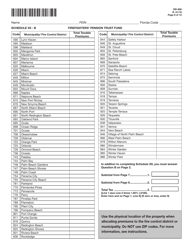

A: Insurance companies and other entities that are required to pay insurance premium taxes and fees in Florida need to file Form DR-908.

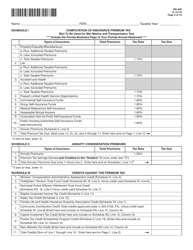

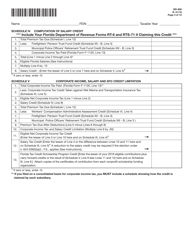

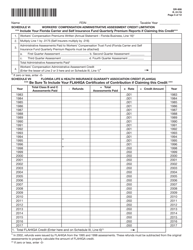

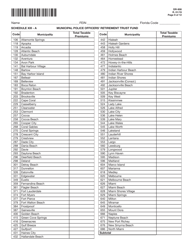

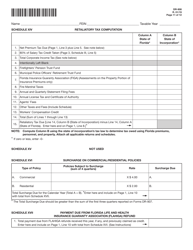

Q: What taxes and fees are reported on Form DR-908?

A: Various insurance premium taxes and fees, including the premium tax, title insurance assessment, fire marshal assessment, and more, are reported on Form DR-908.

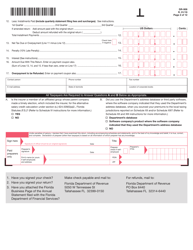

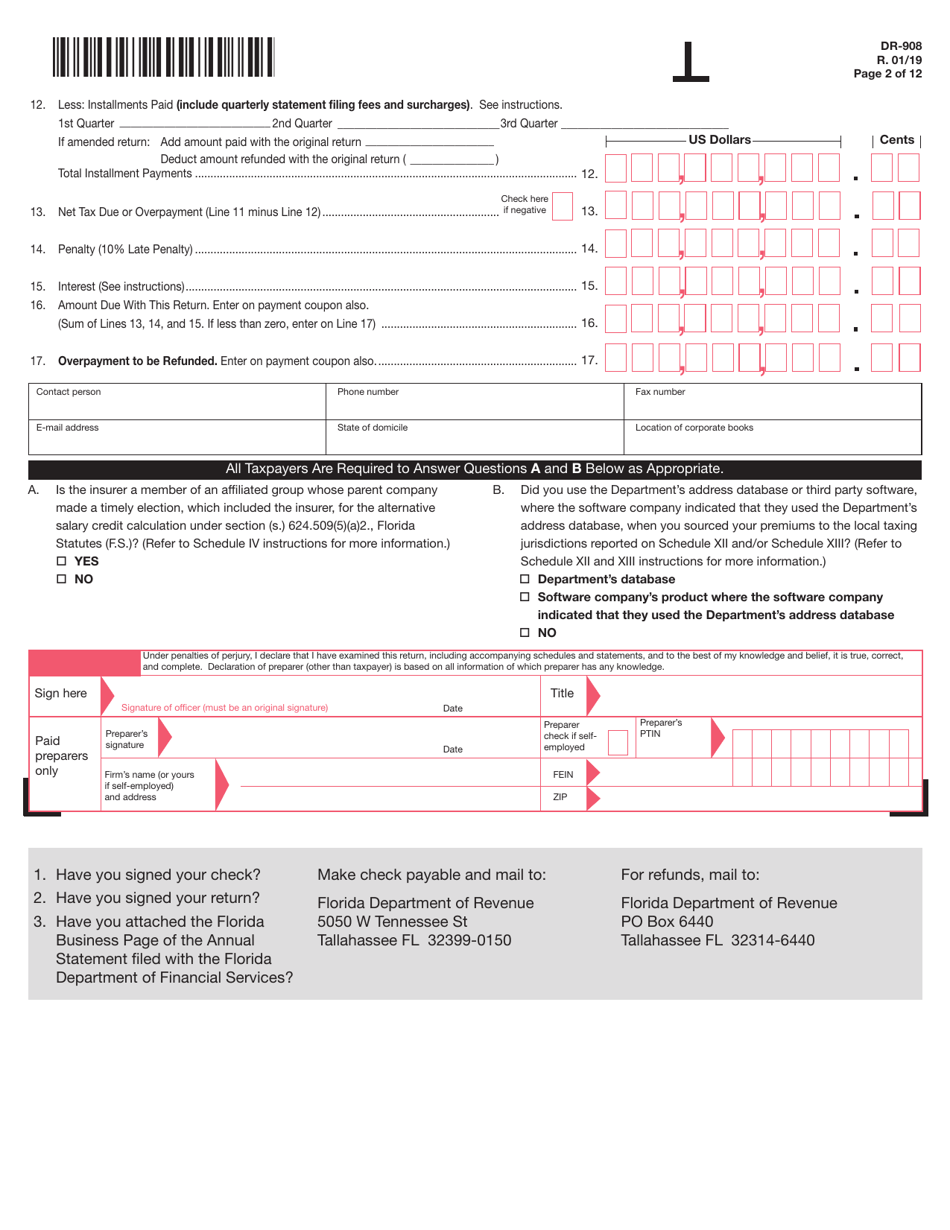

Q: When is Form DR-908 due?

A: Form DR-908 is due on or before the 1st day of April following the close of the calendar year.

Q: Are there any penalties for late filing of Form DR-908?

A: Yes, there are penalties for late filing of Form DR-908, including a late filing penalty and interest on any unpaid tax due.

Q: Is Form DR-908 required for all types of insurance companies?

A: Yes, Form DR-908 is required for all types of insurance companies, including life and health insurers, property and casualty insurers, and more.

Q: Is there a minimum threshold for filing Form DR-908?

A: Yes, insurance companies with a total annual tax liability of $1,000 or less are not required to file Form DR-908.

Form Details:

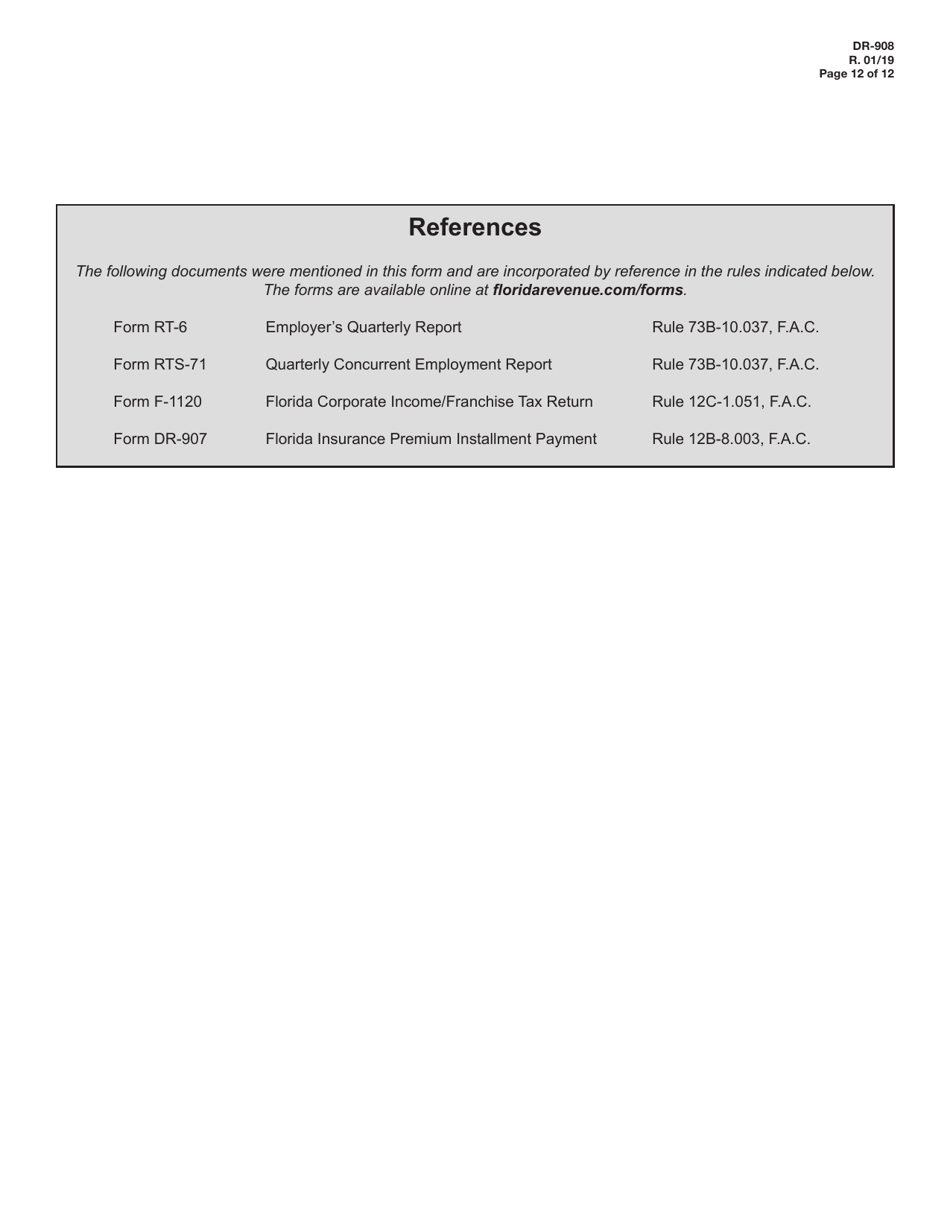

- Released on January 1, 2019;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-908 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.